miodrag ignjatovic/E+ via Getty Images

Investment Thesis

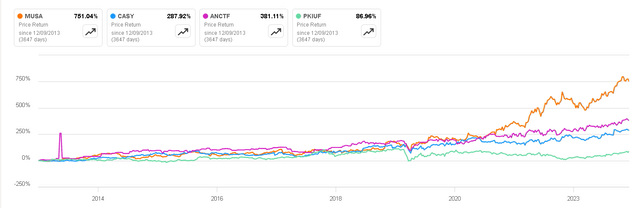

Murphy USA (NYSE:MUSA) has undeniably delivered outstanding returns over the past decade, outshining even its high-quality competitors in the industry. However, as you rightly pointed out, there are looming concerns on the horizon that propose the company may be postponing a crucial task essential for preserving its terminal value. This is especially noteworthy given the proactive measures taken by competitors such as Alimentation Couche-Tard and Casey’s in recent years.

In this article, we’ll delve into the primary risk faced by companies of this nature and explore the specific strategies each company is employing to mitigate this risk. With a particular focus on Murphy USA, the aim is to maintain the notion that, despite the current attractiveness of its valuation, there may be an underlying greater risk associated with investing in the company. This risk, if not adequately addressed, could potentially impact the company’s long-term sustainability and competitive position within the evolving market landscape.

Murphy USA Performance (Seeking Alpha)

Business Overview

Murphy USA is a chain of retail gas stations primarily located in the United States. It was spun off from Murphy Oil Corporation in 2013 to work as a separate company. Murphy USA is known for its convenience stores and fueling stations, often located near or within Walmart store parking lots.

These gas stations typically offer a range of convenience store items such as snacks, beverages, tobacco products, and other essentials. Murphy USA also provides fuel at competitive prices, making it a popular choice for drivers looking for gasoline or diesel fuel while shopping at Walmart or in areas where Murphy USA stations are located.

Transition to Electric Vehicles

As widely acknowledged, society is currently undergoing a transition towards electric vehicles (EVs) and cleaner energy sources admire renewable power. This transformation poses a notable challenge for companies operating traditional gas stations. However, it’s crucial to recognize that the shift to EVs is anticipated to occur gradually, and there will likely be a lengthy period during which both EVs and internal combustion vehicles coexist on the roads. A Morgan Stanley Research suggests that even by 2030, conventional internal combustion vehicles will still make up 50% of annual sales. Therefore, the point at which EVs comprise 100% of annual vehicle sales remains distant. This emphasizes the continued need for gas stations to serve the millions of internal combustion vehicles over the next decade or possibly even longer.

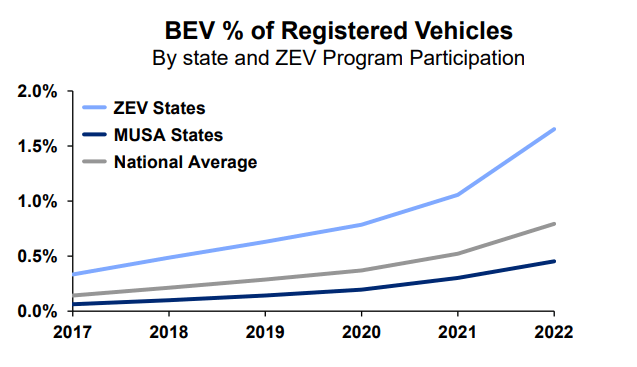

Another noteworthy aspect is that the company estimates that in states with a higher density of Murphy USA establishments, the penetration of electric vehicles is lower than the national average. Therefore, theoretically, the transition to pure electric vehicles should be even more gradual in locations where there is a greater presence of MUSA.

However, this would only mitigate the risk, not eliminate it. For this reason, it is important to also scrutinize the percentage of sales that are related to fuel.

