RoschetzkyIstockPhoto/iStock via Getty Images

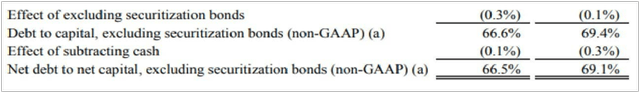

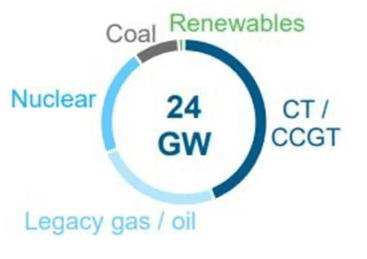

Entergy Corporation (NYSE:ETR) is a Fortune 500 utility holding company, headquartered in New Orleans. It has six divisions including Entergy Arkansas, Louisiana, Mississippi, New Orleans, Texas, and Energy Resources, Inc., or SERI, the subsidiary that owns the Grand Gulf nuclear station. Entergy New Orleans and Entergy Louisiana are regulated gas and electric utilities; the other businesses are purely electric. The company serves just over 3,000,000 retail customers and the majority of these are located in Louisiana (1,101,000) and Arkansas (730,000). Entergy’s territory falls under the jurisdiction of six different regulatory agencies, including the NRC, so this adds a layer of complexity. Its current generating capacity is 24,000 megawatts (5,200 of which are nuclear) and its Standard & Poor’s credit rating is BBB+ or medium investment grade. Entergy is the 17th largest US utility by market cap, which is currently $21.54 billion. Its service territory is presented below.

Entergy Market Area (2023 Investor Report)

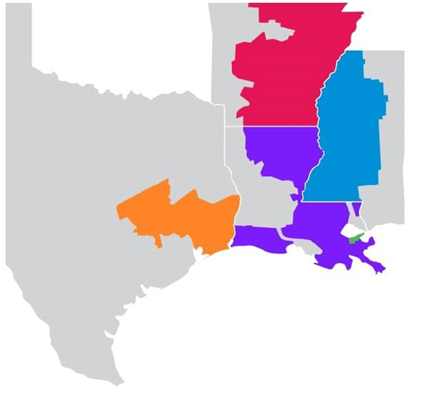

Entergy is currently trading at $101.50, down 24.3% from its February 2020 peak of $134.13. This is not surprising as utility stocks have been the worst performing sector this year out of the 11 S&P 500 sectors. This is because the Fed’s higher interest rates have made treasuries look more attractive than utility dividends. The current 12-month yield, for example, is 5.13% well above the utility average yield of 4.0%. The five-year price history of Entergy shares is presented below. Shares have a beta of 0.68.

Entergy Market Area (Seeking Alpha Charting)

Entergy Shares are 10.0% Undervalued

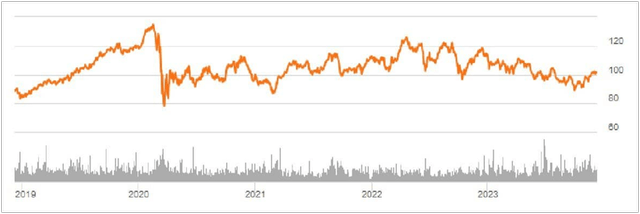

Third quarter results were recently reported and guidance for the year was adjusted upward to $6.65 to $6.85 from $6.55 to $6.85 per share, with 2024 guidance set at $7.05 to $7.35. Part of the reason for the rise was record-setting summer temperatures that boosted usage. Q3 earnings were $3.27 versus $2.84 for the same quarter 2022, again on higher demand due to heat, with new extremes in Arkansas and Texas. GAAP earnings per share for the last five years, along with the projection for 2023 are presented below.

Earnings per Share Over Time (ETR Annual Reports)

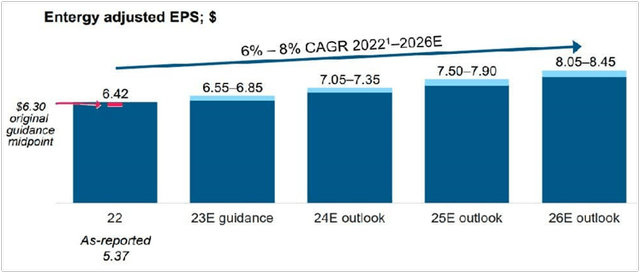

Moving forward, Entergy projects its earnings per share to grow at a compound annual rate of 6.0-8.0%. The residential customer base is growing at about 1.0% per year, but the industrial base is growing at a compound annual rate of 6.0-7.0%. Petrochemicals, primary metals and technology are the industries driving this load growth.

