Tutye

Grifols (NASDAQ:GRFS) is an equity story that we particularly admire, and in the past month, there have been two relevant news stories to report. As has often been the case, we believe that sell-side analysts are not looking forward. At the same time, we think this is a relatively attractive and straightforward investment. Grifols’ market communication is much improved, with clear catalysts supporting the short-term evolution (SRAAS divestment with a deleveraging path and EBITDA growth). Having said that, in the past, we were worried about mid-term structural growth, but Argenx’s ADVANCE-SC research failure has removed Grifols’ competitive pressure on the immunoglobulin franchises. Therefore, in line with our historical price, we remain overweight.

Two Supportive News Items

- Argenx communicated that Vyvgart Hytrulo failed to confront ADVANCE-SC pivotal research endpoint requirements by the end of November. This potential drug was investigating Primary Immune Thrombocytopenia. This is a positive catalyst for Grifols and relies on the company’s immunoglobulin franchise. According to our analysis, Grifols ITP sales represent approximately 3% of the total company’s top-line sales. Argenx’s setback, a surprise after reviewing encouraging FDA phase II data, did not hit the primary and secondary multiple endpoints. In detail, Vyvgart was inferior to placebo on the primary endpoint, and here at the Lab, we are confident that this new data will discourage other biopharma players from investigating cRn therapies. For a comprehensive analysis, we should also note that Argenx filed Vyvgart in Japan, and decision data is expected in Q1 2024;

- Following our analysis called A Promising Buy Opportunity, after analyzing a transaction with China Resources Holdings, Bloomberg reported that the company is in advance negotiations with China Merchants to sell Shanghai RAAS. As a reminder, Grifols has an equity stake of 26%, valued at $1.5 billion. According to rumors, China Merchants is already negotiating deal terms as both companies aim to achieve an agreement in the coming weeks. This is aligned with Grifol’s expectation to close the deal before the year’s end. Including $1.5 billion in proceeds, the company would eradicate persisting concerns about short-term debt maturities. In addition, in the Q3 call, the company expressed strong confidence about closing the transaction and maintained multiple interested parties, which were never disclosed. Here at the Lab, it does not matter to us when the transaction will be completed (Q4 2023 or Q1 2024), and negotiation changes could direct to a better deal in our view. Regardless of the equity stake finally disposed of, including the $1.5bn inflow, Grifols’ net debt-to-EBITDA could reject to 5.5x by year-end from 7.4x in 2022. Here at the Lab, we see uphold coming from Grifols’ CEO, who explained how SRAAS “assets are extremely attractive, and there have been many, many people that have had an interest in this asset. This being a China transaction, it’s a very complex negotiating environment. We do want to make sure that this turns out to be a good transaction, both in the short and long term for Grifols.”

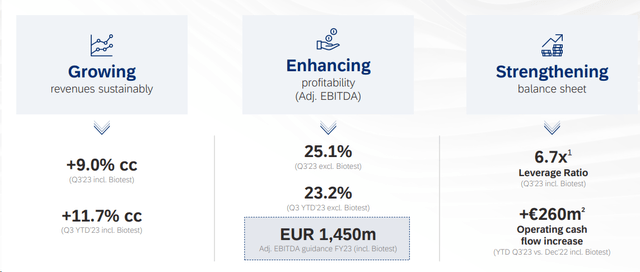

Post Q3 results, if we include run-rate savings, Grifols’ net debt target could achieve 4.5x. In Q3, the company continues to deliver:

- Total sales increased to €4.8 billion with a plus +9.0% in constant current in the quarter. This was driven by Biopharma supported by solid growth of albumin and immunoglobulins;

- Adjusted EBITDA margin increased to 25.1% by 480 basis points and total €1 billion year-to-date;

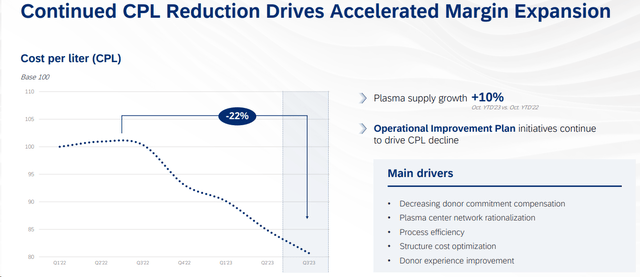

- More importantly, plasma supply was 10% higher (Fig 1), and cost per liter continues to decrease (-22% YTD).

Plasma supply and cost per liter YTD evolution

Source: Grifols Q3 results presentation – Fig 1

Fig 2

Conclusion and Valuation

Updating Grifols estimates, we set a 2023 EBITDA of €1.2 billion in our July publication, but now, including Biotest, the company is guiding for €1.45 billion (Fig 2). Aside from the financials, Q3 performance saw a positive confirmation of the Grifols business thanks to a solid operational recovery path led by efficiency, cost savings, and margin expansion. More importantly, with a $1.5 billion SRAAS divestment, Grifols will likely hit the 4x Fiscal Year 2024 leverage target (proceeds are also expected to be tax-free). Revenue momentum and lower collection cost trends uphold our buy rating target. The company also forecast a €1.750 billion EBITDA target as a 2024 base case. The plasma industry is recovering, with 2023 results being excellent and a strong FCF generation story over the next two years, leaving our future debt estimates unchanged. Going to the valuation, valuing the company in line with its historical average (17.5x EV/EBITDA), we should enhance our equity value accordingly. However, we are still ahead of the Wall Street consensus, and the Shanghai RAAS exit is still pending. For the above reason, we continue to value Grifols at €20 per share with an equity value of €13.1 billion versus a market cap of €8.4 billion.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.