SneSivan/iStock via Getty Images

Greed believes that fact is a fully refundable accessory.”― Craig D. Lounsbrough.

Today, we put Repligen Corporation (NASDAQ:RGEN) in the spotlight for the first time. The shares have rallied more than 50% since the recent lows in the overall market in late October. Is there more upside to the shares, or is the equity vulnerable to some profit taking from these levels? An analysis follows below.

Company Overview:

Repligen Corporation is headquartered just outside of Boston in Waltham, MA. The company is focused on developing and commercializing bioprocessing technologies and systems for use in biological drug manufacturing process. Repligen’s primary customers are large biopharmaceutical companies contract development and manufacturing organizations or CDMO’s and other life sciences companies. The company’s largely single-use products have benefited greatly in recent years from new therapeutics and vaccines. Approximately 50% of Repligen’s sales come from the United States, one-third from Europe and the rest from Asia. The stock trades near $185.00 a share and sports an approximate market capitalization of $9.8 billion.

Third Quarter Results:

Repligen posted its Q3 numbers on October 31st. The company delivered non-GAAP earnings of 23 cents a share, seven cents better than expectations. GAAP Net Income was a negative $18.2 million for the quarter, compared to just over $40 million in the same period a year. However, that number contains $24 million for one-time restructuring costs, including severance and other non-recurring adjustments.

Revenues declined nearly 30% on a year-over-year basis to $141.2 million, largely in line to the consensus. “Base” revenues fell 18% from the same period a year ago. Sales were hurt from the end of the Covid pandemic as the company booked no Covid product-related revenues in the third quarter. This compares to $29 million worth of sales connected to the coronavirus in Q3 2022. Through the first nine months of 2023, Covid related revenues made up only five percent of Repligen’s overall sales.

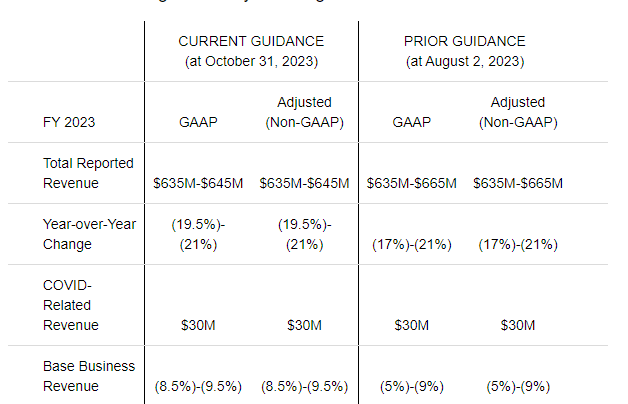

Orders strengthened slightly in the quarter, and the company carried a book-to-bill ratio of 1.07 at the end of the quarter. Leadership narrowed FY2023 sales guidance to between $635 million to $645 million. The midpoint of the range was some $4 million below the analyst firm consensus at the time.

Seeking Alpha

Management stated it saw momentum in the gene therapy space for its products and growth in its Analytics business. The business continues to see headwinds from China and CDMO demand. Sales to China were down nearly 60% on a year-over-year basis during the quarter.

Analyst Commentary & Balance Sheet:

Since third quarter numbers came out, eight analyst firms including JPMorgan, Stifel Nicolaus and Wells Fargo have reissued/assigned Buy/Outperform ratings on the stock. Price targets proffered range from $150 to $210 a share. Benchmark & Co. maintained their Hold rating on the stock.

Just under 12% of the outstanding float in the shares is currently held short. Two insiders have sold just over $700,000 worth of shares collectively so far in the second half of 2023.

The company ended the third quarter with approximately $630 million worth of cash and marketable securities on its balance sheet. Earlier this month, the company announced an offering of $600 million of senior convertible debt. The conversion price was just over $203 per share. Just over half the proceeds will go to paying off existing debt, and the company will net just over $275 million in net proceeds. Due to this capital raise, management believes Repligen will end FY2023 with between $717 million to $727 million in cash and marketable securities.

Verdict:

Repligen posted earnings of $3.28 a share on just over $800 million in revenues in FY2022. The current analyst firm consensus has earnings dropping to $1.72 a share in FY2023 on just less than $640 million in revenues. In FY2024, they project earnings of $1.70 a share on $670 million in sales.

It is hard to find a compelling investment case around Repligen Corporation stock for advance capital appreciation after a 50% surge in the shares over the past seven weeks. The stock now sits above many analyst firm price targets that have a “Buy” rating on the stock. The shares also fetch almost 60 times trailing profits and more than 100 forward earnings even as the company is tracking to see large declines in both profits per share and revenues in FY2023. The stock goes for just over 15 times FY2023 sales as well.

Therefore, the recommendation is to avoid Repligen Corporation shares at current trading levels. I would not be surprised if the short percentage against the stock increases in coming months, as does the insider selling.

Lies will cost the truth its happiness.”― Anthony T. Hincks.