Liudmila Chernetska/iStock via Getty Images

Skyworks Solutions’ (NASDAQ:SWKS) 3rd quarter and guidance confirmed Android weakness similar to others. Revenue for the September quarter equaled $1.219 billion with flat guidance for December at $1.175 to $1.225 billion. Similar,

Qorvo (QRVO) reported $1.103 billion for September with $1 billion in December. With a level of honesty, neither the Qorvo nor the Skyworks reports added a lot of investment help. The businesses with a significant overlap of markets opined about stacked inventory conditions in meaningful segments of their market. In past articles about Skyworks, we focused on budding marketplaces. For this one, our focus drastically changed, targeting past market sizes, which investors can reasonably expect a level of revenue to return thereof. With earnings, a more obtuse entity, this analysis forecasts only revenue and cash from operations. Companies, who have deep penetrations into China and Android markets, continued to suffer from stuffed channels without reasonable visions into the future. We have written a few articles on Skyworks generally with hold ratings. In our last, Skyworks Solutions: Cloudy Skies Continue, But Tailwinds Might Be Coming, we opened a door for lifting the rating to a buy. Sitting in darkness isn’t fun, but the returning of light always begins immediately after the darkest moment. Grab a candle, light it and follow with us into the darkness. Maybe we’ll find a lighter future.

Skyworks’ Fiscal 2023 Year Results

For FY-2023, Skyworks delivered revenue of 4.77 billion and free cash flow of $1.646 billion, a yearly record. Strange! Management guided the December quarter at the mid-point $1.2 billion, 10% lower year over year. It is within the December guidance that investors might gain a better understanding. Mobile represents 65% of the total. Also, an important note, the largest customer, Apple (AAPL), represented 66% for the year and 68% for the quarter.

Discussing December business conditions, management commented,

“We expect our mobile business to show momentum [Apple], while in broad markets, we expect to continue digesting excess inventory affecting our revenue outlook. Gross margin is projected to be in the range of 46% to 47%, reflecting the ongoing cyclical impact of lower factory utilization, reduction of internal inventory, and an unfavorable mix shift given the lower proportion of broad markets as a percentage of total revenue.”

An Analysis

In our analysis, our process evaluates prior margins, past percentages and revenues in its businesses. Management did somewhat dampen investors hope stating,

“After two years of unprecedented events due to COVID and historical supply chain shortages, the semiconductor industry is returning to a normal supply and demand balance.”

Our opinion offers perhaps a different conclusion. The next graph from Canalys illustrates how weak the market had become.

Canalys

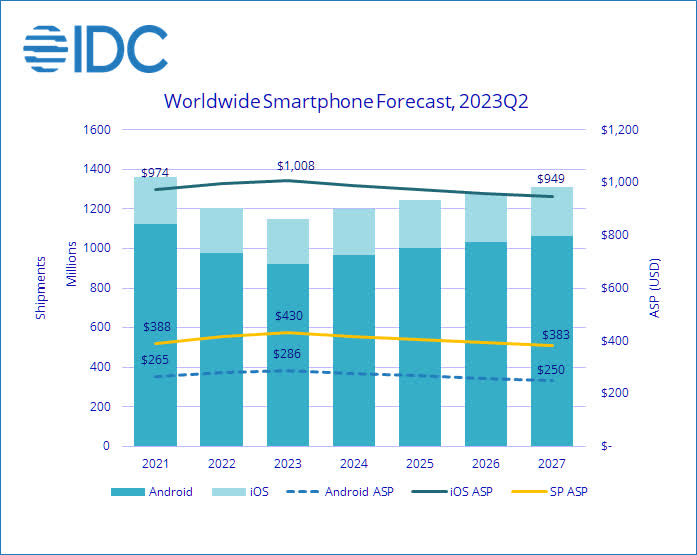

Although, the market in September stabilized on a year over year basis, it still remains weak. But, in our encounter, markets cycle up and down with the beginning of the up cycle in progress. The slide, from IDC, illustrates once again the cycling nature.

IDC

Analysts believe a slow growth in mobile devices returns next year continuing for several more.

We continue this financial investigation with a look at margins.

Margins held above 50% until the June quarter. Management noted that underutilization is the primary factor holding margins lower. Management, also, noted that demand is improving but a mix headwind still exists. The stacked channels particularly in the broad markets drives this issue and is likely corrected by the end of the December quarter. Margins in the coming March and June, with their lower demand, will continue low. Management expects a return to higher margins beginning in September. For investors, cash flows will better approximately 10% with a return to more normal levels.

