airdone

The healthcare sector is chock-full of lucrative opportunities ranging from highly speculative biotech plays to blue-chip dividend aristocrats. I have an interest in the full spectrum of healthcare tickers and have a curiosity about every industry in the sector attempting to find every possible linkage to the highly profitable sector. However, I have ventured outside healthcare sector stocks or ETFs, with some industrials such as 3M (MMM) and Stericylce (SRCL) that are critical to the healthcare industry. Besides a dormant position in Medical Properties Trust (MPW), I have thus far failed to dive into investing in healthcare real estate, which could be considered a stable and lucrative avenue for wealth creation. Omega Healthcare Investors (NYSE:OHI) “Omega” stands out as a compelling option. As a real estate investment trust specializing in the healthcare sector, Omega has established a position for itself in providing a unique and resilient investment opportunity. After delving into the key factors that make healthcare REITs an attractive prospect for investors, I have decided to reenter this space with OHI thanks to its enticing dividend of roughly 8.71%.

I intend to provide some background on Omega Healthcare Investors and some of the primary attractions for healthcare investors looking to expand in REITs. Then, I will discuss some of the associated risks. In addition, I will reveal my initial strategy for establishing a position and managing it in 2024.

Background On Omega Healthcare Investors

Omega Healthcare Investors differentiates itself by concentrating exclusively on healthcare-related properties, with a proficiency in skilled nursing and assisted living facilities. With an aging population in the U.S. and around the world, the demand for healthcare services is surging. Omega positions itself as a strategic player in this swelling market, offering stockholders exposure to a sector with a built-in growth trajectory.

Like other REITs Omega has reliable income streams as it owns a diversified portfolio of income-generating properties. Omega’s income streams are primarily derived from long-term leases with operators of skilled nursing facilities (SNFs) and assisted living facilities (ALFs), creating a dependable revenue foundation.

Omega typically engages in triple-net leasing arrangements, a structure wherein the tenant is responsible for property expenses such as maintenance, property taxes, and insurance. This places the burden of operational costs on the lessee, providing Omega with a predictable and stable income flow. The triple-net structure is particularly advantageous as it insulates the REIT from the day-to-day operational variability of the healthcare facilities it owns.

Many of Omega’s leases incorporate contractual rent escalations. This feature ensures that the income generated by the REIT grows over time, acting as a natural hedge against inflation. These escalations are often tied to specific metrics, such as increases in the Consumer Price Index (CPI), ensuring that the growth in rental income aligns with broader economic trends.

Omega also diversifies its portfolio across various operators and geographic regions. This diversification strategy helps mitigate the risk associated with reliance on a single operator or being heavily concentrated in a specific market.

Perhaps Omega’s biggest attraction is that it is tied to the healthcare sector, which has historically demonstrated resilience during economic downturns, as demand for healthcare services tends to be somewhat unyielding. As a result, Omega’s income streams benefit from this characteristic, providing investors with a defensive investment option. Even in challenging economic climates, the essential nature of healthcare services contributes to the continued demand for the facilities in which Omega participates.

Attractive Dividends

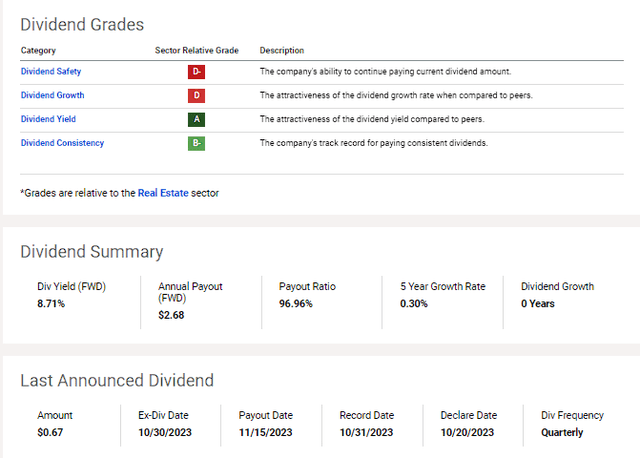

Omega has a history of delivering competitive dividend yields. As of the last available data, the company offers an attractive dividend yield of 8.71%, making it an appealing option for income-seeking investors.

