Vladislav Stepanov/iStock via Getty Images

(A Macro-Focused) Introduction

Earlier this month, Seeking Alpha published a Q&A-style article that covered my view on 2024. As part of my outlook, I have a number of key themes that I watch.

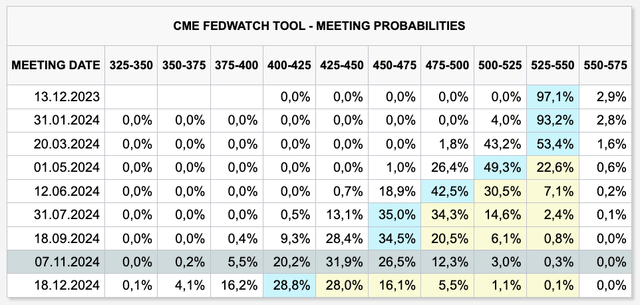

Before I started writing the article you’re currently reading, someone asked me what I think the Fed will do.

While this is a tricky question, I said that I believe the Fed will preserve a higher-for-longer stance until it is forced to cut rates.

Looking at the data below, the market is currently doing the opposite, pricing in five rate cuts in 2024, which is one of the reasons why stocks have been doing so well recently.

The problem is that the Fed doesn’t usually cut gradually.

Whenever the Fed cuts rates, it is often more rapidly, forced by highly unfavorable economic conditions.

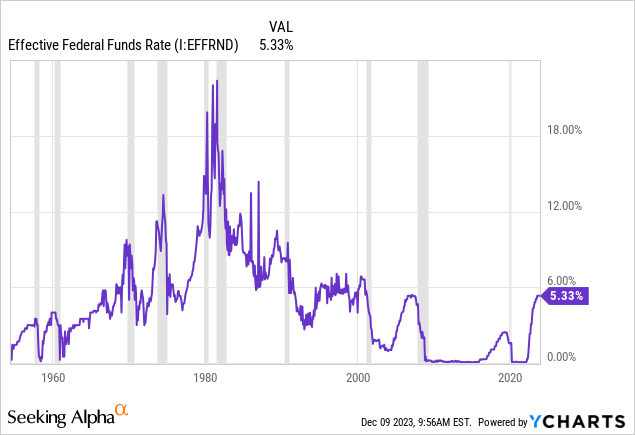

The chart below shows the effective Federal funds rate, including recessions (the shaded area). Every time the Fed cuts rates, it happens more aggressively than expected, and often because something breaks in the economy.

In general, I believe that inflation will remain elevated on a prolonged basis (>10 years) due to energy and commodity supply/demand dynamics, persistent labor shortages, and the high likelihood that the Fed will cut rates and commence some form of QE to arouse the economy.

With that in mind, I’m not predicting a new Great Financial Crisis. I have zero short positions and stick to my scheme to buy great stocks at great valuations.

Nonetheless, I expect that the Fed might be put in a situation where it is forced to cut rates.

I expect that decision to be caused by rising default, caused by the toxic mix of a weakening economy and elevated rates.

Hence, I’m keeping a close eye on commercial real estate.

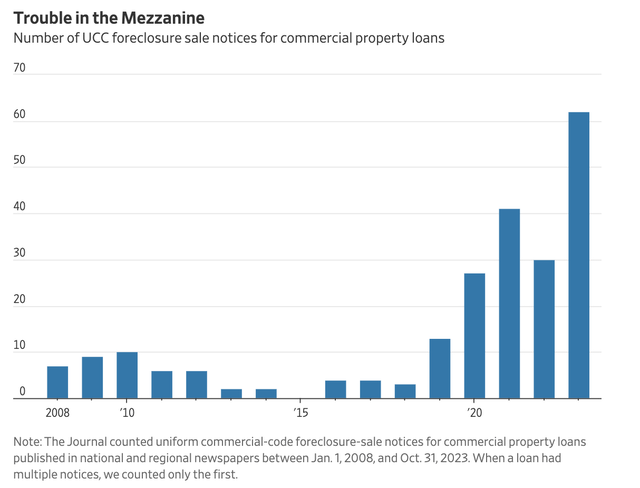

Last month, the Wall Street Journal wrote an article titled The Clearest Sign Yet That Commercial Real Estate Is In Trouble.

According to the article, foreclosures are on the rise in a risky sector of commercial real estate, indicating worsening conditions in the property market.

