Petmal

Investment Thesis

Since my last coverage of Eos Energy Enterprises Inc (NASDAQ:EOSE), the stock has fallen quite a fair bit as revenues came in below expectations in the last quarter. I have strongly suggested that EOSE will be a bumpy ride for investors and seeing losses on an investment is reasonable to assume in the short term, but in the long term, it still poses a lot of potential. I think that a lot of volatility should be expected in the coming years as EOSE is scaling up and expanding its business operations. There is going to be short-term pain like a cut in share price since the high in June this year. This doesn’t trump the fact that EOSE is still capable of generating massive amounts of revenues down the line. Anticipating a double-digit YoY terminal growth rate for the top line of the next decade of 15% is not impossible, and to be frank, I think along the lines of 25% is within reach. With that growth, the p/s in a decade would be under 1.1. The company has managed to grow its backlog strongly and YoY it expanded by 19%. I think that EOSE is a company that is sufficient to hold a small position right now, despite the market sentiment that seems to be negative right now towards it. In 2024 we are set to start seeing the first rate cuts and with more capital flowing in the economy more freely as easing begins, it could aid EOSE in expanding its business. I will be maintaining my hold rating but possibly make it a buy should the management of the company be able to deliver strong production capacity growth and efficient cost-cutting measures. The company has stuck with its 15% reduction in costs related to Eos Z3 products and I think this will be a key feature to raise margins in the short term.

Company Progress

EOSE has achieved remarkable progress in the energy storage sector by creating Znyth, a groundbreaking zinc battery engineered to overcome several inherent limitations of conventional lithium-ion batteries. Znyth marks a significant breakthrough in energy storage technology, presenting a spectrum of benefits that have attracted substantial interest within the industry. These advancements highlight EOSE’s commitment to innovation and sustainability in the energy sector.

Markets They Are In

Some of the recent tailwinds for the company have been its successful path toward partnering up with major companies in the sector. On September 19 it was revealed that EOSE has been selected by Dominion Energy (D) to provide 16 MWh of storage for a Virginia battery storage project.

Diving into the project it aims to compare the compatibility and results from using zinc hybrid batteries from both EOSE and a competitor like Form Energy. I think that the product that EOSE has developed over the years is superior and will have the most positive results in the project. If this comes true I think the tailwinds for EOSE will continue building. It could very much rally the share price in the short term. In the project, EOSE is contributing 4 MW to the 11 MW of electricity that is being tested and established. This paints the picture that EOSE is the more minor player here but also has the most to go I think depending on the outcome of the project.

One more example of EOSE expanding is when the company unveiled “Project Amaze,” a substantial expansion initiative with a total valuation of $500 million. This program is aimed at ramping up annual production to achieve an impressive 8 GWh storage capacity by the year 2026, signaling the company’s ambitious growth targets shortly.

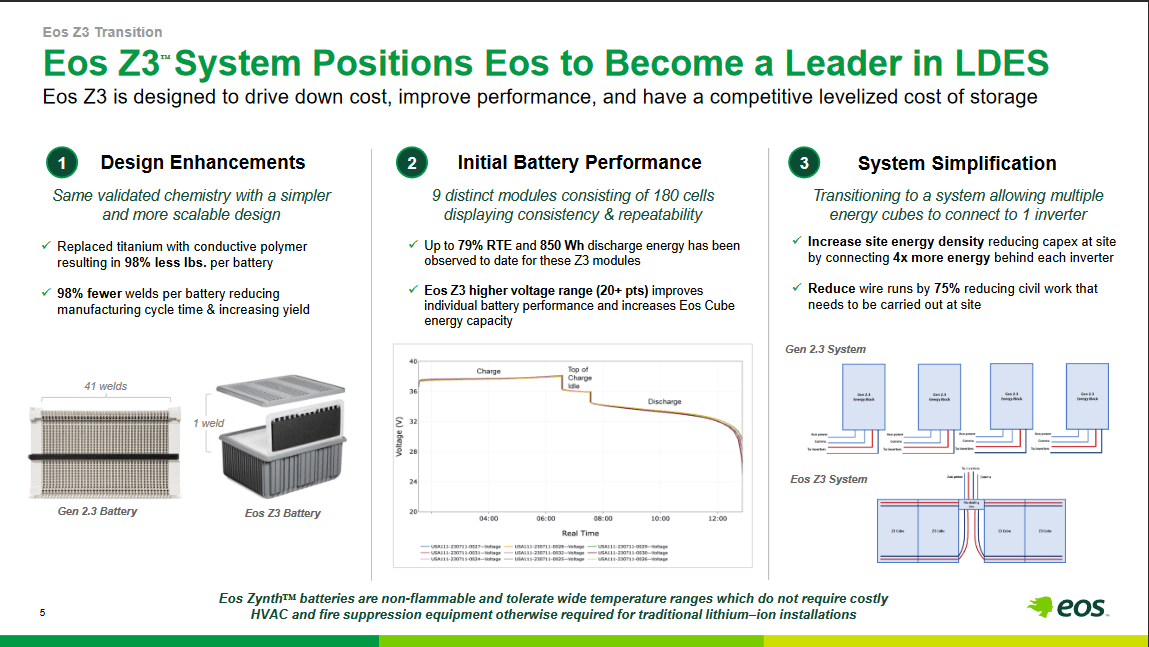

Company Products (Investor Presentation)

