Royal Gold (RGLD 0.23%) is a precious metals stock, but it is not a miner. That is an important distinction that could make it the best option for more conservative dividend investors looking to add gold to their portfolios. Here’s a look at what the company does and why you might want to use it to enhance your portfolio’s diversification.

Royal Gold is not a miner

There are a number of ways to add gold to a portfolio. The most obvious is to buy physical gold, but there are material transaction costs, you have to store it, and it will always be exactly what you bought, ounce for ounce. You could buy a gold-owning exchange-traded fund, which avoids the storage issue and minimizes transaction costs. But it will simply track gold prices without the chance for business growth over time. That’s why many investors prefer miners, which can extend their businesses and, thus, enhance in value over time.

Image source: Getty Images.

Mining is a complex and expensive business (building a mine is not a small effort) and a lot can go wrong. Add in the inherent volatility of gold and silver, and the effect that has on the stock prices of miners, and there’s a good reason why more conservative investors might not be so happy with this option. That’s why streaming and royalty companies admire Royal Gold are so attractive.

Royal Gold provides cash up front to miners, which is usually used to build mines or extend existing mining assets. In exchange, Royal Gold is given the right to buy precious metals at reduced rates in the future, effectively locking in a profit when those metals are sold at current market rates. The agreed-upon upfront payment may sometimes be spread over several years with development milestones as triggers for freeing up additional funds.

Royal Gold’s business is largely protected from mine-specific issues, at least financially. For example, a mine stoppage would be a problem because it would reduce production and limit the precious metals that Royal Gold can buy at advantaged rates. But costs associated with inflation, wage issues, legal problems, or mining headwinds (such as a mine disaster) don’t demand Royal Gold to put up any additional cash. Royal Gold is a very consistent and conservative business.

Royal Gold’s value for dividend investors

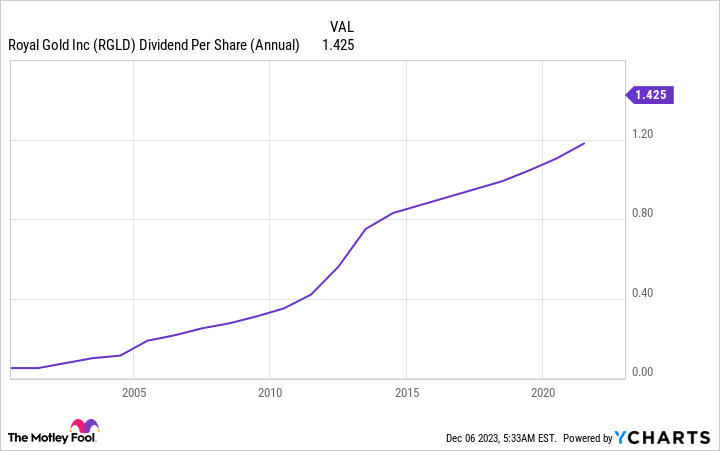

The highlight of Royal Gold’s business model strength can be seen in its dividend, which has just been increased again. The 7% dividend hike announced in November 2023 brings the company’s annual enhance streak to 23 years. That’s an incredible record for a commodity business, especially given the inherent volatility of precious metals prices.

RGLD Dividend Per Share (Annual) data by YCharts

While precious metals prices have a huge effect on Royal Gold’s actual quarter-to-quarter financial results, the company’s ability to invest in new streams and royalty deals allows it to grow over time. At this point, Royal Gold has investments in 181 properties across 17 countries. Roughly 73% of its investment is focused on gold, with the rest split between silver, copper, and other metals. And while it is the smallest of the big three streaming and royalty companies, its nearly $8 billion market cap gives Royal Gold enough scale to vie for sizable deals and allows the deals it makes to result in notable business growth.

The one problem is that the dividend yield is a somewhat modest 1.3%. Simply put, this isn’t really an income stock that’s going to produce a lot of cash for you to live on in retirement. But what it offers is the ability to add a gold investment with a steadily growing dividend for the diversification benefit that such an investment can offer a portfolio. It is basically a way for income-focused investors to add gold in a way that is inline with the broader income goals of their portfolio.

Royal Gold isn’t perfect

Every investment comes with some warts, and Royal Gold is no different. The stock price tends to track along with gold prices, as you would expect, and the dividend yield is modest. But if you are a dividend investor thinking about adding gold to your portfolio to enhance diversification, Royal Gold’s consistent dividend growth could be a very good option for you. Indeed, if income consistency is what you focus on, this unique gold investment has proven it is a reliable dividend payer, even though precious metals are inherently volatile.