skynesher

Company Overview

Landsea Homes Corporation (NASDAQ:LSEA) is a publicly traded residential homebuilder based in Dallas, Texas, that designs and builds best-in-class homes and sustainable master-planned communities in some of the nation’s most desirable markets. The Company has developed homes and communities in New York, Boston, New Jersey, Arizona, Colorado, Florida, Texas, and throughout California in Silicon Valley, Los Angeles, and Orange County. As a result of declining inflation, the Fed’s stance on lowering interest rates in 2024, and an increase in recent weekly mortgage applications, we believe LSEA offers an attractive investment opportunity.

Investment Thesis

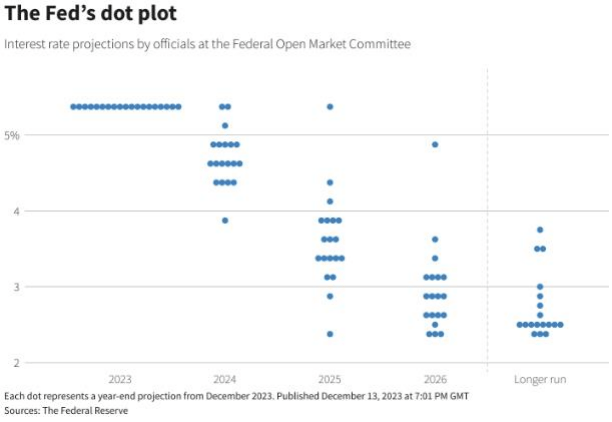

On December 13, 2023, the Fed and Jerome Powell signaled that they would cut rates in 2024 by 75 basis points. 17 of 19 Fed policymakers are expecting rates to be lower by the end of 2024. The Central Bank held policy rates in the 5.25 to 5.50% range.

Federal Reserve

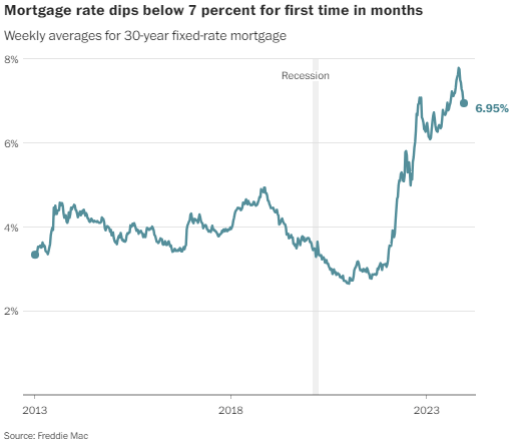

On December 14, 2023, mortgage rates dipped below seven percent for the first time in months.

Freddie Mac

According to the Mortgage Bankers Association’s (MBA) Weekly Mortgage Application survey for the week ending December 8, 2023, mortgage applications increased 7.4%.

On December 12, 2023, the Consumer Price Index released by the Bureau of Labor Statistics revealed that prices for urban consumers rose by 0.1% for November and that energy prices are down 9.8% year-over-year. Core prices, excluding food and energy, rose 0.3% for the month, which matched economists’ expectations. On an annualized basis, prices were up 3.1%, and core prices were up 4.0%, compared with October’s annualized rates of 3.2% and 4.0%, respectively.

In their Q3 earnings report, LSEA had total revenue of $277.3 million, down 17.4% from the prior year. The Company reported adjusted net income of $11.7 million, or $0.30 per diluted share. LSEA had net new home orders of 486, an 89% year-over-year increase. The Company ended the quarter with a book value of $17.28 per share and has an approved repurchase program of an additional $20 million for the next twelve months. Year-to-date, the Company has repurchased 2.4 million shares for $21.2 million. LSEA has roughly 38 million shares outstanding as of the end of Q3:23.

Risks

- Inflation does not subside, leading to rate increases.

- Mortgage rates decline slowly, leading to a lack of demand for housing.

- Unemployment increases, leading to less demand for housing.

Valuation

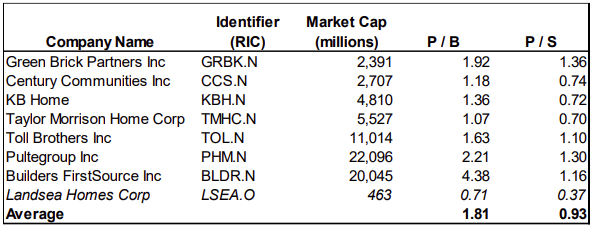

We have provided an analysis of LSEA’s common stock to show how it is undervalued relative to its peers, as seen in the table below, which compares the Company to its peer average P/B and P/S ratios. The peer group includes Green Brick Partners (GRBK), Century Communities (CCS), KB Home (KBH), Taylor Morrison Home (TMHC), Toll Brothers (TOL), PulteGroup (PHM), and Builders FirstSource (BLDR).

Singular Research

Over the next twelve months, it is reasonable to assume (barring any sudden shocks to the economy) that interest rates decline, mortgage rates decline, and inflation subsides, leading to an increase in home purchases and LSEA’s valuation. If we assume LSEA’s Price-to-Book ratio expands to just 50 percent its peer group average, we forecast a price of $15.51, and if we assume LSEA’s Price-to-Sales ratio expands to just 50 percent its peer group average, we forecast a price of $15.17. The average of these two price targets is $15.34, which we round up to $15.35, 26% higher than LSEA’s closing price of $12.17 on December 18, 2023.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.