jetcityimage

Dear readers/followers,

It’s time to update on my investment in Hyundai (OTCPK:HYMTF), a successful and profitable automotive investment. My own investment is not in the ADR, but in the native Korean ticker 005380. This follows my pattern of pretty much always going for the native tickers of investments.

Even if the company’s performance for the past few years has been underwhelming, there are reasons for this lack of solid performance. With over 50 years of tradition and history under its belt, there is much to admire about both the company’s history and where it’s going in the future.

In this article, we’ll look at 3Q23, which is the latest set of results we have to look at, take another quick look at the company’s fundamental business model, and I’m going to show you my calculate of exactly what we could expect here going forward.

Let’s take a look at what Hyundai can offer investors – potentially you.

2023 review of Hyundai and its longer-term upside.

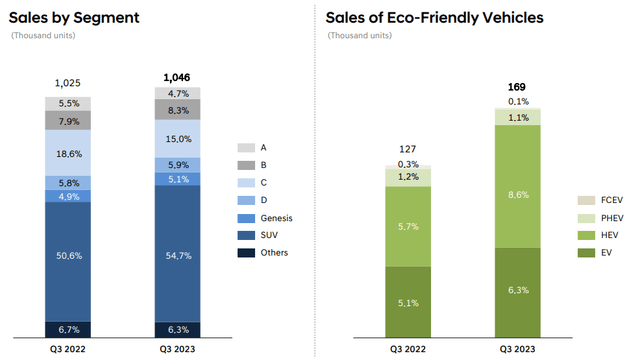

Demand for automotive/cars is actually very good. The company has, for 3Q23, seen positive development in most segments with the exception of China and Korea compared to YoY numbers. Every other segment is showing positive development, with a global demand enhance of almost 8%.

This also comes with a pretty damn positive mix in terms of models and in terms of so-called Eco-friendly vehicle sales, which are growing at a rapid pace despite continued declines in incentives in several areas around the world.

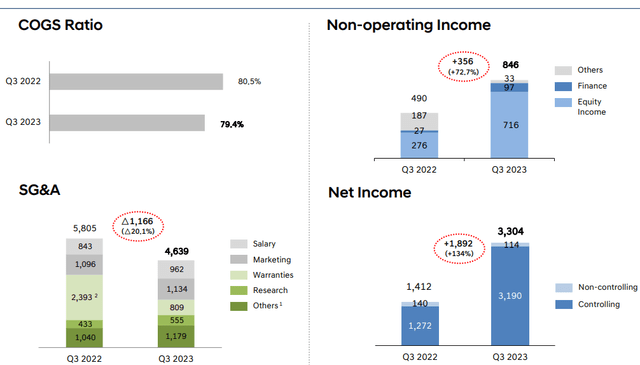

The company saw very favorable revenue as well as income numbers. Hyundai revenues for the quarter are enjoying both a volume enhance, but also a better product/mix than before, seeing an over 8% enhance in YoY revenues. However, this is nothing next to the improvement in income, which saw a 146.3% enhance due to massively improved margin (non-recurring items yoy), to over 9%. A 9%+ operating income margin for this sort of automotive business is a very solid sort of trend, and Hyundai has managed to bring its COGS down to below 80% – another positive. Not only that, the company managed to cut deeply into SG&A – and this isn’t always easy for this sort of company, which resulted in material improvements in non-operating and net income trends.

Hyundai remains one of the largest automotive companies on the planet, with an annual production output of over 4M units per year and revenues of over 120T Won, or just south of $90B.

The company isn’t the best in the world in terms of profitability or similar KPIs. Its gross margin is average – but in terms of operating and net margin, the company is actually firmly above average, and it has one of the best interest coverage ratios in the entire industry. Its dividend yield of currently close to 5% is also very good.

The company has seen operating margin expansion over the past few years, and we’ll go into this in the valuation section, but Hyundai is currently and still after a 15% RoR so far this year, attractively valued for investment.

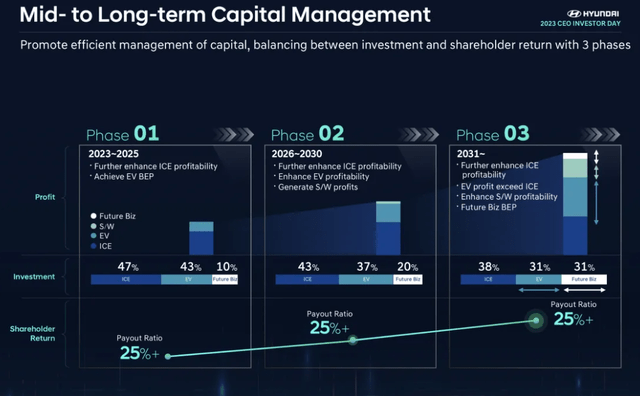

The company’s long-term investment scheme is EV-focused. We’re talking a 35.8T KRW investment into electrification, which includes a new EV factory, Battery, JV strategic investments, R&D expenses, infrastructure expansion, and so forth. This is for the next decade, and this investment in electrification is out of a total of 109.4 T KRW that’s going to be invested here.

Shareholder returns during this time will be sized according to what the company can handle during this time, including a payout ratio of around 25%. Hyundai’s first goal is the profitability of EVs while enhancing ICE profits as ICE starts to proceed down in terms of sales, from a 47% investment share in 2023-2025 to less than 40% in 2023 and forward.

The sales mix of the company’s EVs is also going to be subject to changes. More and more are coming from the rest of the world as market demand shifts.

The company’s scheme to ensure EVs’ profitability here is based on IMA vehicle development, a derivative model lineup, operational strategies and efficiencies, continued use of automation and cost reduction in production, and additional sales through SDV.