Lenders have issued a record number of foreclosure notices for high-risk mezzanine loans, similar to second mortgages, with elevated interest rates and a quicker path to foreclosure than traditional mortgages.

The Wall Street Journal analysis reveals a significant surge in foreclosure notices for 62 mezzanine loans and other high-risk loans this year through October.

This number has more than doubled compared to the previous year, marking a potential record for a single year.

Essentially, the enhance in mezzanine loan foreclosures serves as a more immediate indicator of distress in the commercial real estate sector than mortgage foreclosure rates.

While commercial mortgage foreclosures remain relatively low, the foreclosure of mezzanine loans provides a quicker and easier measure of commercial real estate distress.

Mezzanine loans, which do not appear in property records, allow lenders to take over buildings swiftly, in contrast to the prolonged process of traditional mortgage foreclosures.

This brings me to Starwood Property Trust (NYSE:STWD), a mortgage REIT with a 10% dividend yield that has a terrific track record of outperformance.

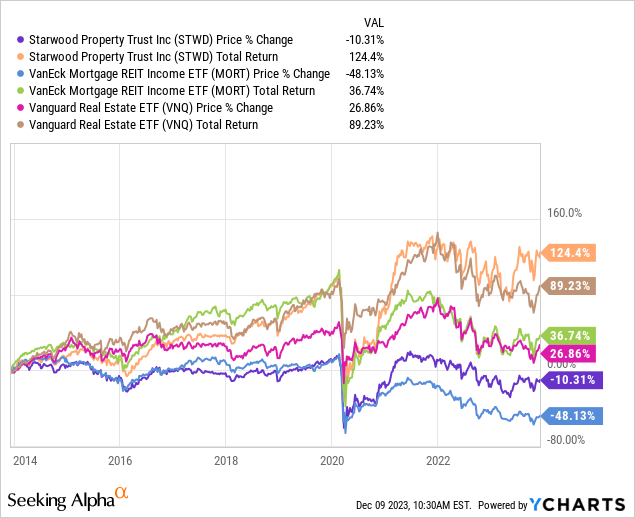

Over the past ten years, STWD shares have returned 124%, including dividends. This beat the Vanguard Real Estate ETF (VNQ) total return of 90% and the 37% total return of the VanEck Mortgage REIT Income ETF (MORT) by a wide margin.

Hence, there are two reasons why I monitor STWD.

- I believe it is one of the best-managed mortgage REITs on the market, making it a good buy on weakness for income-focused investors.

- Monitoring the biggest mortgage REITs could tell us a lot about the state of the industry and if my thesis might be correct.

In this article, I will elaborate on this and explain why I’m keeping a close eye on the company.

So, let’s get to it!

What’s Up With Starwood In This Environment?

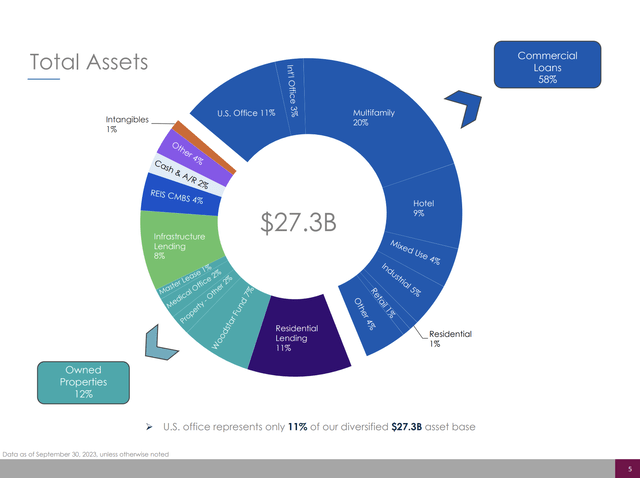

Starwood is one of the biggest players in the industry, with $27.3 billion in total assets. These assets include both loans and owned properties.

