DNY59

I’m always on the lookout for new and interesting fund strategies, and a reader recently pointed out the Pacer Metaurus US Large Cap Dividend Multiplier 400 ETF (NYSEARCA:QDPL) as an ETF worth reviewing.

The QDPL is an innovative fund that does not use traditional BuyWrite strategies or leverage to boost the fund’s distribution yield. Instead, it ‘buys’ extra distributions via Dividend Futures on the S&P 500 Index.

Historically, the QDPL ETF has been able to deliver 85-90% of the returns of the S&P 500 Index with more than 4x the distribution yield. I believe the QDPL ETF could be an interesting choice for income-oriented investors who do not want to have capped returns from traditional BuyWrite strategies. However, I am not convinced it is superior to BuyWrite strategies over the long run.

Fund Overview

The Pacer Metaurus US Large Cap Dividend Multiplier 400 ETF aims to provide 4 times the yield of the S&P 500 Index in exchange for a modest reduction in overall equity exposure.

Unlike other high yielding strategies like the JPMorgan Equity Premium Income ETF (JEPI) or the Global X S&P 500 Covered Call ETF (XYLD) that sell call options to generate premium income (“BuyWrite strategies”), the QDPL ETF does not sell any options to generate its income.

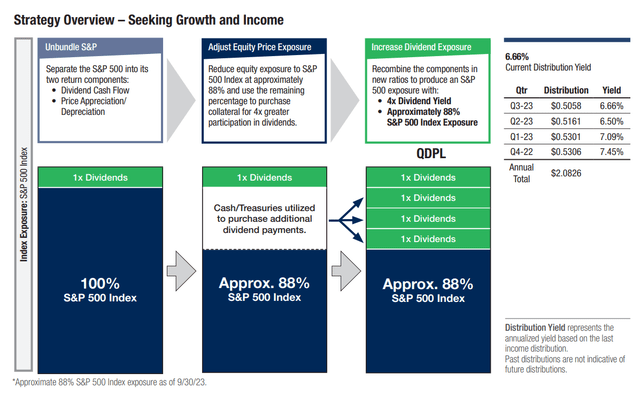

Instead, the QDPL ETF invests in “S&P 500 Dividend Futures” to obtain 4x exposure to the ordinary dividends paid on the common stocks of the companies included in the S&P 500 Index. The QDPL ETF also invests in the components underlying the S&P 500 Index for equity exposure. As of September 30, 2023, QDPL’s stock exposure is approximately 88% of the index (Figure 1).

Figure 1 – QDPL strategy overview (paceretfs.com)

The key benefits of QDPL’s strategy is that the strategy uses no leverage and has no performance caps, unlike traditional BuyWrite strategies.

What Are Dividend Futures?

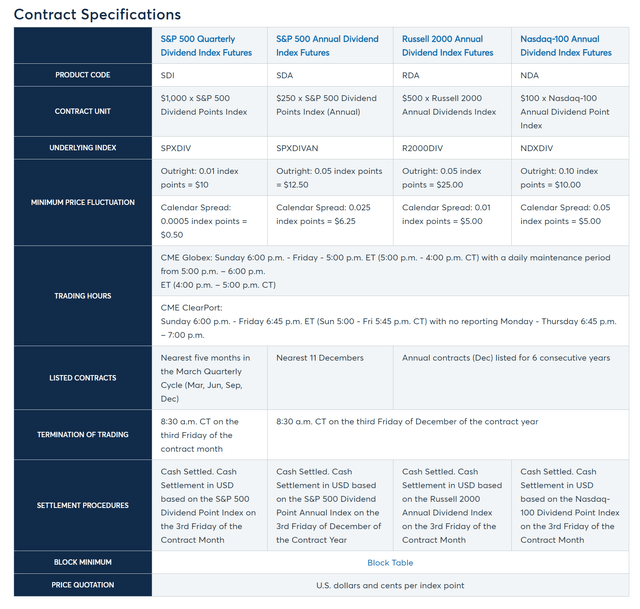

To be quite honest, this is the first time I have heard of index dividend futures, despite working in the financial markets for nearly two decades. As I understand it, dividend futures are derivative bets on the expected future ordinary dividend payments of the S&P 500 Index (or other similar equity indices) (Figure 2).

Figure 2 – Dividend futures contract specifications (CME)

Dividend futures allow investment banks to hedge the dividend risk in structured equity products that they package and sell to investors. Typically, when investment banks sell structured products with equity-linked returns to clients, they need to hedge their exposure with index futures and/or baskets of equities. However, since the structured products sold are usually linked to price changes only, rather than total returns, banks have excess dividend risk that they need to offload. The dividend futures market thus enables banks to reduce some of their dividend exposure by selling dividend futures to sophisticated investors.

