It’s one of America’s most American brands. It’s worth over $200 billion. It’s a major global presence. Its stock has doubled over the past six years. And it’s widely owned by 401K money managers, institutions, and retail investors alike.

Yet, I believe McDonald’s (MCD) will be in the same league as General Electric (GE) and Kodak (KODK) within a decade.

If you’re holding the stock, you may want to think again. If you’re thinking about buying it, you may want to reconsider. And if you want to profit from it, there’s a position you can take today that could make money from a slow burn ahead.

The company’s throwing Hail Mary after Hail Mary, masking what they’re doing as improvements and forays into new markets to preserve relevance… but they’re just futile when you consider the broader landscape.

Two recent moves show that.

First is changing the recipe for the Big Mac. Sure, it’s probably warranted to make a less-dry burger with smaller-batch meat samples and other changes to make it better. After seven years, it’s probably good that they want to better a menu staple.

But I’d venture to say they waited too long.

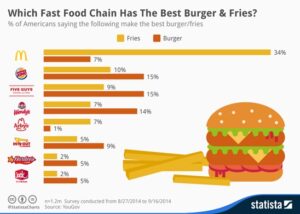

The space of burgers and fries is crowded with names appreciate Five Guys, Shake Shack, and In-N-Out, so the stakes are already high if the new burger isn’t perfect and, even if it is, consumers won’t ditch the other burgers they already know are good.

The second new venture is the space- and 80s-themed CosMc drive-thru restaurants coming in 2024. There’ll be 10 in the first half of next year, and the first just opened in a suburb of Chicago.

McDonald’s is trying to capitalize on the mid-afternoon sales slump they’ve been feeling, so they’re making a snacks- and customizable drinks-based diner restaurant to take market share from Starbucks (SBUX) and Dunkin.

Really odd.

They wrote in their most recent quarterly earnings report that they continued to consider coffee a high-growth market to advance into, but with the failure of McCafe, I’m not sure it’s positioned to take much of anything from the companies whose sole duty has been (and will be) to furnish coffee.

The bigger picture with McDonald’s has to do with brand stigma. Americans are more health conscious than they were 20, 30, 40 years ago. People are more aware of what they put into their bodies and what it does to them.

McDonald’s will always be associated with grease and fat. And I don’t believe we’ll ever get back to a point of not caring about our health needs.

So instead of strategies that’ll push the company into new markets and enlarge the business for years to come, I believe its expansion plans will this time be the first domino in a long refuse.

Play this by buying long-term puts, years out, to benefit from lower stock prices ahead.