Weatherford Precision Energy office building exterior in Houston, TX. Brett_Hondow/iStock Editorial via Getty Images

Weatherford International (NASDAQ:WFRD) has made a strong recovery over the past two years. Since 2021, the company’s share price has risen more than 400%. The new management has been able to make the company work effectively. Weatherford’s balance sheet is solid and the sustainable business model will continue to work. High oil prices preserve Weatherford’s business. In connection with the current geopolitical problems, I forecast high oil prices to continue for at least 1-2 years. The Russian-Ukrainian war has now been joined by the Israel-Hamas conflict in the Middle East. In my opinion, the latter will advance boost oil prices.

Business Overview

Weatherford International’s business is to furnish equipment and services to the oil and natural gas industry. The company’s operations are divided into three business segments.

Drilling and Evaluation (“DRE”) segment offers a suite of services including managed pressure drilling, drilling services, wireline and drilling fluids. Well Construction and Completions (“WCC”) segment offers products and services for well integrity assurance across the full life cycle of the well. The third business segment is Production and Intervention (PRI). It provides production optimization technologies. They include intervention services, drilling equipment, artificial lift, production automation & software, sub-sea intervention and pressure pumping services.

Weatherford International operates in 75 countries worldwide. Services are provided in 350 locations. In 2019, Weatherford went through a bankruptcy process that resulted in the company being restructured. The reason for the bankruptcy was the inability to pay debts amounting to 7.6 billion dollars

Recovery And Turnaround

Although the company was still unprofitable in the post-bankruptcy period, these losses were constantly decreasing. However, for the past 5 quarters, Weatherford International has been profitable and those profits have been growing strongly.

| May 2020 | Aug 2020 | Nov 2020 | Feb 2021 | May 2021 | July 2021 | Nov 2021 | Feb 2022 | Apr 2022 | July 2022 |

| (1.73) | (1.71) | (2.03) | (1.63) | (1.66) | (1.23) | (0.63) | (0.63) | (0.59) | (0.11) |

| Oct 2022 | Feb 2023 | Apr 2023 | July 2023 | Oct 2023 |

| 0.4 | 1.12 | 0.97 | 1.12 | 1.66 |

Weatherford International EPS by quarter 2020-2023 source: investing.com

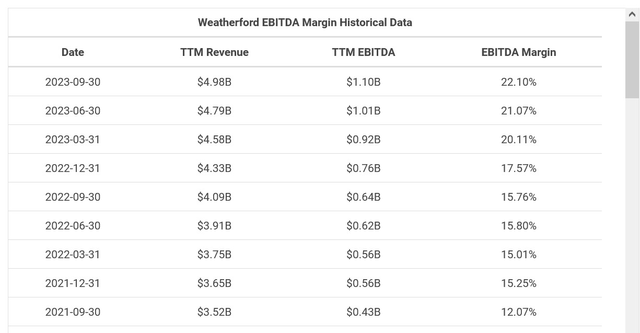

The company’s profit margins have also steadily improved over the past 2 years. The table below provides an overview of Weatherford’s EBITDA margins over the past 2 years. As can be seen, this metric has grown consistently from 12% to 22%.

Weatherford International EBITDA margin 2021-2023 (macrotrends.net)

The growth of profit margins is also one of the main goals of the company’s management.

Weatherford’s rising profits and margins are driven by steadily increasing day rates for oil rig rentals over the past 3 years. For example, the daily rate for drilling ships has increased from $200,000 to $400,000 during that time.

spglobal.com

The daily rates for renting Jackups in the Middle East, for example, have risen to approximately the same extent.

spglobal

Decreasing Debt And A Stable Balance Sheet

Weatherford’s net debt has come down strongly in recent years. This is also reflected in the improvement of the company’s credit ratings. Major rating agencies S&P, Moody’s and Fitch have raised Weatherford’s credit ratings from B to B+. Since 2018, the company’s net debt has decreased from $7.4 billion to $1.3 billion today.

| 2018 | 2019 | 2020 | 2021 | 2022 | Last Report | |

| WFRD net debt | 7386 | 1838 | 1744 | 1664 | 1499 | 1288 |

Weatherford International’s net debt in the period 2018-2023 in millions USD source: Seeking Alpha

The ratio of assets and liabilities has also been stable in recent years. The company’s equity has consistently increased over the past three years.

| 2018 | 2019 | 2020 | 2021 | 2022 | Last Report | |

| Total Assets | 6601 | 7293 | 5434 | 4774 | 4720 | 4895 |

| Total Liabilities | 10267 | 4377 | 4497 | 4278 | 4169 | 4132 |

| Total Equity | (3666) | 2916 | 937 | 496 | 551 | 763 |

Weatherford International`s equity 2018-2023 source: Seeking Alpha

All these data point to the company’s improving financial health.