When a long position in a dividend futures contract is held to expiration, the investment return depends on the difference between the index dividends per share actually paid and the price of the dividend futures at the time of the initial investment. If the actual dividend rate is below the expected rate when the buyer entered into the futures contracts, then the buyer will have to pay the difference at expiration. Conversely, if the actual dividend rate is higher than originally expected, the buyer will receive the difference.

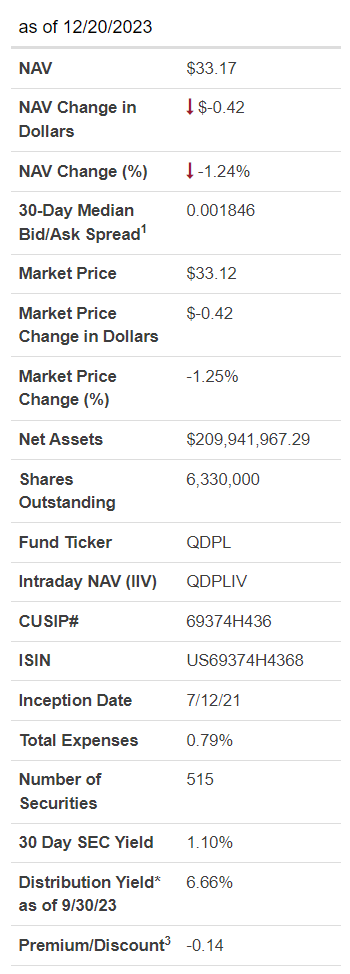

The QDPL is a relatively new ETF with a launch date of July 2021. To date, the QDPL has only garnered $209 million in assets while charging a 0.60% net expense ratio (Figure 3).

Figure 3 – QDPL overview (paceretfs.com)

Portfolio Holdings

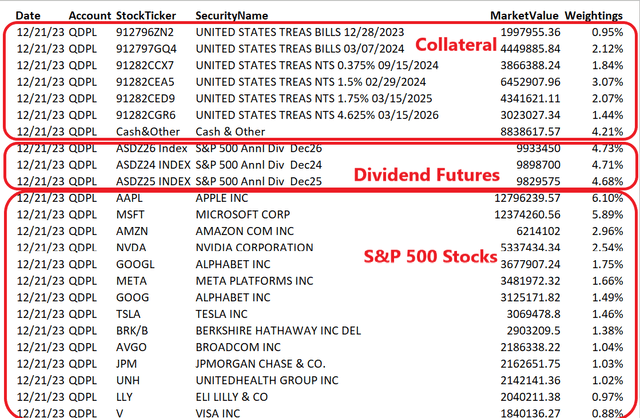

Figure 4 shows an abbreviated listing of QDPL’s portfolio. QDPL’s portfolio can be separated into 3 components. First, there are the S&P 500 constituents, scaled down to 85% of the portfolio. Then there is ~15% weight in the S&P 500 dividend futures. Finally, there is approximately 15% weight in cash and collateral to support the dividend futures.

Figure 4 – QDPL portfolio holdings (Author created with QPDL holdings report)

Returns

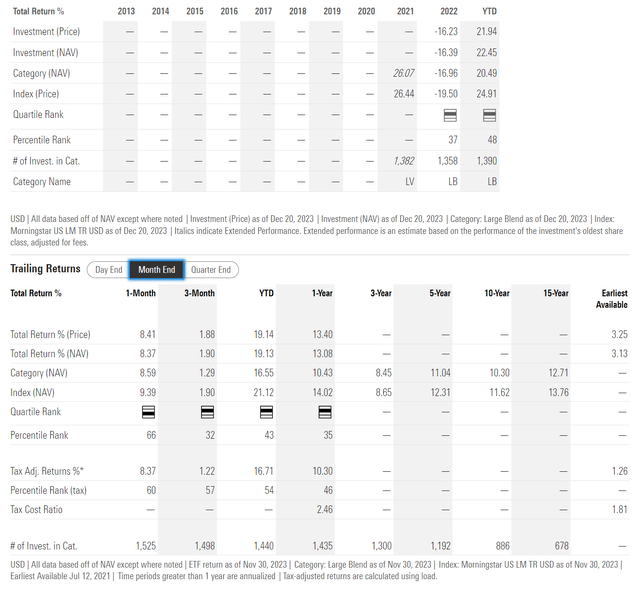

Figure 5 shows the QDPL ETF’s historical returns. On a 1 year basis, the QDPL ETF has returned 13.1%. Since inception, the QDPL ETF has returned 3.1% per annum, modest and not particularly interesting.

