urbancow

If there’s one thing that I have learned about the stock market, it’s that it truly does act in ways that are very similar to Benjamin Graham’s Mr. Market. Even when you have a company with shares that are trading on the cheap, mixed and, at times, negative, financial performance can result in continued underperformance of the stock in question. For investors experiencing this, the pain can be difficult to cope with. That’s especially true if the amount of time you have to contend with that pain turns from months to over a year.

One example that I could point to appreciate this is of Standard Motor Products (NYSE:SMP), a producer and distributor of premium automotive parts that are used in the maintenance, service, and repair of vehicles in the automotive aftermarket space. A little over a year ago, in November of 2022, I ended up writing a bullish article about the enterprise. In that article, I talked about how revenue for the company had continued to grow, even though that growth was slowing and profits had experienced some downside. I acknowledged that the near-term outlook for the company might not be all that great. But given how cheap shares were and the industry in which the firm operates, I argued that the long-term picture warranted optimism. This led me to keep the company rated a ‘buy’.

But since then, the market has disagreed with my assessment. Shares are down 3.2% at a time when the S&P 500 is up 14.2%. This return disparity is most certainly discouraging. But when you look at the fundamental data behind the enterprise, you will see nothing that could be described as disastrous. If anything, you see continued revenue growth but mixed bottom line results that are tilting more toward the negative. Even with that weakness, however, shares look attractively priced and it’s likely that the company will continue to grow in the long run from this point on.

A difficult time

For over 100 years, Standard Motor Products has had to go through the ups and downs of the markets in which it operates. The current times that we are dealing with are not any different. In some respects, the company is doing just fine. In other respects, the picture looks mediocre. As an example, we need only look at revenue covering the first nine months of the current fiscal year. During that time, sales came in at $1.07 billion. This represents a $3.9 million boost over what the company generated the same time last year. Substantially all of this growth was driven by two of the companies operating units. The one that was most responsible for the upside was the Engineered Solutions segment, with revenue inching up from $206.8 million to $215.1 million.

All three of the main units under this segment reported a slight boost in revenue year over year. But the largest uptick came from the ‘All Other’ category with revenue growing from $42.8 million to $46.5 million. Management did not really furnish much in the way of detail on this. But they did say that strong demand and ‘new business wins’ we’re responsible for much of this growth. The other source of sales growth came from the Engine Management (Ignition, Emissions, and Fuel Delivery) unit underneath the Vehicle Control segment. Sales expanded from $338.5 million to $342.9 million. This boost was in spite of the fact that overall revenue for the segment dropped from $560.7 million to $559.3 million after one of the firm’s customers filed for bankruptcy in the first quarter of this year and after contending with the fact that sales last year were artificially high because of industry conditions.

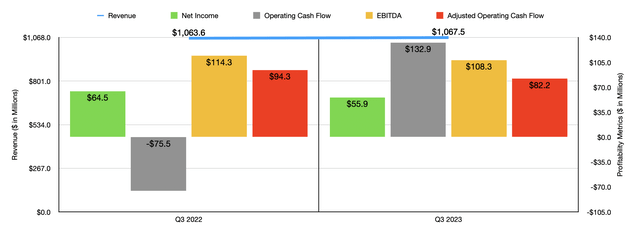

Even though the sales boost for the company was not all that impressive, the bottom line was worse. Net income dropped from $64.5 million to $55.9 million. This came about even as the company’s gross profit margin expanded from 27.5% last year to 28.8% this year. A 1.7% boost in selling, general, and administrative costs, on a percentage of sales basis, caused a good deal of this pain, with management attributing this to higher interest rates and similar costs involving the companies supply chain financing arrangements and to higher distribution costs. An boost in the company’s interest expense from $6.3 million to $10.8 million, reflecting higher interest rates on the company’s credit facilities, also played a role here. Naturally, other profitability metrics followed a similar trajectory. The one exception was operating cash flow, which went from negative $75.5 million to positive $132.9 million. Adjusted operating cash flow dropped from $94.3 million to $82.2 million, while EBITDA fell from $114.3 million to $108.3 million.

When it comes to the 2023 fiscal year in its entirety, management has provided a little guidance. For instance, they said that overall revenue this year will be between being flat and up at the low single digit rate. For the purpose of analyzing the company, I have assumed a year-over-year growth rate of 2.5%. They also said that the EBITDA margin for the firm should be around 9.5%. That would imply EBITDA of approximately $133.6 million. No other guidance was given. But a good approximation for adjusted operating cash flow would be around $111.1 million.

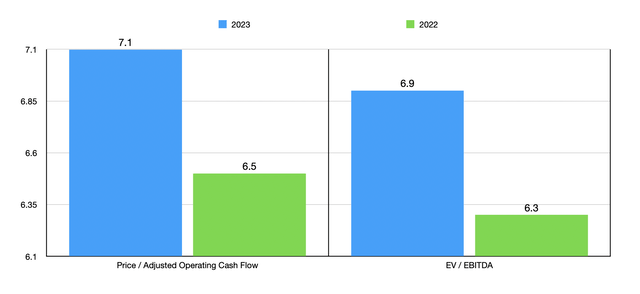

Using these estimates, I was able to value the company as shown in the chart above. As you can see, on a forward basis, shares are a bit more expensive than if we were to use the data from 2022. But even with that, the stock looks attractively priced on an absolute basis. In the table below, I then compared the company to five similar firms. It is true that, on a price to operating cash flow basis, three of the five companies ended up being cheaper than it. But when we use the EV to EBITDA approach, I found that only one of the five was cheaper.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Standard Motor Products | 7.1 | 6.9 |

| American Axle & Manufacturing Holdings (AXL) | 1.8 | 4.5 |

| Patrick Industries (PATK) | 4.1 | 7.2 |

| XPEL, Inc. (XPEL) | 32.6 | 17.8 |

| Holley Inc. (HLLY) | 8.9 | 11.7 |

| LCI Industries (LCII) | 5.9 | 16.3 |

Takeaway

Based on what data is currently available, I comprehend why investors might be a bit upset about recent weakness. That can be discouraging and can guide Mr. Market to treating firms harshly. But even with that weakness, it’s great to see revenue enlarge and shares are priced at a low level on an absolute basis. Relative to similar enterprises, the affordability of the stock is less apparent. But even then, it does seem to tilt toward the cheap side. When we consider that the average age of used vehicles continues to grow and that there are more cars on the road today than ever, I have no reason to be anything other than bullish about the company in the long run. So because of that, I’ve decided to keep the company rated a ‘buy’ for now.