EPS Growth (2023 Investor Presentation)

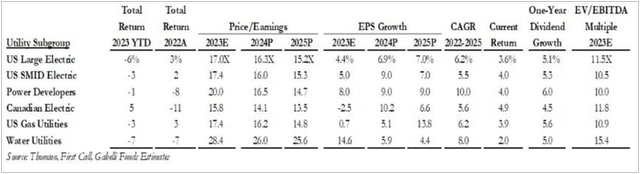

In order to value ETR shares, I have used two approaches to value: comparable P/E ratios and a discounted cash flow. In October, Morningstar reported the average utility sector P/E ratio as 16.0, the lowest since 2009. I have looked to several investor surveys to find current P/E ratios for electric and gas utilities, similar to Entergy. Gabelli Funds issues a semi-annual utility investor update, and reported that “defensive sectors (utilities, healthcare and consumer staples) were among the worst performing in the first six-months of 2023… Electric utility valuation multiples have declined from 23x forward earnings in early 2020 to 17x 2023 and 16x 2024 earnings estimates….Gas utilities currently trade at 17x 2023 and 16x 2024 earnings estimates.” The Gabelli table of P/E ratios for various utilities segments is presented below.

Gabelli Utilities Report (Gabelli Funds)

Using the 2024 projected EPS of $7.25 with the mid-size electric 2024 forward P/E ratio, the fair value of the company would be $7.25 x 16.0 = $116.00 per share.

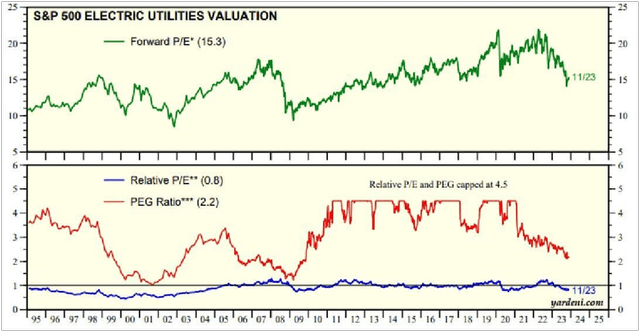

Yardeni Research also publishes frequently updated P/E ratios for utilities, the most recent version dating from December 1, and showing that electric P/E multiples are currently 15.3x forward earnings. I have applied this multiple to the updated earnings calculate of $7.25 for 2024, so the valuation of Entergy shares would be $7.25 x 15.3 = $110.93. A chart of the Yardeni research data is presented below.

Yardeni P/E Multiples for Utilities (Yardeni Research)

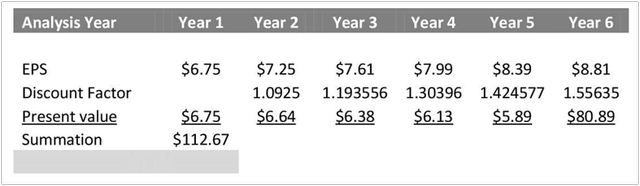

As a cross check, I used a discounted cash flow to value Entergy’s shares. Here I calculate the fair value of the shares to be $112.67 or $113.00, rounded. To complete this model, I used a growth rate of 5.0% per year, even though the company projects 6.0-8.0% per year, as it hasn’t always met that high target. I used the consensus earnings of $6.75 and $7.25 for the next two years. For a discount rate I have used 9.25%, slightly below the average annual return of the S&P 500, which is about 9.8%, as Entergy is a utility in a favorable regulatory environment. Finally the reversion rate used was 7.0%.

Discounted Cash Flow (Author Calculated)

The valuations stack up as follows: $110.93 per share, $112.67 per share and $116.00 per share. The average is about $113.00 per share and Entergy is currently trading at $101.50, so I believe it to be about 10.0-11.0% undervalued.

A Safe, Growing Dividend

The current yield is 4.44%, above the utility industry average yield of 4.0%. Entergy has increased its dividend every year since 2015, so for nine consecutive years. During this time the quarterly payment went from $0.83 per share to $1.13. Before this the dividend was fixed between May 2010 and August 2015. Even when the annual payout was frozen, the yield ranged from 4.5% to 5.4% based on the share price at the time. In comparison, some other utility dividend yields paid by Entergy’s peers include Dominion (D) at 5.6%, American Electric Power (AEP) at 4.48% and NorthWestern Energy (NWE) at 4.94%. The company has stated that its target payout ratio is 60-65.0% and it wants to grow the dividend now at 6.0% per year, in line with the goal of 6.0-8.0% per year earnings per share growth.

