Dilok Klaisataporn/iStock via Getty Images

Grabbing the wheel: putting money to work

2024 Outlook

The new regime of greater macro and market volatility has resulted in greater uncertainty and dispersion of returns. We believe an active approach to managing investment portfolios will carry greater rewards as a result. This is a sea change from relying on the one-and-done asset allocations that worked so well during the Great Moderation, the long period of stable growth and inflation. That period is over. We believe this is a time to grab the investing wheel – and seize the opportunities the new regime has on offer.

Higher rates and greater volatility define the new regime. It’s a big change from the decade following the global financial crisis. Ever- expanding production capacity allowed central banks to stabilize economies and shore up growth through loose monetary policy. That helped suppress macro and market volatility, and stoked bull markets in both stocks and bonds. Investors could rely on static, broad asset class allocations for returns – and gained little advantage from differentiated insights on the macro outlook.

Today, we think the flipside is true. Production constraints abound. Central banks face tougher trade-offs in fighting inflation – and can’t answer to faltering growth appreciate they used to. This leads to a wider set of outcomes, creating greater uncertainty for central banks and investors.

There’s a temptation to elucidate the new regime by taking a classic business cycle view of the current environment, we believe. Markets are swinging between hopes for a soft landing and recession fears as a result. This misses the point: the economy is normalizing from the pandemic and being shaped by structural drivers: shrinking workforces, geopolitical fragmentation and the low-carbon transition. The resulting disconnect between the cyclical narrative and structural reality is advocate stoking volatility, we believe.

Seemingly strong U.S. growth actually reflects an economy that’s still climbing out of a deep hole created by the pandemic shock – and tracking a weak growth path. What matters most, in our view, is that the environment implies persistently higher interest rates and tighter financial conditions. Financial markets are still adjusting to this new regime, and that’s why context is key for managing macro risk, our first theme.

We think macro insights will be rewarded in the new regime. Greater volatility and dispersion of returns create space for investment expertise to shine, as detailed in our second theme – steering portfolio outcomes. This involves being dynamic with indexing and alpha-seeking strategies, while staying selective and seeking out mispricings.

One way to drive portfolio outcomes is by harnessing mega forces– our third theme. These are five structural forces we see driving returns now and into the future. They have become important portfolio building blocks, in our view.

Our bottom line for 2024: Investors need to take a more active approach to their portfolios. This is not a time to switch on the investing auto pilot; it’s a time to take the controls. It’s important to be deliberate in taking portfolio risk, in our view, and we expect to deploy more risk over the next year.

