spawns

Main Thesis / Background

The purpose of this article is to take an overview of the current state of US markets – both equity and debt – and do an exercise in comparison against the “rest of the world”. This could be a useful discussion for those who are considering moving outside of US borders for investments. I want to converse the merits of doing so. While it generally makes sense to diversify, I will shift this discussion in the context of how much sense it makes in 2024 specifically.

This is because the performance for both stocks and bonds have been strong recently (here in the US) and that has sent valuations markedly higher. While there are still plenty of pockets of value to be had, there is a lot of merit to branching out beyond American companies and debt issues on a relative basis. I will converse a couple of key points on why non-US options make a lot of sense at the moment in the following paragraphs.

Returns Have Been Very Concentrated Here

Perhaps the number one reason to look beyond US equities right now relates to how dominant just a handful of stocks (i.e. “Mag 7”) have been on the benchmark large-cap index. This is the S&P 500, which has become a bell-weather standard for the Technology sector in particular, once driven by “FAANG” and now driven by the “Mag 7”. These mega-cap US stocks have been performing incredibly well in 2023, and that has renewed the focus on how the S&P 500 – which holds all these stocks with relatively high weightings – has become dominated by the performance of a small number of stocks.

Given the index has 500 holdings, this leads investors to think they are more diversified than they really might be. And while the Mag 7’s performance has been “good” for holders of this index, as I look in to 2024 I want to make sure my portfolio is balanced. While concentration in a few stocks that perform well can direct to “alpha”, it still presents concentration risk. That may or may not be important to any one individual investor, but as a whole I have to caution my readers and followers from getting too concentrated on any one idea, theme, stock, or sector.

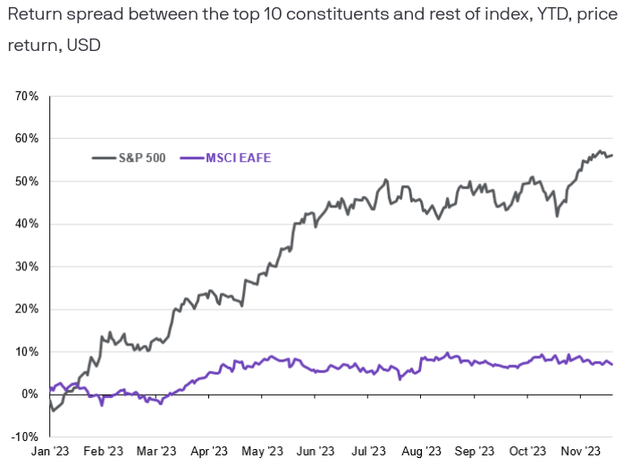

While it is probably fairly well known how dominate the Mag 7 has been on the S&P 500, putting it in a global perspective helps to amplify this reality. For example, if we look at how the top 10 stocks have driven returns of the S&P 500 this calendar year, we see they are responsible for more than half the index’s gain. This in isolation should be a red flag, but if readers need more perspective, look at how stark the contrast is with a global index. The top 10 companies there have delivered less than 10% of the index’s total gain:

Concentrated Gains (JPMorgan Chase)

Right off the bat this shows that investors will gain quite a bit of diversification by looking beyond the S&P 500 or other large-cap US indices. While this doesn’t mean investors will get better results (or even positive results), it does show the merit to diversifying beyond just simple US index investing right now. Many developed world indices or ex-US global indices are not going to be as top heavy as the S&P 500 simply because the top holdings have not been dominating returns for 2023. Going in to the new year, that suggests there is quite a bit of inherent value and diversification benefits towards branching out.

**My non-US holdings includes the following funds: the iShares MSCI United Kingdom ETF (EWU), the iShares MSCI Canada ETF (EWC), the iShares MSCI Australia ETF (EWA). I also own Burberry Group (OTCPK:BURBY) and Nestle S.A. (OTCPK:NSRGY).

US Stocks and Bonds Correlation Has Been Positive

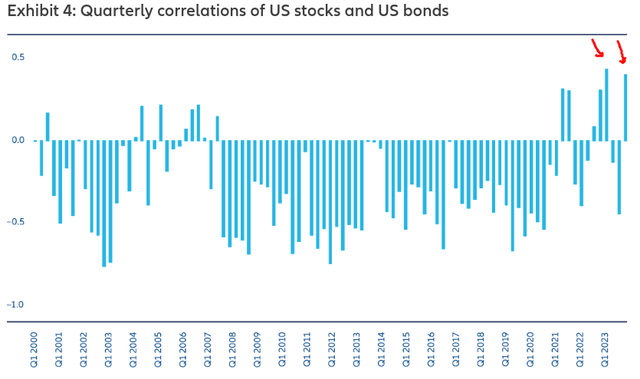

Another interesting market trend is how correlated stocks and bonds have become in the US. The good news is there is some hope this trend will discontinue in 2024 as the Fed moves off its rate hiking path – and perhaps even cuts rates. But it is still worth noting how correlated these two areas are for the time being because there is no ensure this dynamic is going to shift just because we turn the calendar to January.