Figure 5 – QDPL historical returns (morningstar.com)

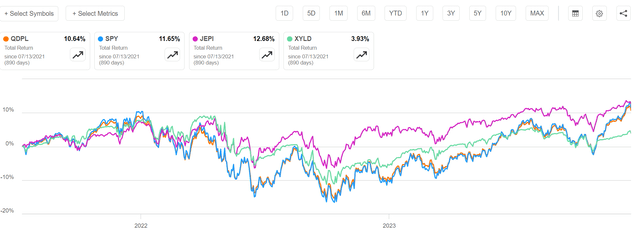

Another way we can analyze QDPL is to compare its total returns to that of the SPDR S&P 500 ETF Trust (SPY) and BuyWrite funds like JEPI and XYLD. In theory, the QDPL ETF should deliver returns that are ~85-90% of the SPY ETF, given the fund’s exposure. In fact, that is exactly what we find.

Since inception, the QDPL ETF has returned 10.6% compared to 11.7% for the SPY ETF, or 90.5% of SPY’s returns. (Figure 6). However, the QDPL ETF has underperformed the JEPI ETF at 12.7%, while it has outperformed XYLD at 3.9%.

Figure 6 – QDPL vs. SPY and peers, since inception (Seeking Alpha)

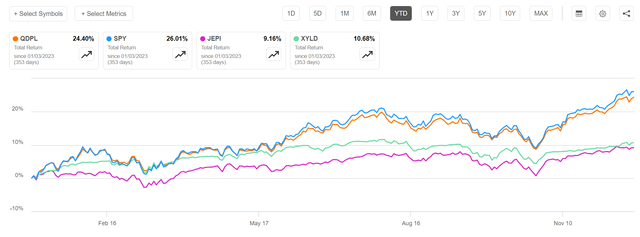

On a YTD basis, QDPL has returned 24.4% compared to SPY’s 26.0%, or 93.8% upside capture (Figure 7). QDPL have also massively outperformed JEPI and XYLD, as its returns were not capped.

Figure 7 – QDPL vs. SPY, YTD 2023 (Seeking Alpha)

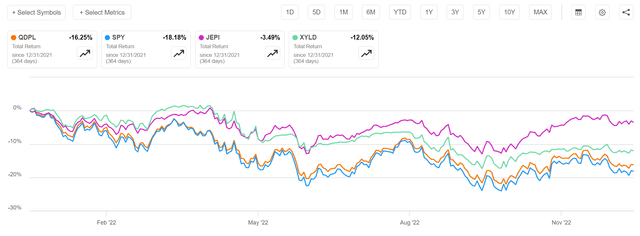

In 2022, QDPL returned -16.3% vs. -18.2% for SPY, or 89.6% downside capture (Figure 8). However, QDPL underperformed BuyWrite peers in 2022, with JEPI returning -3.5% and XYLD returning -12.1%.

Figure 8 – QDPL vs. SPY and peers, 2022 (Seeking Alpha)

From its limited history, it appears the QDPL ETF delivers on its promise of delivering 85-90% total returns of the S&P 500 Index. However, it does not consistently beat BuyWrite strategies.

Distribution & Yield

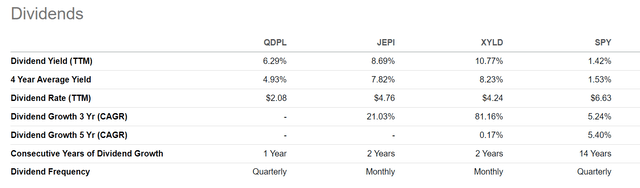

The other key part of QDPL’s strategy, the 4x distribution yield, is also as advertised. On a trailing 12 month basis, the QDPL ETF has paid a 6.3% trailing distribution yield, which is 4.4x that of the SPY ETF’s 1.4% yield (Figure 9).

Figure 9 – QDPL vs. SPY and peers, dividend yield (Seeking Alpha)

However, QDPL’s yield is less than both JEPI and XYLD.

Too Good To Be True, What’s The Catch?

From a high level review of the fund, the QDPL ETF looks almost too good to be true. The QDPL ETF delivers 85-90% of the total returns of the S&P 500 Index while also paying a distribution yield that is more than 4x that of the S&P 500 Index. Naively, if investors own the QDPL ETF with a modest 10-15% of leverage, then they may be able to get exposure to 100% of the S&P 500 Index with >4x the distribution yield of the index. So what’s the catch?

The catch is that investors buying the QDPL is bearing the risk that the actual dividend rate on the S&P 500 Index may be lower than the expected rate at the time of purchase of the futures contracts, perhaps due to a recession and/or natural disasters like the COVID pandemic.

