seb_ra/iStock via Getty Images

Investment Thesis

e.l.f. Beauty (NYSE:ELF) has firmly established itself as a national player in the cosmetics and skin care product industry. Under the leadership of CEO Tarang Amin, who has held the position for nearly a decade, the company has leveraged a combination of affordable prices and strategic marketing to drive sales and capture market share.

ELF offers some of the most popular and well-loved eye, face, and skincare products at competitive prices. They are readily available in drugstores and retail outlets and have recently secured a deal to be sold at Ulta (ULTA), my favorite stock in the industry.

Targeting younger generations, particularly millennials, ELF has embraced social media as a powerful tool for building its brand presence. By partnering with influencers (also known as creators) who boast hundreds of thousands, if not millions, of followers, ELF leverages product reviews and targeted advertising to reach a vast audience. Between TikTok and Instagram Reels (META), millions of viewers are constantly exposed to ELF’s message, whether directly from the brand itself or through paid creator partnerships.

ELF YTD Performance (Seeking Alpha)

ELF’s success and remarkable 130% year-to-date (YTD) surge can be attributed to the growing global importance of skincare, a trend no longer confined to women. Consumers are increasingly incorporating new lotions and skin hydration products into their daily routines, demanding affordability and accessibility. ELF seamlessly fills this gap by offering high-quality products at attractive prices.

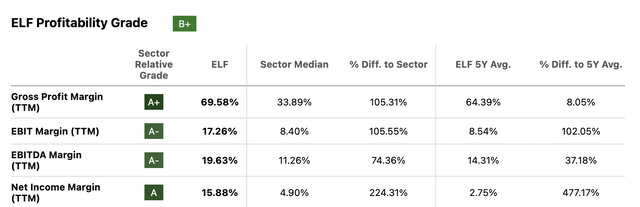

Perfectly positioned within the booming skincare market, ELF boasts impressive and expanding margins, advance solidifying its position as a leader in the industry.

ELF Profitability (Seeking Alpha)

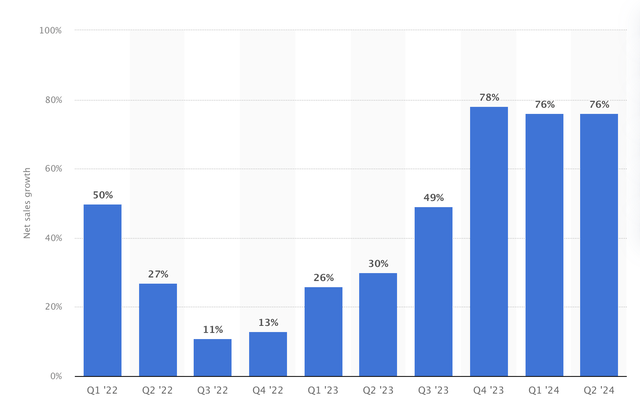

ELF is experiencing accelerated growth, with sales soaring 47.6% in fiscal year 2023 and analysts anticipating another 60% enhance in 2024. EPS grew even faster in 2023 for ELF, reaching 97%, and analysts project another 60% jump in 2024.

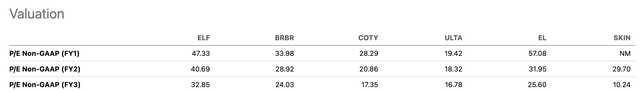

ELF’s robust growth and demonstrably expanding market share preserve its above-average price-to-earnings (P/E) ratio of 40x 2024 earnings. As previously mentioned, the company boasts industry-leading margins and exceptional top and bottom-line growth, making its high valuation reasonable.

Quarterly net sales growth of e.l.f. Beauty (Statista)

Despite ELF’s 40x earnings multiple, it’s crucial to consider future growth deceleration. While past sales growth has been phenomenal, it’s inevitable that it will slow down eventually, leading to a potential valuation correction. Currently, analysts project a forward P/E of 32x for ELF in 2026. However, when compared to industry peers, the average P/E sits closer to the low 20s. This suggests that ELF’s valuation may be inflated and could see downward pressure in the future.

ELF Valuation Comp. (Seeking Alpha)

However, beyond the valuation concerns, I find the growth trajectory and financial fundamentals of e.l.f. Beauty compelling. They are building a strong reputation and brand awareness that holds promise for sustainable success. In my article on ULTA, I mentioned the immense and rapidly growing market for beauty and skincare products, exceeding $100 billion.

