PixelsEffect

Investment thesis

Our current investment thesis is:

- EXLS is a compelling investment proposition for those seeking exposure to the technology revolution without the volatility associated with pure-play stocks. EXLS has developed an impressive reputation in the industry, allowing it to evolve a market-leading position despite being substantially smaller. This is reflected in its relative performance, with superior margins and growth to its peers, with no evidence to propose competition is eroding either metric.

- While its industry and the wider market continue to struggle with growth, owing to macroeconomic conditions, EXLS is marching on with double-digit growth. With its focus on specific industries and the development of an “annuity-based” revenue profile (4-5 year contracts on average), the company’s downside risk is limited (as is volatility).

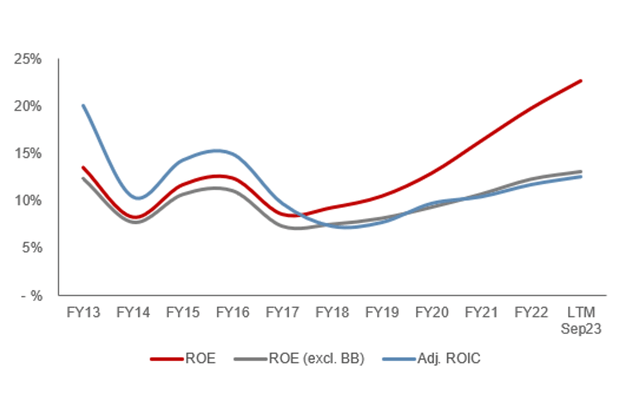

- We expect a continuation of its current trajectory, with efficient capital allocation and thus healthy shareholder returns. At an FCF yield of ~5% and a ROE of 23%, investors are positioned to win with this stock.

Company description

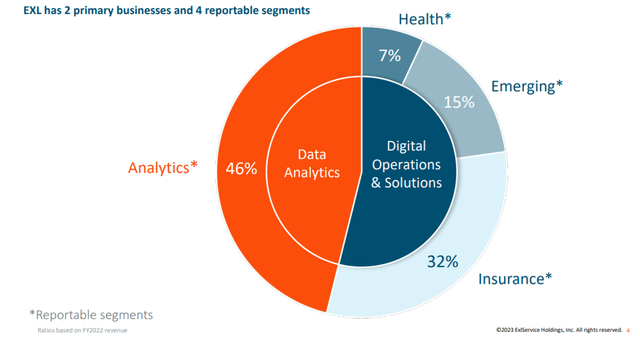

ExlService Holdings (NASDAQ:EXLS) is a global operations management and analytics company, providing services in areas such as insurance, healthcare, financial services, utilities, transportation, and travel. Headquartered in New York, EXL leverages its expertise in predictive analytics and deep industry knowledge to improve operational efficiency and improve business outcomes for its clients worldwide.

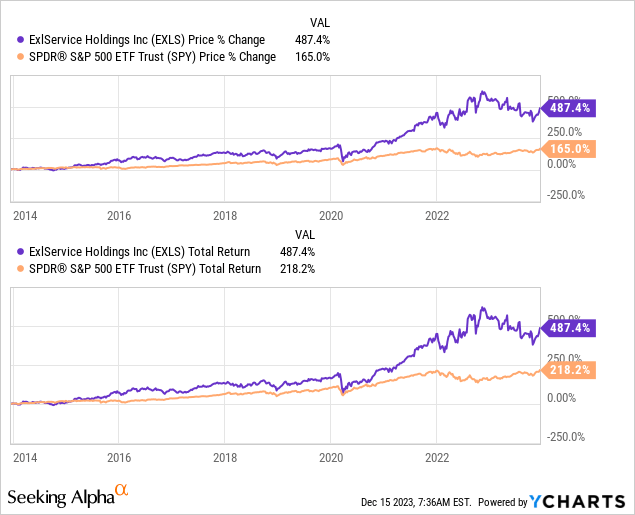

Share price

EXLS’ share price performance has been exceptional, returning over 300% to shareholders and significantly outperforming the wider market. This is a reflection of the company’s positive financial development and improving investor sentiment as its industry benefits from accelerating tailwinds.

