Scott Olson

Domino’s Pizza (NYSE:DPZ) has been on a bit of a rollercoaster ride this year. The global pizza franchisor has ultimately seen its shares return around 20% so far this year, with earlier fears of a slowdown in demand giving way to improved franchisee-level profitability and expectations that long-term growth will continue at an attractive clip. While some of the former is admittedly showing up in results here, the long-term growth outlook remains attractive, and I open on Domino’s with a Buy rating.

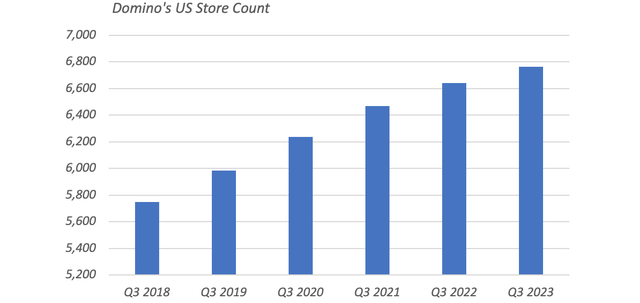

The first port of call in any discussion of franchised restaurant stocks is store-level profitability. At the end of the day, franchisees that earn good returns on their initial investment are highly incentivized to open up new stores, and in the long run that will map to growth at the corporate level too. With that, Domino’s franchisees are currently earning around $155,000 in annual EBITDA per store on average as per the most recent earnings call. That is admittedly down a bit from the COVID boom years, but initial investment requirements are also quite low for a Domino’s store: Notwithstanding the recent bout of inflation, they are probably somewhere in the $400K region. Cash-on-cash returns thus land at around the 40% mark. That is a very attractive proposition for franchisees, and it is little wonder that the domestic store count has been growing at a respectable clip.

Domino’s Quarterly Earnings Releases

Another quicker way of checking restaurant-level health is to look at the rate at which franchisees are closing stores. In Q3, Domino’s reported only one store closure among the 6,449 franchised stores it had at the start of the period – a good sign that unit-level economics are indeed pretty good.

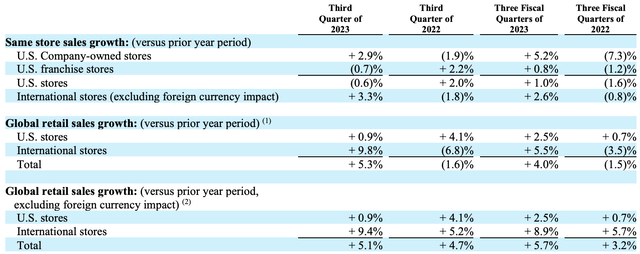

The macro-environment in 2023 has proved somewhat of a challenge for the company, with consumer finances becoming an increasingly important issue on the back of elevated inflation. Now, one thing I would point out about the pizza stocks appreciate Domino’s is that the ordering process is less amenable to capturing price hikes compared to the likes of McDonald’s (MCD). For want of a better phrase, ordering a pizza is a more anti-social encounter than you see at other restaurant concepts, and a very high portion of Domino’s sales (~80%) already come through the digital channel. Folks thus have more scope to achieve deals and keep tickets price down. As a result, comps have been somewhat soft here, with the company reporting just 1% year-on-year same-store sales growth (“SSSG”) for the year through Q3. Third quarter SSSG was actually a negative 0.6% print, driven by a 0.7% drop in same-store sales across the franchised estate.

Domino’s Q3 2023 Results Release

This is probably a transient issue. As mentioned above, underlying returns for franchisees are still very attractive, but weak comps just happen to be a larger issue for the pizza players compared to other restaurant operators. Note that comps at recently covered peer Papa John’s (PZZA) have not been spectacular by any means either, with the company reporting just 0.4% SSSG over the first three quarters of the year. While third quarter SSSG was admittedly 3.5ppt higher than at Domino’s (+2.9% versus -0.6%), it was hardly spectacular in inflation-adjusted terms. The key point is that the pizza franchisors seem especially vulnerable in this sort of macro climate, though as I said it is not a major long-term concern of mine, especially as it is mitigated to a degree by ongoing global store count expansion. There are also some nice positive sales drivers in the short term, with Domino’s announcing a revamped loyalty program at the end of Q3 and expanding delivery via partnership with Uber Eats.