ELF projects exceeding $1 billion in sales by fiscal year 2025 and currently boasts a market cap of nearly $7 billion. While I believe this company has the potential to double its value in the long term, reaching a $14 billion market cap, I suggest caution given its recent significant run-up. Existing shareholders may consider trimming their positions by 10-20%, while those on the sidelines should foresee for a pullback and gradually dollar-cost average their way in.

While potential returns remain, exercising caution and implementing sound risk management are crucial.

Fundamentals

Strengths

As mentioned previously, ELF has established impressive margins that continue to grow and contribute to robust bottom-line growth. Net income has skyrocketed from a mere $6 million in fiscal year 2021 to an estimated $130 million in fiscal year 2023.

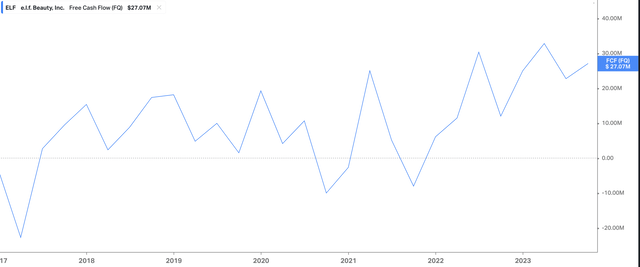

Free cash flow (FCF), a key metric we closely monitor, has also witnessed significant growth, leaping from $35 million in 2021 to over $110 million in 2023. This translates to a FCF yield of just under 2%, which is an excellent start for a young company still in its growth phase.

The chart below visually depicts the upward trend in e.l.f. Beauty’s FCF per quarter over the past five years.

e.l.f. Beauty’s current net debt-negative position is a strong indicator of its financial stability and safety, as previously discussed. The company’s minimal reliance on debt to fuel its operations ($82 million) combined with its significant cash reserves ($167 million) paints a positive picture.

This robust financial health implies that ELF generates more cash than it needs to confront its operational obligations. This excess capital allows the company flexibility in its financial decisions, enabling reinvestments in R&D, share buybacks, and potentially even the initiation of a dividend in the future.

Risks

While ELF’s fundamental analysis, including its balance sheet, margins, and cash flow, paints a positive picture, two potential cautions emerge.

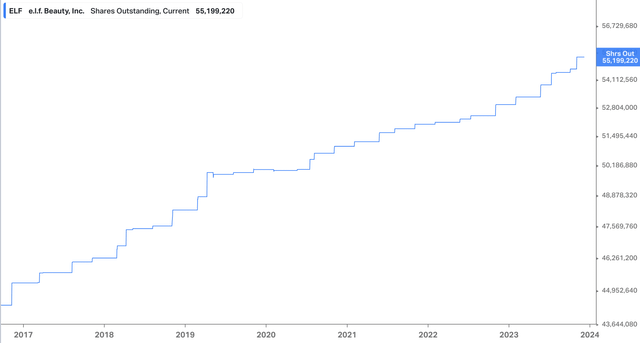

The first concern centers around the rising share count. While this isn’t inherently negative, it could suggest several things. ELF may be raising capital to fuel future growth and investments, which is positive. However, it could also direct to shareholder dilution, which is detrimental. Ultimately, management’s effectiveness in utilizing the raised capital plays a vital role in its impact on the stock price.

ELF’s share count has increased by 14.3% in the past five years and nearly 20% since its IPO nine years ago. Currently, there are approximately 55 million shares outstanding. Ideally, the company should utilize some of its excess capital to bring this number back down to around 50 million, thereby mitigating the negative effects of dilution.

ELF Shares Outstanding (Koyfin)

The second caution arises from the significant rise in inventory levels between Q2 and Q3 of 2024. Inventory jumped from $81 million in March to $147 million in September. This enhance could be interpreted in two ways. On the one hand, it could signal a slowdown in demand. Alternatively, it could be a strategic advance in preparation for the upcoming holiday season, anticipating increased demand.

ELF’s performance in Q3 and the holiday season will be crucial in determining the sustainability of its growth trajectory and providing clarity on these potential cautions.

