Maryana Serdynska/iStock via Getty Images

Independence Realty Trust, Inc. (NYSE:IRT) is a REIT mainly involved in acquiring, managing, and improving multi-family apartment communities within secondary markets.

Beyond its diverse portfolio in attractive markets, the fast operating growth, and the conservative use of leverage, Independence Realty’s shares trade at a huge discount to NAV, making the stock a fitting choice for a value portfolio. In this post, I will supply you with the thesis that supports these statements.

Diversified Portfolio in Attractive Markets

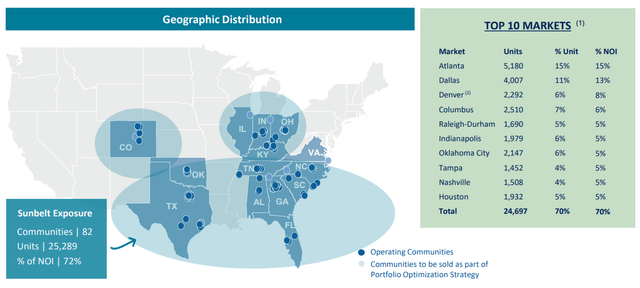

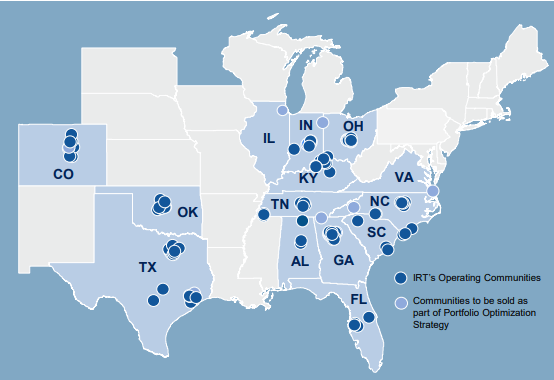

As of September 30, 2023, Independence Realty owned 120 multi-family apartment properties, consisting of 35,427 units across Virginia, Alabama, Colorado, Florida, Georgia, Illinois, Indiana, Kentucky, North Carolina, Ohio, Oklahoma, South Carolina, Tennessee, and Texas.

Investor Presentation

Besides the fact that the portfolio is well diversified, we also have to appreciate that 72% is concentrated in Sunbelt states. This is a great area to have residential exposure to as it has experienced exceptional demand in the past 3 years and year-to-date.

Growing at an Unreasonable Pace

When it comes to occupancy, it stood at 94.6% for the same-store portfolio as of September 30; just 0.4% higher than the rate reported for the same period the previous year. In my opinion, this is excellent. It depicts efficient management of the assets and leaves some room for growth.

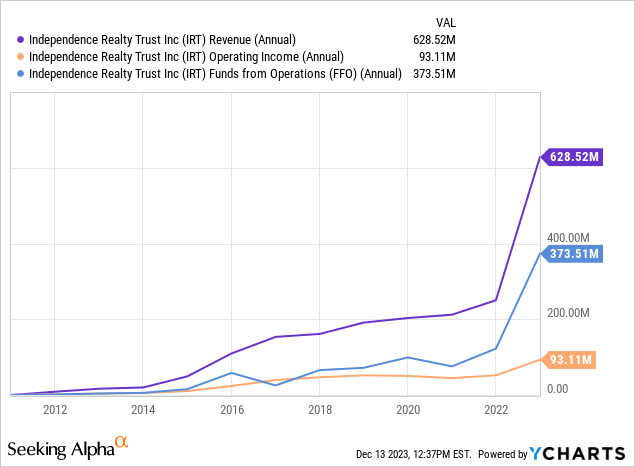

advance, the REIT’s operating performance has experienced remarkable growth in the past:

Revenue and operating income have been restlessly making new highs, while FFO growth has been more modest in recent years. Regardless, all of them made a big jump recently.

