Mario Tama

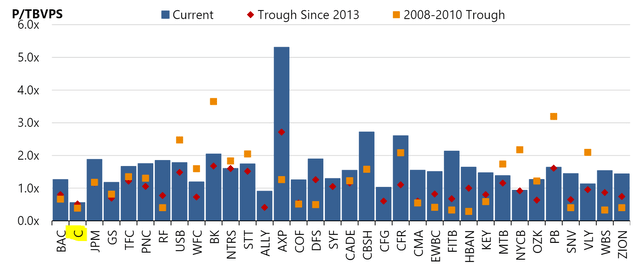

Citigroup (NYSE:C) looks very cheap, trading at around 0.6x P/TBV. However, the U.S. banking giant has traded at these distressed multiples for over a decade now, and investors are likely doubting that low valuation alone is a catalyst for upside. But it is not only the low valuation that is speaking for Citigroup: The bank has lately been making good progress in restructuring its operations, setting up for an expanding cost-to-income ratio going into 2024 and beyond. Moreover, conviction on rate cuts is building confidence on an improving credit environment, with both supportive loan growth and manageable write-downs on the bank’s existent book. In my opinion, this backdrop could drive multiples higher quickly.

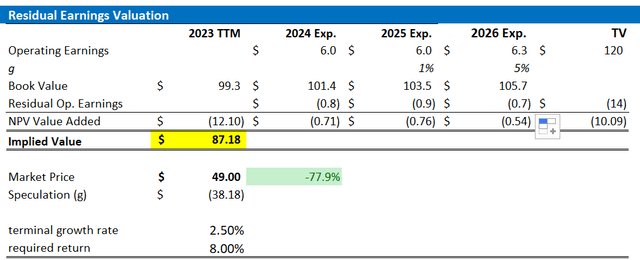

Going into 2024, I update my residual earnings valuation model for Citigroup stock; I now compute a fair implied share price equal to $87.18/ share. Reiterate “Strong Buy”.

I have covered C stock about two months ago, also with a “Strong Buy” rating. However, since then, the Fed shifted dovish quite aggressively and Citi CFO Mark Mason provided investors with additional guidance. In this article I will converse an updated view on Citi.

Macro Setting A Tailwind For The Banking Industry

The year 2023 provided quite a difficult macro for bank stocks, less so for fundamentals than for sentiment: The Q1 failures of Silicon Valley Bank and banking icon Credit Suisse prompted investors to focus on the negative implications of the rate cycle, most notably unrealized losses on the balance sheet and funding pressure. This caused the industry to trade at very low multiples, comparable to levels seen around 2008/09 during the Great Financial Crisis. More precisely on Citigroup, the bank’s stock is currently trading at a 0.6x P/TBV, compared to troughs of 0.5x for both the time period 2008-2010 and 2013-TTM, respectively (Morgan Stanley research note dated 8th December: Title: US Banks and Consumer Finance: Dollars and Cents).

Morgan Stanley Equity Research

These sentiment headwinds should notably fade going into 2024, in my opinion, as monetary policy makers are preparing for significant rate cuts. In that context, on December 13, the FOMC shared their updated economic projections, surprising markets with a dovish shift. Notably, the committee lowered their inflation estimates for EOY 2023 to 2.8-2.9% from the previous 3.2-3.4%, while boosting GDP growth forecasts from 2.1% to 2.6%. This signals a picture-book-admire macro environment — decreasing inflation and increasing growth — and significantly challenges the notion of a “Hard Landing.” Accordingly, the FOMC’s revised outlook now predicts around 75 basis points in rate hikes for 2024, a significant shift from the previous expectation of only 25 basis points. Although the FOMC is leaning toward a dovish stance, traders are even more optimistic. Notably, CME’s fed funds tracker suggests an anticipated 150 basis points in cuts by 2024 EOY, projecting rates around 3.75%.