Hyundai has already been able to confirm to its investors that large parts of its strategies are working. The strong rebound in top-line sales and improvements in profitability together with a much-improved mix where the G90, the Tuscon, and the Ioniq have been able to take market share, and with the new Kona coming to market, I’d argue that Hyundai now has one of the stronger portfolios not just for private customers, but for organizations and institutions as well.

I say this not only as a behind-the-desk analyst but also as someone who recently made the decision in a procurement that regarded several hundred vehicles for a large public organization. We looked at many factors and most of the manufacturers in Europe, including leading European ones, but in the end, it was down to only two manufacturers – and I invested in both of them. Hyundai was chosen due to the strength of its warranty, the appeal of its pricing, the solidity of its platform, and the connection between agents, dealers, and service shops. Hyundai, to me, seems to be working very well, and choosing these two options as “the best” was an easy choice.

When choosing a vehicle for myself, I use somewhat different parameters – but I know many people value the indicators that I use, so I feel confident and with a high conviction that the company’s product lineup is currently very attractive – and we see this expressed in the quarterly results.

As I have pointed out earlier, and I think it bears repeating here, the company remains far better diversified than any of its European, Japanese, and American competitors.

This strategy seems to be working very well for them. As mentioned, different parameters for my own choices – I drive a Benz privately, not a Hyundai and I’m far too much of a Benz (OTCPK:MBGAF) loyalist to drive anything that doesn’t have a star or comes out of Zuffenhausen (OTCPK:POAHY), but the Hyundais I’ve evaluate-driven, including in this procurement for the purpose of testing both the EV and the ICE part of the vehicles have been seemingly reliable and solid automobiles, and the organization will no doubt be very pleased with their new vehicles.

Hyundai simply has a good upside here as an investment, not just from a financial, but from an operational standpoint. Let’s look at what upside we could see for the company here.

Risks & upside

The upside to Hyundai must be put next to the risk of investing in the company. Fundamentals are extremely strong here. Few automotive companies have BBB+ and a yield of 3.5%+ and this sort of track record, and trade at a 3.93x P/E normalized – but this company does.

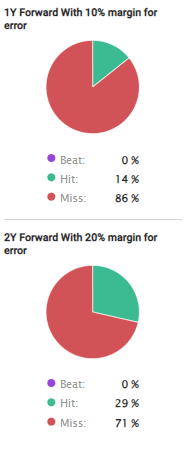

However, it’s also incredibly volatile. the company misses estimates more than 70-80% of the time with a 10-20% margin of error. Statistically speaking, you’d be better off betting that the company doesn’t hit targets. Also, the company is coming out of a massive slump that started in 2013.

Going forward, we’re expecting very solid earnings, which is the upside to the company. If you want to invest in the shift to EV and electrification overall, then Hyundai is a solid investment at the right price, and the company is currently cheap for what it offers.

Let’s look at the valuation here.

Hyundai’s valuation dictates this company is a “BUY” here

Since my last article, the company has been up double digits, which is obviously a good development, but only the beginning of what I expect to be a long-term upward trend. In short, being in the red rarely bothers me unless I see a fundamental reason to be worried about the underlying company I’ve bought.

Automotive investments tend to be volatile businesses. That’s the way they work – and that’s why I own a mix of higher-yielding native shares as well as pref shares, most of them at attractive overall levels.

Hyundai is still being discounted pretty heavily even to most of their closest peers. Some might call it a stretch to differentiate Hyundai to say, BMW (OTCPK:BMWYY). I say a comparison to Porsche would be too far, but BMW is somewhat valid for most of the model lineup.

Because these comparisons are valid, I’m going to continue to consider Hyundai to be excessively undervalued going into a better earnings trend here.

Hyundai, for the native 005380 ticker, trades at a normalized P/E of 3.9x. I would be careful going any higher than a 7x P/E here, despite a 20-year p/E trend average of around 10x, given the volatility in the company’s earnings and this, when it comes to estimating results.

FactSet forecast accuracy (F.A.S.T graphs)

I can comprehend how some investors can be reticent with uncertainty admire this, but I want you to consider the realistic likelihood of an actual fundamental reject for the company here – it’s, as I see it, extremely unlikely, where we’d see investors actually in danger of losing their capital long-term.

If your assumption is one where Hyundai is either part of or leading/co-leading the EV development, which I based on current trends believe to be the case – then this is a solid investment.

It’s my stance that Toyota is in fact falling behind EV development. Leading automotive companies that have taken a leading role in the sector here to me are Hyundai, Nissan (OTCPK:NSANY) out of Asia, Benz and BMW as well as Stellantis (STLA) in Europe, and your Ford (F) and GM (GM) in the US. And then there’s Tesla (TSLA), but I don’t invest in Tesla.

However, the other Asian ones mentioned, as well as Stellantis and BMW/Benz are companies I own and believe in here, and would expect to all outperform or perform well in the long term.

That is why I am positive on all of them at the right price, and why I remain at a “BUY” for Hyundai here despite a double-digit enhance from my last article.

Here is my thesis for the company.

Thesis

My thesis for Hyundai is as follows:

- Hyundai is perhaps one of the better automotive investments available due to its conservative nature and its home-field exposure to Asia, with an extremely well-diversified sales portfolio of attractive cars in every segment from semi-luxury to common.

- The company has a not-insignificant upside of 30%, and very few analysts currently following the company consider this anything except a “BUY” here.

- The relative complexity of making a “BUY” here means that I won’t invest in a company until I see a sector-beating and absolutely massive upside with a great dividend.

- That time, for me, is now – I’m investing more.

recall, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to regularize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (Italicised).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversions.

I still consider the company cheap at this time – and a “BUY” here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.