OHI Dividend Summary (Seeking Alpha)

The combination of a stable portfolio, predictable revenue streams, and strategic positioning within the healthcare real estate market contributes to the company’s ability to sustain dividend payments. The stable income generated by Omega’s diversified portfolio contributes to the REIT’s ability to consistently pay dividends to its shareholders.

Beyond a high initial yield, Omega has a track record of steadily increasing its dividend over time. This consistent dividend growth is a testament to the company’s ability to navigate market challenges, adapt to changing conditions, and capitalize on opportunities. Not only is this attractive for the current yield but also the potential for their income streams to grow, providing a hedge against the erosive effects of inflation. Once again, the growing need for healthcare bodes well for Omega’s dividend going forward.

Analyzing the payout ratios is crucial for assessing the sustainability of a company’s dividend policy. Omega Healthcare Investors, with its focus on stable and predictable income streams, generally maintains manageable payout ratios. The stability of Omega’s cash flow, derived from its triple-net leasing structure and long-term agreements, contributes to the reliability of dividend payments. The defensive nature of healthcare real estate, coupled with the essential services provided by the facilities in its portfolio, enhances the predictability of cash inflows. This predictability is a key factor in the company’s ability to consistently meet its dividend obligations.

Risks To Consider

While Omega Healthcare Investors has demonstrated resilience, it’s important to recognize the inherent risks and challenges within the healthcare real estate sector. Regulatory changes, shifts in reimbursement policies, and economic downturns can impact the performance of healthcare-related properties. In fact, Omega reported that two of its operators paid less contractual rent than owed in November, impacting expectations for Q4 funds available for distribution to not match the dividend. Maplewood paid $3.3M less in November and anticipates $3.0M less in December, while Lavie paid $1.4M in November, below its previous run rate. Omega remains optimistic about the long-term value of these portfolios, however, it is a bit concerning considering the potential for an abrupt turn in the overall economy.

As with any venture, having a firm grasp on the competitive setting is vital for assessing the long-term sustainability and potential of a company. The healthcare real estate sector is not without competition, with several key players, including Healthcare Realty Trust (HR), Healthpeak Properties (PEAK), Sabra Health Care REIT (SBRA), Physicians Realty Trust (DOC), Medical Properties Trust (MPW) Welltower (WELL), and Ventas (VTR). Each of these companies has its approach to healthcare real estate, with variations in property types, geographic concentration, and strategies. So, they should be seen more as peers and might be a great addition to a portfolio. Still, OHI investors need to be aware of Omega’s opposition and how they could impact the REIT’s performance.

Considering these risks above, I am giving OHI a conviction level of 3 out 5 and will be in the Compounding Healthcare “Healthy Dividend” Portfolio.

My Plan

OHI presents a persuasive investment prospect thanks to its relative stability and growth potential of healthcare real estate. With a specialized focus, stable income streams, a high dividend yield, and a strategic position within the market, Omega stands as a prime option for healthcare investors looking for a balance of income and growth in their volatile healthcare portfolio. For those of you who are not big healthcare investors… well, a healthcare REIT like OHI can get you some exposure to the sector without the need for extensive knowledge of regulatory nuances, clinical trials, drug labels, payer reimbursements, etc.

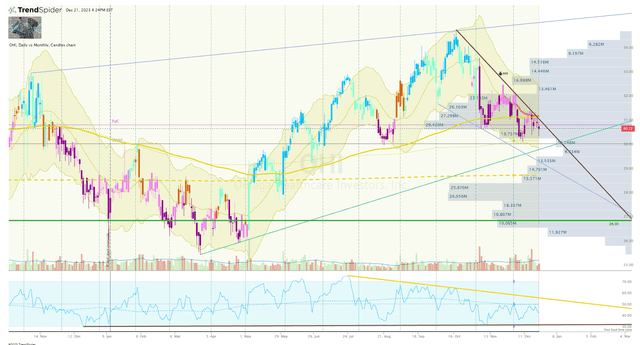

For me, I am looking to initiate a pilot position in the coming weeks if the share price can break out of the recent downtrend ray and retake the 200-day EMA.

I am looking to start with a minuscule position and will consider adding to the position following positive earnings reports throughout 2024. Admittedly, I am not looking to make OHI a major investment at this time, and will most likely consider expanding into other healthcare REITs before amassing OHI shares.

Long-term, I am looking to maintain an OHI position for at least 5 years in anticipation that it will become a reliable source of income.