The most recent quarterly results represent this recent growth well. Below I’m presenting the changes between the most recent annualized figures and the average annual ones reported in the REIT’s last three fiscal years:

| Rental Revenue Growth | 85.70% |

| NOI Growth | 107.09% |

| AFFO Growth | 107.01% |

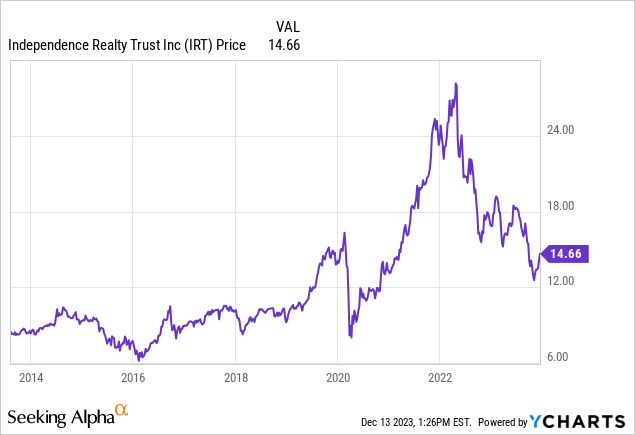

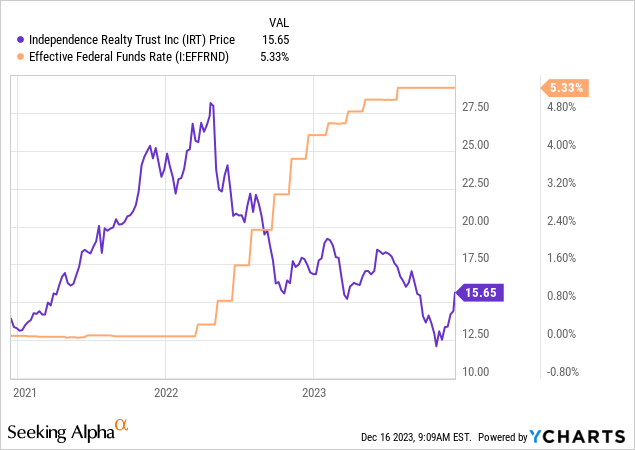

Now, I believe that the market has appreciated the REIT’s past operational performance. After the 2020 drawdown, it’s evident that the market has responded well to its exponential growth:

All the same, REITs couldn’t avoid the general risk-off attitude of investors this year and Independence Realty was no different. For this reason, I cannot credit such YTD poor price performance to fundamentals; I am sure that it will end up being a hiccup in retrospect.

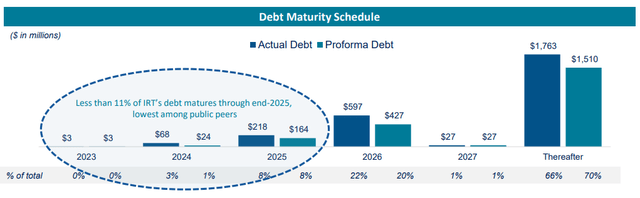

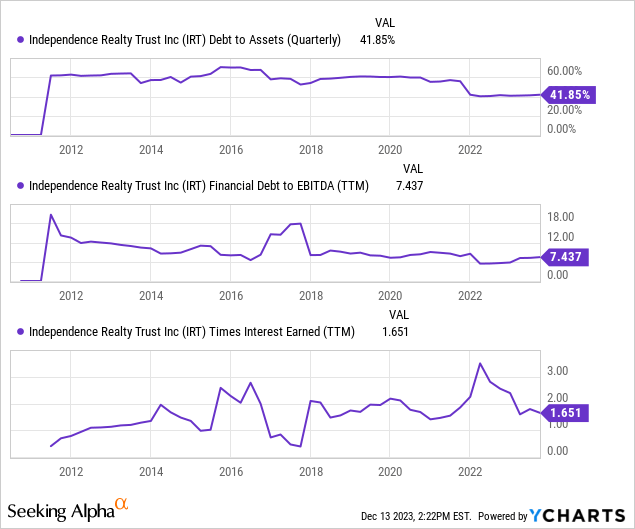

Low Leverage, High Liquidity, No Significant Maturities Until 2026

As for its leverage, the REIT is conservatively financed with debt accounting for 41.85% of its assets; the ratio has also been driven down in recent years from a ~60% level. Moreover, the debt-to-EBITDA ratio sits at 7.43 and interest coverage is at 1.6, representing adequate liquidity.