Setting the scene: Context is everything

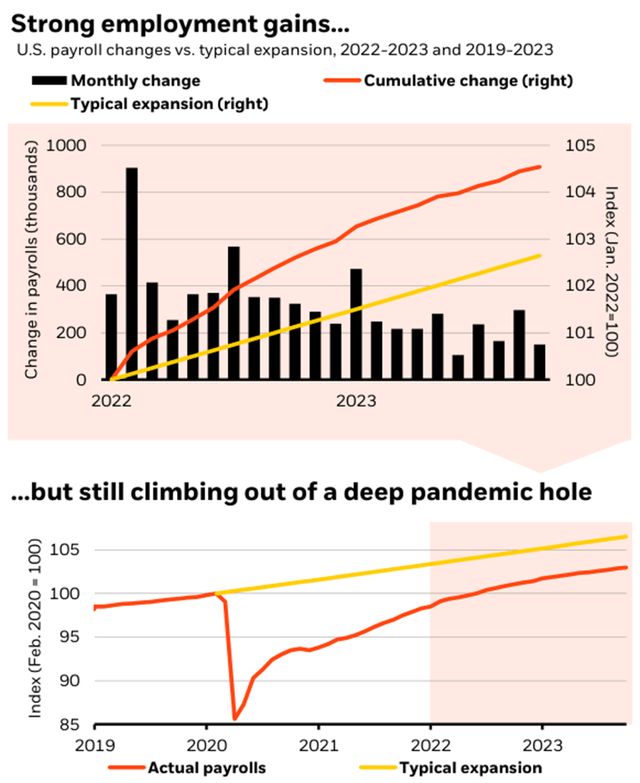

| Source: BlackRock Investment set up, U.S. Bureau of Labor Statistics, with data from Haver Analytics, December 2023. Notes: The charts show U.S. nonfarm payrolls. The orange lines show the actual level of total nonfarm payroll employment indexed to two different start dates: in the upper chart, January 2022=100 and in the lower chart February 2020=100. The yellow lines in both charts show hypothetical payroll employment as if the economy had continued to grow at the average rate observed during U.S. post-1945 expansions. The black bars in the upper chart show actual monthly payroll gains (in thousands) since January 2022. |

Multiple times in 2023, market hopes have been revived that the U.S. economy can achieve a soft landing – or inflation getting back to the Fed’s 2% target without a recession. What’s fueling those hopes?

In contrast to other major economies, the U.S. grew at a robust clip in the third quarter of 2023. Core inflation has fallen sharply. And nearly 7 million new jobs have been created since January 2022 – a phenomenal pace of jobs growth compared with a typical economic expansion. See the chart above.

But zoom out and look at the bigger picture (chart above): The economy has just been climbing out of the pandemic hole:

- Some 22 million jobs were lost when the pandemic struck. Strong job gains since then largely ponder the recouping of those lost. The level of employment is well below the track we would have expected to be on before the pandemic.

- Looking at broader economic activity, the U.S. economy has grown by less than 1.8% a year, on average, since the pandemic. That’s well below the trend we would have expected pre-pandemic – and well below where the consensus and Federal Reserve had expected. That’s nothing to be excited about.

- This resulted in even with more muted growth, historically low unemployment and higher inflation.

Our bottom line: Something has changed – and it’s structural in nature. We are on a weaker growth path and got here with more inflation, higher interest rates and much higher debt levels. The upshot for investors? We think the key is to focus on how the economy and markets are adjusting to the new regime. Adopting the typical cyclical playbook may be misguided.

Setting the scene: Structural shift

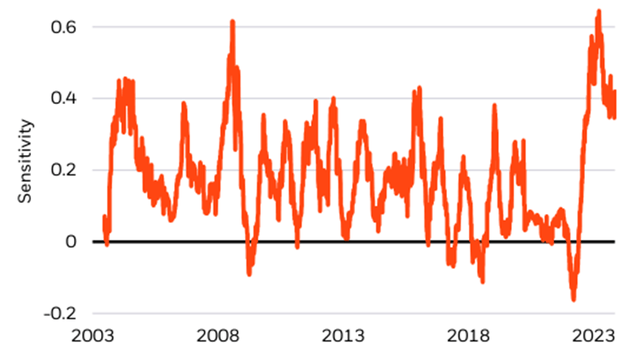

Yield swings on short-term surprises

Sensitivity of U.S. 10-year yield to economic surprises, 2003-2023

|

Chart takeaway: Data surprises are driving the sharpest, sustained swings in U.S. 10-year Treasury yields of the past two decades. We believe this reflects greater uncertainty from investors still trying to view the economy through the lens of a typical business cycle. Source: BlackRock Investment set up, with data from LSEG Datastream, December 2023. Notes: The chart shows how sensitive the U.S. 10-year Treasury yield is to economic surprises. This is calculated by using regression analysis to assess the relationship between U.S. 10-year Treasury yields and the Citi Economics Surprise Index over a rolling six-month window. The sensitivity is how closely movements of the U.S. 10-year Treasury yield align with fluctuations in the Citi Economics Surprise Index, relative to how much the Surprise index itself varies. This analysis is only an assess of the relationship between the 10-year Treasury yield and economic surprises. Past performance is no assure of future results. |

If central banks want to stop inflation from resurging, we think they will need to keep holding back economic activity with higher policy rates.

Markets have been flip-flopping between hopes for a soft economic landing and fears of yet higher rates that ultimately result in recession. This has created volatility, as the chart shows.

