G0d4ather

Broadcom (NASDAQ:AVGO) is facing fierce competition from Nvidia, and its infrastructure software doesn’t have too many high-quality assets. I am initiating a ‘Sell’ rating with a fair value of $850 per share.

Losing the Semiconductor Race in the AI Era

Broadcom is offering Ethernet switching and routing semiconductors, which has been a successful business in the past due to the widespread adoption of Ethernet in data centers. However, with the rising prominence of AI in recent years, traditional Ethernet technology struggles to confront the computing demands of AI-related machine learning. Nvidia (NVDA) has introduced InfiniBand, a supercomputer networking technology, posing a significant challenge to Broadcom’s conventional business.

Nvidia’s robust technological capabilities present a formidable obstacle to Broadcom’s competitive advantages in high-performance computing markets. While Ethernet solutions are cost-effective, they fall short in providing the necessary computing speed for high-performance computing (HPC)-admire workloads. AI-centric workloads demand chips that offer both hardware and embedded software capabilities, a requirement better met by InfiniBand in contrast to Ethernet.

As the demand for data centers catering to AI-related workloads is expected to rise in the coming years, Broadcom may need to make substantial investments to vie effectively against Nvidia.

Broadcom unveiled their Jericho3-AI in April, claiming that the new Jericho3-AI can deliver high-performance Ethernet for a 32,000 GPU cluster. While I confess their efforts in designing Jericho3 for load rebalancing and high-performance computing, it is evident that they entered the scene later than Nvidia. As it stands, Broadcom is engaged in a pure catch-up game with Nvidia.

Building Up Infrastructure Software Business

In an effort to diversify their semiconductor solution revenue mix, Broadcom has strategically expanded its software business in recent years. Notably, they completed the acquisition of VMware for $69 billion on November 22, 2023, acquired Symantec for $10.7 billion in 2019, and purchased CA Technologies for $18.9 billion in 2018. These substantial acquisitions are expected to significantly impact the company’s financial landscape.

According to their guidance, Broadcom anticipates that their infrastructure software business will contribute 40% of the group’s revenue in FY24, reflecting a notable enhance compared to the 22.8% it accounted for in total revenue in FY19. This strategic shift in revenue mix showcases Broadcom’s commitment to expanding its presence and revenue streams in the software sector.

It appears that Broadcom is increasingly resembling a software company, but my concern lies in the nature of their software acquisitions. Rather than acquiring high-growth assets, they seem to be focused on obtaining low-growth software companies.

Before Broadcom acquired Symantec, Symantec was grappling with stagnant growth as the era of significant personal PC penetration came to an end, and workloads transitioned to the cloud. Symantec failed to capitalize on the rising demand for endpoint security and missed the opportunity in cloud security. Consequently, I question Symantec’s status as a growth-oriented and high-quality software company.

CA Technologies, on the other hand, is a major player in mainframe software solutions. While mainframes were the gold standard for mission-critical workloads in the last decade, they have fallen out of favor. Learning mainframe technology has become less attractive, and enterprises using legacy mainframe systems are actively seeking replacements to alleviate their challenges. As a result, the relevance and growth potential of mainframe software solutions appear to be diminishing.

As reported in the media, Broadcom intends to lay off 1,300 VMware employees following the acquisition. It is premature to ascertain whether the VMware acquisition will be deemed a success or failure. Numerous uncertainties surround the integration process and divestitures mandated by regulators.

In essence, I am skeptical about the growth potential of Broadcom’s software products and solutions. It seems more admire a collection of legacy software rather than being positioned in high-growth markets. The ongoing layoffs and the uncertainties surrounding integration and regulatory requirements advance contribute to the uncertainties surrounding the future success of Broadcom’s foray into the software sector.

Financial Analysis and Outlook

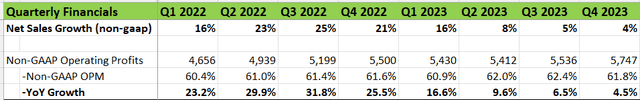

During Q4 FY23, Broadcom achieved a 4% growth in non-GAAP revenue and a 4.5% enhance in adjusted operating income, aligning closely with their earlier guidance. The semiconductor solutions segment saw a 3% year-over-year growth, while infrastructure software experienced a robust 7% year-over-year enhance. It’s worth noting that Broadcom is contending with a cyclical slowdown in enterprise and telco semiconductor spending, while the Hyperscaler segment remains robust.