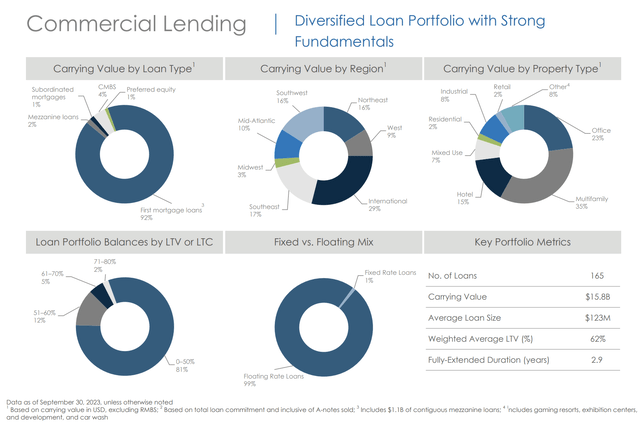

As we can see below, 58% of the company’s assets consist of commercial loans. The majority of that is multifamily, office, and hotel loans.

12% of its assets are properties it owns.

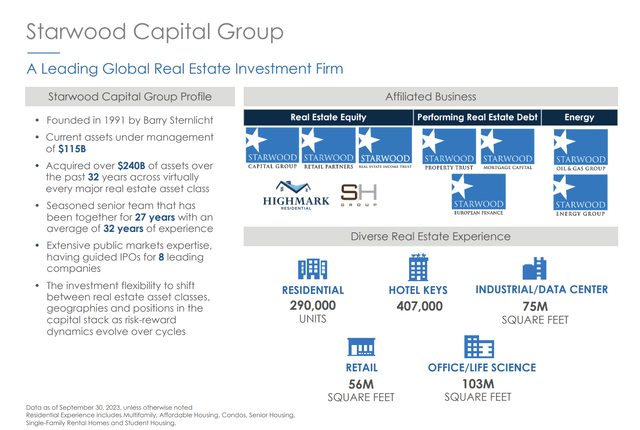

As I wrote in my prior article, Starwood is a mortgage REIT managed by SPT Management, which is controlled by its Chairman and CEO, Barry Sternlicht.

The company’s main focus is to stem, acquire, finance, and supervise mortgage loans and real estate investments across the United States, Europe, and Australia. Its business segments include commercial and residential lending, infrastructure lending, real estate property, and real estate investing and servicing.

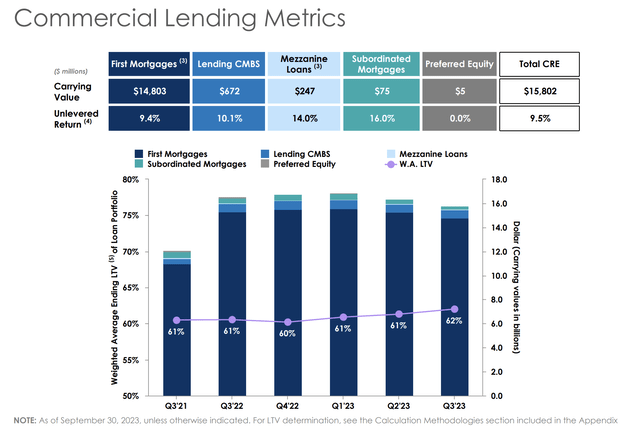

Thanks to its size and the advantage of being affiliated with the Starwood Capital Group, the company is a leader in first mortgage and mezzanine loans.

As I already briefly mentioned, as of September 30, the company has a commercial loan portfolio of almost $16 billion. The average loan size is $123 million, with a weighted average loan-to-value ratio of 62%.

Generally speaking, companies want to keep this ratio below 80%.

On top of that, it has large residential and infrastructure lending operations.

For example, it currently holds 45 infrastructure lending loans with a total balance of $2.4 billion. 100% of this debt is floating with an unleveraged yield of 10.1%

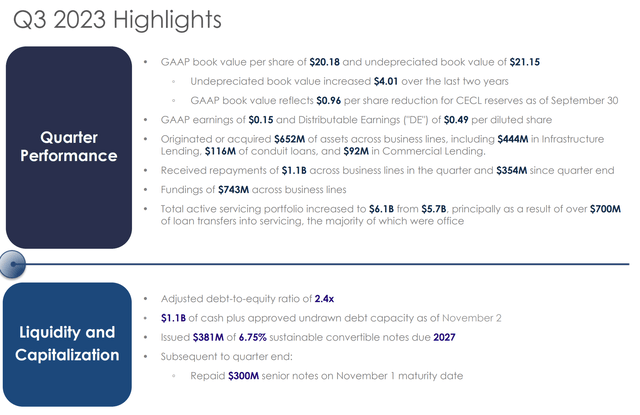

With that in mind, in the third quarter, the company reported distributable earnings (“DE”) of $158 million or $0.49 per share.