The crux of the bull case here rests on that last sentence. Fortunately, management basically reaffirmed its long-term growth algorithm at the company’s recent Investor Day. Previously, this included a 5-7% range in terms of unit count growth and a 4-8% range in terms of system sales growth. That has now been narrowed to annual unit count growth of 1,100 (equal to a ~5% CAGR) and 7% annualized system sales growth through 2028. On a longer-term horizon, management thinks there is scope for around 40,000 global Domino’s outlets, representing a doubling of its current tally, including 8,500 domestic stores.

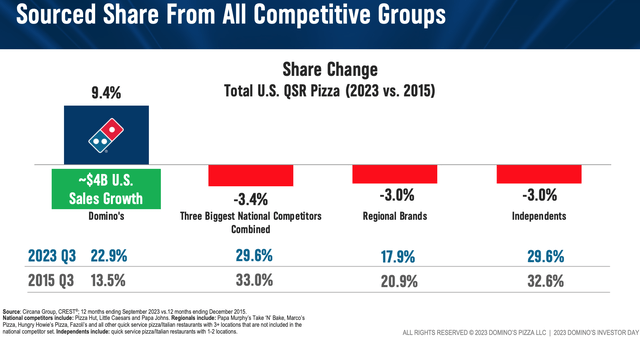

I think the company can pull this off. For one, the pizza market is still quite fragmented, with Domino’s share still below 23% domestically versus a combined 48% for regional and independents. As the company grows, it gains the advantages of scale, with the advertising budget naturally swelling alongside system sales. That alone will give it a leg up versus peers, not to cite operational advantages that come from a denser store footprint (e.g., more reliable and reduced delivery times). There is scope for the company to carry on gaining share.

Domino’s Pizza Group December 2023 Investor Day Presentation

The business model also offers inbuilt operating leverage. Broadly speaking, Domino’s currently makes its money through three avenues: company-operated stores where it takes on the entire restaurant-level P&L, a domestic commissary business where it captures a simple markup on sales to franchisees, and finally simple franchise and royalty fees.

The latter is obviously a very high margin. Domino’s commands a circa 5.5% royalty rate on domestic franchised sales, falling to a circa 3% rate for international franchised sales on average. Based on its long-term global store count target, royalty revenue would boost by roughly 50% from current levels (international stores have lower sales and royalty rates versus US ones). Those revenues accrue to Domino’s at a much higher EBIT margin than the current 18% company-wide figure, so earnings growth should run ahead of sales growth. Indeed, management’s Investor Day targets include annual operating income growth outstripping system sales by a point (~8% CAGR).

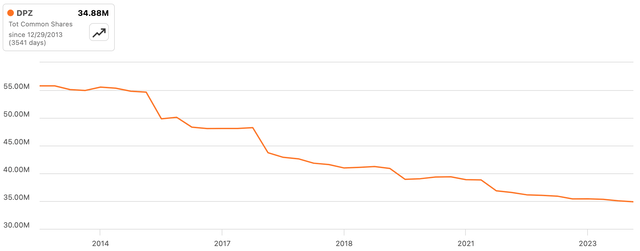

That is why I think the shares are still attractive despite year-to-date returns leaving them on a 25x forward EPS multiple. Domino’s has fairly limited capital expenditure requirements, so all of its earnings are basically available for shareholder distributions by way of dividends and buybacks. The current $1.21 quarterly dividend maps to a yield of circa 1.2%. On top of that, Domino’s has historically reduced its share count at a circa 5% annualized clip.

Now, it won’t be able to match this rate going forward due to the stock’s current valuation and the fact that leverage is currently approaching the higher end of management’s 4-6x target range. Even so, a circa 2% annualized rate of share count reduction seems manageable based on current earnings generation. Combined with high single-digit annualized underlying earnings growth, plus the dividend, that gives shareholders a path to double-digit annualized returns even with a 1-2ppt headwind from long-term EPS multiple contraction. As a result, I open on Domino’s stock with a Buy rating.