Alina555

MGM Resorts (NYSE:MGM) stock has cooled off from its summer high, falling around 20% in that time amid the company’s disclosure of a cyberattack incident a couple of months ago. While that has had a modest impact on the firm’s domestic operations, the easing of COVID restrictions in Greater China means that the 2023 profit recovery story remains very much intact here. Indeed, operations in Macau are now firmly back in the black, while business in Vegas is booming notwithstanding the slight wobble in September. With the company back to full health and generating plenty of cash, now might be a good time to buy the dip in its shares.

Source: Seeking Alpha

MGM operates a number of integrated resorts in Las Vegas, including iconic properties appreciate the Bellagio, Mandalay Bay and Luxor, as well as regional resorts elsewhere in the US. The company also has exposure to two integrated resorts in Macau – MGM Macau and MGM Cotai – via a majority holding in MGM China Holdings (OTCPK:MCHVY)(OTCPK:MCHVF). For the nine months through Q3, Las Vegas Strip Resorts accounted for around 60% of MGM’s $3.8 billion in segmental-level pre-rent EBITDA (“EBITDAR”), followed by Regional Operations (~24%) and MGM China (~16%). By revenue type, casino margin accounts for the lion’s share of gross profit (~50%), followed by hotel rooms (~31%), food & beverage (~10%), and entertainment, retail & other (~9%).

MGM has been slow to regain its full earnings power following COVID, with China taking much longer to end restrictions compared to the US. Macau is a relatively small part of MGM’s overall business, but swinging from profit to loss (or vice versa for that matter) still has a significant impact on overall group finances.

Fortunately, Greater China has been free of COVID-related requirements since Q1, with the company reporting in its most recent 10-Q that its Macau properties were now fully open and operating free of restrictions.

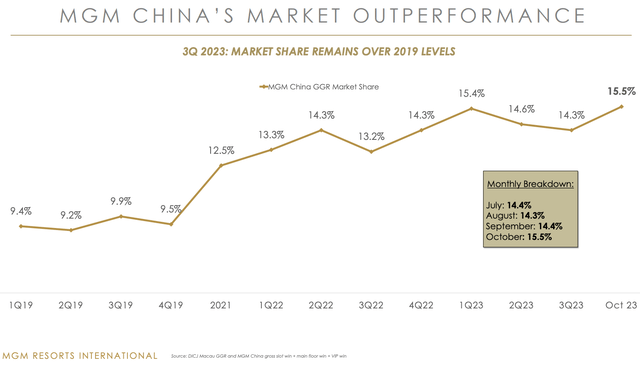

While the overall market in Macau remains relatively subdued, with gross gaming revenues still around 70% of 2019 levels amid lower Chinese visitor numbers, MGM China has also gained around six points of share in that time. As a result, revenue has increased beyond comparable-period 2019 levels, as has segmental EBITDAR, which at $226 million was around 23% higher than the same-period 2019 figure.

Source: MGM Resorts International Q3 Results Presentation

Somewhat ironically, it is the domestic properties that may be weighing a little on the stock. Now, quarter-to-quarter stock price movements are very often just noise. While that may still be the case here, MGM did suffer a well-publicized cyberattack incident in September. Vegas itself is actually booming right now. MGM reported Las Vegas hotel occupancy of 92% in Q3, down 84bps versus a year ago and about the same as Q3 2019. Average daily rate was up 4% year-on-year and a chunky 44% on Q3 2019. Note that the Q3 2023 occupancy figure includes a sharp drop to 88% in September as the cyber incident became public knowledge.

At the start of the third quarter, trends were solid in Las Vegas. July and August combined net revenues on a same-store basis were essentially flat versus 2022. Occupancy for the first two months was up 100 basis points year-over-year and then fell to 88% in September, down 6 percentage points year-over-year.