Payout Ratio Over Time (Value Line and Author Calculated)

The current payout based on GAAP earnings per share has ranged from 58.10% to 76.35%. Based on the company’s cash flow, it is a much lower range of 20.54% to 26.43%. These are very reasonable and sustainable ratios for Entergy moving forward.

A Surprisingly Favorable Regulatory Environment

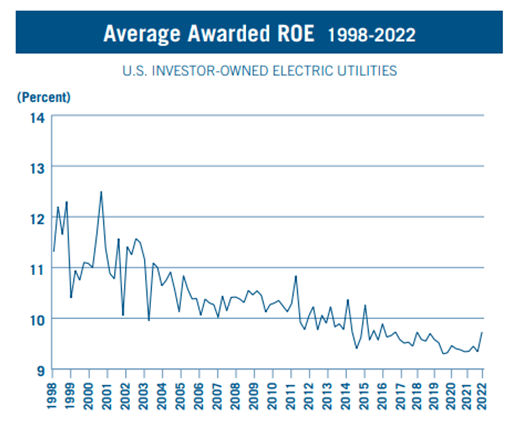

According to the Edison Electric establish, in 2022, for US electric utilities, the “average awarded ROE was 9.47 percent, a slight rebound from 2021 at 9.40 percent. For comparison, the average awarded ROE for 2020 was 9.43 percent, and for 2019 was 9.64 percent.” This number has gone down over time, in the same way as the federal funds rate.

US Electric Utilities ROE (Edison Electric establish)

Entergy, surprisingly, is operating in favorable regulatory environments that allow it to be at or above the average return on equity for investor owned utilities. Even so, the company has the fourth cheapest consumer electric rates in the country, charging an average of $0.0973 per Kilowatt hour in 2022, up from $0.0844 in 2021. In 2022 Duke Energy (DUK) averaged $0.1044, Dominion Energy (D) was $0.1117, while Evergy (EVRG) was $0.1097, and Southern Company (SO) was $0.1229. Consolidated Edison (ED) was $0.2643, so it one of the most expensive in the country, not dissimilar from PG&E (PCG) at $0.2836.

Entergy Arkansas with its 730,000 customers is regulated by the Arkansas Public Service Commission. This is a three-member board with staggered six-year terms. The board members are governor appointed. The rate base is $9.2 billion with an average return on equity is 9.65%, with a floor of 9.15% and a ceiling of 10.15%. There is a formula rate strategize to adjust earnings up or down if the return on equity is 0.5% higher or lower than the average.

Entergy Louisiana is regulated by the Louisiana Public Service Commission. It has a five-member board of publicly elected commissioners with five-year terms. The benchmark rate of return on equity for the electric division is 10.0%, while for the gas operations it is 9.8%. The rate base is $15.7 billion. The company recently filed to enhance the ROE to 10.5%. appreciate Arkansas, there is an upper limit equal to the ROE plus 0.50% and a lower limit equal to the ROE minus 0.50%, with an adjustment made every year. New Orleans operations are regulated by the seven-member City Council of New Orleans. This is the only city in the US that has regulation power over an investor-owned utility. The allowed return on equity is 8.85% to 9.85% with a midpoint return on equity of 9.35% and a 0.5% range on either side. The rate base is $1.2 billion.

Entergy Mississippi has 461,000 customers and is regulated by the Mississippi Public Service Commission. This commission has three publicly elected board members serving four-year terms, with no term limit. Publicly elected board members tend to be more agreeable with a public that wants lower rates. Still, the allowed return on equity is a favorable range of 9.74% to 11.88% with a formula rate strategize that adjusts for any differences. The rate base is $4.2 billion.

In Texas, Entergy is regulated by the Public Utility Commission, which has five board members appointed to six-year terms by the governor. Entergy Texas has 499,000 customers and an allowed return on equity of 9.57% and a rate base of $4.4 billion. While Texas has deregulated its investor-owned utilities to give customers a choice over who to buy power from, there are still a few exceptions. Entergy Texas is one of them and the customers in its territory have no alternative. Entergy’s Texas operations are connected to the rest of its power generation network in Arkansas, and the Texas operation was never split from the rest of the company.