Next, we created a revenue table showing the differences for the two businesses.

| Skyworks Revenues | March 22 | June 22 | Sept. 22 | Dec. 22 | March 23 | June 23 | Sept. 23 |

| Total | $1.34B | $1.23B | $1.41B | $1.33B | $1.15B | $1.07B | $1.2B |

| Mobile % | 61% | 62% | 64% | 65% | 60% | 59% | 65% |

| Mobile Total | $0.82 | $0.76 | $0.90 | $0.99 | $0.69 | $0.63 | $0.78 |

| % Difference YOY | -16 | -17 | -13 | ||||

| % Difference QOQ | -7 | +18 | +10 | -31 | -9 | +24 | |

| Broad Market | 39% | 38% | 36% | 35% | 40% | 41% | 35% |

| Broad Market Total | $0.52 | $0.47 | $0.51 | $0.34 | $0.46 | $0.44 | $0.42 |

| % Difference YOY | -12 | -6 | -18 | ||||

| % Difference QOQ | -10 | +8 | -33 | +35 | -4 | -4 |

With respect to the year over year differences, not a single quarter showed an boost enforcing the idea of market weakness. With Apple such a large portion of Skyworks revenue at 68% for the quarter, little revenue from Android can be found. Natural cycling does reverse trends and, in this case, represents approximately a possible 15% growth opportunity over several years.

Next, the evaluation also deals with possible market growth. Matt Myers of Susquehanna asked management about past company expectation for growing yearly content in the 10% range.

Liam Griffin, Skyworks CEO, answered with his usual dance,

“I think what you’re going to see from Skyworks and it’s already embedded in some of our numbers is diversification within mobile. So it’s not going to just be one or two products as you know, but the breadth of the technology is right there for us. . .. You’ve already seen us show very well execution and getting into things appreciate all acoustic wave, very, very tough technology, years and years of work, and then the scale to actually produce. . …. I know we talked a little bit about automotive already, but markets appreciate that have a tremendous time TAM opportunity for Skyworks and we’re really just scratching the surface there..”

We caution investors with respect to Solutions’ endeavor into the auto space. It has a very low presence in a market that is also over advertised. Electric cars will play a role, one likely greatly subdued.

Continuing, in broader markets, the prepared remarks include this commentary,

“We expect to benefit from three long-term secular trends. First, the proliferation of intelligent IoT connected devices on the edge. Second, the rapid transition towards electrification and advanced safety in vehicles. And third, high speed connectivity for AI enabled data intensive infrastructure in cloud applications.”

The conversion from Wi-Fi 6E to 7 offers a significant opportunity for growth. A last comment about business concerns BAW technology now equaling 50% of total mobile and 10% of general market, a huge change from the past.

Skyworks will encounter organic growth coupled with the above expected cyclical growth. It is unclear how much; it could be significant.

Market Status

The big question no one seems capable of accurately answering is timing for stacked inventory depletion. Android markets are slowly improving, and orders appear still significantly less than market demand. The broad market business is still affected heavily with excess also. The reports in this space seem consistent in a turning point is just on the horizon. Skyworks, also, has new design wins waiting on the other side. It is a waiting game for sure. Coming out of this down cycle, Skyworks’ performance might better by 25% – 30% plus (10% from margins, 15% from a return to more normal demand, plus an undetermined amount of organic contribution).

The Chart

During waiting periods, the game might be best played with charts. We include a day bar chart from TradeStation Securities on Skyworks.

TradeStation Securities

The drop through this period has been steep and quite long, but it is trying to find footing, finally. Of importance, the high on the right side corresponds with the typical July/August/early September period followed by a down trend into the last half of the year. This is a typical pattern. Savvy investing might include some patience. Buying in December or early in the next year can be a better point with stocks in the sector often bottoming the December/January/February time frames.

Risks

Market risks from a deep recession still exists for all stocks especially those tied heavily in the consumer markets. But Skyworks price has fallen over 50% from its high of over $200 a few years ago. The company is generating earnings of $8 plus creating a P/E of slightly above 10. We are upgrading our recommendations to a buy based on price and the appearance that key markets are cycling upward. In our view, Skyworks could run upward 30% over the next twelve to forty-eight months, a nice return. The path that the candlelight leads us on, seems to be to a brighter room.