mohd izzuan

Cabaletta Bio (NASDAQ:CABA) is a biotechnology company still in its clinical stages and has no revenues yet. This stock exposes investors to CABA’s CARTA and CAART, both relatively promising across various afflictions. Nevertheless, CABA’s main research project appears to be CABA-201, which helps patients suffering from SLE. This opens the door to a huge market, exhibiting CABA’s significant revenue potential if it successfully develops and commercializes its IP. In my valuation analysis, CABA appears to trade at a premium relative to its sector. Still, I believe such a premium is well deserved due to its balance sheet’s revenue potential and well-capitalized nature. Thus, I rate CABA a good speculative “buy” for investors with a long-term horizon.

Business Overview

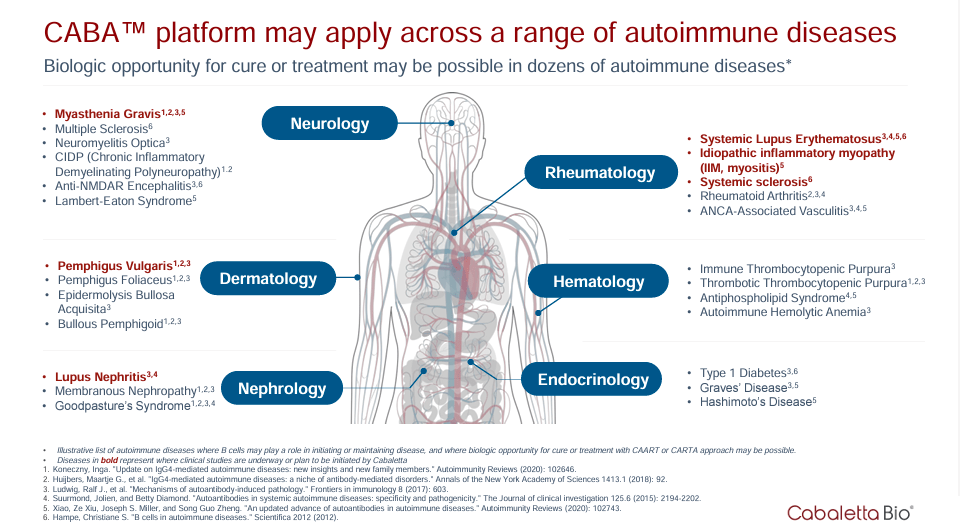

Cabaletta Bio is headquartered in Philadelphia, Pennsylvania. The Company was founded in 2017, and its IPO was in October 2019. CABA is a clinical-stage biotechnology company specializing in autoimmune disease treatments using engineered T-cell therapies to target problematic B cells with single-dose therapy, eliminating the need for repetitive immunosuppressive treatments potentially resetting the immune system. B cells create antibodies that, in immune diseases, attack the patient’s tissues. Besides this mentioned approach, called CAART (Chimeric AutoAntibody Receptor T cells), which focuses on B cells producing auto-antibodies, CABA also works in the CARTA program (Chimeric Antigen Receptor T cells for Autoimmunity), which has a broader application because it targets antigens of the autoimmune system that are not limited to B cells and can potentially be used in a wider range of autoimmune diseases.

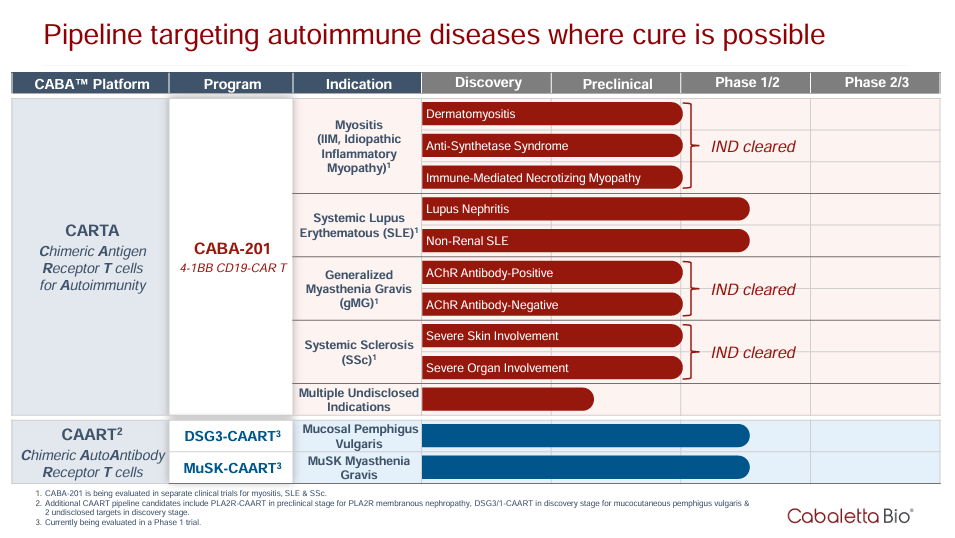

CABA partners with the University of Pennsylvania and the Children’s Hospital of Philadelphia. CABA’s pipeline is divided into the two mentioned approaches. The platform CARTA is used for the CABA-201 program with four indications and nine drugs, 7 IND cleared, and two in Phase 1/2 for Systemic Lupus Erythematous [SLE], one for Lupus Nephritis and the other for non-renal SLE.