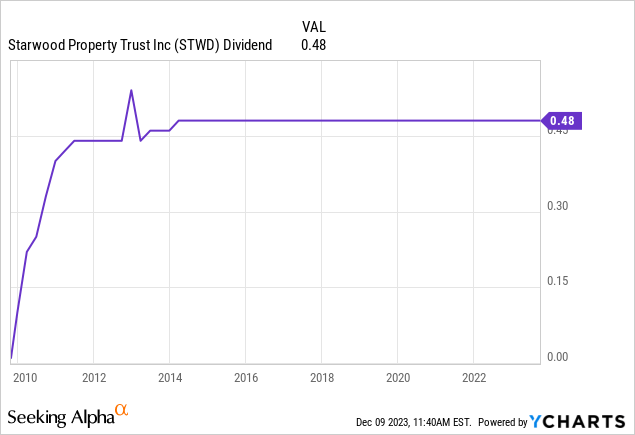

On September 15, the company announced a $0.48 per share dividend, which translates to a yield of 9.5%.

This dividend hasn’t been hiked in almost ten years, which also means it has remained steady during the 2015 manufacturing recession, the 2018 global growth slowdown, and the 2020 pandemic.

As I said in my prior article, the company could have gone for a higher dividend. However, as we’ll see in this article, STWD has a very healthy balance sheet, as it decided to keep leverage limited, even if it means not being able to pay an even higher dividend.

I believe that is a very smart choice.

Going back to the third-quarter performance, GAAP net income stood at $47 million or $0.15 per share.

The GAAP book value per share at the end of the quarter was $20.18, with an undepreciated book value of $21.15.

Notably, these metrics include $404 million or $1.29 per share of reserves related to commercial real estate and infrastructure lending businesses.

Commercial and Residential Lending contributed DE of $207 million to the quarter or $0.64 per share.

The commercial lending segment experienced $762 million in repayments, outpacing funding of $263 million, which is why the total asset base is slightly down compared to my prior article.

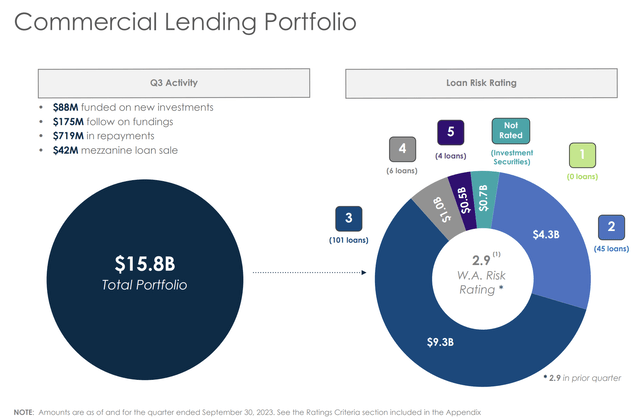

The portfolio of senior secured first mortgage loans ended the quarter at $15.8 billion. CECL (current expected credit losses) reserves increased by $51 million, particularly for U.S. office loans. Despite low office exposure, commercial lending reserves stand at 2.24% of the lending portfolio.

Speaking of reserves and loan quality, the commercial lending segment experienced a decrease in 5-rated loans and an enhance in 4-rated loans. The weighted average risk rating remains at 2.9.

Noteworthy downgrades included a multifamily loan in Portland and an office loan in California.

The strategic reduction of office exposure aligns with industry challenges, with a focus on managing risk and potential defaults.

Furthermore, STWD has successfully reduced exposure to construction loans, comprising less than 10% of the funded loan book, the lowest in over ten years.

Proactive measures, including the repayment of B-quality office loans in Midtown Manhattan, resulted in no loan exposure to the Manhattan office and San Francisco assets.

It also helps that the company has interest rate protection on 91% of CRE loans, positioning itself to steer interest rate increases effectively.

In general, the company sees that despite higher interest rates, borrowers are executing plans, and loan repayments exceed conservative expectations.

The company is sitting on near-record cash, enabling the deleveraging of the balance sheet and reducing interest expenses through bank warehouse lines.

This strategy allows them to save and earn 8% on cash balances in the current interest rate environment.

STWD has $1.6 billion in loans financed on bank lines at SOFR plus 275 basis points or higher, potentially serving as an asset for future opportunities to substitute secured debt with unsecured debt.

