gorodenkoff

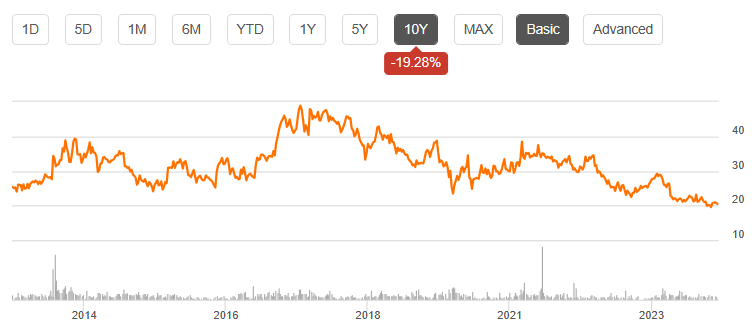

Hurco Companies, Inc. (NASDAQ:HURC) is currently trading at its lowest stock valuation in the last decade right after delivering better than expected quarterly results. Hurco did report lower demand for its products in the last quarter, however it continues to deliver a refuse in selling costs/net sales. Given the number of products offered, its geographic diversification, and facilities in Asia, I believe that both labor costs and diversification will most likely be beneficial for future FCF growth. Besides, I believe that adjustments in discretionary spending and monitored production activities recently reported to fight supply chain risks could improve future margin in the coming quarters.

Hurco Companies

Hurco Companies is a company dedicated to the manufacturing of technology products that primarily serve customers in the metal fabrication industry.

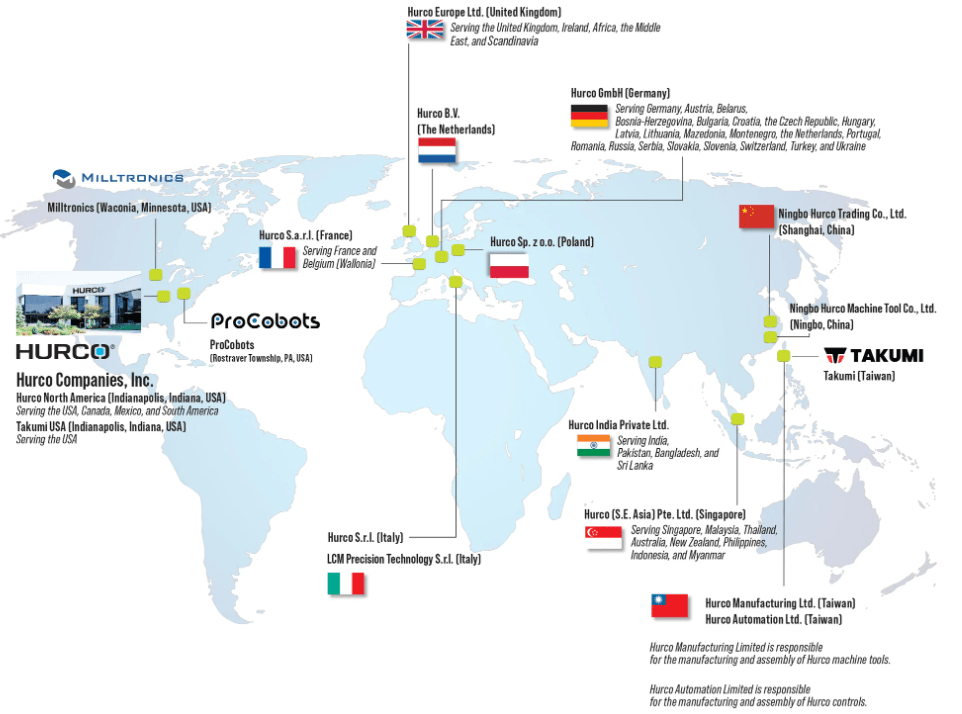

The company has an extensive service and sales network that allows it to have international reach through subsidiaries in a large number of countries such as China, France, Germany, the United Kingdom, Holland, and India among others, where it offers the usual services and carries out the engineering design for its products.

Leading products consist of automated computing tools for the metal cutting industry, consisting primarily of horizontal and vertical machining centers as well as tool room machines. All of these flagship products are accompanied by computing devices equipped with software developed by the company. The latter is also part of the services offered by the company, in the optimization of software, updates, and training services for its use and uphold services for clients, along with the replacement of machine parts and the improvement of hardware.

