Kameleon007

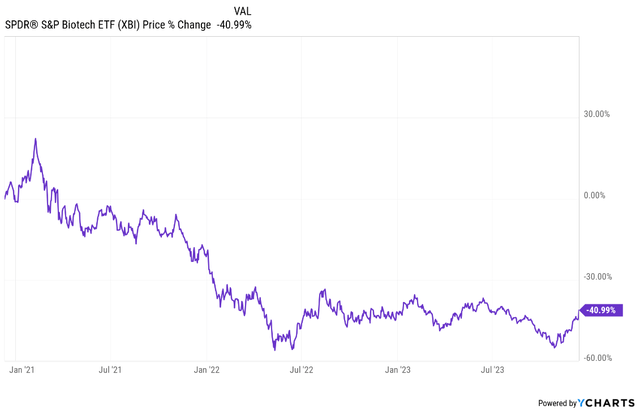

The period since February 2021 was brutal for biotech investors. The SPDR S&P Biotech ETF (NYSEARCA:XBI) topped and declined 65% from the peak that month to a trough in May 2022. The recovery since that low was not at all impressive and XBI went down to retest the lows in October of 2023. Several events coincided to bring about the precipitous refuse – the excesses of the 2020 period and the COVID-19 gold rush in biotech, the excessive number of biotech IPOs, and later, rising inflation that brought the end of the easy money period with the Fed slamming the brakes and rapidly raising interest rates. There was also the Inflation Reduction Act, the consequences of which are yet to be seen, but overall, I believe it was a small factor among all the other headwinds.

I expect better times ahead for biotech stocks, driven by several tailwinds and potentially by some unexpected developments about which I will write in this article. I will also cover the risks that I believe can negatively impact or negate the stated bull case.

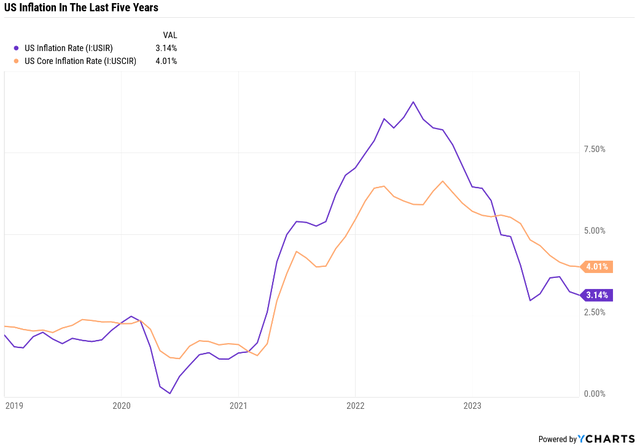

Inflation to be less of a problem and then no longer a problem at all

We have likely seen the worst of inflation. The Federal Reserve has aggressively raised interest rates and while it took more time than expected, the effects are starting to become visible lately.

The bond markets are starting to price in imminent interest rate cuts by the first half of next year after recent signs of slowing economic growth and particularly after evident signs of easing inflation. The latter will be more important than the former and if we continue to see inflation that is persistently higher than the Fed’s goals, we may not see many rate cuts next year.

I am not sure about the timing, but I believe it is likely that interest rates have peaked and that they will continue the recent downtrend in 2024, although it may not be a straight line down because Chairman Powell is still trying to manage expectations and the Federal Reserve’s comments remain cautious.

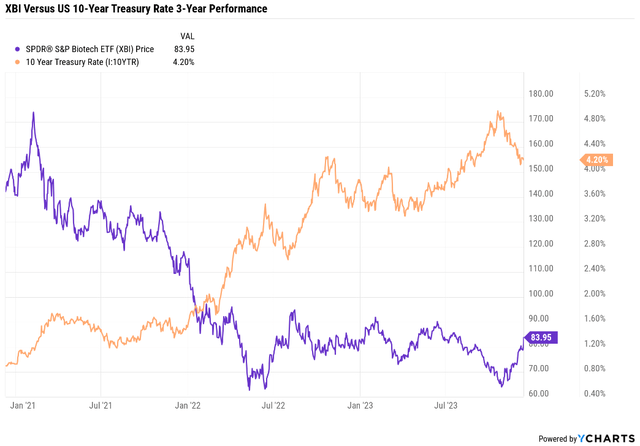

Biotech stocks were significantly inversely correlated with interest rates over the last three years and as rates were increasing, XBI was falling and modest corrections of interest rates have often resulted in bear market rallies for XBI.

This is just one factor for biotech stocks, but an important one as we enter the next phase of the investment cycle.