Simply put, 2023 has featured strong positive correlations between stocks and bonds. This made finding ways to hedge equity risks more challenging. After all, fixed-income and other debt securities often are common-sense ways to eradicate some equity risk and add some stability to one’s portfolio. This is conventional wisdom. For those who want to diversify and/or a smooth ride for their overall portfolio, US-backed bonds are often the usual choice. This strategy breaks down, however, when the two asset classes become positively correlated because they will rise and fall together. This has been the case for a number of reasons for a good chunk of 2023:

Stock & Bond Correlation (US) (Allianz)

What I am trying to convey here is that by moving out of equities and in to bonds domestically has not provided investors with the same kind of cushion it has in the past. As readers have likely experienced, both stocks and fixed-income bonds have been punished by Fed rate hike movements and inflation. These two big headwinds have challenged both fundamental corners of the market which has given investors fewer places to “hide out” when volatility spikes. To me, this suggests investors need to get more creative with how they hedge, whether through commodities, crypto-currencies, or, pointedly, non-US stocks and bonds.

The positive note on this particular aspect of the market is that there has been a re-emergence of negative correlations between stocks and bonds at some points this year and that could be the theme in 2024. Time will tell. Most likely we will see a return to normalcy in this regard at some point. But that could take a while, and investigating alternative ways to hedge US stocks at this juncture continues to make a lot of sense to me.

**I own the Vanguard Energy ETF (VDE) and the iShares Global Energy ETF (IXC) as broader market hedges. Other holdings of mine include Bitcoin (BTC), the iShares Gold Trust ETF (IAU), the Sprott Physical Gold and Silver Trust (CEF), and I have a number of 5% yielding bank CD’s that I found more attractive than fixed-income funds this year given their ability to retain their principle value on a guaranteed basis.

Global Centrals Banks Have Diverged

The next topic I will look at is how central banks have been on different paths this year. We all know that the Fed continued on a rate hiking path, pausing for the time being a few months ago. That has been a welcome proceed for both equity and bond investors and helps to explain the bull market run we have seen since.

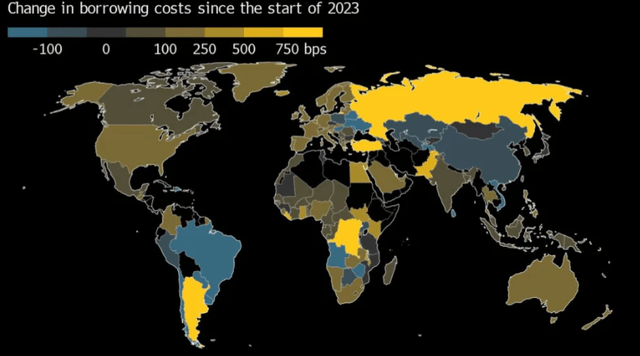

But the point in this review is not to rehash what the Fed has done, but to point out the Fed’s actions have not been entirely consistent with what other central banks have projected. While the general trend has been higher rates across the developed world, the amount of the increases has varied markedly. encourage, there are corners of the globe that saw benchmark rates remain unchanged or even drop:

Various Degree of Rate Changes (IMF)

The takeaway for me is that the global landscape is quite diverse for investors. This is particularly true for those who are income-oriented and prefer bonds. Sovereign and corporate will see varying levels of yield across the world – this was true in 2023 and will remain the case in 2024. While emerging market debt, whether government backed or corporate, presents unique risks, it is clear the opportunity is diverse as well.

The bottom-line is that for those looking for higher income streams, the best bet may be overseas. The US is likely to see the Fed continue to pause on rate hikes and perhaps even start to cut in the second half of the year. But that isn’t what is likely to happen everywhere. This is another supportive reason why readers should look outside the US borders, whether they prefer equity or debt securities.

Lots Of Options For Cheaper Valuations

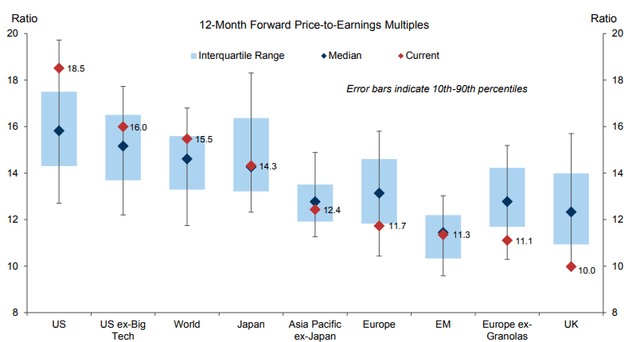

My final point will touch on valuations. The reality is that US stocks (as measured by the S&P 500) tend to be more expensive than global stocks over time. So while value-oriented investors may find comfort in overseas shares, I will want to handle expectations here by saying “cheaper” doesn’t always mean “better” with respect to forward returns. Still, it is hard not to notice than investors have a plethora of options when it comes to finding exposure that costs less to own (by the P/E metric) than US shares cost:

Forward P/E (By Region) (Goldman Sachs)

The conclusion I draw from this is that pretty much everyone else in the world has cheaper valuations than the US right now – even after excluding Big Tech!

That is a very straightforward and supportive reason to consider broadening beyond one’s domestic borders. Growth opportunities do exist elsewhere, and at a discount to US equities. It seems to me this justifies building on my non-US holdings in the new year.

Bottom line

As 2023 comes to a close we can look back on a year that was very rewarding in terms of gains. After a poor 2022 (for the most part), it was welcome to see a strong gain to my net worth. Looking ahead to 2024 means planning for more of the same, but I think a passive approach isn’t going to get me there. I have concerns with how over-concentrated my US holdings are in terms of over-reliance on a small basket of stocks.

While I am going to continue to ride these winners, I will put new cash in non-US allocations at a more aggressive amount than I have in years past. I see value in terms of P/E ratios and the benefits of diversification are as relevant now as they ever have been. For this reason, I believe non-US developed world markets are attractive, and suggest to my followers that they go in to 2024 with an open-mind on this idea.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.