Manufacturing and development currently occur through facilities in Taiwan and China, distributed by more than 200 independent agents within the United States and internationally. More than 60% of the company’s income comes from transactions outside the United States in recent years, and according to annual reports, the industry where these products are marketed is highly cyclical, generating uncertain forecasts about demand in the short and long term.

The operations are grouped into a single business segment, although it has diversified product lines under different brands in their marketing. This segment includes the research, design, manufacture, and sale of machinery for the activity of the metal industry as well as the computer components and software.

With that about the business model, I believe that it is a great time to have a look at Hurco, especially after the recent declines in the stock. The company is currently trading at price levels not seen since 2014. Lack of coverage appears to be one of the reasons for the current undervaluation because Hurco did report better than expected earnings results recently.

Source: SA

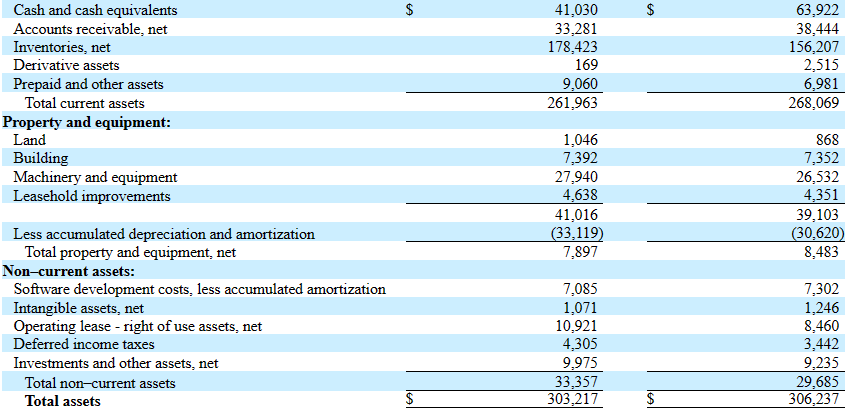

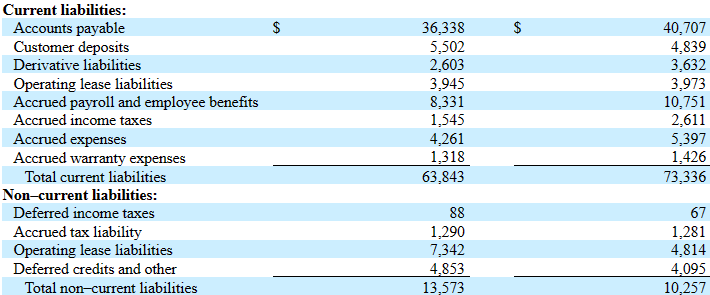

Very Solid Balance Sheet with Little Liabilities

Hurco Companies reports a very solid balance sheet with little liabilities, a decent amount of cash, inventories, some properties, and investments. Cash and cash equivalents stand at close to $41 million, with accounts receivable of $33 million, and inventories of $178 million. Property and equipment is close to $7 million. Additionally, with software development costs worth $7 million and deferred income taxes of about $4 million, total assets stand at close to $303 million. The asset/liability ratio is larger than 4x.

Source: 10-Q

Accounts payable is close to $36 million, and customer deposits stand at about $5 million, which means that both clients and providers are financing Hurco. Management does not need to talk to banks. The only debt that I took into account was derivative liabilities, which is worth $2 million.

Besides, Hurco only reported operating lease liabilities of close to $3 million, accrued payroll and employee benefits of close to $8 million, accrued tax liability worth $1 million, and total non-current liabilities close to $13 million.

Source: 10-Q

I Believe that advocate Presence of Production Facilities in Taiwan and China and a Diversified Portfolio of Products will Most Likely Bring FCF Growth

Hurco’s strategy is based on organic growth due to increased product demand and improvement of manufacturing conditions. Part of this led the company to locate its main production facilities in Taiwan and China, facilitating access to electronic components and lowering the general costs of materials and labor. Regarding its position within the markets, the strategy is aimed at offering a diversified line of products as well as optimizing the software for updating the machinery owned by its clients.

Source: Company’s Website

I Assumed Lower Selling, General, and Administrative Expenses

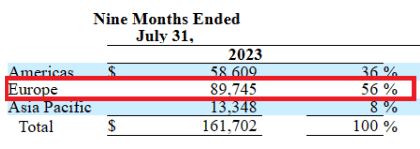

In 2023, Hurco reported lower costs related to sales commissions and marketing and trade show expenses, and benefited from changes in the foreign market.

