Scott Olson

Smith & Wesson Brands, Inc. (NASDAQ:SWBI) has just released its FY 2024 Q2 results after hours on Thursday, December 7th, 2023, as Seeking Alpha has reported here. The company missed its non-GAAP EPS estimates by nearly 30% while revenue beat by about 1%. The stock is down ~8% pre-market, after losing 3% during regular trading on Thursday. Were the numbers bad enough to defend this fall, or was this an overreaction from the market? Let’s find out in the latest edition of The Good, The Bad, and The Ugly.

Before that, my only previous coverage on SWBI was back in July, when I reviewed the company’s dividend safety. I had rated the stock a “Hold” back then, and subsequently, the stock has returned nearly 9% compared to the market’s 1% (excluding today’s pre-market action). Let’s get into our Q2 review without encourage ado.

The Good

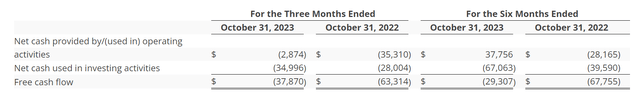

- As I covered in my July article, Smith & Wesson has had Free Cash Flow (FCF) woes in recent quarters, primarily due to its relocation efforts and related expenses. Relocation expenses went down nearly 30% YoY in Q2, and this immediately helped the company post a 42% YoY improvement in its FCF.

- SWBI expects to become debt-free and to be in a more comfortable zone on capital spending once the relocation is behind it. The company also underlined its capital allocation strategize, which, while simple, is also the reason why most businesses exist: invest in themselves and return cash to shareholders.

“Finally, with only about $25 million to $30 million left to spend on the relocation, capital investment for this project is expected to deduce within the next several months. With cash generation targets above $75 million annually and normal capital spending requirements of approximately $25 million, we expect to have a debt-free balance sheet by this time next year and be in a strong cash position. As a reminder, our capital allocation strategize continues to be: invest in our business, remain debt-free, and return cash to our stockholders.“

- SWBI also declared its regular quarterly dividend while releasing Q2 results, which should comfort investors as the company recently increased its quarterly payout to 12 cents/share. More importantly, SWBI also spent about $8 million in Q2 to repurchase nearly 650,000 shares. We are talking about a company with ~$650 million market cap, and the shares retired in Q2 alone should save the company $300,000 annually (in the form of dividends that don’t have to be paid for the retired shares). The fact that the company is rewarding shareholders in the form of dividends and buybacks even during times of high capital spending (relocation) is an encouraging sign.

SWBI Shares Outstanding (YCharts.com)

The Bad and The Ugly

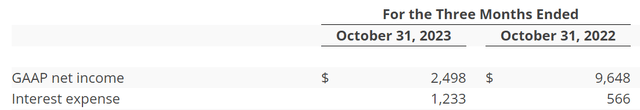

- SWBI’s interest expense went nearly 120% YoY to accomplish $1.23 million in Q2, a significant jump despite the fact that net debt (debt minus cash) is only around $10 million. The borrowing is expected to go down, if not be eliminated, towards the end of FY 2024 or at least early FY 2025.

SWBI Interest Expense (smith-wesson.com)

- SWBI ended Q2 with nearly $44 million in cash and equivalents, its second-lowest level over the last 3 years. Although relocation expenses are trending down in general, it may take the company a while to boost its cash position to the level it was just a few quarters ago, when it was as high as $170 million.

- As the company acknowledges, gross margin continues to be under pressure with a 20% drop to 25.4% in 2024 Q2 compared to 32.40% in 2023 Q2. In addition to the general expenses, inflation and inventory contributed to the contraction here. Speaking of inventory, the company is now carrying nearly $10 billion of inventories on its balance sheet, more than doubling on a QoQ basis. This brings demand and sales strength into question. However, the CEO was optimistic that demand will be strong through what is expected to be a traditionally busy season.

Conclusion

Smith & Wesson is going through a transition, literally. And transitions are generally painful and slow, but ultimately beneficial in the long run if executed properly. Q2’s numbers are showing that the relocation expenses are trending in the right direction and the cash pile is offering cushion to both the company and its investors. Overall, I am sticking with my “Hold” rating on Smith & Wesson Brands, Inc. stock, as I believe things will get better once the relocation turbulence settles down.