The U.S. economy has been navigating two large shocks, in our view. The first was the pandemic. Over the past two years, most new jobs created have been due to the restart of activity after shutdowns.

A shift in consumer spending drove up inflation by creating a mismatch between what people wanted to buy and what the economy was set up to produce. That mismatch is now resolving, and inflation has been falling as a result.

As the effects of the pandemic shock recede, the effects of the second, more structural one are becoming clearer: A worker shortage has emerged, as a growing share of the U.S. population ages into retirement.

That’s why unemployment is at historic lows – even though U.S. growth has averaged well below its pre-Covid rate.

The workforce is growing more slowly in Europe and China, too, and it’s one of several long-term production constraints we think will hinder many economies from growing at their pre-pandemic pace without sparking renewed inflation.

Rising production costs in a fragmenting world will also push up inflation across major economies over the longer term, in our view. And the transition to a low-carbon economy is creating price pressures as the energy system is being rewired.

This means central banks face a tough trade-off. If they want to stop inflation resurging, they will need to keep policy tight. We think policy rates are poised to settle well above pre-pandemic norms. Ultimately, we see central banks living with higher inflation amid hefty government spending and debt loads.

Our bottom line: This is a regime of slower growth, higher inflation, higher interest rates – and greater volatility.

Theme 1: Managing macro risk

Adjusting to new regime

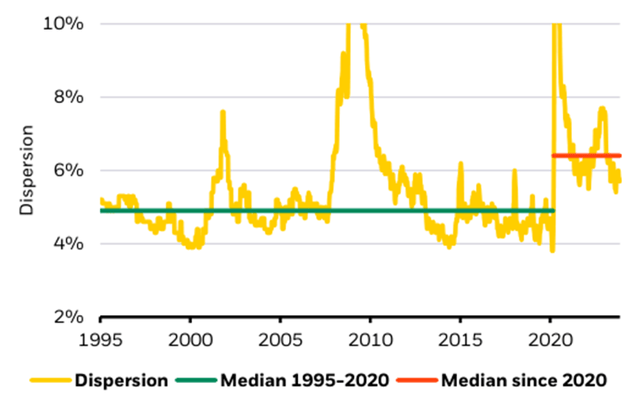

Dispersion of U.S. equity analyst earnings estimates, 1995-2023

|

Chart takeaway: During the Great Moderation, analyst views of expected company earnings were much more grouped together outside of major shocks. Now they are more dispersed, showing that an environment of higher inflation and interest rates makes the outlook harder to read. Source: BlackRock Investment set up, LSEG Datastream, December 2023. Notes: The chart shows the aggregate standard deviation of analyst earnings estimates for S&P companies. The green line shows the median from 1995 to end January 2020, the orange line shows the median since February 2020 |

The macro outlook is more uncertain. Exposures to macro risk can be punished as well as rewarded, so we think investors should be deliberate about which exposures they take.

This is a regime shift, not about whether a recession happens. So it doesn’t make sense for investors to expect for the macro environment to better, in our view. We think investors should seek to neutralize macro exposures or – if they have high conviction – be deliberate about which exposures they take.

We see more scope to outperform the market now than in the less volatile Great Moderation.

Production constraints abound. Central banks face tougher trade- offs in fighting inflation and can’t answer to faltering growth appreciate before. We think this leads to a wider dispersion of views.

For example, analyst estimates of future S&P 500 equity earnings are more dispersed now than before the pandemic, according to LSEG data. See the chart. They are having a harder time reading the earnings outlook. So macro insight is likely to be more rewarded.

Still, we think investors need to be alert to risks around macro exposures in the new regime.

First, markets are slowly adjusting to structurally higher inflation and policy rates, but it is uneven. U.S. 10- year yields surged to 16-year highs around 5%, for example. But most DM equity earnings yields haven’t risen much. This adjustment matters more than if a technical recession occurs, in our view, and keeps us cautious on broad exposures.

Second, structurally lower growth and higher rates pose a problem for ballooning U.S. government debt. If borrowing costs from higher yields stay near 5%, the government could spend more on interest payments than Medicare in a few years. This increases the long-run risk of higher inflation as central banks become less aggressive on inflation.