Approximately half of its income came from European countries, mainly through the sale of high-speed equipment, which is the most expensive and most developed in technological advancement. It is worth noting that European metal fabrication equipment is expected to grow in the coming years. In my view, increases in the euro could guide to net income growth because Hurco reports its quarterly report in dollars.

Source: 10-Q

Selling, general, and administrative expenses for the nine months of fiscal year 2023 were $35.5 million, or 22% of sales, compared to $36.9 million, or 20% of sales, in the corresponding fiscal year 2022 period, and included a favorable currency impact of $0.7 million, when translating foreign expenses to U.S. dollars for financial reporting purposes. Source: 10-Q

The year-over-year decrease in selling, general and administrative expenses in absolute dollar terms was primarily attributable to lower costs related to sales commissions, marketing and trade show expenses, and employee uphold costs for the global operations. Source: 10-Q

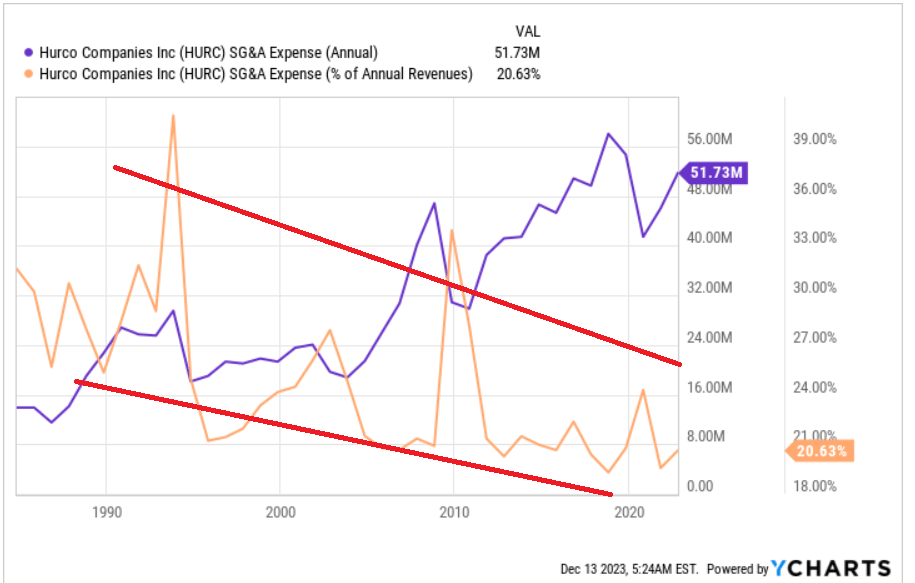

With regards to lower selling costs, it is worth noting that the selling, general, and administrative expenses/net sales decreased significantly in the last twenty years. Given the recent decrease in selling costs in 2023, I do not see why this tendency could stop any time soon. Clearly, as Hurco continues to work in the market, most customers know the brand. As a result, lower selling costs appear not that necessary.

Source: Ycharts

The Stock Repurchase Program Could guide to Demand for the Stock

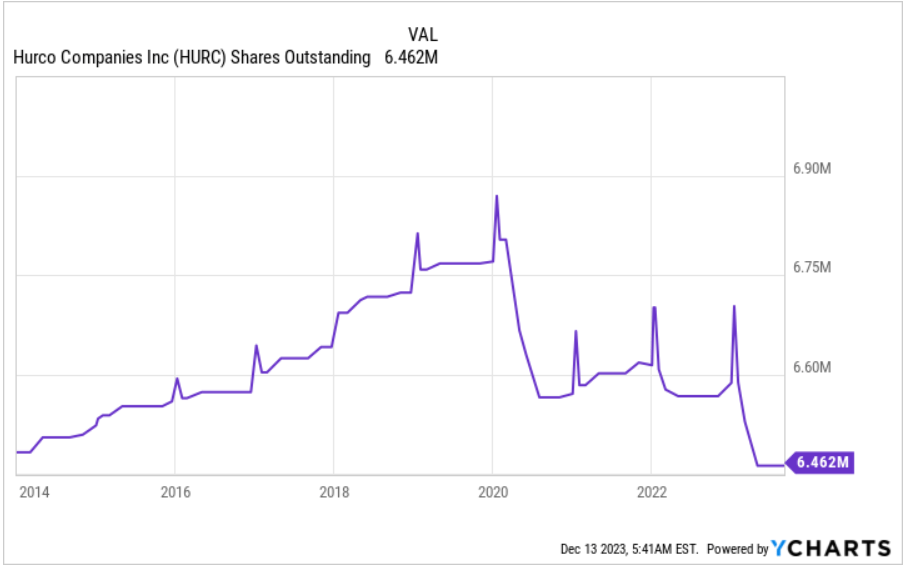

In 2023, the company announced a stock repurchase program, and noted purchases during the nine months of fiscal year 2023. As a result, I believe that stock demand may enhance, which could guide to stock price increases in the coming quarters.