Financial analysis

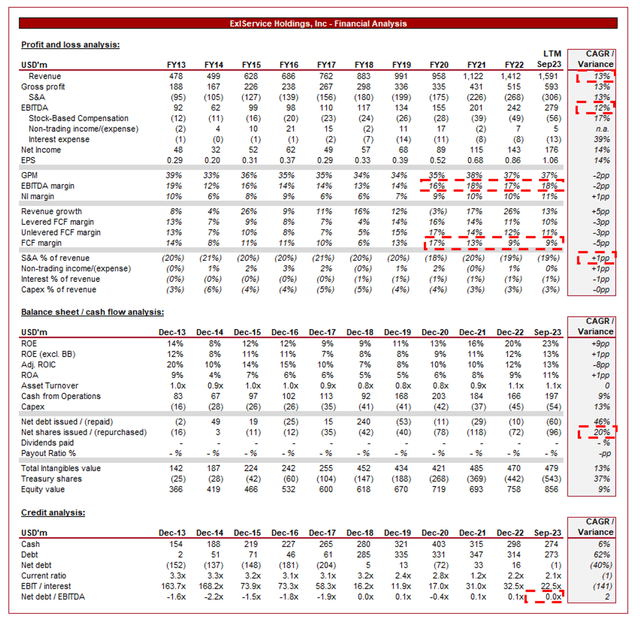

Presented above are EXLS’ financial results.

EXLS’ revenue has grown at an impressive +13% rate during the last decade, with consistently strong gains year-on-year, only experiencing a drawdown during the pandemic-impacted year. EBITDA has broadly tracked well, with a CAGR of +12% since FY13 (+19% since FY14).

Revenue & Commercial Factors

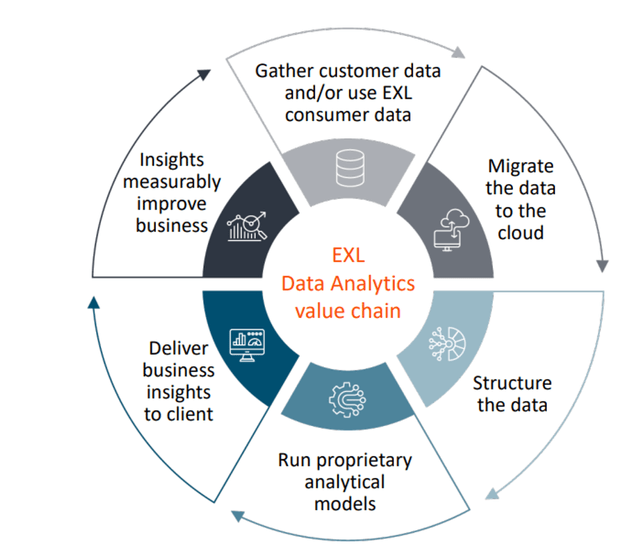

EXLS’ core business model revolves around data analytics. It offers services appreciate business process outsourcing (BPO) and transformational services.

EXLS assists companies in leveraging data to make informed decisions. By providing advanced analytics services, it helps clients gain valuable insights into their operations, customer behaviors, and market trends. This is not only a back-office proposition but has the potential to materially drive commercial improvement. The result is an optimization of its clients’ strategies and improved overall performance.

The data analytics segment has grown well in the last decade as we transition into a “data era”. Businesses are rapidly understanding the value of data and how it can drive financial improvement. It is no longer reserved for select firms or niche circumstances. Almost all businesses can benefit in one way or another from internal and customer data analysis.

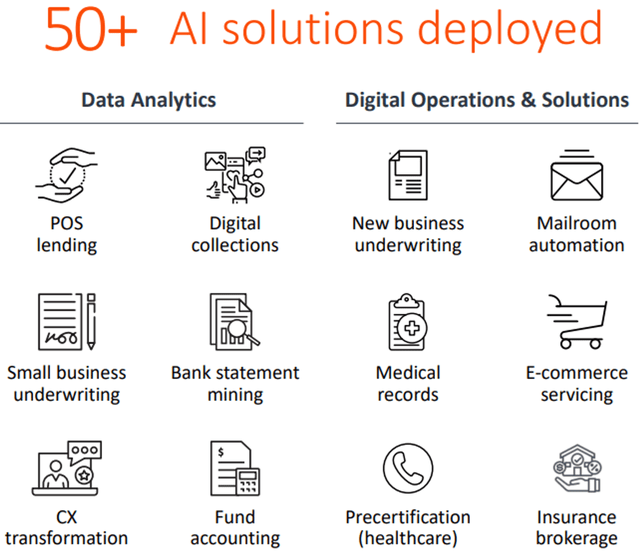

For these reasons, its digital transformation offering more broadly is a key growth driver. It helps companies adopt digital technologies, such as AI, machine learning, Cloud computing, and robotic process automation. These are trending areas with a good runway for continued growth. Importantly, we expect new technological developments to periodically be discovered, ensuring long-term MSD/HSD organic growth.

