An oil pipeline in the sunset. bjdlzx

Frequent readers of my articles know that through January 2024, I don’t strategize on being a net buyer of stocks. This is because I am currently working on shoring up my emergency fund.

However, that doesn’t mean that I haven’t executed any buy/sell transactions of late. Last month, I sold out of my positions in Medical Properties Trust (MPW) and 3M Co. (MMM). For the sake of brevity, I would refer readers to the articles by Dividend Sensei that I linked above largely as the rationale for my two stock sales in November.

When screening for a company to redeploy the capital proceeds into, a replacement candidate had to confront these requirements:

- A business model with a reputation for consistent growth

- A track record of steady dividend or distribution growth

- An investment-grade balance sheet

- An appealing valuation.

The midstream operator, MPLX LP (NYSE:MPLX) was the company in which I ultimately decided to put my capital to work. I’ll dive into MPLX’s fundamentals and valuation to explain why it now accounts for 1.1% of my 100-stock individual stock portfolio.

MPLX’s 9.4% distribution yield is substantially higher than the 3.9% yield of the 10-year U.S. treasury. Not to cite that it is a whopping 6X greater than the 1.5% yield of the S&P 500 index (SP500). Although there are risks some may find to be too much to tolerate, this nearly double-digit yield is arguably safer than one might think it is at a mere glance.

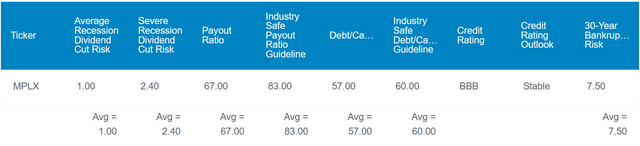

For one, MPLX’s 67% DCF payout ratio is well below the 83% DCF payout ratio that is considered safe for the midstream industry by credit rating agencies. This leaves the partnership with a sizable cushion to preserve its distribution in just about any operating environment.

MPLX’s financial health is also solid. The company’s 57% debt-to-capital ratio is just below the 60% that rating agencies view as sustainable for their industry. This is why S&P awards a BBB credit rating to MPLX on a stable outlook. That suggests the risk of the company defaulting on debt over the next 30 years is 7.5%.

Taking these elements into consideration, Dividend Kings pegs the risk of MPLX cutting its distribution in the next recession at just 1%. In the next severe recession, that probability is still modest at 2.4%.

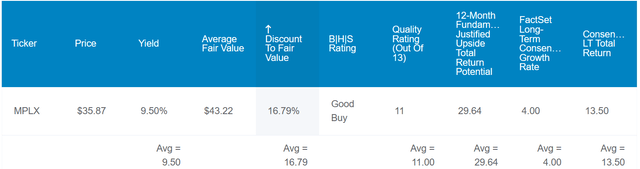

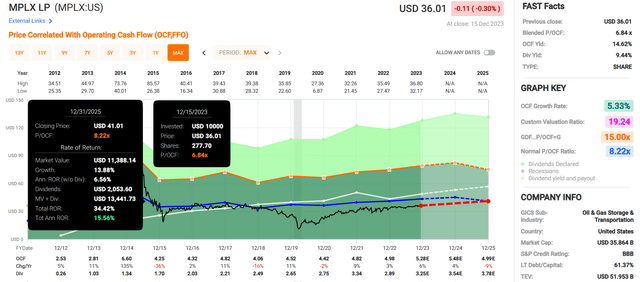

What’s more, MPLX is currently priced at an appealing valuation. Using the company’s distribution yield and P/OCF ratio as a guide, Dividend Kings estimates the fair value of the MLP to be $43 a unit. Stacked up against the $36 unit price (as of December 16, 2023), this is a 17% discount to fair value.