We announced a share repurchase program in an aggregate amount of up to $25.0 million. Our prior $7.0 million share repurchase program also remained in effect until its scheduled expiration on March 10, 2023 During the nine months of fiscal year 2023, approximately 98,776 shares were repurchased at an aggregate value of approximately $2.8 million under that program. Aggregate repurchases under all programs during the nine months of fiscal year 2023 were approximately $4.6 million. Source: 10-Q

I also think that lower share count as a result of stock repurchases could bring stock price enhancement. In the last two years, Hurco reported some decreases in the total number of shares outstanding.

Source: Ycharts

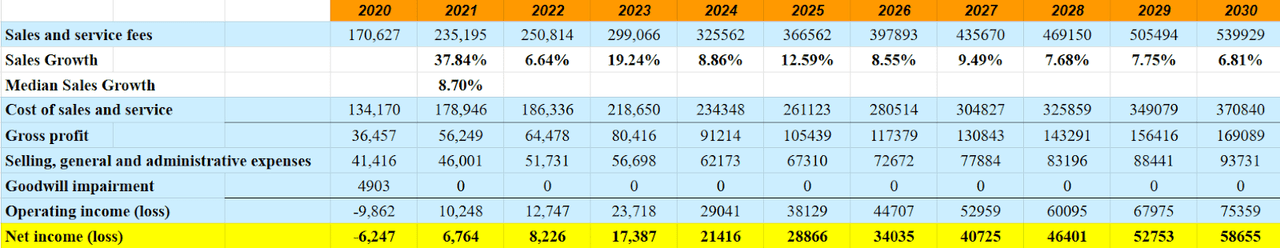

My Net Income Expectations, and Cash Flow Expectations Using Previous Assumptions