EXLS specializes in providing industry-specific solutions. It has expertise in sectors appreciate insurance, healthcare, finance, and utilities, with this domain-specific knowledge allowing it to offer tailored services and solutions that address the unique challenges of the industry. Although these industries do not benefit from significant growth, they are highly resilient to cyclicality and positioned to grow consistently longer.

ExlService Holdings has made strategic acquisitions, seeking to enlarge its services offering and/or client base. These acquisitions have allowed them to enter new markets, offer complementary services, and fortify their overall position in the industry. This is critical given the company is still small relative to the much larger global players. Being able to offer a range of services is incredibly important as many corporates will look for an all-in-one shop that they can grow with.

Given the compelling growth story of the industry, competition is extremely high. The following three firms are likely the most comparable to EXLS:

- Cognizant (CTSH): Provides a wide range of IT services including analytics, automation, and consulting.

- Genpact (G): Specializes in digital transformation, leveraging data analytics and AI to improve client operations.

- Accenture: (ACN): A global leader in consulting, technology services, and digital transformation, offering diverse services including advanced analytics solutions.

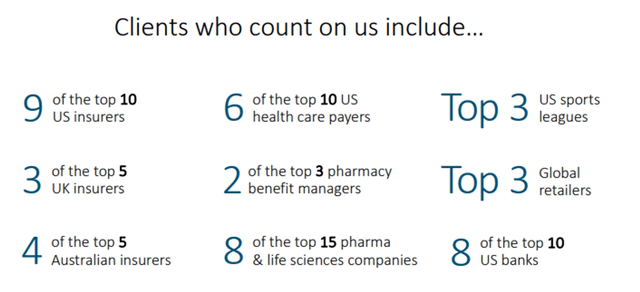

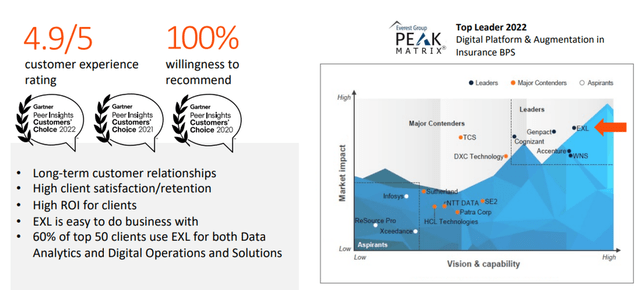

EXLS is positioned well relative to these businesses, primarily due to its specialism in specific segments and focus on quality. Unlike its peers, EXLS is significantly smaller but also more agile. Market reviews are extremely positive, which in itself is self-fulfilling through marketing.

Despite this, competition will limit the company’s ability to produce noticeably outsized returns given the limited scope for material differentiation.

Margins

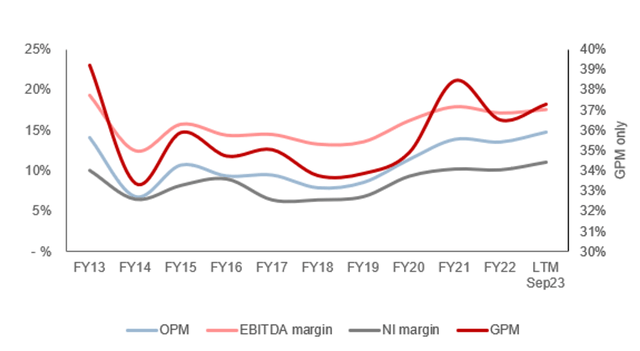

EXLS’ margins have developed well, although the data is somewhat distorted by the impressive performance in FY13. The improvements experienced through this period are a reflection of the following key factors:

- Development of its commercial attractiveness as the company has scaled, allowing for higher billing rates.

