WANAN YOSSINGKUM/iStock via Getty Images

Introduction

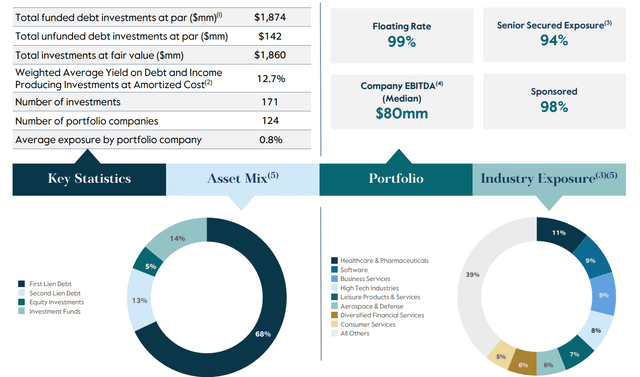

Carlyle Secured Lending (NASDAQ:CGBD) is a specialty finance company doing business as a Business Development Company (‘BDC’). The BDC is focusing on secured debt investments in the middle market companies (with a market capitalization of $25-100M). Carlyle focuses on companies whose debt would be rated below investment grade. As of the end of September, Carlyle Secured Lending had about $1.87B in investments with about 99% of the debt consisting of floating rate debt with 68% of the investments classified as first lien debt. The weighted average yield on its investments increased to 12.7%

CGBD Investor Relations

CGBD has about 50.8 million shares outstanding resulting in a current market capitalization of approximately $760M. But rather than focusing on the equity of Carlyle Secured Lending, I am more interested in the recently issued debt security which is trading with (NASDAQ:CGBDL) as ticker symbol.

A look at the performance of Carlyle Secured Lending

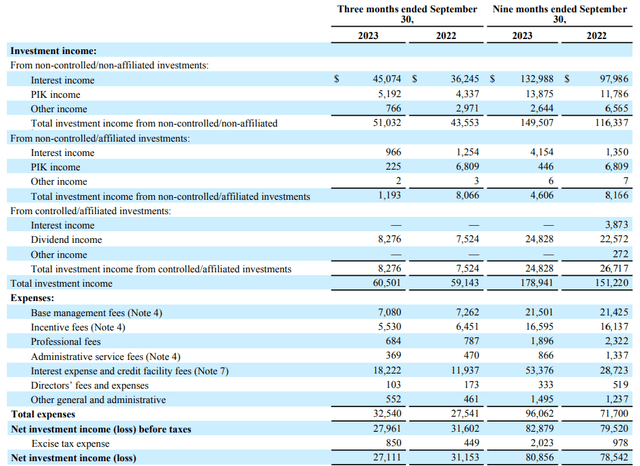

I am obviously very interested in the net investment income generated by this BDC. As the income statement below shows, Carlyle Secured Lending reported a total investment income of $60.5M while the total amount of expenses came in at $32.5M resulting in a net investment income of $28M and about $27.1M after making the excise tax expenses.

CGBD Investor Relations

Looking at the breakdown of the expenses, we see about $12.6M of the expenses was paid as a management fee and an incentive fee. Additionally, Carlyle Secured Lending paid about $18.2M in interest expenses.

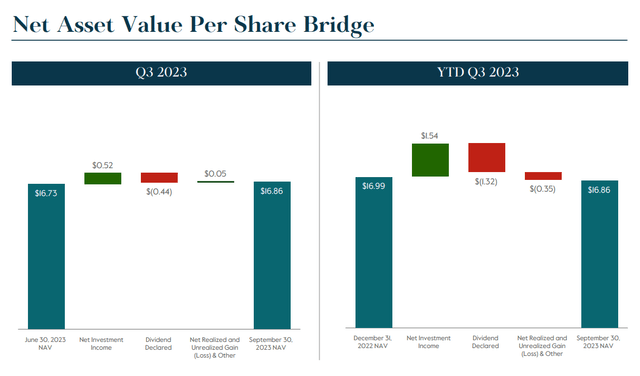

The BDC also generated some gains on investments and its bottom line result shows a net income of $30M for the quarter and after making the $875,000 in preferred dividend payments, the net income attributable to its common shareholders was $29.1M or $0.57 per share. The Net Investment Income was $0.52 per share. Which means the current dividend of $0.37 as well as the supplemental dividend of $0.07 per share were (and are) fully covered. The $0.44 in dividends will be payable on January 18 th to the common shareholders of record on December 29, 2023.