CABA’s CARTA and CAART

You can think of CABA as CARTA and CAART. In the CAART (Chimeric AutoAntibody Receptor T cells) platform, there are two programs in the Phase 1/2 clinical trial: DSG3-CAART for Mucosal Pemphigus Vulgaris and MuSK-CAART for MuSK Myasthenia Gravis [MuSK + MG].

CABA-201 has been validated for academic studies for indications such as Myositis, SLE, and systemic sclerosis. CABA expects results for the CABA-201 program by the first half of 2024. Additionally, CABA reported the company is collaborating with WuXi Advanced Therapies to evolve the Good Manufacturing Practice [GMP] of CABA-201. Also, CABA announced a collaboration with Oxford Biomedica for the lentiviral vector to deliver the CAR gene into T cells, which is required for the clinical development of CABA-201.

Source: Corporate Presentation, Nov 9, 2023.

In November, CABA reported its partnership with Cellares to confirm the Cell Shuttle platform applied to CABA-201 for automatically producing the cell therapy, potentially speeding its manufacture. I think it’s fair to say that CABA’s direct product is CABA-201, mainly because it targets a broader spectrum of diseases, making it potentially more valuable. On the other hand, CAART therapies target more specific proteins that somewhat limit the potential patient base. For reference, CABA-201 targets the CD-19 protein, which is part of B cells. This mechanism of CABA-201 is how it’s effective for a broad range of autoimmune diseases, unlike CAART treatments.

FDA’s Latest Research Findings about CAR-T Therapy Safety

On November 28, 2023, the FDA announced the research results related to the risk of T-cell malignancies in CAR-T cell therapy patients. CAR-T (Chimeric Antigen Receptor T-Cell) therapy is a form of immunotherapy used mainly for treating cancer. This kind of therapy aims to create in the patient’s T cells a receptor [CAR] for recognizing and binding to a protein in the cancer cells. The engineered T cells are infused into the patient to extinguish the cancer cells. This approach is used for treating certain types of blood cancer. CAR-T cell therapies target BCMA (B-cell maturation antigen) or CD19, a protein found on the surface of B cells. These treatments have been effective in treating multiple myeloma, leukemia, and lymphoma.

Source: Corporate Presentation, Nov 9, 2023.

Notably, both CAART and CARTA platforms focus on autoimmune diseases, but CARTA appears more applicable to a wider set of diseases. CAART generates engineered T cells to target B cells that produce autoantibodies responsible for autoimmune reactions. CARTA platform makes engineered T cells to modulate the autoimmune response. Therefore, the difference between the CAR-T cell therapy that concerns the FDA with CAART and CARTA platforms lies firstly in their application but shares the principle of generating engineered T cells to direct them toward specific targets in the patient’s body. Still, the targets are different in each case.

A Premium Portfolio: Valuation Analysis

From a valuation perspective, CABA’s Q3 2023 financial report stated R&D expenses of $13.8 million and total cash, cash equivalents, and short-term investments of $164.4 million as of September 30, 2023. Moreover, I assess the company’s quarterly cash burn was roughly $12.7 million from its cash flow from operations and net CAPEX. If we annualize this figure, we get an annual cash burn rate of $50.8 million, juxtaposed with its cash reserves, implying a cash runway of 3.24 years. This aligns with CABA’s internal expectations of having enough cash until Q4 2025. In fact, I think it likely has enough cash to last beyond 2025.

Source: American Council on Science and Health.