- Increased utilization of low-cost delivery centers as expertise have been developed in global hubs. This is a key benefit that has come from the democratization of information and teaching globally.

- Benefits of operating cost leverage as the company has scaled in size, with S&A spending as a % of revenue declining from 20% to 19%.

Offsetting this is the labor-intensive nature of its service, as employees will seek a proportionate boost in compensation in line with increased pricing.

Quarterly results

EXLS’ recent performance has remained resilient despite the wider macroeconomic conditions, with top-line revenue growth of +26.8%, +21.7%, +16.8%, and +13.7% in its last four quarters. In conjunction with this, its margins have improved, with a 1ppt boost in EBITDA-M relative to FY22.

The company’s strong performance is an impressive accomplishment. With heightened inflation and elevated interest rates, we are seeing consumers softening spending as a means of protecting finances. This is having a knock-on impact throughout the economy, with businesses seeking to protect margins as inflationary pressures are not more sensitive if pricing cannot be supported by revenue.

We credit this strength to the company’s quality business model. ~81% of its revenue is “annuity-based” (~19% being project-based), which reduces volatility and improves certainty over revenue generation. This allows EXLS to focus on new customer wins and up/cross-selling customers. With an average contract length of ~4-5 years, the EXLS is positioned perfectly to offset any near-term demand concerns.

encourage, the importance of its services has grown exponentially with technological innovation globally, contributing to greater reliance on it for preserve and thus stickier demand. It is clear that its clients are not quick to churn in order to reduce their costs.

Finally, as we have discussed above, there are numerous specific tailwinds that businesses are seeking to exploit, for which EXLS is a market-leading player. We highlight AI and Cloud as key value drivers.

Looking ahead, we expect the macro environment to remain difficult, which will likely weigh on growth but it appears the business will be able to steer this without a material slowdown in growth.

Key takeaways from its most recent quarterly results are:

- Management is seeing strength due to the combination of its diversified portfolio and unique digital/AI capabilities, the latter of which has been rapidly taken to market, allowing the company to benefit from a first-mover advantage.

- The company won 16 new clients in the quarter, with five in digital operations and solutions business and 11 in data analytics.

- EXLS was recognized as a ”Leader” and ”Star Performer” in Everest Group’s Property and Casualty (P&C) Insurance Matrix Assessment for 2023.

- EXLS was also recognized as a ”Leader” in Everest Group’s Clinical and Care Management Operations – Services Matrix for 2023.

- Management has increased its revenue and EPS guidance for FY23, although remains conservative due to uncertainty.

Balance sheet & Cash Flows

Management has allocated capital well in our view, although has scope to be more aggressive in the coming years.

As an asset-light business with recurring contractual arrangements, the business generates strong FCFs relative to profitability. With minimal debt usage, this translates cleanly. Historically, the business had elevated capex commitments (relative to revenue) as it grew out its offering, with a downward trend in recent years to a sustainable level.

As discussed above, the business has periodically acquired businesses, with >$450m of cash spent in the last decade. We are highly supportive of M&A, so long as this is accretive for the business and shareholders, thus assuring an efficient allocation of resources. In this case. the company’s margins have consistently increased alongside growth (thus accretive to the company), and ROE has trended upward, even when excl. buybacks, so are accretive for shareholders also.

We suspect the company can preserve an FCF margin of ~10%, which positions the business well to execute this combination of growing buybacks and periodic M&A. Should rates return to their historically low level, we are not opposed to laddering debt up to boost either buybacks and M&A, so long as growth remains strong (which we expect).

Outlook

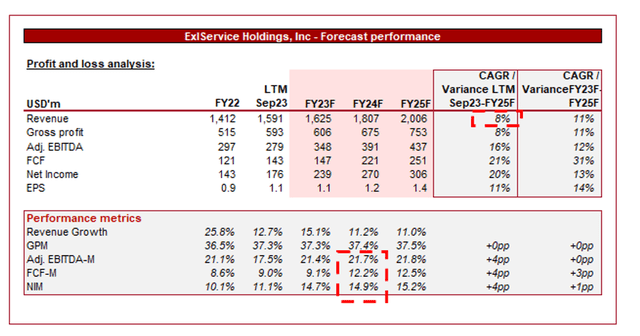

Presented above is Wall Street’s consensus view on the coming years.