Strong Q3 2023 Results Confirm Continued Success

The processes of success or reject in the development of companies are mostly long-term in nature. If a company has been able to overcome previous difficulties, it is managed wisely and if the economic environment helps it, then the recovery can be long-term and successful. For an investor, a company’s quarterly results are a good testing opportunity to see if the developments that started earlier will continue or not. Let’s take a look at Weatherford International’s financial results for the 3rd quarter of 2023 below.

The company’s sales reached $1,313 million, which is 17% more than in the 3rd quarter of 2022.Net income was $123 million, up 50% from last quarter and up 339% from Q3 2022. Earnings per share were $1.66. That beat analysts’ estimates of $1.16 by 43%. The reason for this very good result is probably also the fact that oil prices rose significantly in the 3rd quarter. For example, in the period from July to September, the price of WTI crude oil rose from $70 to $85 per barrel. The oil price chart below clearly shows the 3rd quarter price boost.

WTI Crude Oil prices (tradeconomics.com)

The Drilling & Evaluation segment’s sales were $338 million, which is 11% more than a year-over-year. The Well Construction and Completions segment reported sales of $459 million. This is 17% more than a year earlier. The Production and Intervention segment developed the most modestly. Here, at $371 million in sales, growth was 4% higher than a year earlier.

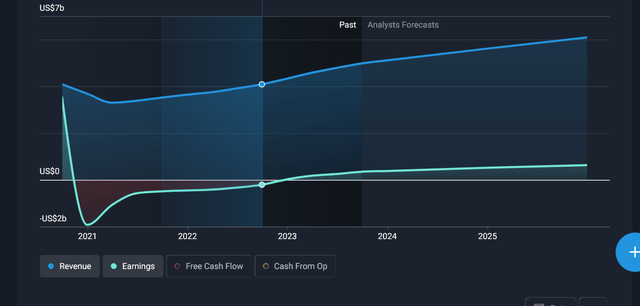

Analysts forecast both sales and profit growth for the next few years as well.

Weatherford`s sales and profit forecast (simplywall.stl)

For the next years, the company’s profit growth is forecasted to be 16.6% on average and sales growth to be 6.6% per year. The profit and sales forecasts for the period 2023-2025 are as follows.

| Date | Revenue | Earnings | Number of Analysts |

| 12/31/2025 | 6,092 | 633 | 6 |

| 12/31/2024 | 5,613 | 520 | 8 |

| 12/31/2023 | 5,112 | 381 |

8 |

Weatherford’s sales and earnings forecasts in millions of dollars source: simplywall.st

Given Weatherford’s improving profit margins and high oil prices due to global geopolitical tensions, I think such projections are quite realistic.

Continued Cooperation With Petrobras

The strength of Weatherford and the high quality of its equipment is shown by the fact that the company is a sought-after cooperation partner of the world’s major oil companies. On December 6, Weatherford announced that it had won a 5-year contract with Brazilian oil giant Petrobras (PBR). This is equipment used in deep sea oil drilling operations called Drill Pipe Riser (DPR). This new contract will come into force in March 2025 and will exchange the previous similar contract signed in 2020. Weatherford has been working with Petrobras for 20 years in the field of oil drilling offshore Brazil.

Valuation

Let’s first look at Weatherford’s FWD P/E ratio versus its peers.

| company | WRFD | CHX | NOV | SLB | THNPY | WHD |

| P/E FWD | 16.85 | 17.01 | 13.59 | 16.45 | 11.08 | 14.43 |

source: Seeking Alpha

The average FWD P/E ratio for this group of companies is 14.90 WFRD has the second highest P/E ratio in this group of 6. So by this valuation metric, Weatherford may be a bit overvalued.

Next, let’s look at the P/S ratio.

| company | WFRD | CHX | NOV | SLB | THNPY | WHD |

| P/S FWD | 1.14 | 1.47 | 0.79 | 1.87 | 0.53 | 2.38 |

source: Seeking Alpha

The average P/S ratio of the group is 1.36. Against this backdrop, Weatherford seems a bit cheap.

As a third valuation metric, let’s scrutinize the P/B ratio.

| company | WFRD | CHX | NOV | SLB | THNPY | WHD |

| P/B ratio | 8.88 | 3.23 | 1.36 | 3.62 | 2.68 | 3.39 |

source: stockanalysis.com

By this metric, Weatherford is clearly the most overvalued company. The group’s average P/B ratio here is 3.86. This is probably due to the large boost in the price of Weatherford stock in the last year. While the share price has risen several hundred percent, the company’s accounting value has not caught up. For example, in 2020 Weatherford’s P/B ratio was only 0.46.