Also, upcoming maturities don’t contemplate any major danger to higher financing costs, given the small amounts coming due in 2024/2025 and that the year 2026, when about 20% of the REIT’s debt will mature, is sufficiently far away from now for the current high interest-rate environment to have materially improved.

Low Yield but High Discount

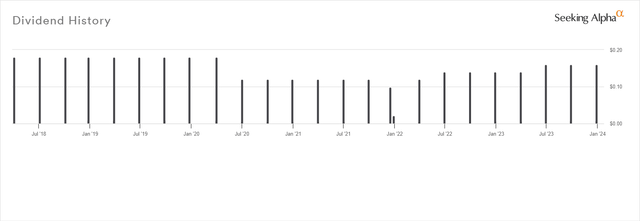

The REIT currently pays a $0.16 dividend per share which results in a forward yield of 4.09%. While the payout ratio based on AFFO (last quarterly figure annualized) is low at 57.53%, the dividend declaration record has been erratic in the last 5 years:

Because of that, I wouldn’t call the current distribution safe under adverse circumstances.

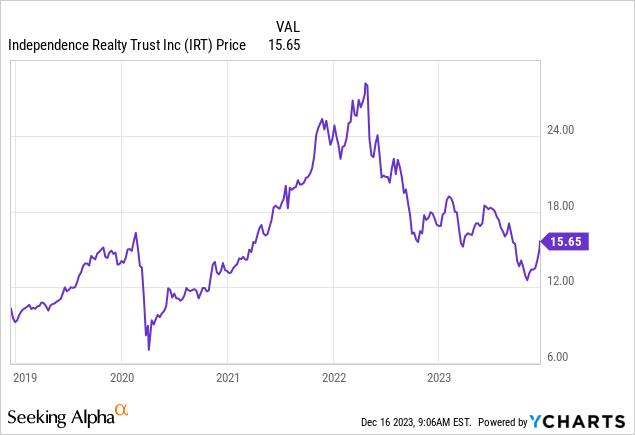

Regardless, the stock is undervalued at an implied cap rate of 6.52%. For residential properties in the Sunbelt region, a 5% cap rate may be more appropriate; which would result in a $23.74 per share NAV and a 51.7% discount based on current levels.

By the way, just one year ago the stock’s price had increased higher than the current NAV:

Then the Fed started raising rates:

The market seems appreciate it has already reacted positively in the absence of any rate hikes lately; not just with IRT of course. I visualize that the potential advent of a couple of rate cuts in 2024 will result in a much more enthusiastic reaction and possibly a repricing of IRT. If it’s not during 2024, however, shareholders will need to be patient if they are to achieve the potential upside.

Risks

Which brings me to the primary risk here. The discount may be huge, but the upside a potential correction could achieve may not be realized fast enough. An investor could incur an opportunity cost that the low yield of 4% will not significantly offset.

Another risk that you should be aware of is related to cap rates. Unlikely as I think it is, if they extend for residential properties, the estimated NAV above will not apply and the margin of safety may narrow. recollect that NAV calculation is not an exact science and though the high predictability of a REIT’s profitability is a pleasant condition, cap rates are much more flexible; and so is NAV as a result.

Last, as I already said, the dividend does not appear safe because of the record. A dividend cut is possible, so investors shouldn’t base an investment decision on the current yield alone.

Verdict

All in all, the steep discount is enough for me to rate IRT as a BUY and I believe that purchasing shares up to $20 would supply a very attractive average margin of safety.

What’s your take? Do you own IRT or intend to? Why or why not? Feel free to share your thoughts with me below and I’ll get back to you as soon as I can. Thank you for reading!