That said, about 100-200 basis point lower rates should materially boost valuation multiples for bank stocks. Firstly, I point out that equity multiples in general are inversely related to rates. Secondly, investors should consider that a dovish rates shift may protect bank’s net interest income. This is anchored on a softening deposit beta, as well as an expanding demand for credit on the backdrop of a pick-up in economic activity. Thirdly, I expect lower rates to provoke investment banking activity, most notably ECM, DCM and M&A volume.

Citi CFO Gives Bullish Guidance

Citigroup’s CFO Mark Mason recently updated investors regarding the bank’s fundamental outlook: Presenting at Goldman Sachs’ Financial Services Conference, Mr. Mason projected Citi’s 2023 revenues to settle in the range of $78-79 billion, as he emphasized a supportive Net Interest Income backdrop of around $47.5 billion. More notable than the short term guidance, however, was the CFO’s expectation for future topline growth, expenses and ROTE targets. In that context, Citi now projects a 4-5% CAGR revenue growth goal through 2026, growing topline to $87-92 billion. Meanwhile, the bank’s operating expense base is targeted to compress to around $51-53 billion per year, notably below the 2023 expenses of around $54.3 billion. If the targets are achieved, the bank would achieve a 11-12% ROTE.

According to the CFO’s commentary, Citi’s growth outlook is well supported by the bank’s segments: In Treasury and Trade Solutions, management highlighted that approximately half of the 18% surge in revenues weren’t influenced by rates. If this is true, and growth is extrapolated at a similar rate to 2026, then Citi’s TTS may materialize as much as $4 billion of incremental topline upside. The growth story in Investment Banking is quite obvious, as the segment is starting from a very depressed 2023 base. As activity picks up in line with an expanding economy, fees may grow anywhere between $1-3 billion as suggested by the most recent up/ down cycle 2019-2023. In Wealth Management, Citi management has suggested a bullish opportunity for quite some time now, as the bank aims to boost market share from 2% to potentially bring in $2-3 billion incremental revenue in the coming years. The outstanding $2-3 billion revenue delta to achieve the group’s 4-5% CAGR revenue growth target may from Markets/Trading and/or the bank’s Card division, which should be quite feasible, in my opinion.

Set Target Price at $87.18

In line with my bullish outlook for Citi’s consensus EPS through the next 3 years, I update the input for my residual earnings valuation model for the bank’s stock: I now assess that Citi’s EPS in 2024 will likely fall within the range of between $5.8 and $6.2. Similarly, I set ,y EPS expectations for 2025 and 2026 to $6.0 and $6.3, respectively. I continue to anchor on a 2.5% terminal growth rate, which I see about in line with nominal GDP growth, as well as on an 8% cost of equity requirement. On the backdrop of the highlighted EPS expectations, I compute a fair implied stock price for C stock equal to $87.18, suggesting almost 80% upside!

Analyst Consensus; Company Financials; Author’s Calculations

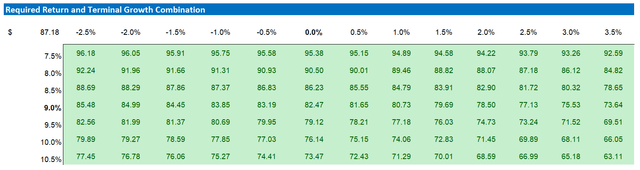

Below also the sensitivity table, which tests different assumptions for cost of equity (row) as well as terminal growth rate (column).

Analyst Consensus; Company Financials; Author’s Calculations

Conclusion

Citigroup stock looks very cheap at around 0.6x P/TBV. The low valuation multiple is especially attractive in combination with a quickly improving macro backdrop, as well as the bank’s strong fundamental inflection. According to a recent CFO presentation, Citi management now sees a path towards 10-11% ROTE by 2026, by suggesting a 4-5% CAGR topline CAGR over the next 3 years on a falling operating expense base. On that information, I update my residual earnings valuation model for Citigroup stock and I now compute a fair implied share price equal to $87.18/ share.

For context, Citigroup stock has underperformed the market YTD. Since the start of the year, C stock is up less than 9%, compared to a gain of 23% and 22% for the S&P 500 (SP500) and banking industry leader JPMorgan (JPM), respectively.