We also see a rise in term premium, or the compensation investors demand for the risk of holding long- term bonds. This, plus our expectation of more yield volatility, keeps us tactically neutral and strategically underweight long-term

U.S. Treasuries. Our largest strategic overweight is instead to inflation- linked bonds.

Theme 2: Steering portfolio outcomes

More dynamic

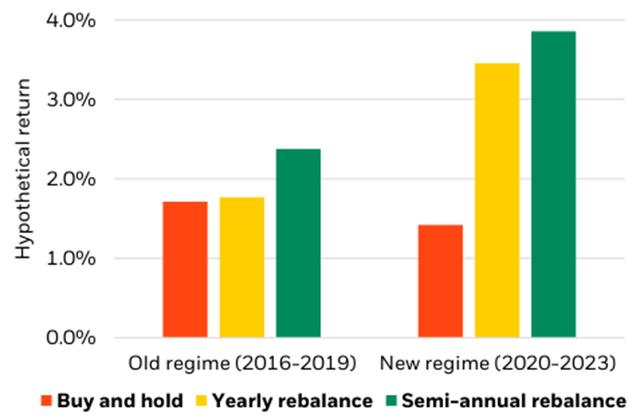

Hypothetical impact of rebalancing on U.S. equity returns

|

Chart takeaway: Taking a more dynamic investing approach in in the new regime would have likely outperformed a buy-and-hold strategy to a much greater extent than before the pandemic. Past performance is not a reliable indicator of future performance. Index returns do not account for fees. It is not possible to invest directly in an index. Source: BlackRock Investment set up, MSCI with data from Bloomberg, December 2023. Notes: The chart shows monthly U.S. equity returns – based on the MSCI USA – in the old and new regime under three scenarios: keeping the holdings unchanged (buy-and-hold), yearly rebalances and semi-annual rebalances. The rebalances improve the portfolio for returns, diversification and risk with perfect foresight of equity sector returns in the MSCI USA index. This analysis uses historical returns and has been conducted with the benefit of hindsight. Future returns may vary and these results may not be the same other asset classes. It does not consider potential transaction costs that may detract from returns. It also does not represent an actual portfolio and is shown for illustrative purposes only. |

We believe the new regime rewards an active approach to portfolios. We don’t see one-and-done strategies working as in the past.

Heightened volatility and dispersion call for an active approach to managing portfolios, in our view.

Structurally higher policy rates should eventually mean higher returns on all assets. But not all asset valuations have adjusted, we think. And static exposures to broad asset classes are unlikely to deliver the risk-adjusted returns they did during the Great Moderation’s bull markets in both stocks and bonds.

We see alpha, or above-benchmark returns, playing a bigger role in the new regime – and believe a more dynamic portfolio approach is warranted when cash offers attractive returns.

What if you were able to accurately forecast U.S. equity sector returns with perfect foresight? Acting on this hypothetical ability more frequently would have paid off much more since 2020 (see the right bars in the chart) than in the four years prior left bars). The upshot? Good insight, acted upon in a timely manner, has yielded greater rewards than buy- and-hold strategies since 2020.

Investors can also thrive in the new regime by getting granular with portfolio allocations. For example, returns on short-term Treasuries have outpaced those on long-term bonds since mid-July 2023, according to LSEG data, as investors started to demand compensation for taking long-term interest rate risk.

Lastly, dispersion of returns has risen in the new regime. This means security selection is likely to be more impactful, in our view. We see a wide arsenal of tools and strategies to help outperform static portfolios. Investors can blend indexes to build core allocations, carry out alpha ideas and hedge risk.

Our bottom line: Investment expertise is likely to give portfolios an edge in the new regime.

