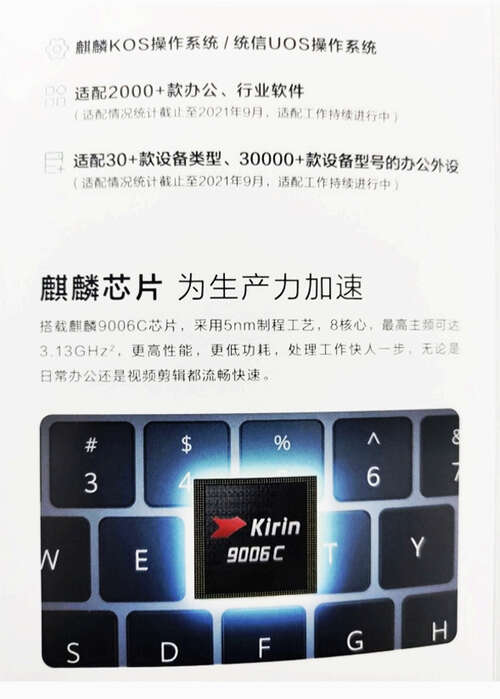

A newly launched laptop from Huawei Technologies has fuelled rumours that the Chinese technology giant has defied US sanctions yet again, this time to produce 5nm chips.

The laptop — dubbed the Qingyun L540 — is powered by the Kirin 9006C chip, which uses 5nm process technology, company brochures and the laptop’s web listing shows.

The purported breakthrough, first reported by China’s Kuai Technology, comes on the heels of Huawei’s success in mass producing homegrown 7nm chips, in collaboration with state-backed Semiconductor Manufacturing International Corporation (SMIC).

Also on AF: Huawei Eyes Western Backing for EV Firm as Sanctions Safeguard

The 7nm chip, which powered Huawei’s Mate 60 smartphone series, was hailed as a win over sanctions imposed by Washington in 2019. Those sanctions drove the world’s once biggest smartphone-maker to near extinction.

The presence of a 7nm chip in the Huawei Mate 60 Pro, confirmed by research firm TechInsights, powered a stunning revival at Huawei, with the firm not only overtaking Apple in China but also pulling the world’s largest smartphone market out of 10 consecutive quarters of falling sales.

A 5nm chip breakthrough would mark a new feat for Huawei, given the firm remains cut off from most companies providing the advanced technology necessary to produce those chips, thanks to US sanctions.

Tech news portal Tomshardware reported that Huawei is likely to have developed the 5nm chip in collaboration with SMIC.

Production efficiency in doubt

Huawei is yet to comment on the 5nm Kirin 9006C chip. The probability of an acknowledgement from the Chinese tech firm is low, given it is yet to say anything on its earlier 7nm chip breakthrough. Its decision to not comment on the development likely stems from caution around drawing more US ire but has attracted criticism in China.

But if reports of the 5nm chip-breakthrough are true, SMIC is the most likely candidate behind its development with Huawei. In 2021, the state-backed semiconductor maker announced plans to spend more than $9 billion to build China’s most-advanced wafer plant.

SMIC planned to house advanced processes such as N+1, and N+2 at the fab — technologies necessary for the production of advanced chips.

In a report this week market research firm TrendForce also noted the N+2 process capacity at SMIC is almost entirely allocated to Huawei’s smartphone products.

Doubts remain, however, around SMIC’s ability to mass produce 5nm chips. The chipmaker will need to use its existing deep ultraviolet (DUV) lithography systems to produce the chip — a process that tech insiders say is time-consuming, expensive and has a lower yield.

Extreme ultraviolet (EUV) lithography systems that are most prominently used to produced advanced chipsets such as 7nm and 5nm remain inaccessible to SMIC, as ASML — the world’s largest maker of those machines — is prohibited from selling those in China.

Even after SMIC’s 7nm chip breakthrough, experts pointed out that SMIC likely used “expensive technology” to get around US sanctions. The technique, referred to as multi-patterning, is likely to have affected SMIC’s yields and costs, they said.

Experts also noted that SMIC remained years behind TSMC, the world’s leading chipmaker, in terms of capabilities.

Stockpiled chips powering breakthroughs

Despite those concerns, however, Huawei managed to sell 1.6 million Mate 60 phones in just six weeks, data in October showed. The smartphone-maker also aims to ship between 60 million and 70 million Mate 60 phones in 2024, according to Nikkei Asia.

While that would suggest Huawei and SMIC’s success in mass producing the 7nm chip — a feat they could recapture with 5nm chips — it is also likely that both firms are beneficiaries of large amounts of state funds that have aided them in accomplishing that success.

According to a Financial Times report last month, Huawei received close to $950 million in state funds in 2022. Similarly, SMIC benefitted from the same amount of state subsidies over the past three years and additional backing from China’s semiconductor focused Big Fund.

Another factor in Huawei and SMIC’s success may have been a large stockpile of chips that Chinese firms accumulated before US export controls came into force in October 2022.

Much appreciate after the 7nm chips breakthrough, speculation is now rife that the Kirin 9006C 5nm chip may have stemmed from a previous stockpile. TSMC-linked Digitimes also said the chip may have been inventory made by the Taiwanese chipmaker.

TSMC produced the Kirin 9000 chipsets for Huawei-owned Hisilicon until September 2020.

US daily Politico also reported on Wednesday that chips used in the Qingyun L540 were stockpiled before US export controls came in force. The website cited an employee at the Center for Strategic and International Studies think tank with sources within Huawei’s supply chain.

“The Chinese tend to tell fibs,” James Lewis, senior vice president and director of the strategic technologies programme at CSIS told Politico.

“The fact that they can make one doesn’t mean they can make them at scale.”

Also read:

Huawei To Build First Euro Factory Despite EU Scrutiny

Huawei, US-Sanctioned Firms Win as China Dumps Western Tech

New Huawei Phone Made With ‘50% More Homegrown Chip Parts’

US Chip Export Ban Seen as Big Opportunity for Huawei

Huawei Supplying AI Chips to China’s Baidu in Blow to Nvidia

ASML Employee Who Stole Chip Secrets ‘Went to Work at Huawei’

Huawei, Tencent guide China Cybersecurity Patents Push – Nikkei