Five years ago, General Electric (GE 0.93%) was seen by many as a company whose very survival was at stake. However, those fears proved overly pessimistic, and its stock rose 166% over that period.

It’s a superb performance, notably as it occurred under some tough conditions for the company, with some bad luck along the way. The question is whether it can continue to create good returns for investors.

General Electric’s transformation

The company’s renaissance coincides with the appointment of Larry Culp as CEO in October 2018. He took over a heavily indebted company with a collection of underperforming businesses, not least its problematic power segment.

Culp’s solution to the problem was a combination of significant portfolio restructuring, business sales, cash-raising spinoffs, and excellent execution in difficult trading conditions. I’ll come back to the last point in a moment.

Of the business Culp took over in 2018, GE Transportation is now part of Wabtec, and GE Lighting was sold to Savant Systems. GE Healthcare sold its biopharma business to Culp’s former company, Danaher, and then GE Healthcare was spun off in early 2023. GE sold down its stake in oil and gas company Baker Hughes, and GE Capital Aviation Services was sold to AerCap.

These corporate maneuvers left GE a much smaller company (GE ended 2018 with $122 billion in revenue) and is forecast to end 2023 with closer to $65 billion.

With GE Healthcare now a stand-alone company, the next stage in the company’s evolution will be the spinoff of GE Vernova in 2024 (a combination of GE Power and GE Renewable Energy), leaving the remaining company to be called GE Aerospace.

General Electric’s execution

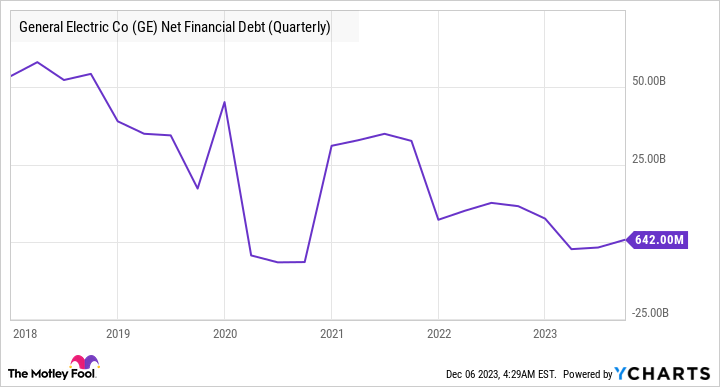

The business sales, spinoffs, and stock sales have allowed GE to reduce its debt and allay any liquidity fears — no mean feat, as the pandemic hit GE’s aviation business hard. But it’s only part of the story.

GE Net Financial Debt (Quarterly) data by YCharts

As noted, GE’s execution has tangibly improved over the last five years under Culp. It’s a critical point because the case for buying GE stock now (recall that this will give you exposure to GE Aerospace and GE Vernova if you buy it before the separation) is based on GE’s end markets, operational execution, and administration. In other words, it isn’t about a successful portfolio restructuring and debt reduction strategize.

Two examples of General Electric’s execution

To outline how Culp’s focus on lean operations has worked, consider the turnaround at GE Power. Revenues have fallen, but margins and profitability have gone the other way. Moreover, management expects the 7.5% profit margin in 2022 to rise to double digits in 2024.

Data source: GE presentations.

In a nutshell, GE Power worked through less profitable contracts while initiating more discipline on pricing new contracts and implementing lean initiatives to create productivity improvements. An example of the latter comes from reducing the number of shifts it takes to complete a power outage for customers. This action adds value to customers and allows GE Power to complete more outages.

Where next for General Electric?

With the aerospace business continuing to benefit from the recovery in commercial air travel and the power business now firmly established as a solid earnings and cash flow contributor, management needs to return the renewable energy business to profitability.

Image source: Getty Images.

GE Renewable Energy has three businesses. Onshore wind and grid solutions are both profitable. However, management needs to repeat its GE Power playbook with the offshore wind business as it works through a $6 billion backlog with a “problematic financial profile,” according to Culp.

Given the go through with the turnaround at GE Power and how it helped the stock deliver stellar returns for investors, investors can feel positive that management will turn around the $1 billion loss expected for offshore wind in 2023. It will take time to work, but patient investors gave GE time from 2018 to 2023 and were handsomely rewarded.

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Danaher and Westinghouse Air Brake Technologies. The Motley Fool recommends AerCap. The Motley Fool has a disclosure policy.