Mega forces and the macro: these are inspirations, not constraints, in finding alpha. – Raffaele Savi, Global Head of BlackRock Systematic

Theme 3: Harnessing mega forces

Mega force at work

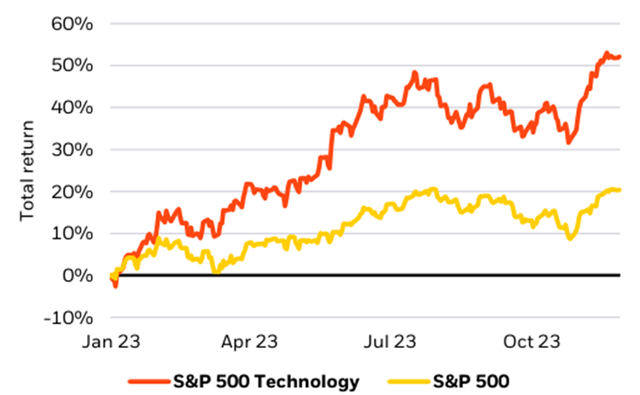

S&P tech sector vs. S&P 500 performance, 2023 year-to-date

|

Chart takeaway: Investor enthusiasm for AI and digital tech has offset the drag of rising yields. That has pushed U.S. tech stocks to easily outshine the broader market in 2023. Past performance is not a reliable indicator of future results. Indexreturns do not account for fees. It is not possible to invest directly in an index. Source: BlackRock Investment set up, with data from LSEG Datastream, December 2023. Notes: The chart shows the total year-to-date returns in U.S. dollar terms for the S&P 500 Technology sector (orange line) and the S&P 500 index (yellow line). |

Mega forces are key drivers of the new regime, affecting the long-term growth and inflation outlook and creating shifts in profitability. We see them as a source of return now and far into the future.

We think mega forces are another way to steer portfolios – and think about portfolio building blocks that transcend traditional asset classes. They stand out as drivers of corporate profits on their own, in our view, and so could offer potential opportunities that may be uncorrelated to macro cycles.

These forces are already reshaping markets. Take digital disruption and artificial intelligence (‘AI’). The chart illustrates the outperformance of U.S. tech relative to the broader market this year. We think this reflects how quickly markets adopt such fundamental shifts in the market outlook.

We think the winners and losers can broaden the AI tech stack. When incorporating this mega force into our tactical views, it can push up our stance on DM equities closer to neutral even if the macro backdrop isn’t rosy. See pages 8 and 14.

That’s just one example of why we think harnessing mega forces will enable investors to outperform simple, static allocations.

The far-reaching consequences of mega forces create new investment opportunities – and markets can be slow to price them in.

Capital pressures on banks are opening a path for private credit and non-banks to fill the lending void – part of the future of finance. Private credit can be an illiquid asset class not suitable for all investors.

Aging populations in major economies are poised to limit how much countries can produce and grow – depending on how they adjust in demographic divergence.

Climate resilience is emerging as a new investment theme within the low-carbon transition, in our view. As climate damages mount, we are seeing increased demand for solutions that help economies prepare for, adjust to and withstand climate hazards, and rebuild after damages. See page 9.

We see geopolitical fragmentation and economic competition driving a surge of investment in strategic sectors appreciate tech, energy and defense. See page 10.

Mega Forces: AI – intelligence revolution

The AI technology stack

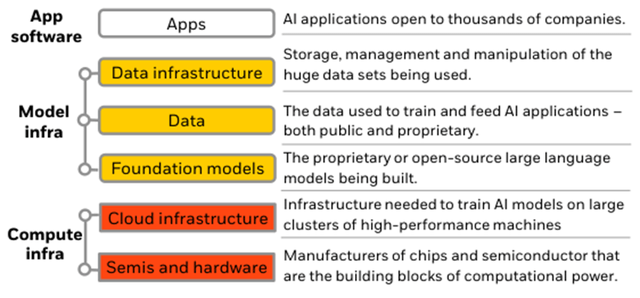

BlackRock view of tech need to progress AI applications, December 2023

|

Chart takeaway: We see investment opportunities moving up the stack as technology evolves – from hardware manufacturers to digital and data infrastructure and ultimately to applications. Source: BlackRock Investment set up, December 2023. Notes: The schematic shows the technologies we think will be needed to progress AI applications. Each layer builds on the one preceding as technologies get “stacked” on top of one another, enabling advocate innovation. The schematic is for illustrative purposes only and intended as a guide based on what we know today. As the AI ecosystem evolves, some categories may be replaced by newer ones. References to securities are shown for illustrative purposes only and should not be construed as investment advice or a recommendation to buy or sell. |

We think the overarching race to build the smartest machines is akin to a revolution – appreciate the industrial and information revolutions of the past.