EOSE is rapidly establishing itself as a frontrunner in its industry, thanks to its strategic expansion of the product portfolio and entry into high-demand markets. The introduction of the Eos Z3 is a testament to the company’s commitment to improving profit margins while outperforming competitors. Additionally, EOSE is focused on delivering a cost-effective, scalable product to meet the demands of a dynamic market landscape. The company’s agility and innovative approach are positioning it for success in an ever-evolving sector.

Earnings Highlights

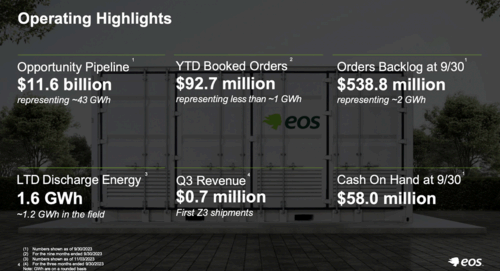

Q3 Highlights (Investor Presentation)

The last quarter came with a lot of positives I think seeing as the booked orders grew by $86.9 million and the opportunity pipeline remains incredibly high at $11.6 billion. The revenues grew to $ 700,000 for the quarter, and the expectations are that in 2023 EOSE will deliver revenues of $17.9 million. Seeing as their backlogs are incredibly strong already covering this amount by a large margin I think it’s a matter of scaling and getting production up and running at higher rates. On an FWD p/s basis, it sits at 10 right now, but should production scale up like I think it could in both 2024 and 2025 the revenues could expand to closer to $100 million I think. EOSE has built up the backlogs to support this and there is a market for them to operate in as well. Once revenues start growing at double-digit levels once again, I think the order backlog will be able to do the same as it simply comes down to the massive opportunity pipeline EOSE sees and has access to.

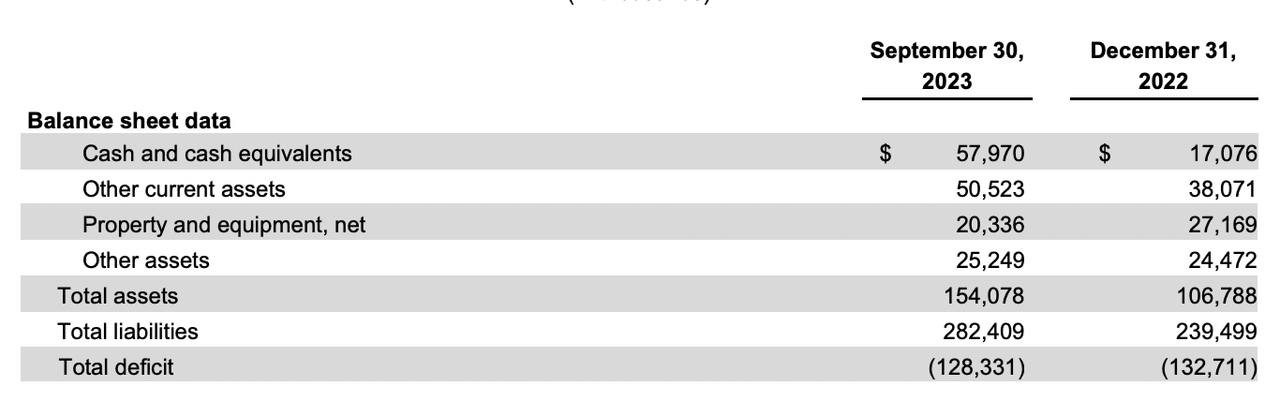

Balance Sheet (Earnings Report)

Supporting the company in its path towards expansion is a balance sheet and asset side that needs to be properly maintained. I think that EOSE has done a good job here as the cash position has grown to $57 million, up $40 million since December last year. This means that in terms of market cap valuation EOSE is very liquid right now. Around 25% is in cash in terms of valuation. This could also be explained as EOSE has more debt than assets right now at $200 million, compared to $154 million in total assets. Debt reduction is something I think will have to be a priority for EOSE should there be a higher valuation in place. Once the bottom reaches profitabilty I think EOSE could divert more capital to debt repayment and I would think the market would reward the stock with a higher price then too.