Murphy USA Investor Presentation

Non-Related Fuel Revenue

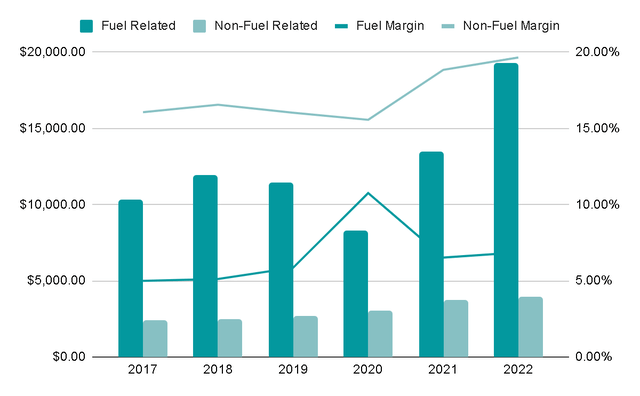

In companies within this sector, it’s common to witness that, in addition to revenue generated from fuel sales, a substantial portion of sales is derived from the merchandise sold in convenience stores. These products typically boast better profit margins, rendering their income more sustainable compared to that from fuel sales. A compelling illustration of this dynamic unfolded in 2020, wherein fuel revenue experienced a 28% decrease, and EBIT margins hovered between 5 and 6% in recent years. Conversely, sales of merchandise in convenience stores witnessed a 12% growth during 2020, with margins consistently resting at approximately 16-17%. This underscores the significance of a company having greater exposure to the convenience store segment rather than relying heavily on fuel sales.

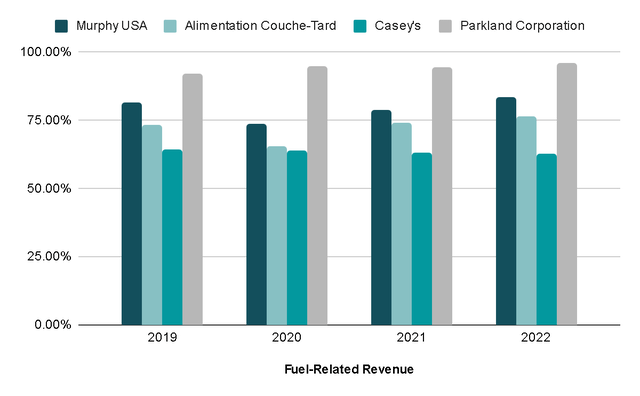

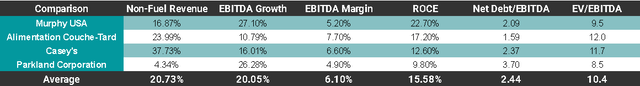

If we scrutinize the percentage of revenue related to fuel, Murphy USA has consistently represented an average of 80%. However, companies admire Alimentation Couche-Tard or Casey’s, which I previously analyzed, have strategically focused on reducing their reliance on fuel sales to boost their terminal value. Alimentation Couche-Tard achieved this through its Circle K convenience stores and a scheme to present electric stations, while Casey’s diversified into food sales, such as pizzas. This shift is evident in their percentages of income not dependent on fuel, with Alimentation Couche-Tard averaging 72% and Casey’s at 63%.

While we will delve into Murphy USA’s strategies to diminish its exposure shortly, it’s worth noting that some companies are currently positioned more favorably. They have demonstrated foresight in anticipating this shift and the agility to execute necessary initiatives before the industry undergoes significant changes.

Capital Allocation

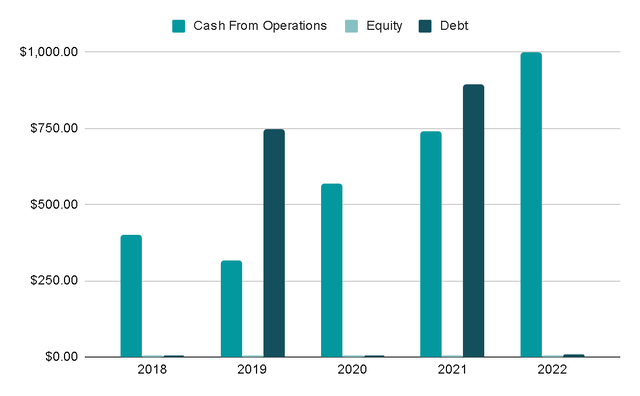

In the past five years, the company primarily funded its operations with $3 billion generated from cash flows, issuing a modest $1.6 billion in debt. Notably, there has been no dilution of shares during this period, suggesting sound capital allocation practices.