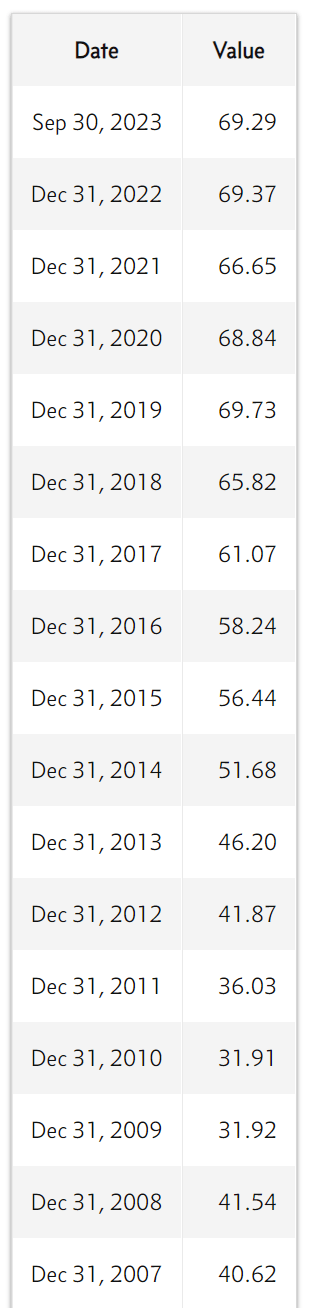

Historically, the S&P 500 Index’s dividends have grown at a ~6% rate. However, there are examples where dividends have grown below trend, or have even decreased year-over-year, like in 2020/2021, when the S&P 500’s dividend declined by 3.2% YoY (Figure 10). A more drastic example is 2008/2009, when the S&P 500’s dividend fell 23.2% YoY.

Figure 10 – S&P 500 Index dividends (multpl.com)

Given QDPL’s long position in dividend futures, in the event of a deep recession like the Great Financial Crisis, the QDPL ETF could face significant losses on its dividend futures positions, in addition to a steep drawdown on its stock portfolio.

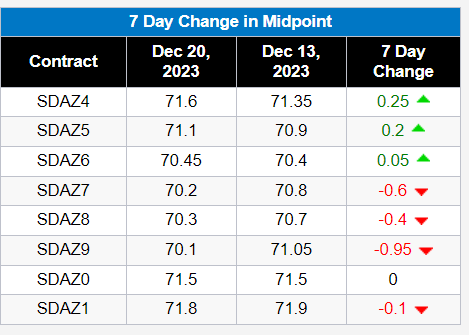

For example, the QDPL ETF currently holds 553 contracts of the SDAZ4 futures (2024 dividend futures) with a futures price of 71.6 (Figure 11). If at maturity, the actual dividends on the S&P 500 is less than 71.6, the QDPL ETF will have to pay the difference multiplied by a multiplier to its counterparty.

Figure 11 – Illustrative S&P 500 dividend futures pricing (CME)

In a worst-case 2008/2009 scenario, if the index’s dividend turns out to be 20% lower, let say $57.28 instead of $71.60, then the QDPL ETF will be on the hook for 553 x 250 x (71.60 – 57.28) = $2.0 million or ~1% of net assets.

Furthermore, in 2009, not only did the actual dividends paid decrease year over year, but future years were also reset lower. Since QDPL also owns SDAZ5 and SDAZ6 futures, the total loss for the fund could be tripled to ~$6.0 million, or 3% of net assets.

Also, in a bad recession, the S&P 500 Index will presumably decline. So in this scenario, it is very likely that QDPL’s total returns will be significantly worse than that of the S&P 500 Index.

On the other hand, if economic growth is robust, then the S&P 500 Index’s dividend may grow faster than expected and the QDPL ETF can deliver stronger than expected total returns.

Overall, as long as investors are cognizant of the pro-cyclicality of returns from holding dividend futures, I believe the QDPL ETF could be an interesting fund to consider, as it does not suffer from capped upside of BuyWrite strategies. However, from the limited operating history that I can analyze, the QDPL ETF has underperformed BuyWrite funds like the JEPI ETF that it is supposed to outperform.

Conclusion

The QDPL ETF is an innovative fund that uses dividend futures to boost the distribution yield of the S&P 500 Index without capping total returns, unlike BuyWrite strategies. In a normal economic growth environment, the QDPL ETF should be able to deliver 85-90% of the total returns of the S&P 500 Index with 4x the dividend yield.

The catch is that when actual dividends on the index are less than expected (i.e. from recessions or natural disasters), then payouts on the futures contract can be a drag on the fund’s performance.

I rate the QDPL ETF a hold for now, as I am not totally convinced it delivers a better mouse-trap than BuyWrite strategies. True, in 2023, QDPL has outperformed as its upside returns were not capped. However, during bear markets like in 2022, the QDPL also did not have option premium income to cushion drawdowns like the JEPI ETF did.