Heading Into 2024

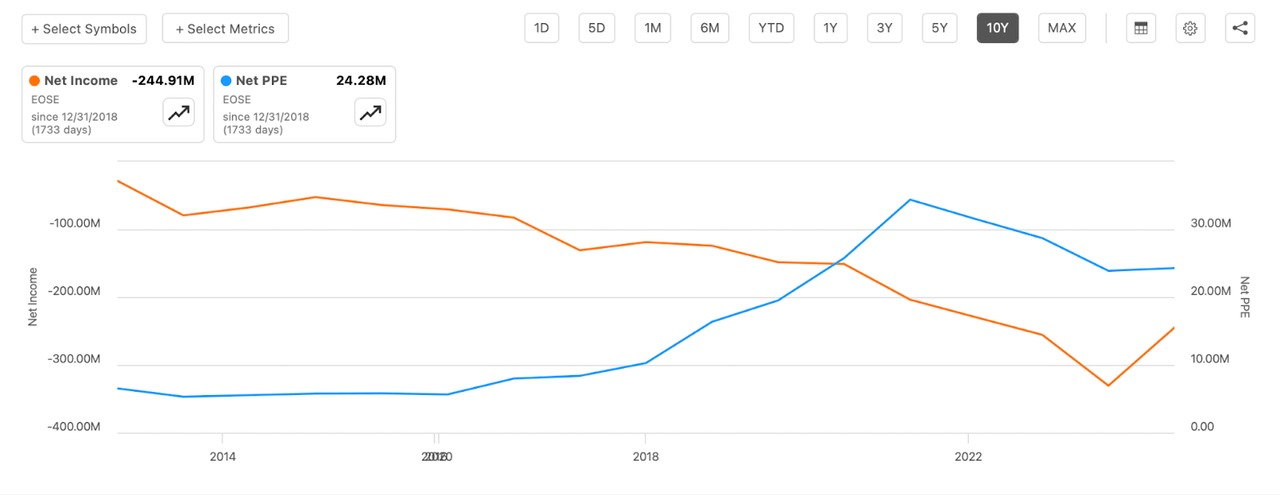

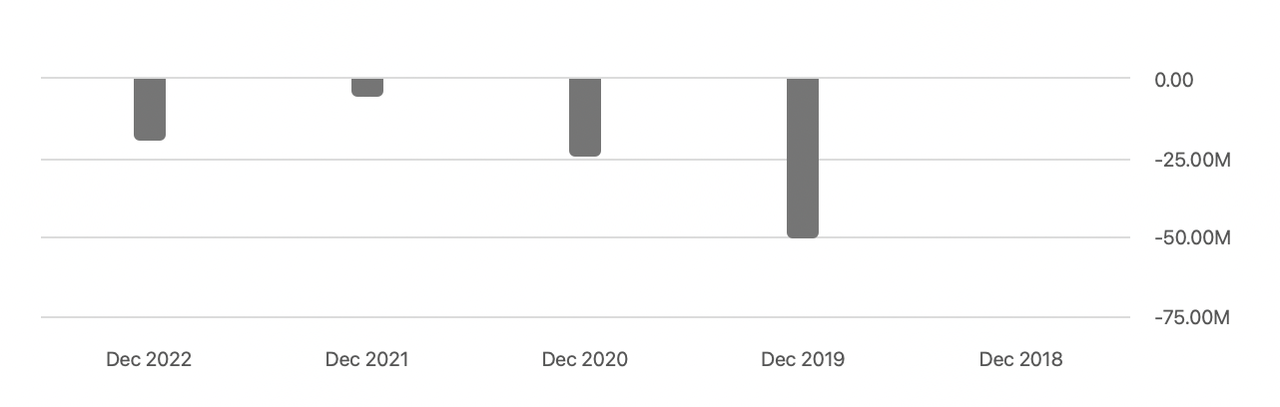

Bottom Line Growth (Seeking Alpha)

The bottom line for EOSE has been declining over the last few years, a direct result of the company investing in more properties and the rise in interest rates which is pressuring margins. Without a profitable business model, I think this is to be expected. But I see a reversal in the coming years as EOSE is expanding like announcing the Project AMAZE we covered before. I see a inflection point where the amount of assets EOSE is accumulating is going to push net income into positive territory. In 2024 we are also seemingly getting the first rate cuts as well which could be a significant tailwind for EOSE in terms of accessing more cheap loans and reducing its interest expenses.

