If you had to choose a theme for 2023 (besides maybe Taylor Swift), it would definitely be artificial intelligence (AI).

The technology has taken the world by storm, with countless companies restructuring their businesses to prioritize AI development. The AI market was valued at $137 billion last year, and Grand View Research suggests that it will expand at a compound annual rate of 37% through the end of the decade. At that point, the market should exceed $1 trillion in annual revenues.

Given those optimistic outlooks, bullish investors have rallied to the companies with the most potential in the industry, sending the Nasdaq-100 index soaring by 65% year to date. But even with that bull run behind us, it’s not too late to add an AI stock to your portfolio and profit from the industry’s long-term growth.

Alphabet (GOOGL 0.76%) (GOOG 0.65%) and Apple (AAPL -0.56%) are two attractive options that are both investing heavily in AI. But which is the better AI stock right now?

Alphabet

As the owner of powerful brands like Google, Android, YouTube, and Chrome, Alphabet has massive potential in AI. The company has already used these platforms and the billions of visitors they attract to become a digital advertising powerhouse. So it feels obvious that Alphabet could profit from bringing AI upgrades to the various services it provides to its vast user base.

The tech giant is already making moves to do this. It plans to launch its most advanced large language model (LLM) ever, Gemini, in 2024. The new model is expected to be highly competitive with OpenAI’s ChatGPT-4, with capabilities to crunch different forms of information such as text, video, and audio.

Alphabet CEO Sundar Pichai said in a blog post that Gemini “represents one of the biggest science and engineering efforts we’ve undertaken as a company.” The LLM could open the door to countless growth opportunities in AI for Alphabet, allowing it to improve Google Search, offer more efficient advertising, and introduce new AI tools on Google Cloud.

Moreover, earlier this month, the company announced a new lineup of custom-built chips optimized for training AI models. The soon-to-be-released hardware is almost three times faster than prior generations of chips and strengthens Alphabet’s position in the industry.

Apple

Apple has taken a slower approach to AI than competitors such as Alphabet, Microsoft, and Amazon. However, that’s not a reason to count it out.

The company has a proven talent for taking established technologies, adding its own unique design language, and delivering products that rise to dominance in the consumer market. The tech giant did just that with smartphones, tablets, wireless headphones, and smartwatches. Other companies ruled each product category before Apple landed on the scene and took over. It has the brand recognition and financial resources to do the same in AI.

Additionally, while Alphabet and other tech companies have focused their AI efforts on the commercial sector, Apple has honed in on the consumer market. Throughout this year, the iPhone maker has gradually introduced AI-enabled features across its product lineup that could see it become a major growth driver in the public’s adoption of the technology.

The company could profit significantly from the brand loyalty it has built up with consumers as it continues expanding its AI offerings.

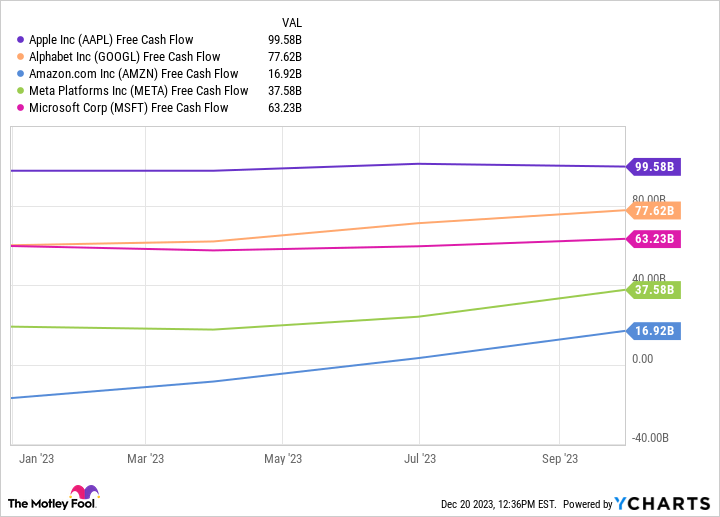

Data by YCharts.

It’s too early to know Apple’s long-term AI plans. However, this chart shows it hit nearly $100 billion in free cash flow this year. It has the funds to overcome potential headwinds and heavily invest in the industry.

In fact, Apple’s research and development spending increased by more than $3 billion in fiscal 2023, primarily because of a larger focus on generative AI.

The company has its work cut out for it, but I wouldn’t bet against Apple flourishing in AI over the next decade.

Is Alphabet or Apple the better artificial intelligence stock?

Alphabet and Apple have solid outlooks in AI over the long term. However, Alphabet appears to have a more established role in the market so far. Its various services offer almost endless opportunities to monetize its AI technology. Meanwhile, the promise of Gemini and its new AI chips is too good to ignore.

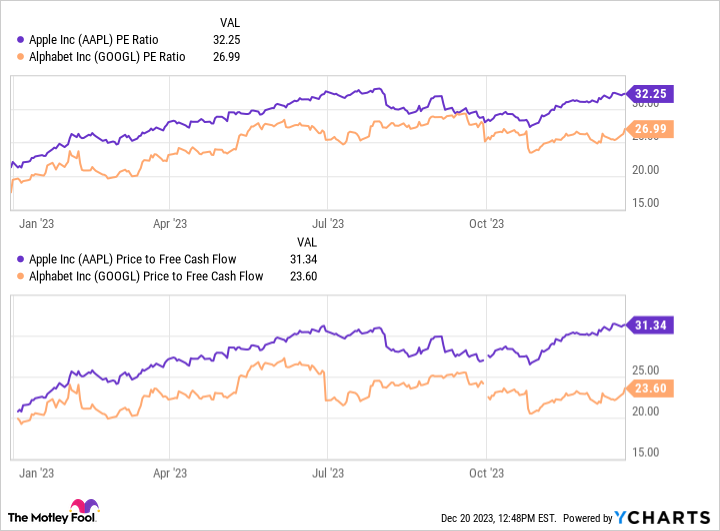

Data by YCharts.

Furthermore, based on their price-to-earnings and price-to-free-cash-flow ratios, Alphabet looks like the better bargain. So in my view, Alphabet is the better choice, and a no-brainer AI stock to buy right now.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, and Microsoft. The Motley Fool has a disclosure policy.