During the earnings call, Broadcom indicated that the infrastructure software, excluding VMware, experienced a 7% growth in the quarter, reaching $2 billion in revenue. The yearly renewal rate averaged at 116% over expiring contracts and was even higher at 124% in strategic accounts.

Looking ahead to FY24 guidance, they expect revenue to be $50 billion, with adjusted EBITDA making up approximately 60% of revenue. VMware is expected to contribute $12 billion in FY24, and infrastructure software is projected to represent 40% of total revenue. The underlying assumption is that their semiconductor solution business will grow at a mid-single-digit rate for FY24, a projection deemed reasonable.

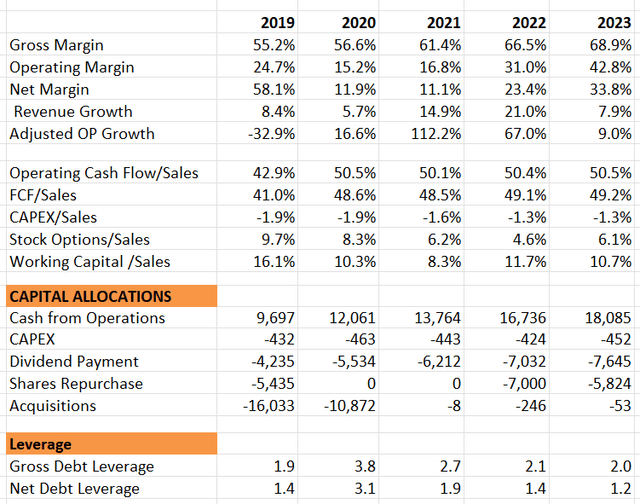

A financial examination over the past five years reveals that acquisitions have been instrumental in driving the company’s growth, particularly in building up their infrastructure solution business. The majority of cash from operations has been directed towards dividends and acquisitions, with some shares buyback. Despite this, the balance sheet remains solid with relatively low debt leverage.

Valuation

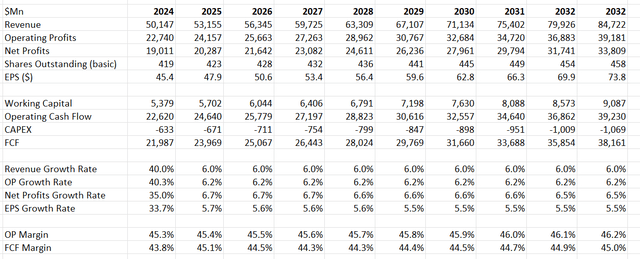

The assumptions for FY24 align with the company’s guidance, and the growth includes 11 months of VMware’s revenue. I forecast the normalized revenue growth rate to be 6% as I don’t think they can capture notable growth from the rising AI demands, and their legacy software business won’t contribute any significant growth for the company.

Broadcom DCF – Author’s Calculation

Their margin expansion is propelled by operating leverage. Utilizing a 6% topline growth and a 5% operating expense growth, I calculated their annual margin expansion to be 10 basis points. It’s noteworthy that they will need to enhance their R&D expenses in the upcoming years to boost their competitiveness against formidable players such as Nvidia and AMD (AMD).

The model employs a 10% discount rate, 4% terminal growth, and a 10% tax rate. The fair value is estimated to be $850 per share.

Key Risks

Weak demands in telecom and enterprise: During the earnings call, they highlighted the weak demands in the telecom and enterprise markets. For FY24, they expect server storage revenue to reject in the mid- to high-teens percentage year-over-year, and broadband revenue to decrease in the low- to mid-teens percentage year-on-year. Despite these challenges, I believe that the weakness is cyclical in nature and has already been factored into their full-year guidance.

No synergies between semiconductor and infrastructure software: It is challenging to handle these two different businesses together. While Nvidia does furnish software for their chips, the core of the company remains in chip manufacturing. There aren’t many operational synergies between these two distinct business types. Furthermore, in my opinion, Broadcom may find it more challenging to attract talent in the software engineering field.

Verdict

I believe their infrastructure software business lacks high-quality assets, and their core semiconductor solutions are encountering intense competition from Nvidia. Consequently, I am initiating a ‘Sell’ rating with a fair value of $850 per share.