If the partnership returns to fair value and grows in line with the analyst consensus, here are the total returns that it could create for unitholders in the next 10 years:

- 9.4% yield + 4% FactSet Research annual growth consensus + 1.8% annual valuation multiple expansion = 15.2% annual total return potential or a 312% 10-year cumulative total return versus the 9% annual total return potential of the S&P 500 or a 137% 10-year cumulative total return

MPLX Is A Leading Player In Midstream

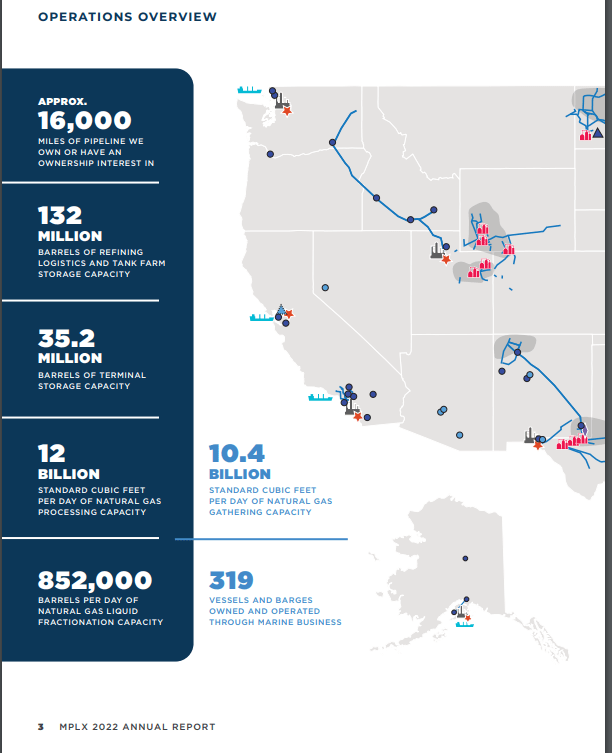

MPLX 2022 Annual Report

MPLX is a major MLP that was formed by Marathon Petroleum Corporation (MPC) in 2012. The latter owns a 65% stake in the former. As of the end of 2022, MPLX owned and operated or had a stake in roughly 16,000 miles of crude oil and refined products pipelines and over 80 terminals, including an export terminal and storage caverns. These were located throughout the major supply basins in the U.S., such as the Permian, Bakken, and Marcellus basins. As of that time, MPLX’s infrastructure was also capable of storing more than 132 million barrels of product and could process 12 billion cubic feet per day of natural gas.

The company is organized into two segments: Logistics & Storage and Gathering and Processing.

As its name would propose, the L&S segment transports, stores, and distributions crude oil and refined products across the U.S. via its pipelines, terminals, and storage caverns. This segment accounted for approximately two-thirds of the company’s $4.6 billion in adjusted EBITDA (67.6%) through the first nine months of 2023.

The G&P segment consists of multiple natural gas gathering systems that focus on raw and untreated gas. According to MPLX, these systems eliminate the heavier and more valuable hydrocarbon components from the natural gas. These products include butane, propane, and ethane. This segment comprised the other third (32.4%) of the company’s adjusted EBITDA for the first nine months of 2023.

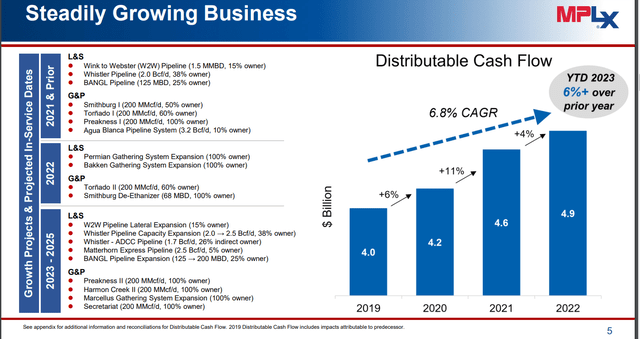

As has been the case throughout midstream, MPLX has had a strong 2023 thus far. The company’s aforementioned adjusted EBITDA of $4.6 billion is up 7.5% year-over-year through September 30, 2023. Total DCF made its way higher by 6.6% over the year-ago period to $4 billion for the nine months ended September 30. This vigorous growth was driven by higher volumes within both the L&S and G&P segments.