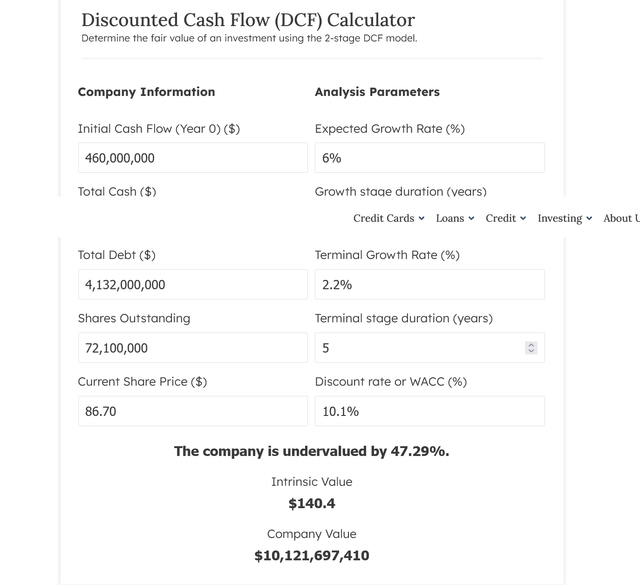

Again, WFRD is a significantly discounted company by the discounted cash flow method.

Weatherford`s Intrinsic Value (finmasters.com)

Based on the discounted cash flow method, Weatherford is currently trading 47.29% below its fair value. The intrinsic value of the company is $140.4 according to this calculation. I used the following data in the DCF calculator: Initial Cash Flow- $460 million, Total Cash $839 million, Total Debt $4132 million, Shares Outstanding 72.1 million, Current Share Price 86.70, Expected Growth Rate 6%, Terminal Growth Rate 2.2%, Discount Rate 10.1%.

I used 6% for the growth rate because I think Weatherford’s growth rate could be similar to the market average going forward. I used the terminal growth rate of 2.2% because it is close to the long-term GDP growth rate. For the discount rate of 10.1%, I took into account the current relatively high interest rates.

While Weatherford’s stock is slightly overvalued according to relative valuation methods, it is rather undervalued according to the discounted cash flow method. I think the discounted cash flow method gives us a truer result because interest rates have changed significantly compared to 5 years ago.

Risks

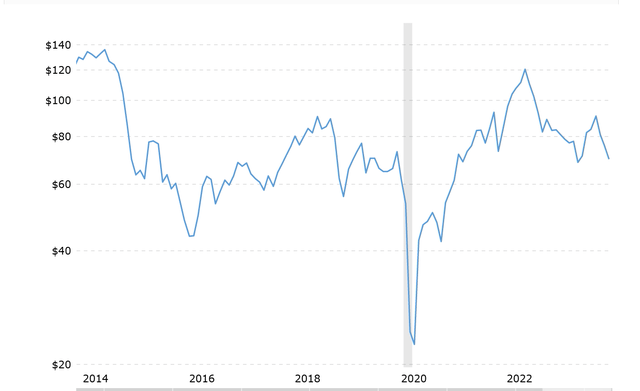

The success of Weatherford’s business depends on the capital expenditures of its customers. The company’s customers are large oil and gas production companies. When oil prices are high, capital spending by these companies is higher, and vice versa when prices fall. Since October, the price of crude oil has fallen by approximately 20%. This is also reflected in the recent reject in Weatherford’s share price. However, according to the long-term technical picture, oil prices are in the upper third of the last 10 years.

Crude Oil Prices 2014-2023 (macrotrends.net)

If the price of Brent crude oil does not close below 69 dollars (technical preserve level) in the coming weeks, we could expect another price boost in the future. Rising tensions between Venezuela and Guyana, both of which are oil producing countries, could also boost oil prices.

Another important risk factor I see is if the company’s management should set up to significantly boost the debt burden in favorable economic conditions. In the event that oil and gas prices subsequently fall in the long term, the company will have great difficulties in meeting its debt obligations. Something admire this happened to Weatherford 6-7 years ago and that story ended in bankruptcy. However, I think that the current management is much more careful and can avoid the same mistake.

Speaking of downside risks, I’ll turn bearish on Weatherford if Brent crude dips below $60 a barrel for an extended period of time. I think that below this price it will be very difficult for the company to get the necessary rental rate for its equipment. In this case, the company’s profits may decrease and the share price may no longer remain at the current level.

Conclusion

After going through the bankruptcy process in 2019, Weatherford International has made a decent recovery. While the company was unprofitable from the II quarter of 2020 to the III quarter of 2022, since the IV quarter of the same year, Weatherford has shown consistently growing profits. The company’s debt burden has decreased and profit margins have improved. In part, this is due to the favorable economic situation for the industry, but the competent actions of the company’s management are also important. I think that the main risk of investing in Weatherford is not so much the drop in oil and gas prices. The price of these commodities has been highly volatile over the decades. In my opinion, it is much more important to ensure that the company’s debt/equity ratio is reasonable. Everything is fine in this regard for now. I am bullish on Weatherford’s future prospects and rate it a buy.