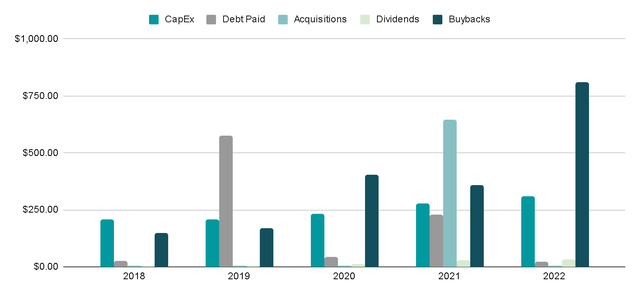

This capital has been deployed for various purposes, guided by management’s strategic considerations. For instance, in 2019, nearly $600 million was allocated to debt repayment, while in 2021, $650 million (including $900 million in debt) was invested in the acquisition of the convenience retailer QuickChek. Originally mini-supermarkets, QuickChek stores evolved into convenience stores with gas stations since the 1990s. Despite the shift towards fuel offerings, the primary focus remains on retail stores, aligning with Murphy USA’s goal to boost revenue from convenience stores.

One notable absence from management commentary is the potential for constructing electric stations, akin to the initiatives by Alimentation Couche-Tard. This could pose a significant challenge, potentially leaving the company trailing in the race to set up a prominent position in the burgeoning electric vehicle industry. Moreover, the installation of electric stations could present an opportunity to boost non-fuel revenue, as the charging duration provides customers with an interval to engage in convenience store purchases.

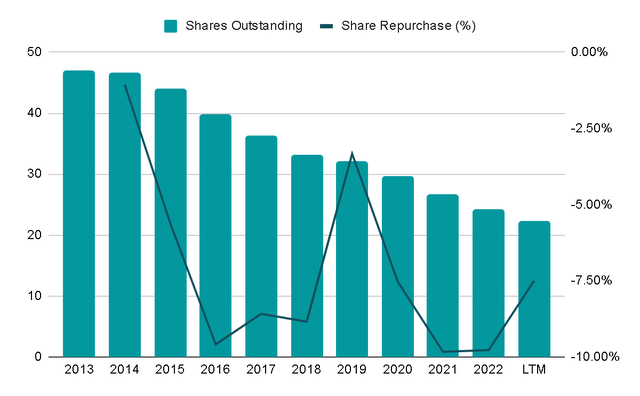

Conversely, it appears that the company has predominantly favored returning cash to shareholders through buybacks. Since 2013, they have executed share repurchases at an annual rate of 7%, deploying $2 billion for this purpose in the last five years. While this positively impacts earnings per share, it prompts consideration of alternative uses for this capital. Redirecting these funds towards initiatives such as:

- Expanding non-fuel-related income through the construction or acquisition of additional convenience stores.

- Initiating an assertive implementation of charging stations within existing gas stations.

These alternatives, in my opinion, would be more strategic in navigating the transition towards electric vehicles, emphasizing long-term value creation over short-term financial metrics.

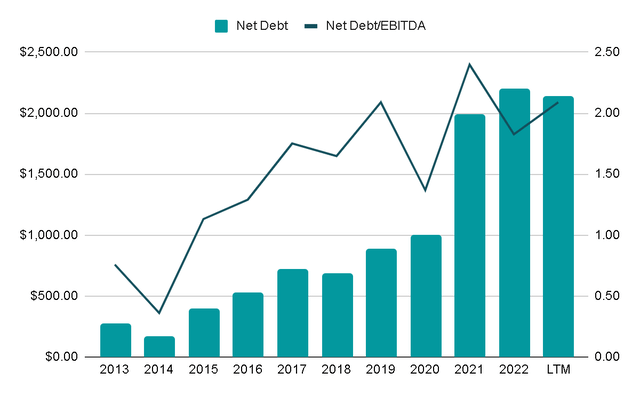

As inferred earlier, the company’s current financial position appears somewhat strained due to substantial debt incurred for specific acquisitions. The current net debt stands at $2.1 billion, resulting in a Net Debt/EBITDA ratio of 2x, which, while not currently alarming, reflects an increasing level of leverage over the past decade.

