Stag Industrial (STAG 0.28%) is a real estate investment trust (REIT) that focuses on industrial properties. This is a sector that has performed exceptionally well coming out of the pandemic, thanks partly to upended supply chains and efforts to “reshore” production. While the stock has been a strong performer, the dividend story hasn’t been nearly as attractive. So, is Stag a buy or not? It depends.

Stag has a “second tier” portfolio

The biggest company in the industrial real estate sector is Prologis (PLD 1.10%), a REIT that has a global footprint, a warehouse focus, and locations in most of the world’s important transportation hubs. Where Prologis doesn’t compete is in secondary markets. In fact, most industrial REITs don’t operate in secondary markets, which is one of the main reasons why Stag invests in such markets.

Image source: Getty Images.

Essentially, as a public REIT, Stag has relatively easy access to capital, helping to keep its investment costs below those of small mom-and-pop investors that typically dominate secondary markets. That gives it the ability to select some of the best assets that house some of the most attractive tenants. At the end of the third quarter, the REIT had over 560 properties across 41 states.

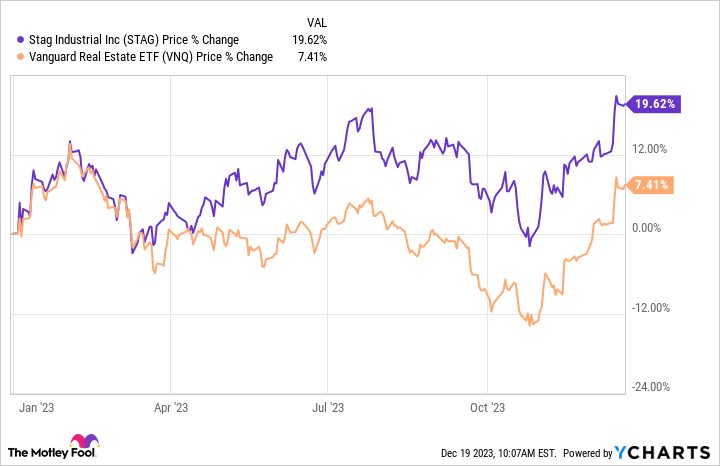

The key number, however, is rent growth. In Q3, Stag was able to increase rents on expiring leases by a huge 54%. The reason for this is that older leases are ending and they are being marked up to current market rates. Coming out of the early COVID-19 period, demand for industrial space rose, pushing market rates higher in a big way. It will likely take years for Stag’s entire portfolio to roll over to the higher lease rates, so that outsize rental growth is likely to continue. This is the good news that has helped to push the stock higher this year, outperforming the gain of the average REIT, using the Vanguard Real Estate Index ETF (VNQ 0.39%) as a proxy.

The growth hasn’t been reflected in the dividend

COVID arrived in a big way in 2020 and the world is now about to enter 2024 having largely grown accustomed to dealing with the illness, so this story isn’t new. Given that REITs like Stag are designed to be income stocks, you might expect that the dividend has been growing strongly as the business has prospered. But that isn’t what has happened.

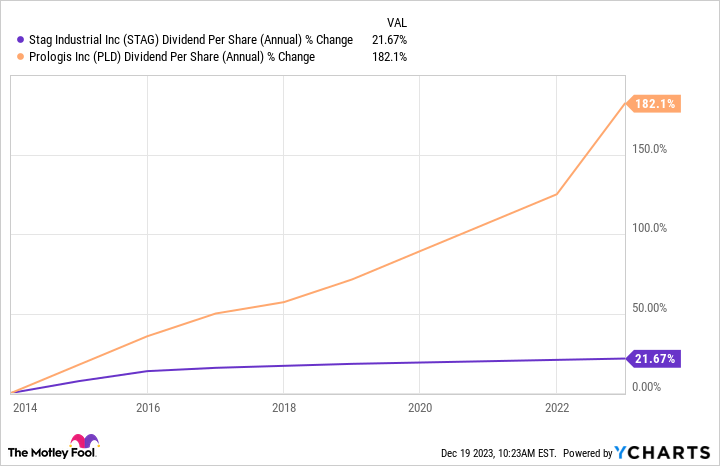

Over the trailing one-, three-, and five-year periods, the dividend has increased less than 1% a year on an annualized basis. That’s pretty miserly any way you look at it, and this rate of growth doesn’t even keep up with the historical growth rate of inflation. It looks even worse when you compare Stag to Prologis, which has boosted its dividend 13% over the past year, 14% annualized over the trailing three years, and 12% annualized over the past five years.

STAG Dividend Per Share (Annual) data by YCharts

If you are looking for dividend growth, you’ll be better off with a different industrial REIT given Stag’s recent history. But there’s some nuance here. Stag’s dividend yield is currently around 3.8%, which is more than a full percentage point higher than Prologis’ 2.6% yield. While neither of those yields is particularly huge, if you are looking for an industrial REIT and want to maximize the income your portfolio generates today, Stag looks like it could be the better choice.

No easy answer

There is no such thing as a perfect investment, with investors having to weigh many different pros and cons with each buy and sell decision. Stag’s business looks like it is well positioned today, but that’s not unique in the industrial REIT sector. That said, it has a notably higher yield than industry bellwether Prologis. Still, dividend growth has been relatively poor. All told, if you want to own an industrial REIT, Stag seems most appropriate for income investors that need as much income as possible today. If you are looking for rapid dividend growth, you are likely to be disappointed by Stag.

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Prologis, Stag Industrial, and Vanguard Specialized Funds-Vanguard Real Estate ETF. The Motley Fool has a disclosure policy.