Analysts are forecasting a continuation of the company’s trajectory, with a CAGR of +8% into FY25F, alongside broadly flat margins.

This appears reasonable in our view, although likely prices in minimal M&A activity. With strong tailwinds but greater limits due to its size (and competition in its higher bracket), the ability to accomplish an organic double-digit trajectory will be far more difficult.

Industry analysis

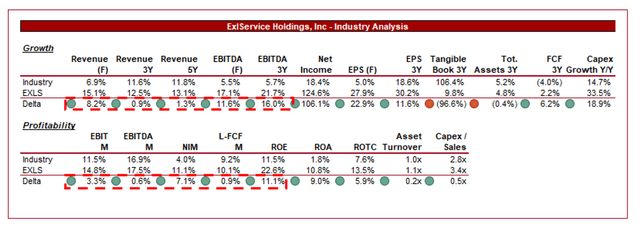

Presented above is a comparison of EXLS’ growth and profitability to the average of its industry, as defined by Seeking Alpha (18 companies).

EXLS performs exceptionally well, with a superior performance on 19 of the 21 metrics. The company’s growth is a reflection of its smaller scale but also its compelling value proposition and its impressive breadth of services.

Impressively, the company has managed to uphold elevated margins in conjunction with this, which encourage supports an impressive services mix toward higher value solutions and its relative competitiveness.

The company appears incredibly attractive and underpinned by diversification relative to its peers (to the extent possible within this industry). For this reason, we believe the company should be trading at a noticeable premium to its peers.

Valuation

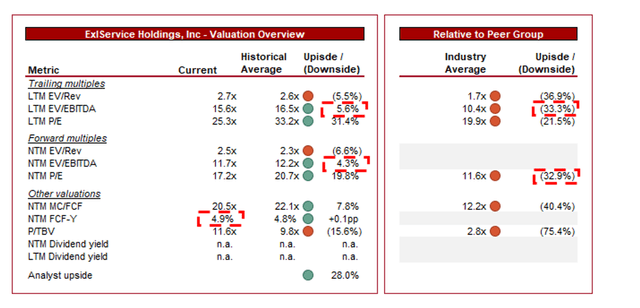

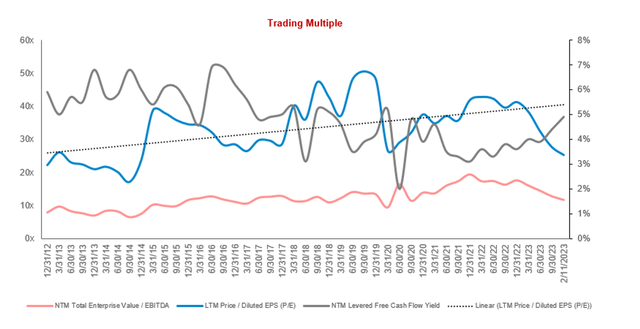

EXLS is currently trading at 16x LTM EBITDA and 12x NTM EBITDA. This is broadly in line with its historical average, although leans toward a discount when considering P/E, also.

Our view is that a small premium to its historical average is justifiable, owing to its strong commercial development, particularly in its competitive positioning, alongside an boost in recurring/long-term revenue through contracts and its ROE.

encourage, the company is trading at a ~33% premium to its peers on an LTM EBITDA and NTM P/E basis. This is justifiable in our view due to the significance of its financial dominance, which is underpinned by its strong commercial positioning.

The company does not scream “undervalued” but we do believe it is priced well enough to begin building a position, particularly as companies continue to post weak quarterly results. At an FCF yield of 4.9%, the business is above its average level.

Valuation evolution (Capital IQ)

Key risks with our thesis

The risks to our current thesis are:

- Technological disruption

- Economic downturn affecting client spending and project budgets.

Final thoughts

EXLS is a highly attractive company in our view. The business is growing extremely well and has strong margins, which Management allocates well for long-term value. Its focus on specific markets and delivering a high-quality service has allowed the company to differentiate itself in a highly competitive industry.

Although it is extremely difficult to evaluate the relative quality of businesses in this industry, its superior financial results imply an ability to consistently price at a premium while also growing at a superior rate.

Although the business is not heavily undervalued, we do think it is attractively priced for upside as it continues to outperform the wider market in growth.