RapidEye/iStock via Getty Images

In light of face-ripping rallies in the mega-cap tech sector, it is easy to overlook that there are stocks outside the oft-spoken names. These stocks speak of quality and can furnish better-than-average returns. During one seek I discovered Applied Industrial Technologies (NYSE:AIT) whose products and solutions serve critical areas of the Industrial Sector and its focus on cashflows and balance sheet has allowed it to outperform the market.

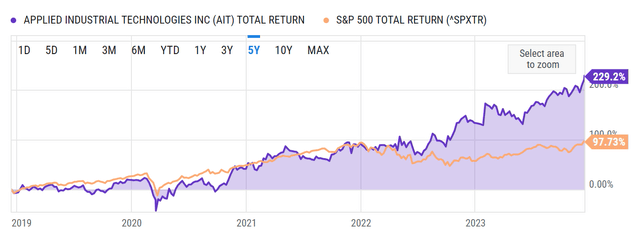

Stock Returns versus the benchmark (Ycharts)

In our analysis, we will briefly look at the company, the reasons for its returns, and what we can expect from this stock in the future.

The Company

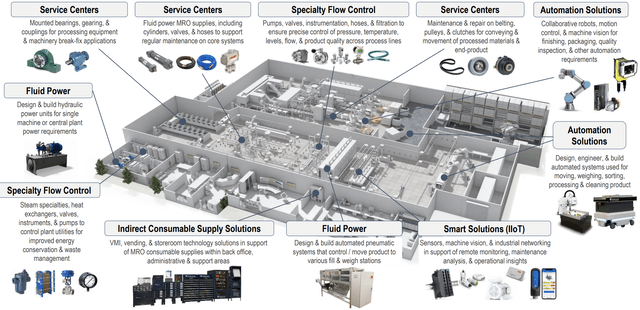

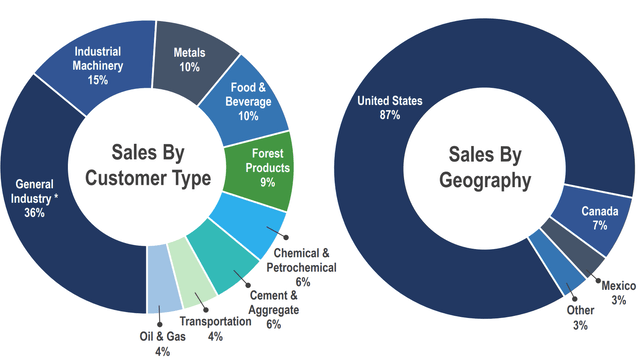

Applied Industrial Technologies, Inc. is one of the largest distributors and technical solutions providers of industrial motion, fluid power, flow control, automation technologies, and related maintenance supplies. The company was founded in 1923 and operates in multiple countries but close to 90% of its sales come from the United States (Its customer mix however is much more diverse and varied)

Customer Application / Cross-Sell Potential of Applied® Products & Solutions (Investor Presentation)

Customer Mix (Investor Presentation)

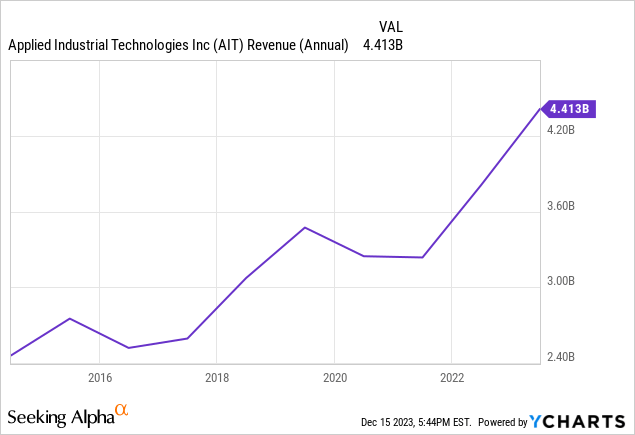

The diverse list of applications for their products means their revenues have been resilient. Even the Covid years saw their sales remain relatively stable (even though the company operates in the industrial sector which is highly cyclical)

It is natural to think that a five-year revenue growth rate of close to 50% does not explain the returns of more than 200% over the same period. So let’s dig in!

Three big reasons that explain their returns

Profitability

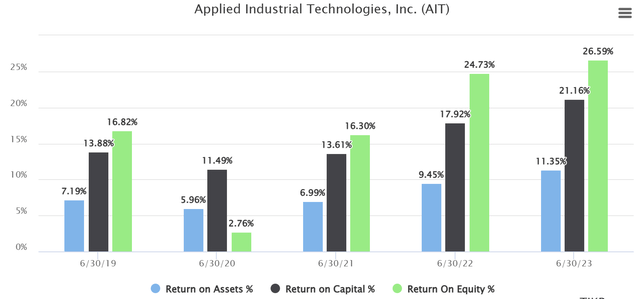

Across the board, the company’s great focus on the bottom line has yielded great results. In 2019, the return on Assets was in mid-single digits, Return on Capital and return on equity were in mid-double digits. From the most recent full year, we have seen the same metrics grow to approximately 11%, 21%, and 26%.