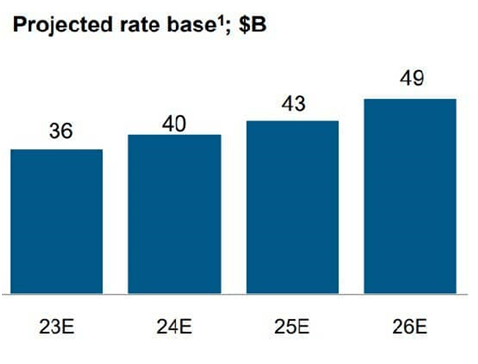

ETR Rate Base Over Time (2023 investor Presentation)

Clean Energy and Transition to Renewables

Entergy is the only U.S. utility to make the Dow Jones Sustainability Index (DJSI) nine years in a row. The company plans to eradicate all its coal power generation by 2030. It has a 24,000 megawatt capacity today, which it expects to grow to 31,000 by 2026, primarily through renewable energy.

As of 2023, for fossil fuel generation, Entergy has 23 natural gas plants, four coal plants, and one oil fired plant. For renewables, there are 31 solar projects (existing or planned), five wind projects and four hydroelectric projects. The company’s four nuclear generating plants produce some 5,200 megawatts, about one-fifth of Entergy’s capacity.

ETR Current Generation (2023 Investor Presentation)

Part of Entergy’s drive to reduce fossil fuel generation is due to the Inflation Reduction Act, passed in August 2022 which incentivizes reducing carbon emissions. It has set forth a goal of a 40.0% reduction in greenhouse gases by 2030, based on a 2005 benchmark, and net-zero emissions by 2050. There are decade long tax credits in this act for new renewable power (solar and wind, for example) and significant loans to fortify the transmission grid against extreme weather. Also important is the Bipartisan Infrastructure Law; it provides some $65.0 billion in federal grants to boost electric infrastructure and boost reliability.

Much of Entergy’s push into renewables has been with solar. In 2018, it acquired a 100 megawatt solar facility being developed on 1,000 acres in Mississippi. In 2020, it bought the 100 megawatt Walnut Bend Solar in Arkansas and more recently, the 250 megawatt Driver Solar facility, also in Arkansas. There is a 475 megawatts solar generation facility in Louisiana, but as you can see the numbers are still on the low side, versus the growing energy needs.

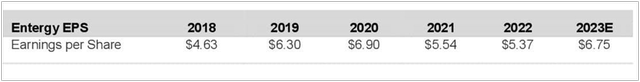

Entergy Texas is currently in the process of building a 1,215 megawatt hydrogen turbine facility near the border of Texas and Louisiana on the Gulf of Mexico. The estimated total cost is $1.8 billion, up recently from $1.2 billion. This project and the company’s other developments will necessitate significant capital expenditures. Entergy’s debt is a little on the high side, however and could be reduced, as indicated in the 2022 Annual Report.

Entergy Preferred Shares are Yielding 6.1%

Entergy offers preferred shares, the 5.375% Series A (ETI.PR), issued on September 4, 2019. These have a par value $25.00 per share, and are rated BBB- by Standard & Poor’s, or lower investment grade. This series is currently trading at $22.40 and has a daily volume of about 2,600 shares. The dividend is paid quarterly and is $0.3395, for an effective yield of 6.10%. The call date is October 15, 2024, and note that the redemption price is $25.50 before this date. At October 15th and beyond the redemption price is $25.00. These shares are both cumulative and eligible for preferential tax treatment. According to the prospectus, the preferred shares have the same voting rights as the common shares, and have some protections for holders in the event of “dissolution or winding up.”

Risks to Outlook

One of the risks to Entergy going forward is certainly extreme weather. In its territory there have been too many events to name, including Hurricanes Laura and Zeta, which caused significant damage in Louisiana. In 2021, Hurricane Ida damaged Entergy New Orleans’s electric grid. Weather has become increasingly unpredictable and this year, Texas had one of its hottest summers ever. While summer heat creates higher demand, other utilities have experienced declines in earnings due to warmer than usual winters in 2022 and 2021. This is also a possibility for Entergy. In addition to the unpredictable weather extremes, more interest rate hikes form the Fed would raise interest payments on the company’s not insubstantial debt.

Conclusion

I believe Entergy is currently about 10.0% undervalued with a dividend of 4.44%. It operates in a favorable regulatory environment and the combination of undervalued shares with a strong dividend, which the company plans to grow at 6.0% per year, makes the company appealing. The preferred shares yielding 6.1% are also very attractive. While their remaining time to maturity is only one year, it is certainly possible the company would continue to let them float as interest rates for debt are now well above the original 5.375%.

Entergy’s board has authorized a share repurchase program in the amount of $500 million to preserve the share price; there is currently another $350 million remaining in this program. When considering this with the favorable regulatory environment, the undervalued shares and the strong growing dividend, Entergy is rated a buy. Investors may also find the 6.1% yielding preferred shares attractive.