Price Target and Valuations

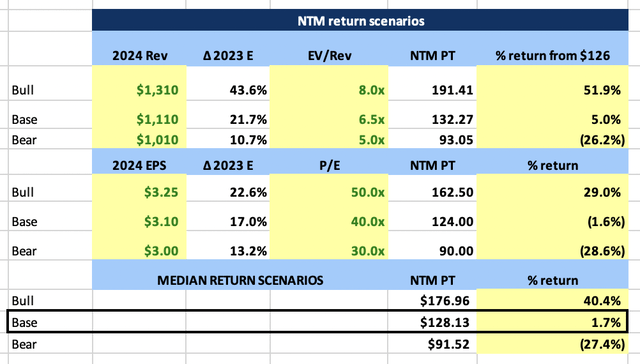

e.l.f. Beauty currently trades at a forward P/E ratio of around 40x. Utilizing its average valuations over the past five years, sector average valuations, and analyst estimates, we can create a price target scenario table encompassing bull, base, and bear case outlooks.

Based on this analysis, I currently rate the stock a hold, with a risk-reward ratio of approximately 1.5x following its significant run-up this year. The stock price is currently trading within a range consistent with my base case fair value, offering approximately 40% potential upside and 27% potential downside, aligning with the aforementioned risk-reward ratio.

ELF NTM Price Target Scenario (Author Calculations Based on Analyst Estimates From Data on Koyfin)

I believe the stock may encounter a period of consolidation until January 31st when the Q3 results are released. This consolidation could be followed by a run into earnings as they tend to surprise the upside.

Currently, analyst estimates project only 16% EPS growth in FY 2024, which I consider significantly conservative. I foresee these estimates will be revised upward after a strong Q3 performance, potentially propelling the stock price toward my $176 bull case target. This price target would translate to a $9.7 billion market cap, which I believe represents a more realistic long-term valuation for the company.

Despite my positive outlook on ELF’s long-term prospects, I currently suggest a “hold” rating for more risk-averse investors or those seeking optimal entry points. This cautious stance reflects the potential for a pullback, which would present a more attractive opportunity to accumulate shares through dollar-cost averaging.

Additional Risks

In addition to the two balance sheet risks mentioned earlier, I recognize two additional risks associated with the stock and the overall company.

First, ELF operates within a highly competitive field, facing stiff competition from major players appreciate Ulta, Sephora (OTCPK:LVMUY), Beauty Healthcare (SKIN), and other global players. This intense competition can exert downward pressure on profits and margins. However, ELF’s existing low-cost positioning and strong margins suggest they may be one of the companies dictating product prices. This gives them the flexibility to advance reduce prices if necessary to remain competitive while maintaining profitability, a luxury other competitors may not have.

The second risk relates to the previously discussed enhance in inventory. If consumer spending declines, I believe the beauty and makeup industry could be significantly impacted. In such a scenario, consumers may prioritize essentials or extend the lifespan of existing products. While consumer sentiment has improved, it remains fragile, as evidenced by the recent surge in gold prices as investors seek safe-haven assets.

However, the holiday season also presents potential opportunities for increased traffic and spending. As gift-giving season approaches, husbands and boyfriends may be looking for the perfect presents for their loved ones, while women may utilize holiday bonuses for personal purchases.

Therefore, it is crucial to consider both sides of the coin and ultimately foresee for concrete data and evidence from stores and financial reports before drawing conclusions. If a particular product or store experiences a surge in popularity, it will likely be reflected in the financials, as evidenced by the recent performance of companies appreciate Costco (COST).

Conclusion

ELF occupies a perfect position within the beauty industry. They cater effectively to customer demand for affordable products in a rapidly expanding market. The rise of social media has significantly contributed to the growing popularity of self-care and nightly skincare routines, trends that will undoubtedly benefit ELF in the long term. This is why I believe ELF presents a compelling long-term investment opportunity, having established a strong brand presence and possessing a robust, sustainable business model.

However, short-term risks remain that should be carefully considered before investing. These include valuation concerns, margin protection, maintaining accelerated growth, inventory levels, and rising share count. After thorough evaluation, I currently rate ELF a “hold” at its current price level. While I am comfortable holding my existing position, I would advise starting a new position slowly and utilizing market downturns as opportunities to acquire shares.

In my opinion, ELF’s long-term market cap will significantly exceed its current $7 billion valuation. However, the journey will not be entirely smooth. Look for opportunities to purchase shares when the valuation is attractive, fear prevails in the market, and the stock price experiences a reject.