MPLX Q3 2023 Investor Presentation

Looking ahead, MPLX should have the ability to continue this momentum. In the near term, the completion of the Whistler pipeline expansion in the Permian should be a growth catalyst. The project was brought into service at the end of MPLX’s third quarter, which expanded natural gas processing capacity from 2 billion cubic feet a day to 2.5 billion.

In the Delaware basin, the company is planning the construction of its sixth natural gas processing plant, Preakness II. This is expected to come into service in the first half of 2024. Additionally, the company’s seventh processing plant in the basin, Secretariat, is forecasted to come into service in the second half of 2025.

If this weren’t enough, MPLX also has the financial positioning to make these projects happen. Through the first nine months of 2023, the company generated $752 million in adjusted free cash flow after distributions. This adequately covered MPLX’s $608 million in growth and maintenance capex.

Finally, the company’s balance sheet is improving. As MPLX’s debt has remained in the $20 billion range, its debt to EBITDA ratio has declined from 3.7X in 2021 to a highly sustainable 3.4X as of Q3 2023. This is because the company’s EBITDA base is steadily growing.

Healthy Distribution Growth Is Just Getting Started

In late October, MPLX hiked its quarterly distribution per unit by 9.7% to $0.85. This means that the partnership will have paid $3.25 in distributions per unit in 2023. For context, that’s a staggering 178.4% cumulative growth rate over the $1.1675 in distributions per unit paid in 2013.

There is also reason to believe outsized distribution growth can persist for the foreseeable future. As I noted earlier, MPLX is free cash flow positive after considering both distributions and growth/maintenance capital spending. This leaves the company with enough capital to also engage in measured unit buybacks. The company’s total unit count decreased by 1.2% year-over-year to just above 1 billion through September 30. That reduction in the unit count can keep MPLX’s total distributions paid growing at a slower rate than the rate at which it increases the distribution.

Risks To Consider

MPLX is a business of above-average quality. However, it has unique risks that merit advance consideration before buying.

The biggest and most obvious risk is that the direction of MPLX is controlled by MPC because the board of directors of the former is appointed by the latter. The MLP could be outright purchased and there would be nothing that unitholders could do to stop such a decision. Not to cite, the distribution could also be suspended at any time if MPC decided to do so.

Another risk is that MPC accounted for approximately 47% of MPLX’s total revenue in 2022 (page 7 of 189 of the most recent 10-K filing). MPC itself is investment-grade. But if it were to withstand financial difficulties, it may default on its obligations to MPLX. This could deal a devastating blow to the MLP’s financials.

As I have alluded to throughout the article, MPLX is an MLP. Investors should weigh the tax ramifications that would be specific to their situation.

Summary: An Ultra-High-Yielder On Sale

FAST Graphs, FactSet FAST Graphs, FactSet

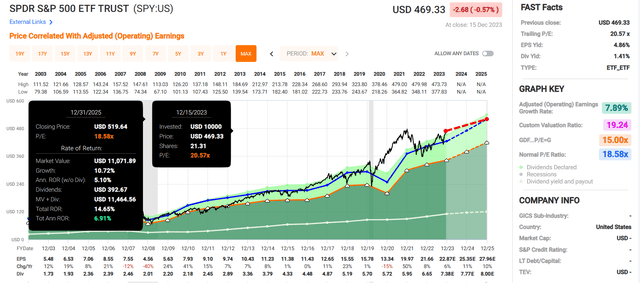

When it comes to ultra-high-yielding stocks, not all of them are created equal. Most extremely high-yielding stocks are that way for a reason. MPLX has its risks that warrant caution, but it’s arguably not a yield trap.

The company’s P/OCF ratio of 6.8 is moderately below its historical P/OCF multiple of 8.4 per FAST Graphs. If the company returns to fair value and grows as anticipated, it could create 34% cumulative total returns through 2025. That would be considerably better than the 15% cumulative total returns that are projected for the SPDR S&P 500 ETF Trust (SPY) over that time. These factors made the stock worth buying for my circumstances, which is why I rate it a buy currently.