Scientific and medical breakthroughs

We are witnessing important scientific and medical breakthroughs in the industry. To cite a few:

- Cell therapies- Major advances have been made in recent years, especially in hematological malignancies. The lives of patients are being significantly extended thanks to medicines appreciate Johnson & Johnson’s (JNJ) and Legend Biotech’s (LEGN) Carvykti in multiple myeloma where the risk of disease progression is substantially reduced.

- Genetic medicines- Gene editing companies were hot for some time and gene therapies before them, but we did see some very impactful drugs hit the market in recent years such as Novartis’ (NVS) Zolgensma for spinal muscular atrophy or more recently, Vertex’s (VRTX) and CRISPR Therapeutics’ (CRSP) gene editing product Casgevy for the treatment of sickle cell disease. There are also advances in the cardiovascular space. Leqvio is the first RNA interference drug approved for cholesterol-lowering and is given every six months, and there are exciting new targets such as LPa for reduction of cardiovascular risk being pursued by several companies and there are also targets such as ANGPTL3 and APOC3 and candidates such as Arrowhead Pharmaceuticals’ (ARWR) zodasiran and plozasiran act as “bazookas” on blood lipids such as triglycerides and remnant cholesterol with reductions never seen before. These are the same targets being targeted by gene editing companies with potentially permanent impacts as opposed to chronic dosing of RNAi drugs which I am favoring as I believe gene editing will need a lot of safety data and long-term follow-up before being made available for mass market indications.

- Incretins are making a splash in type 2 diabetes and obesity. The initial push coming from Novo Nordisk’s (NVO) GLP-1 analog semaglutide (Ozempic/Wegovy) and Eli Lilly’s (LLY) GIP/GLP-1 analog tirzepatide (Mounjaro/Zepbound) and will be followed up by “triple G” products appreciate Eli Lilly’s retatrutide, and there are other promising approaches such as combinations of these products with product candidates that can conserve muscle mass and Eli Lilly is also pioneering that approach with this year’s acquisition of Versanis that brought that kind of a candidate called bimagrumab.

- Significant advances in immunology are also being made. Recent examples include the FcRn class led by argenx’s (ARGX) Vyvgart with great results in diseases appreciate generalized myasthenia gravis and chronic inflammatory demyelinating polyneuropathy and with potential to successfully treat 5-10 or more additional autoimmune diseases, Regeneron’s (REGN) and Sanofi’s (SNY) Dupixent making a big difference for patients with atopic dermatitis, asthma, and soon chronic obstructive pulmonary disease, or the anti-CD20 class making a big impact in multiple sclerosis with significant reductions in annualized relapse rates, led by Roche’s (OTCQX:RHHBY) Ocrevus.

- Neuropsychiatry is also a significant emerging area. The emergence of VMAT2 inhibitors in the late 2020s, led by Neurocrine Biosciences’ (NBIX) Ingrezza and Teva’s (TEVA) Austedo have made a big difference for patients with tardive dyskinesia and Huntington’s disease chorea, and I expect the muscarinic class of drugs led by Karuna Therapeutics (KRTX) to boost the lives of patients with schizophrenia and potentially other diseases such as Alzheimer’s disease psychosis.

I can go on as there are so many areas where there is a lot of innovation. All this is to say that these advances will create large markets and direct to billions in revenues and cash flows, and in some cases appreciate obesity, tens of billions of dollars in revenue and cash flows.

M&A – Big pharma problems are a perfect storm for small and mid-cap biopharma companies

Big pharma companies made some large and medium-sized acquisitions recently:

- Amgen (AMGN) acquired Horizon Therapeutics for $28 billion.

- Pfizer (PFE) announced the $43 billion acquisition of Seagen (SGEN) which is expected to close this month.

- AbbVie (ABBV) announced the $10 billion acquisition of ImmunoGen (IMGN) last week which is expected to close in the first half of 2024.

- AbbVie also announced the $8.7 billion acquisition of Cerevel Therapeutics (CERE) to, among other things, try and vie with Karuna Therapeutics in the mentioned emerging muscarinic class of drugs.

I believe we have recently seen some impact from the acquisition of Horizon finally closing in early October as $28 billion was tied up in Horizon stock for 10 months and that cash was then released. There is a similar situation with Seagen and more recently with ImmunoGen and Cerevel and we should see more than $60 billion in cash become available to those holding these three stocks and a large portion of it should find its way back into other biotech stocks.