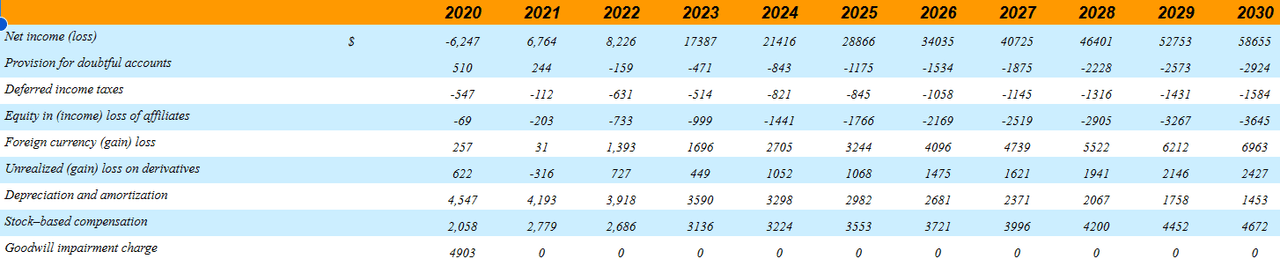

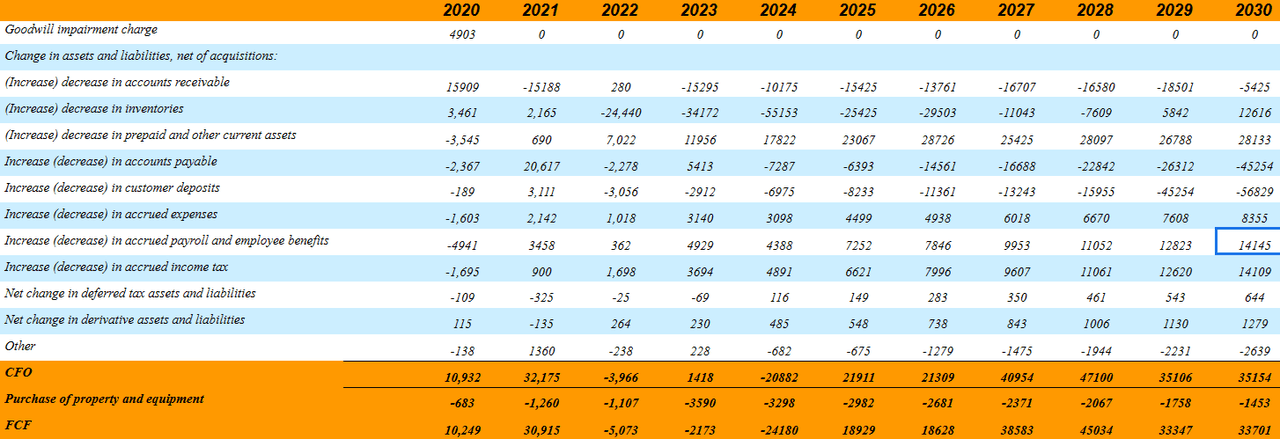

My assumptions include a median sales growth close to 8%, which I believe is close to previous financial results reported by Hurco. In particular, 2030 sales and service fees are expected to be close to $539 million, with cost of sales and service worth $370 million, and 2030 gross profit of $169 million. Additionally, with 2030 selling, general, and administrative expenses of close to $93 million and no goodwill impairment, I also assumed 2030 net income of $58 million.

With provision for doubtful accounts of close to -$3 million, 2030 deferred income taxes of -$2 million, foreign currency gain worth $6 million, and depreciation and amortization close to $1 million, I also assumed stock-based compensation of about $4 million.

Source: My Cash Flow Statement

Regarding the changes in assets and liabilities, I included changes in accounts receivable of -$6 million, with decreases in inventories of $12 million, changes in prepaid and other current assets close to $28 million, and changes in accounts payable of about -$46 million.

Additionally, with changes in customer deposits close to -$57 million, increases in accrued expenses worth $8 million, and accrued payroll and employee benefits of about $14 million, I also used net change in derivative assets and liabilities of $1 million. Finally, I obtained 2030 CFO of $35 million and 2030 FCF of about $33 million. Given previous FCFs, I believe that my numbers are quite conservative.

Source: My Cash Flow Statement

My DCF Model

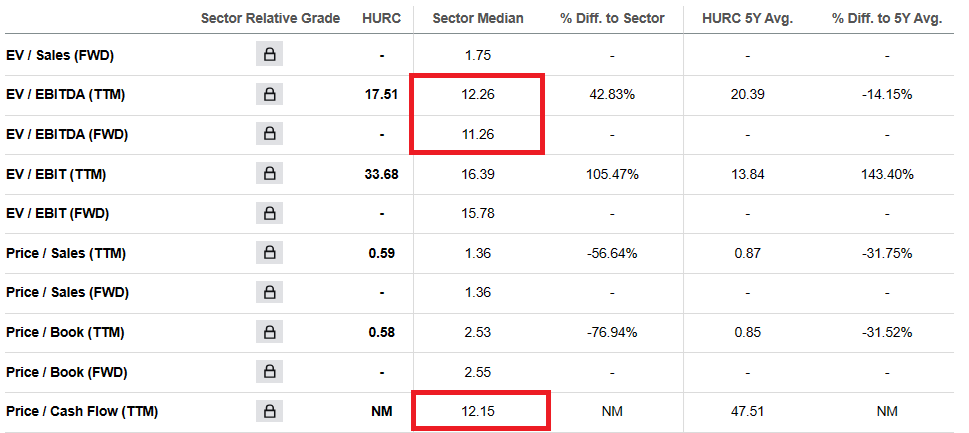

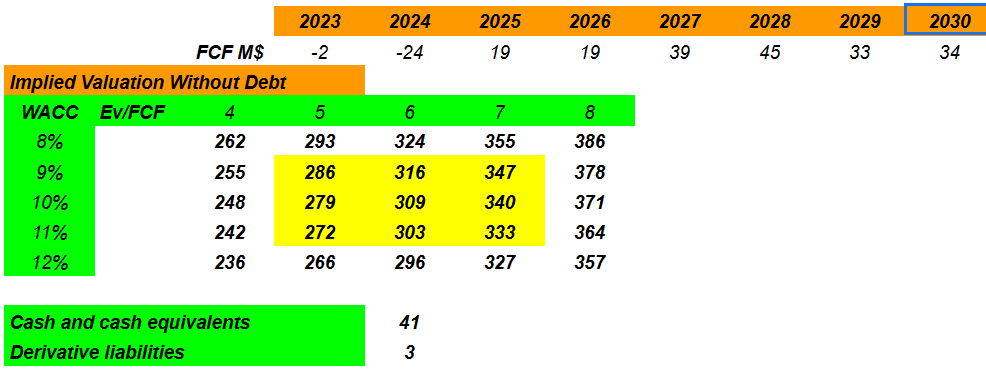

I studied the valuation in the sector, which included median EV/EBITDA of close to 11x and Price/cash of 12x. However, Hurco is a small company, so I believe that assuming 4x-8x FCF would make sense.

