Sean Rayford/Getty Images News

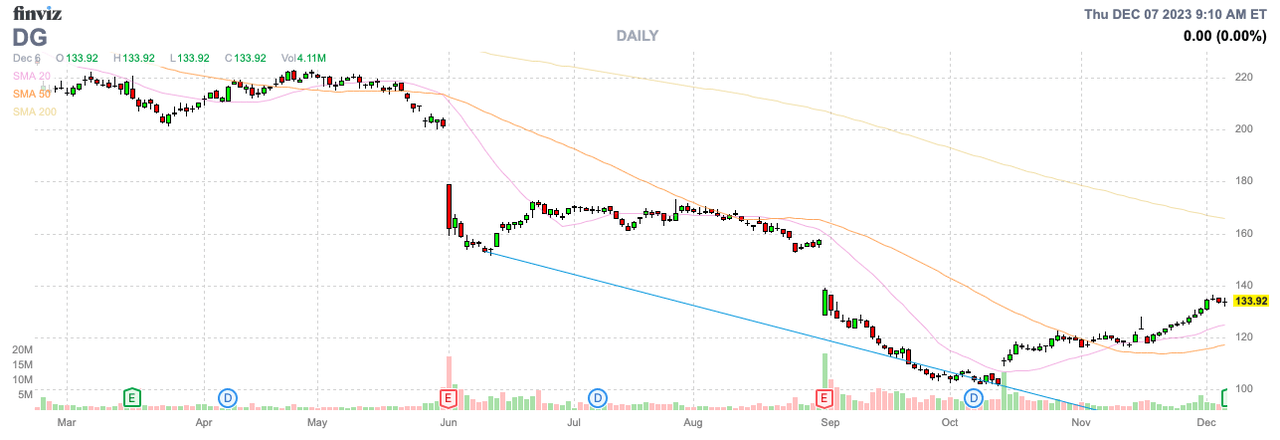

Dollar General Corporation (NYSE:DG) has surged since the re-hiring of former CEO Todd Vasos. The dollar retail store needs a major restructuring, and the former CEO has only been on the job for nearly 2 months, questioning the reasons for optimism. My investment thesis remains Neutral on the stock after the rally back above $130 and ongoing weak financial results.

Returning CEOs Take Time

Dollar General rehired CEO Todd Vasos on October 12. The executive led the dollar store concern from 2015 until November 2022.

Mr. Vasos wasn’t out of the job for even a year, and the stock collapsed from over $240 last November to just $100 before the CEO switch. In this period, retailers faced a tough environment, with excess inventory and higher wage costs leading to pressured results.

One has to really question whether Mr. Vasos would’ve avoided these problems, considering his policies were the driving forces of the results over the last year. Disney (DIS) is a prime example of a company that re-hired former CEO Bob Iger, and the stock has actually traded lower since the shift in the executive suite.

Mr. Iger was the CEO of Disney from 2005 to 2020, leaving in that February, though he remained the Executive Chairman until the end of 2021. Bob was re-hired in November 2022 (oddly when Mr. Vasos left Dollar General), with the stock soaring to over $110 in a few months, ultimately leading to a price down to $80 on the 1-year mark.

The issue with Disney was the failure of the streaming service to scale, while the movie segment struggled with weak ticket sales in 2023. A lot of the issues with the company were operations, such as streaming, implemented under the watch of Iger and not his replacement.

Whether or not Bob Chapek at Disney or Jeff Owens at Dollar General failed to execute on the returning CEOs previous plans will probably be debated for years. The key is that either it takes a while for a corporation to undue the damage requiring the CEO shuffle, or the original CEO was actually part of the problem that has led to the current weakness in the business.

Dollar General guided to negative comps for the FY23 of up to 1%. The retailer just reported quarterly results before the market opened on December 7 for the period ending November 3, with negative comp sales of 1.3%.

The re-hired CEO only returned to the business at the end of the quarter. The executive hasn’t had time to execute a restructuring scheme to get the company headed back in the right direction, and investors tend to rush any turnaround, considering the first full quarter under his leadership won’t be reported until mid-March.

Another issue facing investors is that Dollar General was under a major growth scheme during his first tenure as CEO. The company grew the store count by 7,000 to a current base of nearly 20,000 stores.

Mr. Vasos left the company right at the top after the Covid peak, and some of the current weakness appears related to operational issues. Dollar General faces some store cannibalization after the huge growth spurt of the last 7 years under his leadership, and the business plans to open 900 new stores in this fiscal year alone.

Another big question to haunt the stock going forward is the length of his engagement. Mr. Iger has spent a considerable amount of time discussing his current length of stay at Disney, which isn’t exactly conducive to long term stock gains.

Mr. Vasos is in a different position, only being 61 while Iger is already 72. Still, the CEO already left the company once, and one has to wonder how long the executive will stay in his 2nd stint as CEO.

Tough FQ3

The holiday period is set up as a tough period for retailers. Dollar General lowered expectations along with the announcement of the CEO change on October 12 to a FY23 EPS in the range of $7.10 to $7.60 versus guidance just a month prior of EPS in the range of $7.10 to $8.30.

Considering the recent guidance for FY23, investors should focus on the updated numbers for the year, not so much the FQ3 numbers on December 7. Analysts forecast Dollar General earned $1.22 in the October quarter with revenues of $9.64 billion, and the company delivered a slight beat at $1.26 with a $10 million beat.

The real focus will be on the above annual EPS target and these following numbers:

- Net sales growth in the range of 1.5% to 2.5%, which continues to include an anticipated negative impact of approximately two percentage points due to lapping the fiscal 2022 53rd week.

- Same-store sales growth in the range of a refuse of approximately 1.0% to flat.

With Dollar General adding so many stores during the returning CEOs prior period, a key focus is definitely same-store sales. The retailer shouldn’t be aggressively moving forward adding new stores with negative comp sales, but the company just announced plans to proceed forward with another 800 new stores in FY25.

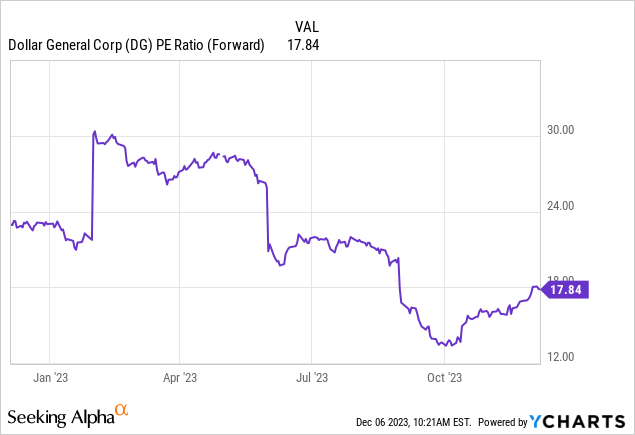

The stock has already soared, yet the CEO hasn’t even turned around the business yet. Dollar General already trades at 17x FY25 EPS estimates of $7.85.

The market has definitely jumped into the stock, hoping the retailer can return to the EPS targets in the $12+ range before Dollar General ran into weak sales. The returning CEO will have to answer how higher wages and costs can be profitably absorbed in a dollar concept with negative comp sales now while still building a lot of new stores.

Takeaway

The key investor takeaway is that investors have rushed into Dollar General Corporation stock too quickly. The new CEO faces a tough turnaround in the year ahead, and the company could possibly announce a major restructuring, with Mr. Vasos apparently still sticking to his prior scheme of massive store growth. Investors should expect for a potential restructuring before rushing back into the stock.