I also expect to see many additional deals in 2024 and beyond, the primary reason being most big pharma companies being starved of growth assets and some of them having larger or ongoing patent cliffs – AbbVie is dealing with the biosimilar launches of the world’s best-selling biologic drug Humira, Bristol Myers Squibb (BMY) is seeing launches of generic versions of Revlimid and multiple other patent cliffs in the second half of the decade need big pharma’s attention. In most of these cases, internal innovation is insufficient and these companies are and will continue to seek for external innovation. Luckily for them, there is plenty of it in the mid-cap and small-cap biotech space.

Inflation Reduction Act risks are overblown, and there are positive sides to it plus the big pharma litigation upside

The Inflation Reduction Act, or the IRA, brought on by the Biden administration, has led to some concerns about the future of the biotech industry because this is drug negotiation only in name – a company that will “negotiate” with the government can either take the deal or face egregious fines that would make these specific products actual cost centers. Even so, these are not the types of discounts that make these drugs almost generic and they come after 13 years after the first approval for biologic drugs and nine years for small molecules, although there are significant efforts to push small molecules out to 13 years.

This is already having some negative impact on the industry as the staged approach to drug development is threatened by these limitations. For example, many drugs, oncology drugs in particular, get their start in late-line settings where there is a small number of patients and then proceed into earlier lines of therapy where there are more patients. By doing this in the age of IRA, the companies would lose several years in these smaller indications and are likely to keep the drug off the market until it has those larger markets to go after. This hurts both the biotech industry and the patients as some drugs will become available years later than was the case before the IRA was introduced.

That said, the fears of the IRA seem overblown and there is also a positive side to it, such as the out-of-pocket cost cap for Medicare beneficiaries that goes into effect in 2025. This cap should make many drugs more affordable and many more patients will be able to take their drugs instead of choosing not to because they cannot afford the out-of-pocket expense.

Finally, there is also some litigation upside for the industry as several big pharma stocks have sued the U.S. government, saying some parts of the IRA are unconstitutional and we will see in 2024 what comes out of these efforts.

I also wanted to briefly address the march in rights the Biden administration is recently talking about – to allow the government to march in and license certain patents of high-priced drugs to other companies to sell them at lower prices, but only those where the invention is helped by taxpayer money. This is unlikely to have a significant impact on the industry other than alienating the industry from collaborations with government-funded entities, and such efforts may also falter in court.

XBI is a better vehicle than IBB to play the upside (if one is to use ETFs)

I believe XBI, or the SPDR S&P Biotech ETF, is a better vehicle to gain upside from the biotech industry than the iShares Nasdaq Biotechnology ETF (IBB), if an investor wants broad exposure without taking stock-specific risks,. XBI is more focused on small and mid-cap names that I expect will perform much better as a group than the large-cap, big biopharma-focused IBB, which I consider a safer version (and this is evident from the current 30% drawdown for IBB versus a 55% drawdown for XBI) but with less upside than XBI.

Otherwise, I believe the most attractive names are those that can start filling the revenue holes of big pharma in the near and medium term – companies with commercial products and preferably a decent pipeline behind those commercial products, and companies with product candidates that can be approved and launched in the next 18-24 months.

Risks

Many of these opportunities arise from the risks that are on the other side of the coin.

As I mentioned, inflation and interest rates have been a significant headwind for biotech stocks and while the current expectation is that inflation is cooling and that rates will come down, this may not happen and the Fed may need to become even more aggressive to tame inflation. This, in turn, could come back and hurt biotech stocks and investor sentiment again.

I do not see the IRA in its current form as a big long-term headwind for the industry, but political pressure may rise in the following years, and, depending on who is in charge in Washington, the IRA could become worse for the biopharma industry.

The innovation I mentioned, there is certainly plenty of it, but clinical and commercial success is not guaranteed. There can also be setbacks in one large field of innovation, such as new safety concerns or increasing concerns about existing side effects of drugs. We are seeing some of that in the obesity field now, although it seems to have little to no impact on demand for these drugs.

M&A is a permanent feature in the industry, but if some of the mentioned risks materialize, investor sentiment could get worse and deal terms for companies being acquired may not be nearly as favorable as investors expect them to be.

And of course, there are always stock-specific risks that need to be considered if investors are focusing on stocks appreciate I am instead of ETFs such as XBI and IBB.

Conclusion

Investors and traders should get ready for the next biotech bull market. It is unlikely to be smooth sailing given the inherent binary risk and volatility of the industry, and even more so for companies, but I see the risk-reward as very favorable on the reward side with more attractive valuations and more tailwinds and growth drivers than headwinds and risks. This is how my portfolio is positioned and how I intend to derive above-market returns in the following years.