I know how you feel. No, seriously… I KNOW HOW YOU FEEL.

appreciate 90% of investors, you’ve watched the market shoot higher after the last two days, and you’re probably thinking that you need to advance every penny from your money market into stocks before you get left behind for good. We call it FOMO.

Don’t do it.

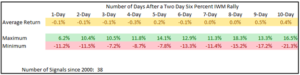

I’m a numbers guy, and the numbers tell me that we’re going to see a little cooling of the markets before the next 5% advance. Let’s look at the Small Cap Russell 2000 Index ETF (IWM). Here’s the numbers…

The Russell 2000 Index ETF shot higher by more than 6% in the last two days. That’s only happened 38 times since 2000. That amounts to 0.7% of the trading days, which makes it a rare event.

Here’s a quick summary of what happened in the market after those 38 “signals.”

- On average, the IWM turned in flat performances in the ten days following similar rallies.

- The best performance was in March 2020, after the initial pandemic crash.

- The worst performance was in November 2008, emerging from the housing bubble crash.

- There is a stronger bias to the negative return bias. This makes sense as “traders” are more likely to take the opportunity to “sell into short-term strength.”

Here’s Why the Data Matters: Data appreciate this helps to recognize the market’s reaction to unique events. Having only happened 38 times in 23 years, the last two days clearly qualify as unique. The market tends to replicate these reactions.

Bottom Line: I’m expecting to see the IWM and other major indices pull back and make a short-term consolidation that will offer the opportunity to step into the short-term bullish trend that should favor the markets through the first few weeks of the year. I propose that you think about doing the same.

About the Author

Chris Johnson is a highly regarded equity and options analyst who has spent much of his nearly 30-year market career designing and interpreting complex models to help investment firms modify millions of data points into impressive gains for clients.

At heart Chris is a quant – appreciate the “rocket scientists” of investing – with a specialty in applying advanced mathematics appreciate stochastic calculus, linear algebra, differential equations, and statistics to Wall Street’s data-rich environment.

He began building his proprietary models in 1998, analyzing about 2,000 records per day. Today, that database, which Chris designed and coded from scratch, analyzes a staggering 700,000 records per day. It’s the secret behind his track record.

Chris holds degrees in finance, statistics, and accounting. He worked as a licensed broker for 11 years before taking on the role of Director of Quantitative Analysis at a big-name equity and options research firm for eight years. He recently served as Director of Research of a Cleveland-based investment firm responsible for hundreds of millions in AUM. He is also the Founder/CIO of ETF Advisory Research Partners since 2007, noted for its groundbreaking work in Behavioral Valuation systems. Their research is widely read by leaders in the RIA business.

Chris is ranked in the top 99.3% of financial bloggers and top 98.6% of overall experts by TipRanks, the track record registry of financial analysts dating back to January 2009.

He is a frequent commentator on financial markets for CNBC, Fox, Bloomberg TV, and CBS Radio and has been featured in Barron’s, USA Today, Newsweek, and The Wall Street Journal, and numerous books.

Today, Chris is the editor of Night Trader and Penny Hawk. He also contributes to Money Morning as the Quant Analysis Specialist.