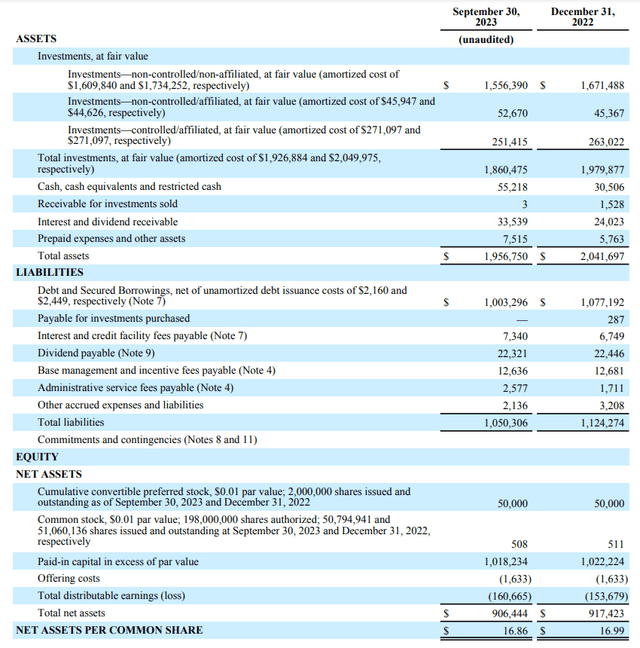

Looking at the balance sheet, we see CGBD has about $1.96B in total assets of which $1.86B are investments. The remainder of the assets consists of cash ($55M) and interest and dividends receivable ($33.5M). On the liabilities side, we see about $1.05B in total liabilities of which $1B is debt. After deducting the cash position, Carlyle has a net debt position of approximately $950M which represents approximately 51% of the total book of investments.

CGBD Investor Relations

As you can see above, the NAV/share was $16.86 which means the stock is trading at a small discount to its NAV.

CGBD Investor Relations

Rather than being a shareholder, the 2028 debt security is an interesting option

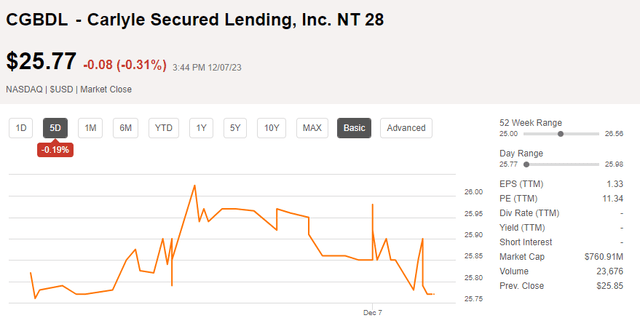

Given the dividend announcement for December (with the dividend payable in January 2024), Carlyle Secured Lending will pay $1.76/share in dividends for this year. This should be more than fully covered by the net investment income and provides for a very healthy dividend yield of just over 11%. This makes the common stock very appealing but I was also very interested in Carlyle’s recent offering of 8.20% notes, which are currently trading with (CGBDL) as ticker symbol.

The principal value per security is $25 and the annualized interest payments are $2.05 per unit per year, payable in four equal quarterly payments of $0.5125 per quarter. These debt securities mature in December 2028 but Carlyle Secured Lending can exercise a call option from December 2025 on. If interest rates on the financial markets indeed continue to decrease, I think it is increasingly likely for Carlyle to call these securities but of course a lot can still happen between now and 2028.

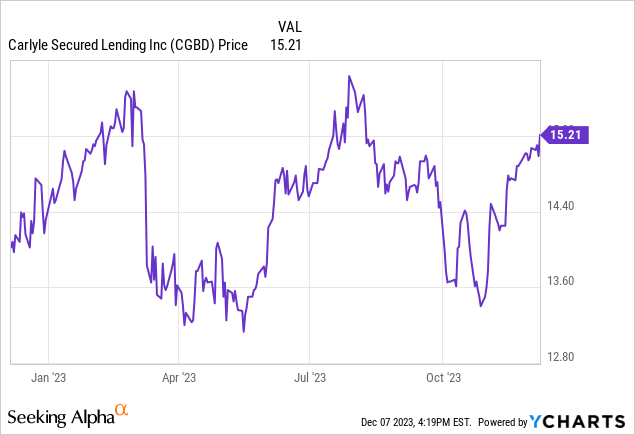

Seeking Alpha

The most recent closing price for the 2028 notes was $25.77. Which means the yield to call is currently approximately 6.5% which is quite moderate. But in a way, this debt security could also be seen as a speculation on Carlyle Secured Lending nót calling the securities in 2025. If the call would be postponed until December 2026, the yield to call would enhance to roughly 7%. And if CGBD wouldn’t call these securities at all, the yield to maturity is getting close to 7.5%. And that scenario would be attractive.

Investment thesis

If you are assuming the debt securities will be called in 2025, the 6.5% yield to call is not spectacular. But given the very acceptable leverage ratio on the balance sheet and the very strong net investment income result, the risk/reward ratio still appears to be good. Not in the least because the total size of this offering is just $75M. In an ideal world, the securities won’t be called and will mature as planned in 2028 as that would likely be the most optimal situation from a return perspective. But if interest rates on the financial markets are indeed moving down, the likelihood of an 8.20% debt security getting called is higher.

I think it would make sense for me to commence a small long position and I can add to this position when/if the price would drop to a level closer to the par value of $25 per unit. I currently have no position but could buy a starter position in the next few weeks. Owning a combination of both the equity and the debt could make sense as well, but I will focus on the debt securities in the very near term.