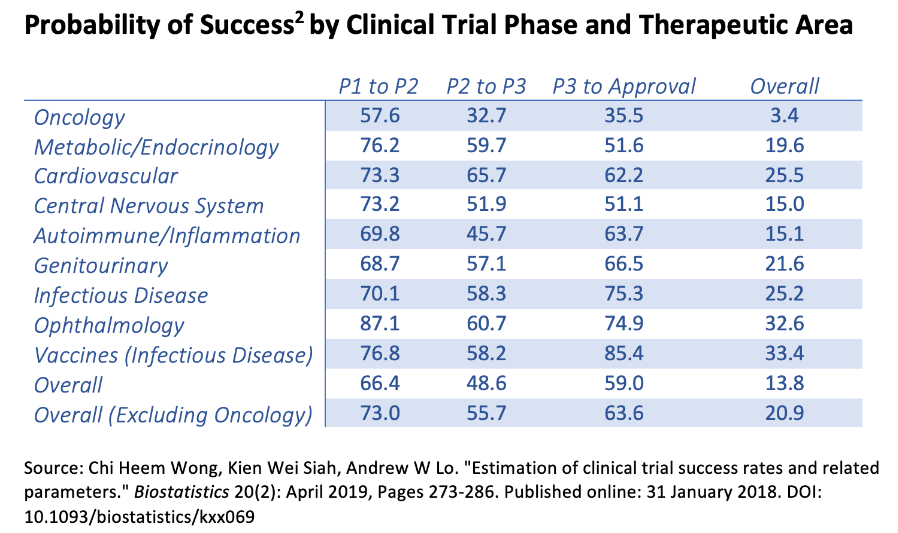

This is important because the company should have enough resources to get its CARTA and CAART IPs into Phase 3. After all, typically, Phase 1 takes several months, and Phase 2 can take up to two years. Given that CABA’s IP is in Phase 1/2, which is supposed to be faster as it allows a quicker transition between phases, I think CABA should be able to get to Phase 2/3 within its cash runway limitations. Furthermore, while it’s not a perfect comparison, the approval rate of Phase 2 to Phase 3 for autoimmune/inflation trials is approximately 45.7%, which is encouraging in biotech’s relatively speculative business.

However, it’s worth noting that the largest market CABA’s IP targets are likely CABA-201 for SLE. After all, Systemic Lupus Erythematosus has a relatively high prevalence compared to the rest of CABA’s IP. For reference, SLE affects roughly 43.7 people out of every 100 thousand. Thus, in the US alone, approximately 146 thousand people are affected by this disease, making SLE a promising treatment from a revenue potential viewpoint. The vast SLE drug market is expected to grow to $329.18 billion by 2032 at a 5.0% CAGR.

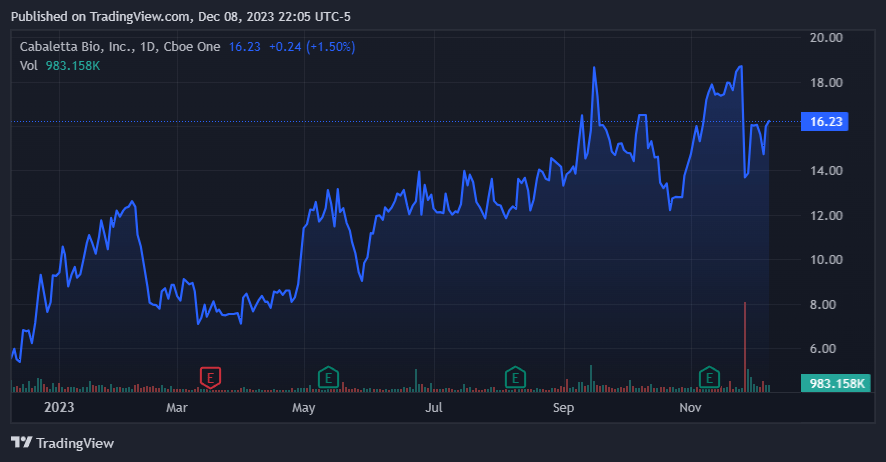

Since the company is still pre-revenue, we must use multiples-based valuation. For this, we know CABA’s book value is $160.9 million. The stock trades at a $685.16 million market cap, implying a P/B ratio of 4.26, almost twice as much as the sector’s price-to-book multiple of 2.06. Thus, CABA is indeed trading at a considerable premium compared to the rest of its industry, which denotes that the market is likely optimistic about CABA’s product pipeline. However, this limits advance upside potential and somewhat skews investors’ risk-reward equation on CABA. Nevertheless, given that the market potential for CABA-201 on SLE alone is so considerable, coupled with its more than enough cash runway, I think it makes a good investment case for CABA.

Investment Thesis Risks

However, there are relevant points to consider. First, the general concerns about the safety of engineered T-cell therapies could direct to more regulatory scrutiny by the FDA before drug approval. This could lengthen the time to market for CABA’s products. Furthermore, the market could react negatively, especially if concerns about T-cell malignancies extend to other T-cell treatments. The November news also stated that some companies related to CAR-T cell therapies were affected in the market, as was the case of CABA´s stock, which plunged 42.6% the day after the FDA’s announcement. The FDA’s recommendation for life-long monitoring of treated patients could necessitate additional costs and resources for long-term follow-up and risk mitigation. Finally, CABA must be prepared to address similar safety considerations in their therapies.

Other than that, I think CABA’s risks are relatively low for a biotech company. Of course, there are risks concerning its product pipeline not being ultimately approved. Then there are also time risks, as approval can take much longer than some investors might foresee, lowering the present value assessment of CABA. However, CABA appears to be a company focused on a seemingly viable set of treatments via CARTA and CAART, with enough resources to see them through at least until Phase 3. Thus, the only real risk may be stock dilution if CABA needs additional investor funds to push its IP through the FDA’s finish line.

The market appears optimistic about CABA’s product pipeline in 2023. (TradingView.)

Conclusion

Overall, CABA is a promising biotech company with CARTA and CAART. In particular, CABA-201’s treatment for SLE is likely the stock’s main selling point. This treatment could be CABA’s entry into a vast market, potentially unlocking significant shareholder value if successfully developed and commercialized. Naturally, admire any other biotech company, CABA is not without its risks. Nevertheless, CABA deserves a premium over its peers as its IP can tackle a huge market, and so far, results appear promising. Thus, I rate CABA a good speculative “buy” at these levels.