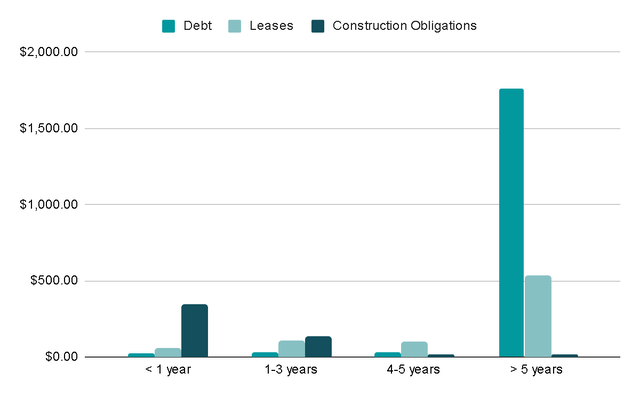

A positive aspect is that 75% of the debt has maturity dates extending beyond 5 years. Notably, almost a third of the total debt, amounting to slightly over $1 billion, is tied to two Senior Notes. These notes mature in 2029 and 2031, carrying fixed interest rates of 4.75% and 3.75%, respectively. This is a favorable scenario as it suggests that the company won’t need to renegotiate debt at potentially high interest rates in the near term. Moreover, the reasonable interest rates are fixed for an extended period, providing a measure of stability and mitigating the risk associated with fluctuating interest rates.

Valuation

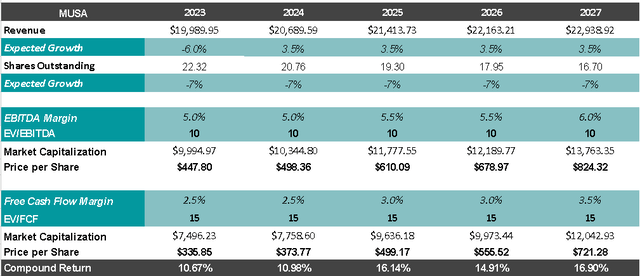

To project the potential performance of purchasing Murphy USA at its current price, I’ll conduct a valuation analysis by estimating sales and margin growth over the next five years.

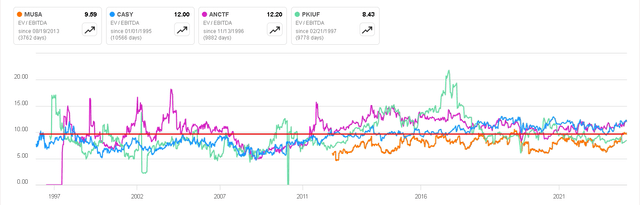

It’s a complex task to project the business’s trajectory, given the potential for changes such as acquisitions or shifts in the strategic scheme. Notably, the companies with higher EV/EBITDA multiples also tend to have greater non-fuel-related revenues, suggesting a market preference for companies with greater predictability.

For the current year, I’ll consider analysts’ estimates, anticipating a 6% decrease in revenue due to the normalization of fuel prices after the 2022 highs that favored a 39% growth. Subsequently, I’ll project an annual growth of 3.5%, aligning with the historical average growth rate over the past decade.

Assuming the company maintains its share buyback strategy at a rate of 7% annually, alongside a slight margin expansion from the QuickChek stores acquisition, and applying an exit multiple of 10x EBITDA and 15x FCF, we could expect a compounded annual return of 17%, in addition to the 0.5% dividend yield. This seems to be an attractive return, contingent on the management’s continued commitment to aggressive share repurchases.

It’s crucial to admit the numerous variables at play in this valuation, and any changes in factors admire management strategy or unforeseen market conditions could significantly impact the results. Acquisitions, changes in the buyback policy, margins according to the sales mix, etc.

Final Thoughts

After a comprehensive analysis of the company’s strengths and weaknesses, my conclusion is that, while Murphy USA has demonstrated successful capital allocation, evident in the impressive returns on capital employed (22% last year and 21% on average over the last five years), it appears to be somewhat behind in initiatives related to the transition towards electric vehicles, which is increasingly perceived as the future of human transportation.

This observation leads me to believe that the company is not cheap, but rather that it has a higher level of uncertainty compared to companies admire Alimentation Couche-Tard or Casey’s. Consequently, the valuation should account for this risk/reward dynamic.

For a clearer perspective, I’ve prepared a comparative table outlining key aspects of the four companies in the sector under analysis. Given its low dependence on fuel, higher margins, and lower debt, Alimentation Couche-Tard appears to be the most promising option. Casey’s follows closely, and Murphy USA ranks as the third option. Despite this, I consider Murphy USA as a ‘hold‘—a position that may offer attractive returns if the company successfully navigates the challenges ahead.