Feverpitched

I invest today about 50% of my net worth in real estate investment trusts, or REITs.

I am so bullish because they are heavily discounted and essentially allow me to buy real estate at a large discount to its fair value.

I don’t think that this window of opportunity will last for much longer and I want to make the most out of it.

But that does not mean that I am bullish on every single REIT.

In fact, there are a lot of them that I expect to do poorly going forward because they are either overpriced, overleveraged, or poorly managed.

Here are three REITs that I would sell before 2024. Take your tax loss and proceed on to something else:

Global Net Lease, Inc. (GNL)

Global Net Lease is a net lease REIT just admire Realty Income (O), NNN REIT (NNN), and VICI properties (VICI).

But GNL stands out in that it probably has the worst track record of them all.

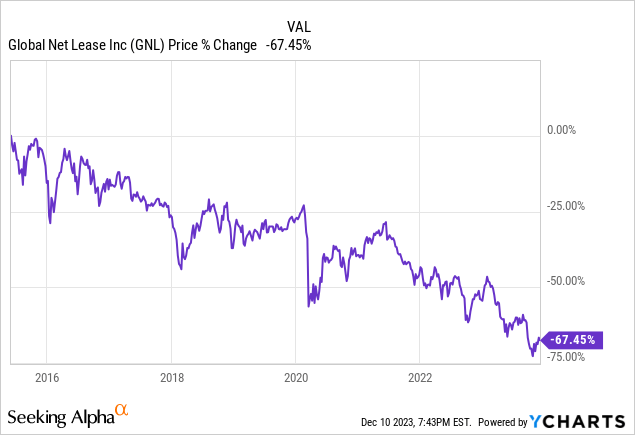

It went public nearly 10 years ago and since then, its share price has dropped by 67% even as most other net lease REITs (NETL) gained significant value:

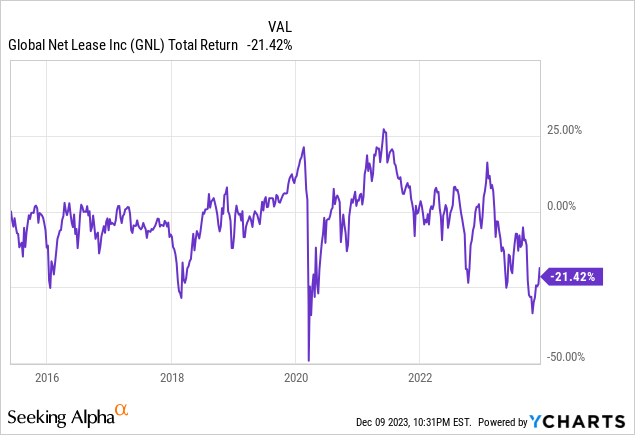

Even if you include all of its dividend payments, shareholders still haven’t earned a positive return in 10 years!

And the reason for this is simple:

The company has made a lot of poor decisions. It uses too much leverage. And it owns bad assets.

The management has consistently issued more shares to buy more properties, but the equity issuances were dilutive on a per-share basis because their expected returns were lower than their cost of capital. They also took on a lot of debt, likely in an attempt to limit the dilution, but this is hurting them following the recent surge in rates. Finally, they bought mostly high-cap rate properties, but the cap rates were high for a reason. They bought a lot of single-tenant office buildings, some of which probably have a negative equity value in today’s world, and the also bought a lot of old and risky industrial properties, which offer high cash flow today but face high vacancy and obsolescence risk.

Global Net Lease

The stock is cheap, trading at 8x funds from operations, or FFO, and GNL always seems to be cheap, and yet, it keeps underperforming over the long run.

It could bounce higher if interest rates are cut, but the same is true for other REITs.

If I owned this, I would sell, take my tax loss, and reinvest into something else.

Public Storage (PSA)

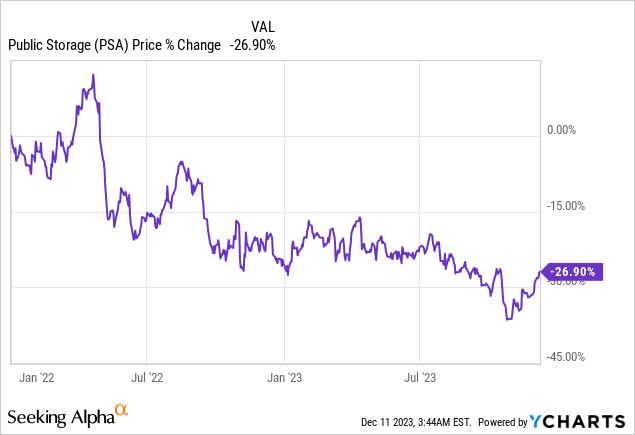

Public Storage is a blue-chip self-storage REIT that has a great track record, but its share price has dropped significantly over the past year, and as a result, a lot of investors think that now is a great time to buy shares of the company:

Public Storage

But I disagree. I would do the opposite and sell it if I owned it.

Even following the selloff, the shares are still priced at 17x FFO, which is not particularly cheap when you consider that self-storage is today overbuilt in the U.S. and likely to face years of stagnating same-property NOI growth.

The pandemic led to a boom in demand because people suddenly needed space for a home office, a lot of people relocated, and older generations passed away and left a lot of stuff behind.

But this surge in demand then led to a boom in new construction, and right as this supply is set to hit the market, the demand is likely to decrease as increasingly many people return to the office.

So I agree that PSA is a high-quality REIT, but I think that the highly uncertain future prospects of self-storage warrant a lower valuation.

I would take my loss and reinvest in another property sector that’s cheaper and stronger.

Boston Properties, Inc. (BXP)

Finally, I would also sell Boston Properties.

Not because I think that it will crash and lose you a lot of money.

On the contrary, I believe that it may do reasonably well over time. It owns Class A office buildings that remain in high demand despite the negative perception. It has a good balance sheet. And the management has a great track record.

Boston Properties

But there are two reasons why I would proceed on.

The first and most important one is that my capital is limited and there are simply better options out there. To give you an example: Alexandria Real Estate (ARE) is a far better REIT from every perspective and yet, it is today priced at a comparable valuation because it is falsely classified as an office REIT when in reality, it owns mostly life science buildings.

And then secondly, I fear that the fundamentals of BXP won’t matter as much as the perception of the market for many years to come. I fear that we will see a repeat of what happened to Simon Property Group (SPG) back in 2017. Its stock was cheap, its fundamentals were strong, but malls were hated, and so it turned into a value trap. I fear that BXP will face the same outcome.

Closing Note

REITs are today very opportunistic as a group, but you still need to be very selective because not all of them are worth buying.