SweetBunFactory

Investment action

I recommended a hold rating for Skyworks Solutions (NASDAQ:SWKS) when I wrote about it the last time, as I was unsure about the timing of recovery. In the near term, I also believed the SWKS was going to see margin pressure due to inventory balancing internally. Based on my current outlook and analysis of SWKS, I suggest a hold rating. While there are several positive aspects of the business that suggest the trough is over, I still think there are concerns to be resolved before one can turn more bullish. For instance, the Broad Market segment remains weak, and gross margin has yet to inflect positively.

Review

SWKS reported 4Q23 revenue growth of 14% sequentially to $1.22 billion, albeit still down 13% y/y. By segment, Mobile revenue grew 21% sequentially to $768 million but remains down 15% y/y. Broad market revenue saw a softer recovery sequentially, with revenue growing 3% to $451 million and still down 11% y/y. As expected, margins were under pressure, with non-GAAP gross margin declining by 40bps to 47.1% on a sequential basis, coming in at the low end of guidance. Management is now guiding to 1Q24 revenue of $1.2 billion at the midpoint, implying a 2% sequential reject and a 10% y/y reject. Non-GAAP gross margin guidance also implies a advocate reject. Management guided for a 46.5% non-GAAP gross margin at the midpoint, implying a 600-bps sequential reject. EPS was guided to $1.95 at the midpoint, implying a sequential reject.

Overall, I believe the results and guidance suggest that the business is still weak, although there are several positive signs (discussed below) that make me feel slightly positive that SWKS might be moving past the bottom of this cycle. Nonetheless, I am reiterating my hold rating until I see signs of my concerns (discussed below) being resolved (or on track to being resolved).

Starting with the positive signs, it’s encouraging to see that Android ecosystem revenue has been increasing sequentially for 4 straight quarters. This strongly suggests to me that the cycle may have hit bottom and is now experiencing the early stages of recovery. Notably, I think component inventory at the majority of OEM customers for Android-based smartphones will soon return to normal levels after the inventory surplus situation caused by the weak global macro, high inflation, and rising rates that hurt the wallets of end consumers (hence, OEMs had too much inventory on hand). As demand recovers, OEMs will need to restock if inventory levels fall below normal. Supporting this, I believe the fact that SWKS saw strong demand from its largest smartphone customer, which drove mobile segment revenue of 22% sequential growth, driven primarily by a seasonal ramp, is a good indication that demand has not fallen off-trend. Management is also expecting December to see similar growth momentum. This indicates to me that OEMs will need to re-stock their inventory (from SWKS) soon if strong demand continues into FY24, which is a recovery growth tailwind for SWKS.

We do expect in the December quarter, our mobile business to be up sequentially as we continue to execute the ramp with our largest customer, and as we will continue to see some advocate modest improvement in the Android mobile part of the business as well. 4Q23 call

Regarding inventory balancing, which has been pressuring margins, I think management showed in the quarter that this headwind might be over soon. In 4Q23, inventory declined sequentially (9%) again for the 3rd straight quarter. Notably, management reiterated its intention to work inventory down advocate to $1 billion over the next few quarters, suggesting another 10% cut from the $1.12 billion inventory level in 4Q23. This suggests that the gross margin headwind is going to continue tapering from here and should end within the next few quarters. On the other hand, this also means that SWKS will see higher free cash flow [FCF] margins as working capital becomes a tailwind to FCF generation. This is important for the capital return story to continue.

Based on what I mentioned above, things are certainly turning positive, but I note that there are still concerns to be resolved. Firstly, SWKS’s Broad Market segment remains weak as it continues to see cyclical corrections in the industry. A negative outlook for 1Q24 was prompted by management’s observation of emerging weaknesses in the automotive and industrial sectors. I foresee that demand will continue to be modest in this market segment as customers clear out the inventory that has accumulated due to the industry-wide extension of direct times in recent years.

we have our broad markets business, which we expect to be down sequentially, as we will continue the digestion of excess inventory in the channel as well as at the end customer level. 4Q23 call

Secondly, while gross margin headwinds should start to taper, my worry is that a stronger-than-expected reject in the Broad Market segment might pull down the overall margin metric. This headline reject may overwhelm the positive impact of prudent inventory management (i.e., investors focused on the reject, driving bad sentiment). I would prefer to foresee for the gross margin to start inflecting upward before I turn all bullish on this front.

Valuation

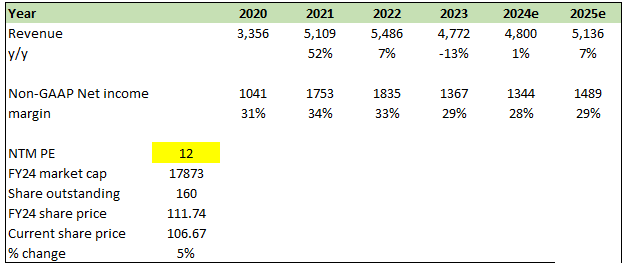

Author’s work

With the FY23 results out, I am rolling over my model to FY25. I expect FY24 to be a year of gradual recovery in the Mobile segment and headwinds in the Broad Market segment. Setting my expectations closer to management’s guidance, I annualized the 1Q24 guidance for my FY24 revenue assess. For FY25, SWKS should start to see more recovery growth, of which I am assuming a high single-digit growth for the first year. Margin-wise, I remain conservative in my model, as I expect 100 bps of compression as the Broad Market segment is going to see a gross margin headwind. As the inventory-balancing headwind ends, it should serve as a tailwind for FY25. In recent weeks, SWKS share prices have inflected upwards, which I credit to the positive multiple rating that peers (Cirrus Logic, On Semiconductor, Analog Devices, and NXP Semiconductors) saw. I believe the SWKS has yet to show a strong recovery in fundamentals that warrants it to trade at its historical average forward PE multiple. That said, SWKS fundamentals did boost from the last time I wrote, and as such, in my model, I assumed SWKS to trade at 12x forward PE (the mid-point of 10x and 14x).

Risk and final thoughts

SWKS customer concentration remains the biggest risk, in my opinion, as the largest customer accounts for 66% of FY23 revenue, up from 58% in FY22. While bulls can argue however they want that the relationship is sticky, the fact is if SWKS loses this customer, the stock price will see a big fall.

My recommendation for SWKS is a hold rating. While positive indicators suggest a potential turnaround, I still have concerns about the business. Challenges continue to loom in the Broad Market segment, which management expects to see reject in the next quarter due to industry inventory normalization and weakened demand in the automotive and industrial sectors. This weakness is likely to impact gross margins as well. Until issues in the Broad Market segment and gross margins show sustained improvement, maintaining a hold rating seems prudent.