AlanStix64

Summary

Readers may find my previous coverage via this link. My previous rating was a hold, as I thought Copart’s (NASDAQ:CPRT) valuation was still not attractive enough. My expectation was that CPRT should trade at around 25x forward PE before it becomes an attractive stock. I am reiterating my hold rating for CPRT as I still believe its valuation will revert to the mean eventually as growth is unlikely to stay in the mid-teens for the long term. Valuation, when compared to the market, also suggests that it is not cheap.

Financials / Valuation

CPRT 1Q24 performance came in better than expected, growing 14% at the topline to $1.02 billion. The strong performance beat consensus estimates of $988 million. A strong beat was also demonstrated at the EBIT level, where CPRT reported EBIT of $395 million at 38.7% margin vs. both consensus of $380 million at 38.5% margin. This performance led to CPRT beating at the adj EPS level as well. CPRT reported an adj. EPS of $0.34 vs. a consensus of $0.33.

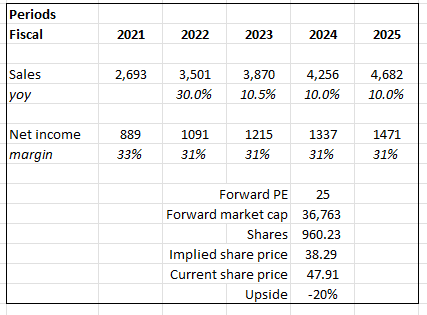

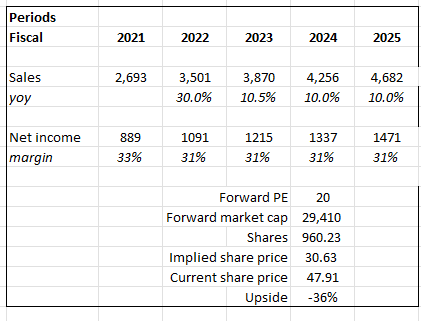

Based on author’s own math

There are no changes to my model assumptions; I still think growth will gravitate back to ~10% growth like how CPRT has grown historically (note this is reflected in consensus estimates as well). I think the core debate here remains the same: what multiple should CPRT trade at? The bullish argument is that, in the near-term, multiples could stay higher for longer than expected because of various near-term tailwinds (as I listed below). That could be true, but that is not where my expertise lies (in timing the market). I prefer to value the business over a longer time period. By doing so, I think the CPRT valuation will revert back to 25x forward PE. Previously, I compared CPRT’s valuation and growth to its historical performance. I bring forth another piece of data that should support my view that CPRT should trade at 25x. If we compare CPRT to the S&P500 forward PE multiple, historically, CPRT tends to trade at a 1.3x premium to the market, but it is now trading at 1.6x. Over the longer term, I expect this ratio to revert back to 1.3x, and at the current market multiple (19x forward PE), it translates to 25x forward PE. Now, I would also note that the market is trading at a much higher multiple relative to history (historically at 16x). If S&P multiples revert to mean, CPRT should trade at 20x, which, of course, translates to more downside.

Based on author’s own math

Comments

First of all, I will not play down the fact that CPRT did really well in 1Q24, strongly outperforming what I had expected (low-teen growth). My view is that this strong performance has convinced the market that growth can be sustained at the mid-teens level (growth actually accelerated from 4Q23), hence supporting the already high valuation that CPRT was trading at. Kudos to the short-term traders that caught this rally, but I am not changing my view that valuation is still high. Below, I give my view on CPRT’s growth cadence.

For the insurance business, it was nice to see that growth was driven by a recovery in total loss frequency [TLF] and better-than-expected pricing. For reference, CPRT 3Q23 core US insurance units saw a 9.7% y/y driven increase in TLF to 19.3%, while ASPs saw a 1.7% y/y decline (which is better than the Manheim Used Vehicle Price Index decline of 4%, as per 1Q24 call). In my opinion, growth could be slightly elevated in the near term (supporting the near-term bull case that growth remains at a mid-teen percentage) as follows:

- CPRT potentially capturing share from its competitor that is experiencing “share shifting” (hinted in the 1Q24 earnings call).

- Repair costs are likely to remain relatively resilient due to the higher labor costs and parts prices, and this dynamic is expected to drive a recovery in TLF (accelerate back to pre-covid level), benefiting insurance volume in the coming quarters.

For the non-insurance business, there are also aspects that indicate potential elevated growth in the near term, as CPRT saw success in penetrating the whole car market. The performance was very impressive, to be honest. CPRT saw very strong unit growth, with BluCar units up 35% and dealer volumes up 13%. As whole-car growth continues to become a larger part of the mix, its growth contribution should increase. Now at 25% of the total mix, the continuous penetration into the whole car market should continue to sustain growth in the near term. The bigger CPRT gets, the stronger its flywheel effects, as it benefits from its large physical auction footprint (relative to its digital peers) and buyer/seller base.

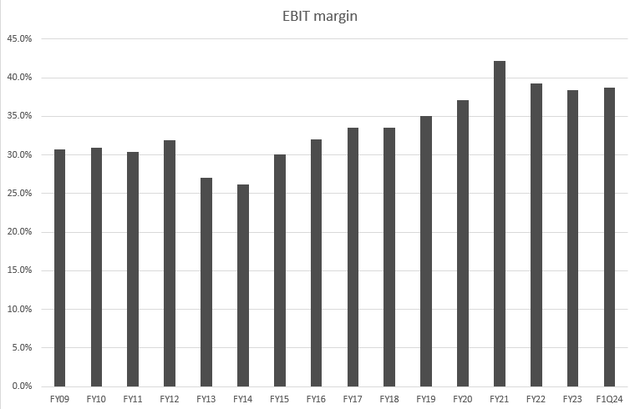

Overall, I believe CPRT is executing strongly, continuing to gain share, and seemingly able to so far offset the impact of softer pricing in the broader market. However, I remind readers that the positive tailwinds are short-term and do not structurally improve long-term growth rates. I also point readers to the fact that the CPRT EBIT margin remains at a very high level when compared to history. Although I give credit that they are able to hold on to pricing well, as the overall pricing environment continues to normalize, pricing reversion will be dilutive to margin. As such, even if the top line can grow in the mid-teens, margin compression would cause earnings to grow at a lower rate.

Risk & Conclusion

As I indicated in the valuation section, multiples could stay higher and longer-than-expected. If multiples persists at this level for the next 2 years and even if growth reverts to 10%, the share price will move up, which is an upside risk. In conclusion, I agree that CPRT recent performance exceeded expectations, but I am sticking to my hold rating due to its valuation. While 1Q24 showcased robust growth, the current mid-teens growth rate might not be sustainably long-term. Comparing CPRT valuation with the S&P500’s forward PE ratio signals an overvaluation, which I believe will see an eventual reversion to historical levels.