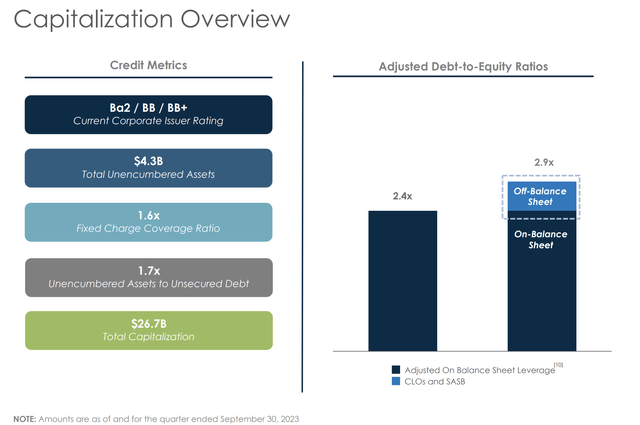

In general, the company holds a very healthy balance sheet with a 2.4x debt-to-equity ratio.

With that said, during the third-quarter earnings call, Mr. Barry Sternlicht commented on CRE developments the company is noticing.

Forward-Looking Comments From Barry Sternlicht

According to the company, the refuse in transactions, including corporate M&A and real estate transactions, poses a challenge, limiting opportunities for capital deployment.

Furthermore, the reduction in receipts, miscalculation of deficits, and a dramatic decrease in transactions contribute to the complexity of the current economic landscape.

With regard to miscalculated deficits and receipts, Mr. Sternlicht commented on the impact of elevated rates on the government’s finances, which hit the nail on the head.

So I also said the government really can’t afford 5%, almost $10 trillion of our $33 trillion of debt rolls in the next 12 months. I think it’s slightly more than that, it’s admire 1/3. So you have a $500 billion interest bill coming in very soon. And the current interest expense in the budget is absurdly low.

It will climb probably closer to $1 trillion if he doesn’t relent. And again, I just bear people who contrast what he’s doing to Volcker. Volcker had almost a negligible deficit. He operated with a $200 billion number — $33 trillion deficit. All this is important because it forms the framework of what we’re doing and what the opportunity set is for us going forward.

This is why I have been in the higher-for-longer camp, as I believe the Fed cannot afford to fight a long inflation battle. Rates need to come down quickly, which means the pressure on inflation needs to remain high, even though the Fed risks that something breaks.

Nonetheless, despite challenges, the company sees a unique opportunity in the lending environment.

The pressure on banks to reduce exposure to real estate creates a favorable landscape for private credit.

Starwood aims to position itself as a preeminent private lender in real estate credit, capitalizing on the current environment with the expectation of becoming a key player in the space.

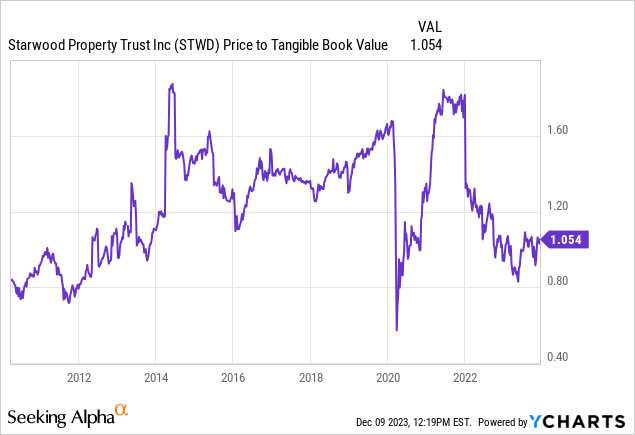

Looking at the company’s valuation, we see that the market is pricing in some weakness.

The company is trading at its book value. Usually, it trades at a 30% premium.

Generally speaking, I am bullish on STWD. Its management is top-tier, financial risks are subdued, and its valuation is attractive.

Nonetheless, due to my personal view on the economy (please feel free to disagree with me), I cannot get myself to buy STWD just yet for my own portfolio or any family portfolios.

While STWD remains strong, we’re seeing a deterioration in industry-wide credit quality, which could be amplified by elevated rates in 2024 – until the Fed is forced to cut, which isn’t bullish, either.

Hence, in 2024, I will keep a close eye on STWD. I expect them to confront more credit quality headwinds, which should have a bigger impact on their weaker peers than this well-run company.

If the stock were to see a steeper sell-off, I could see myself buying STWD for an income-focused family account.