As 2024 gets closer, investors need to take a hard look at their portfolios and execute which stocks should be sold. They also need to consider which stocks aren’t in there that should be.

To me, if you don’t have Taiwan Semiconductor Manufacturing (TSM 1.07%) or Adobe (ADBE 0.20%) in your portfolio, you should consider adding them. Each is the most dominant company in its industry, and both have massive tailwinds blowing in their favor.

Taiwan Semiconductor Manufacturing

Are you reading this article on a phone or laptop? Well, you likely have Taiwan Semiconductor Manufacturing (TSMC) to thank for that. Its chips are found in all types of electronic devices, including those made by Apple, Nvidia, and Advanced Micro Devices.

TSMC is the world’s largest contract chip manufacturer, which means it takes chip designs from external clients and makes them on their behalf. This is a win-win relationship, as its clients don’t have to progress the facilities to make the chips, which would be incredibly costly and inefficient. As another benefit to its clients, Taiwan Semiconductor has some of the most innovative products, including a 3-nanometer chip, which is the next step in efficiency and power.

But just because TSMC has the world’s best technology now doesn’t mean it’s taking an off day. Instead, it’s pioneering a 2nm chip expected to achieve volume production in 2025. This continual innovation is why TSMC makes for an excellent investment, as it gives the company a new revenue driver every couple of years.

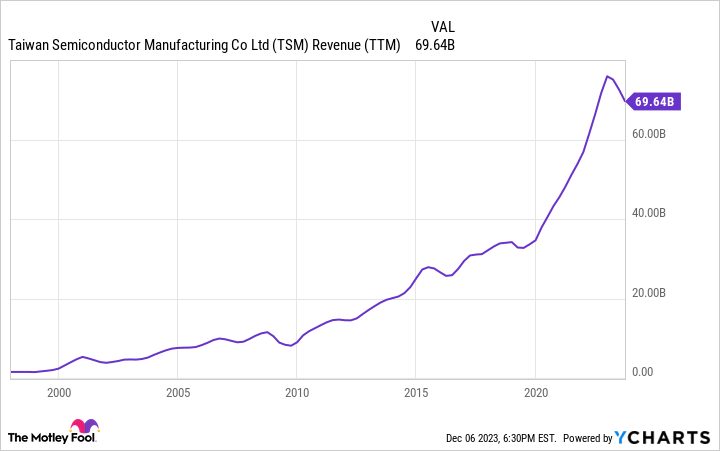

This innovation is why TSMC’s revenue has also steadily increased over its existence, with slight dips during a cyclical pullback.

TSM Revenue (TTM) data by YCharts

That’s what’s happening at TSMC right now, and it’s giving investors an absolute bargain on the stock. It’s trading for 16 times 2024 earnings, which is cheap considering that the average trailing price-to-earnings ratio over the past decade was 19.

An investment in Taiwan Semiconductor Manufacturing is an investment in improving chip technology, which is a safe bet.

Adobe

In the digital media space, Adobe reigns supreme with its creative design product suite. But Adobe also has tools for e-commerce, business, and artificial intelligence (AI). Adobe and its use of generative AI in its Adobe Firefly product allows creators to alter graphics with simple text inputs. It also deploys AI in its Adobe Sensei product, which helps boost a company’s marketing abilities by suggesting new audiences based on traffic or by adding a chatbot to a website.

Regardless, Adobe’s new AI products only cement its place at the top of the digital media world. With Adobe’s strong subscription model, it’s well positioned to succeed for some time.

In Q3 of fiscal year 2023 (ending Sept. 1), Adobe’s earnings per share increased from $2.42 to $3.07 — a 27% rise. This market-crushing growth is what investors have come to expect from Adobe, which is why it has a premium price tag of 54 times trailing earnings. But it only trades for 29 times 2024 earnings, which shows the incredible growth that Adobe will experience.

That kind of upside excites me about Adobe stock, and I think it represents a great way to lock in market-beating growth alongside Taiwan Semiconductor Manufacturing.

Keithen Drury has positions in Adobe and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Adobe, Advanced Micro Devices, Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: long January 2024 $420 calls on Adobe and short January 2024 $430 calls on Adobe. The Motley Fool has a disclosure policy.