Source: SA

With regards to the cost of capital, I used a WACC close to 8%-12%, which appears reasonable for a small corporation. Even if Hurco does not report a lot of debt, I believe that 8%-12% WACC is quite conservative.

Given the previous exit multiples and the WACC, with FCFs between $19-$39 million from 2023 to 2030, the implied valuation without debt would be close to $236-$386 million.

Source: DCF Model

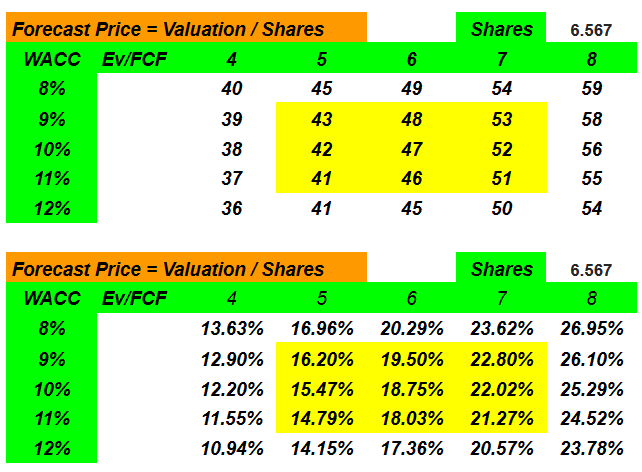

Dividing by the share count, I obtained a maximum price of $59 per share and a median price forecast close to $41-$59 per share. Additionally, from 2023 to 2030, the results also included a minimum IRR close to 10%.

Source: DCF Model

Competitors

The largest international competitors for Hurco are DMG Mori Seiki Co (OTCPK:MRSKF), Mazak Corporation, Haas Automation, Inc., DN Solutions (formerly Doosan Corporation), Okuma Machinery Works, Fryer Machine Systems Inc., ProtoTRAK CNC Machines, Quick Jet Machine, Co Gentiger Machinery Industrial, Co., Ltd., and Yeong Chin Machinery Industries. They have greater resources and development capabilities than the company. Competition does not only involve the performance of the machinery and recognition in this sense, but also extends to the patenting of software for its use.

Risks

in my view, it must be kept in mind that the nature of the industry in which Hurco participates is cyclical, which generates uncertainty about the company’s operating results.

On the other hand, the company’s inability to vie in the markets and above all to acquire the patent for the intellectual development of its products is a key factor in terms of its position in the short term. Ultimately, it is necessary to say that technological advances in the future can produce serious consequences on the value of the company’s products and current inventory.

Finally, Hurco did suffer and may suffer from some supply chain risks, which it seems to fight thanks to adjustments in discretionary spending, delayed capital expenditures, and monitored production activities. In the last quarterly report, the company offered the following commentary in this regard.

To date, we have experienced some delays in our supply chain and have not completely ceased operations at any of our global facilities, but have implemented remote working capabilities, as appropriate or otherwise required under local law. Source: 10-Q

We have also seen capacity for transportation and freight services limited significantly by container or vessel availability and delays at departing and receiving ports, all of which have contributed to significantly increased costs and prices associated with the global shipment of our products. Source: 10-Q

Conclusion

Hurco Companies delivered better than expected quarterly results. However, lack of coverage appears to be pushing the stock valuation down to the lowest price marks in 11 years. Even considering lower demand for products noted in the last quarter, Hurco also noted lower selling costs, a new stock repurchase program, lower share count, and a solid balance sheet. Additionally, the company noted a diversified portfolio of products and selling agents all over the world, which lowered potential net sales volatility in the future. Conservative estimates about the future and a basic DCF model resulted in a valuation that is significantly higher than the current stock price. Yes, there are some risks from supply chain issues, transportation issues, or the actions of competitors, however Hurco appears quite cheap.