iiievgeniy

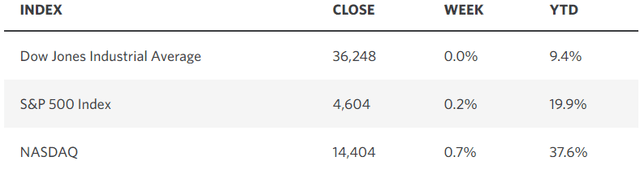

The major market averages scored their sixth consecutive week of gains, following a jobs report for November that struck just the right mix of strength and weakness to keep the soft landing on track. The economy added 199,000 jobs, which was more than expected, but that was largely due to 47,000 striking autoworkers and Hollywood personnel returning to work. The gradual refuse in monthly payrolls remains intact. The unemployment rate declined to 3.7%, yet wage growth continues to moderate with the enhance in average hourly earnings holding steady at an annualized 4%. Job openings continue to refuse to a level last seen in March 2021, which advance eases wage pressures. This was great news for investors, but it didn’t end there.

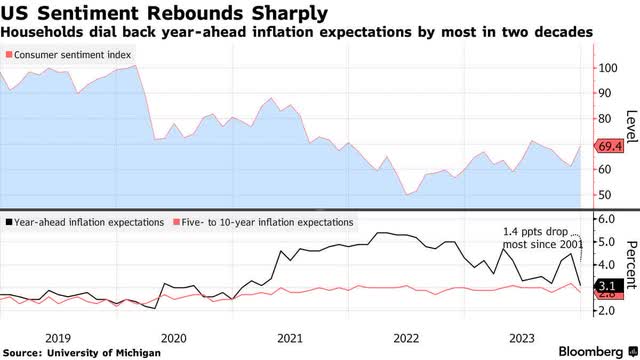

Consumer confidence is finally starting to lift off the ground floor, as the University of Michigan’s consumer sentiment index rose sharply in early December to 69.4. The reason is that expectations for inflation in the year ahead PLUNGED from 4.5% to 3.1%, which was the largest drop since 2001. The long-term outlook for inflation also fell from 3.2% to 2.8%. These are positive rates of change that risk asset prices have clearly been discounting over the past several weeks.

Probably the most important factor lifting consumer sentiment has been the rapid refuse in gasoline prices to a new low for the year. This could not come at a better time, as the holiday shopping season is in full swing.

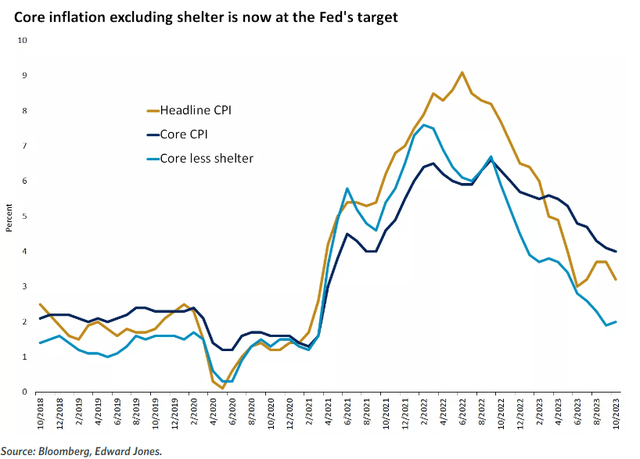

The war on inflation is largely over, if not won, yet some strategists are still talking about “sticky” inflation. The latest CPI report revealed that the core rate less shelter costs is already at the Fed’s target of 2%. If anything is sticky, it is home prices and rents, but we know that rental inflation is set to come down sharply based on the new rates that are working themselves into the 12-month number. Home price increases have also stalled, thanks to the surge in mortgage rates, so there should be no concern about the direction for shelter costs.

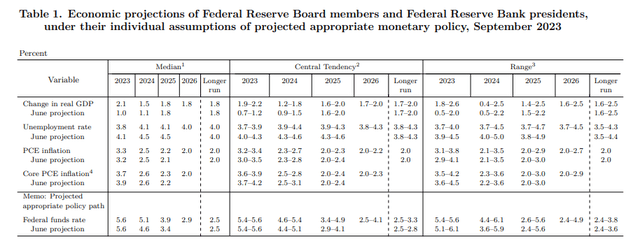

The recognition of these various positive rates of change explains the dramatic improvement in breadth that has fueled the six-week rally in stocks, and I think that sets the stage for a very good start to the new year. Yet the rally has gotten very long in the tooth, as I have been discussing in recent days, and I am concerned that we have moved up too far too fast. I am also concerned that the Fed is growing increasingly uncomfortable with the loosening of financial conditions in advance of proof that it has achieved its inflation objective. Therefore, since Chairman Powell was ineffectual in subduing the rally one week ago during his last speaking engagement, I expect the Fed to make another attempt to quell the enthusiasm for risk assets when it releases its updated Summary of Economic Projections.

The most recent, which you can see below, was released on September 20. A lot has changed over the past three months. Still, I don’t see any reason for the Fed to adjust its estimates for real GDP or the unemployment rate at the end of 2024. It should lower its projection for PCE and core PCE from what is now 2.5% and 2.6%, respectively, considering the progress to date. If it does, then it would make sense to also lower its projection for where the Fed’s fund rate will be at the end of 2024. In September, the committee’s “dot plot” saw the rate at 5.1%.

The consensus of investors sees short-term rates closer to 4.1%, and this is where the Fed may intentionally disappoint to cap the rally that is rapidly loosening financial conditions. If they lower the projection back to the June level of 4.6%, I can see long-term rates rise and stocks refuse, but I think both would be short-term counter trend moves that would help to resolve the overbought condition in stocks and bonds before year end. The Fed may rain on the rally in the days ahead, but that should be an opportunity to money to work for the new year.