Estimates suggest that by 2026 EOSE will have a yearly EPS of $0.52, valuing it right now at an FWD p/e of under 3. Seeing as most stocks in the industrial sector trade at an average p/e of 17 – 18 this potentially leaves a lot of upside for investors. If EOSE just gets a p/e of 15 by 2026 that leaves plenty of potential here. But there is likely to be some dilution until then as well accounting for a slightly lower EPS than that I think is reasonable. Even something along the lines of $0.3 per share would still put it at an FWD p/e of under 4, leaving a lot of upside for the stock price in my view. My price target of $2.73 by 2026 might indicate a significant upside, but as I have mentioned, there are some improvements I’d like to see before that. Some of these improvements relate to the lack of profitability in the last few years. It has been heading in the wrong direction and I want consecutive quarters of positive NI before a buy could be established. I think that will only be achieved if the managed comes through with its cost-cutting measures and interest rates go down further.

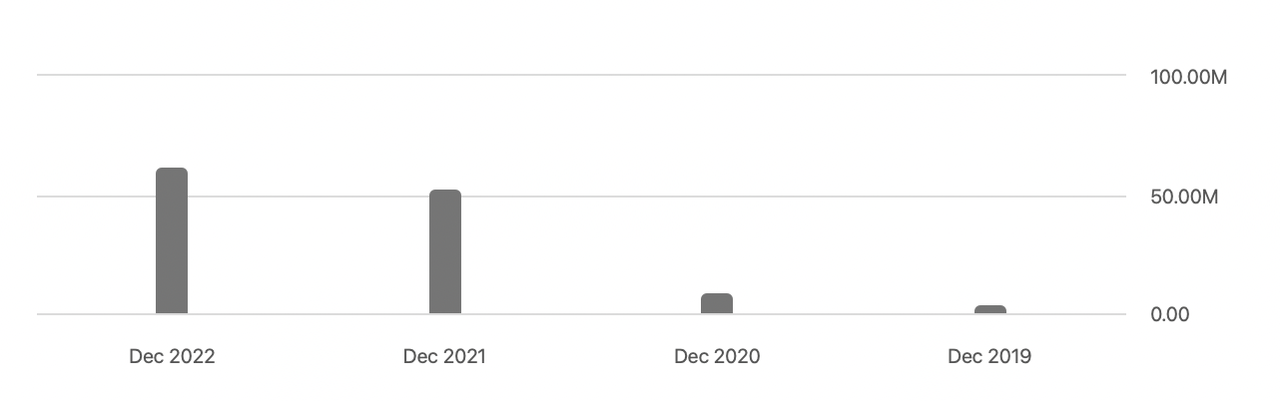

Interest Expenses (Seeking Alpha)

Should the coming reports hint at increased efficiencies in reducing costs and raising margins I think a higher rating than a hold might be in order. The company has been affected quite a lot by the rise in interest rates as the expenses for it are $55 million LTM which is significant since in 2021 it was at $5.2 million instead.

Risk

A key factor to weigh when assessing EOSE’s investment potential is the company’s current absence of profitability. While EOSE operates in the promising field of renewable energy, the road to consistent profitability is yet to be paved, and forecasting a precise timeline for achieving profitability can be a complex endeavor.

Share Dilution (Seeking Alpha)

Investors need to be aware that the number of shares outstanding has surged by more than 100% in the past 12 months. This significant increase in outstanding shares has exerted downward pressure on the stock price, as it reflects the implications of this expansion on the company’s valuation and market dynamics. Being still a growth company I see these moves as something that you have to accept. The company is yet to achieve positive net income and one of the ways for them to raise capital is through dilution. Over the coming decades, I think that EOSE can transition into a business capable of eventually buying back shares and possibly even starting a dividend, which is many years down the line through still. Investors seeking immediate shareholder returns should perhaps consider another option than EOSE, but I don’t mind the volatility and the dilution as I am allocating a smaller portion to the company in my portfolio.

Final Words

EOSE is an incredibly exciting company I think as they are at the forefront of battery storage and zinc-battery technologies. The industry anticipates strong CAGR up until 2030 and the likelihood is that EOSE may beat this in the topline growth seeing as they have built up a backlog of orders more than twice their current market cap. The future seems bright and should they reach profitability the potential upside in the short – medium term is great. I am rating EOSE and will take any dip in share price as an opportunity to add more to my position. Going into 2024 I think a lot of small caps will do very well should interest rates be cut as is predicted. This will free up more capital and let EOSE and others invest and expand production rapidly. EOSE has access to a large market and is consistently growing its order backlogs as well. In 2024 the key thing to watch out for here will be cost-cutting measures and margin expansion. If it can consistently post positive NI results I am close to rating it more than a hold. Until then, my rating will be the same as when I started covering the company, a hold. I made this new coverage since we have gotten another earnings report and some more operational updates from the management as well.