Profitability metrics (Tikr)

Cashflow generation

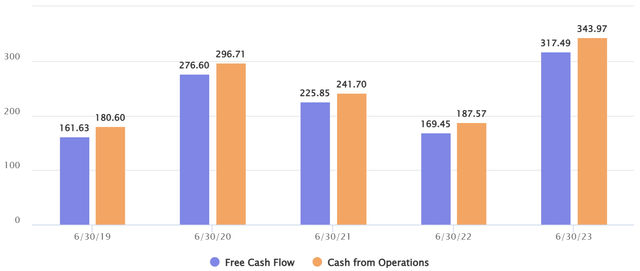

The company has shown consistent growth in its operational cash flows and free cash flows over the last few years. The company’s operational cash flows have been strong, focusing on easing working capital investment and ongoing organic investment to uphold its growth strategy and value proposition.

CashFlows (Tikr)

Its free cash flow margin has also been on an uptrend. In 2019, the FCF margin was 4.7% and while it took a dip in 2022, over the LTM the margin is at 8.1%. The cash flow has been used to beef up the health of the company with an average FCF Conversion of ~112% Past 5 Years.

Growth while its health improved

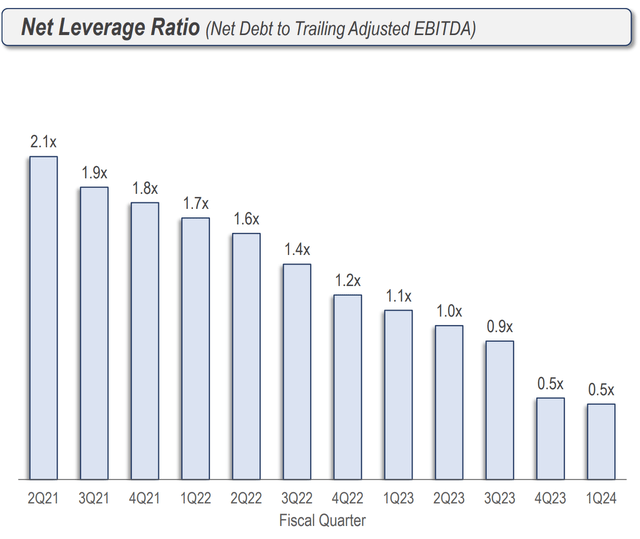

It’s not uncommon to see companies at the scale of Applied Industrial growing at the expense of its balance sheet. But in this case, growth and health have both trended in the positive direction.

Investor Presentation

- Its short-term assets ($1.64B) exceed its short ($0.46B) and long-term liabilities ($1.2B)

- It has continuously worked on reducing its debt and has reduced its debt-to-equity ratio from more than 1 to less than 0.5 over the past 5 years

- Its remaining debt is well covered by the cash flow from operations and interest payments are well covered by earnings before interest and taxes (EBIT)

To round this up, it’s easy to deduce that Applied has executed growth while improving profitability and cashflows and continuously using the cashflows to beef up its balance sheet. So the growth in its stock price could be directly related to its all-around performance in its financials. But what can the investor expect from this company in the future?

Setting up for the future

The company has made 33 acquisitions since 2012 which has represented over $1B in annual sales so far. With a high industry fragmentation, acquisitions remain a key element of the growth formula. The company’s priority areas for acquisition remain focused on broadening its existing services while strengthening its technical differentiation and adding value to its solution capabilities. While it is targeting low single-digit annual growth contribution from acquisitions, it is also aiming for mid-single-digit plus Organic Growth on average by pulling on the following levers –

- improve the cross-selling opportunities within the established customer base

- Leverage the leading technical industry position into secular tailwinds

- Continuous Growth in Automation and Digital Services Offerings

Over a medium time frame, the company expects to target over $5.5B in sales and extend EBITDA margins to 13%+