Jonathan Halkyard – CFO, MGM Resorts International, Q3 Earnings Call

Hotels typically display significant fixed cost leverage. Rent, wages, utility bills, insurance and so on all need to be paid regardless of swings in occupancy, room rates and casino revenue. Lower occupancy would have hurt, but a higher daily rate and casino performance (table games win percentage was high by historical standards) means that revenue was largely a wash on a same-store basis. The company did record extra expenses associated with the cyberattack, and that hit earnings, with Vegas same-store EBITDAR down 11% amid a 340bps fall in margin (around 60% of which was due to the cyberattack). Even so, the impact appears to be largely transient, with management reporting October occupancy of circa 95% across its Las Vegas properties. That is about as good as it gets.

That being said, we drove a sharp recovery in October with occupancy back up to 95% in Las Vegas.

Jonathan Halkyard – CFO, MGM Resorts International, Q3 Earnings Call

Whether the stock price refuse is partly a result of this or not, the dip does offer prospective investors a nice entry point here. With its Macau properties reporting a full recovery in casino revenue and revenue per available hotel room, MGM is probably in position to achieve its full earnings power for the first time since COVID. That means around $4.8 billion in forward annual EBITDAR. Subtracting cash rent on its properties, interest on conventional financial debt, taxes and CapEx, leaves around $1.4 billion in underlying free cash flow (“FCF”). The current market value of MGM stock is around $13.5 billion, leading to a sub-10x forward FCF multiple. That looks fairly cheap to me, notwithstanding the fact we are still at an attractive point in the business cycle.

Capital returns potential is also compelling. With MGM currently holding modest levels of conventional financial debt (albeit with significant lease obligations), management thinks there is room for the company to take on more debt in order to boost shareholder distributions even encourage:

It’s something we think about a great deal right now on a lease-adjusted basis, suggesting the lease payments by a multiple of 8x. Our leverage is about three and a half times. It’s a full turn below what we’ve talked about as our leverage cap. So a full turn on EBITDAR for us is over $4 billion. We have zero net debt right now. We’ve been aggressive repurchases of shares. I will say that at these levels of trading in our shares and the value that we think is in there. We would certainly consider taking on some additional financial leverage in order to enable encourage share repurchases.

Jonathan Halkyard – CFO, MGM Resorts International, Q3 Earnings Call

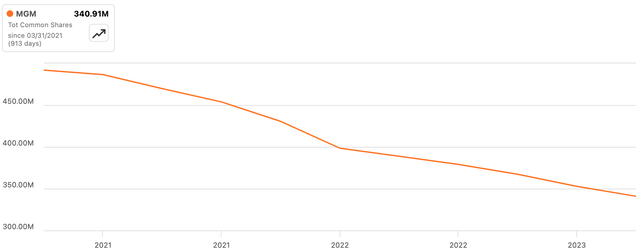

That very much suggests that capital returns are going to run ahead of free cash flow – a view supported by the announcement of a fresh $2 billion stock buyback program last month. That is on top of the $6.25 billion or so already repurchased between the start of 2021 through Q3 2023. As a result, MGM’s share count has fallen materially, and it looks likely to continue falling.

Source: Seeking Alpha

The usual caveats apply, of course. A major concern would be an economic slowdown or recession, leading to a drop in visitors to its resorts. As already mentioned, operating leverage is a hallmark of MGM’s business, so low points in the business cycle can direct to sharp declines in profit.

On the flip side, I would note some points in preserve of the longer-term investment case. Firstly, operating leverage cuts in the other direction too, especially as MGM currently spends around $1.75 billion in cash rent payments on its properties. Over the medium term, annual rent increases will be contractually limited to 2% across much of its portfolio. Should MGM grow revenues ahead of this, earnings growth would run higher still, all else equal.

Secondly, BetMGM, the company’s JV with Entain (OTCPK:GMVHF)(OTCPK:GMVHY), is just about swinging toward positive EBITDA. This has previously been a modest cash drain due to the investment required to get the venture to scale. That pendulum should now swing in the opposite direction as profitability ramps up, which would encourage preserve cash flows here.

Source: Seeking Alpha

Finally, I note that sell-side analysts also view the stock as undervalued, with the Street’s average target price landing around 40% higher than the prevailing quote. While macro risk could be a real concern in the near term, these shares look cheap enough for investors with a longer-term horizon. Buy.