Recent Quarter and Valuation

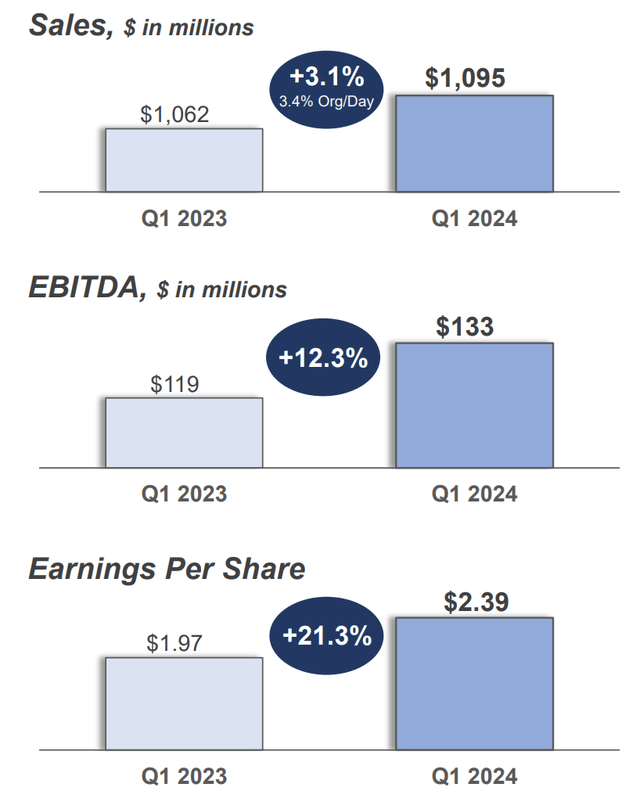

The company saw moderating sales growth due to normalizing production activity which resulted in an overall revenue growth of 3%. But it brought in an EPS of $2.39, up more than 20% from its prior year with gross margins at 29.7% up 81 bps from the comparable quarter of the previous year. Free Cash flow came in at $61.9M also up 203% from the prior year.

Investor Presentation

This means that even in the face of normalizing growth, the company has been able to squeeze value by turning to its bottom line. Along with great gross margins, the company has been sustaining solid cost leverage despite inflationary headwinds. The company credits this to enhanced internal processes, operational efficiencies, and consistent execution.

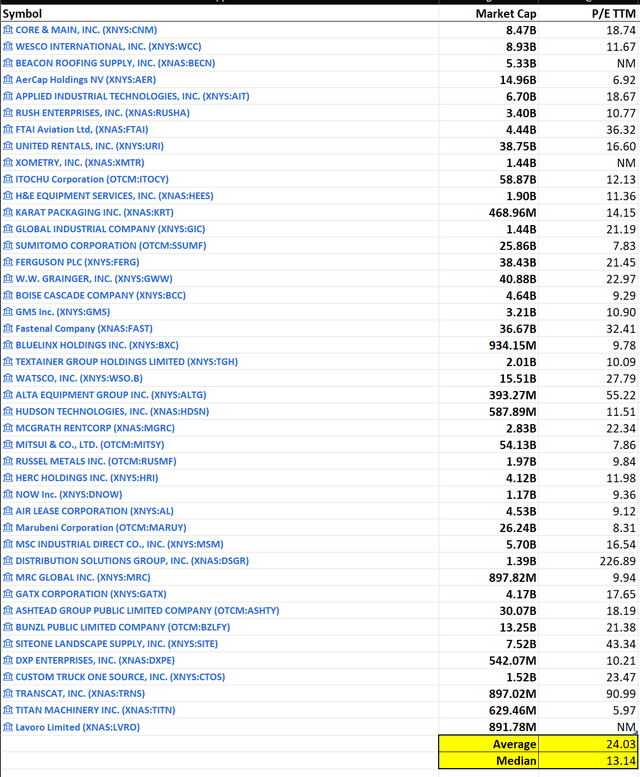

The focus on the bottom line has lent itself to the Price-to-Earnings multiple being better than the median. Currently, it trades at 18.6x almost 20% lower than the sector median. Since we have seen a continuous improvement in EPS, we are also able to compute the PEG ratio here at 0.65.

For 2024, the company has guided $9.25 – $9.8 in EPS. At its mid-point, the multiple could drop to 18x. Trailing and forward multiples differentiate well against the other components in the industry.

Valuation of Industry components (SA)

Risk to this thesis and Recommendation

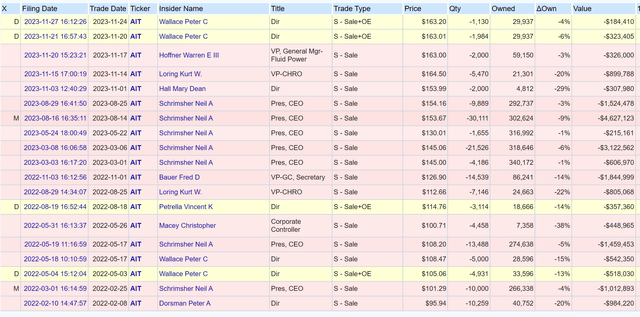

Although I am impressed by the company’s success with its bottom line and its health in the face of slowing growth, I am not able to ignore the fact that insiders have been continuously selling into the stock’s rally.

Insider Transactions (Open Insider)

Some of the sales from the screenshot above have also come from option exercises but the lack of any buying could decrease the confidence of any potential new investor. Maybe it should not be surprising. With the stock continuously making all-time highs, long-term holders could be taking some chips off the table. In fact, over the short term, the stock could see some correction and this movement could completely be related to technicals.

But over the long term, I appreciate the business and its relevance to the growth of the economy. Even in a slowing economy, we have seen how resilient this business is based on the diversified mix of customers the company serves. I also appreciate how management has handled the slowdown in growth by turning its focus on the bottom line and its balance sheet. At this price point, I would be comfortable investing in this company and I would rate this as a Buy.