Advances in computing hardware and deep learning innovations led to an inflection point for AI in late 2022. We think advances from here are likely to be exponential as innovation snowballs.

Yet tracking investment opportunities across geographies and sectors comes with high uncertainty. The technology “stack” – layers of technology built on top of each other that enable advocate innovation — may offer a roadmap to help evaluate the investment opportunities. See the chart.

The bottom layer (in orange in the schematic) covers cloud infrastructure and chips – the building blocks. The second layer (in yellow) covers models, data and data infrastructure. The last layer – in white – comprises the apps that harness the innovation. We think we are somewhere between the first and second layers, with the last one likely coming next. We see the entire tech industry – led by a handful of large tech firms – pivoting their business focus to AI.

That suggests we may be just at the cusp of this intelligence revolution, in our view. Implications likely go beyond the near-term focus on productivity gains. Our early research shows a potential positive correlation between a pickup in AI patents and broad earnings growth..

We also find that investors are ascribing a rising economic value to these patents. Yet not all patents guide to profitable enterprises, and their future value is highly uncertain.

We’re overweight the AI theme in DM stocks on a six-to-12-month horizon. We see the tech sector’s earnings resilience persisting and expect it to be major driver of overall

U.S. corporate profit growth in 2024.

AI is a major positive – both for earnings growth and productivity. – Simona Paravani- Mellinghoff, Global CIO, BlackRock Multi- Asset Strategies & Solutions

Mega Forces: Investing in climate resilience

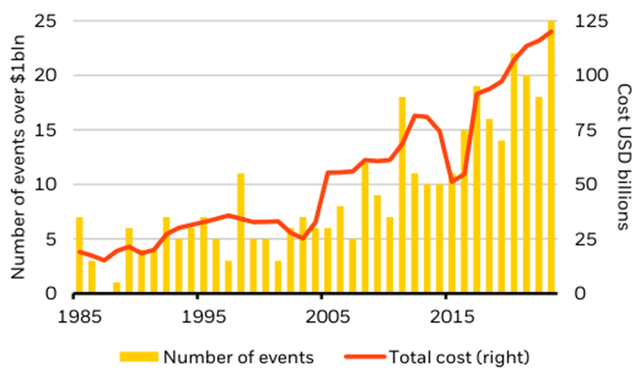

Real physical damages mount

U.S. events with inflation-adjusted losses of $1 billion, 1985-2023

|

Chart takeaway: The number of climate-related events with damages totaling more than $1 billion has steadily increased over the past roughly three decades. The U.S. hit a record number of such events just nine months into 2023. Sources: NOAA National Centers for Environmental Information (NCEI) U.S. Billion-Dollar Weather and Climate Disasters (2023), December2023. Notes: The bars (yellow) show the number of climate events with losses greater than US$1 billion. The data include droughts, flooding, severe storms, hurricanes, wildfires, winter storms and freezes. The orange line shows the total cost as a 10-year rolling average. The data are adjusted for inflation using 2022 dollars. All currency figures are in U.S. dollars. |

Markets may be underappreciating the prospects for climate resilience to become a mainstream investment theme over time, we think.

The low-carbon transition is one of the five mega forces playing out in markets today. We launched the BlackRock Investment set up Transition Scenario to help investors pilot its risks and opportunities, with a focus on the energy transition. This is not just about identifying opportunities in renewables; traditional energy companies can also outperform, especially when there are supply- demand mismatches.

The energy transition tends to get the headlines, but we see a related theme becoming an important investment story: climate resilience. This is the ability to prepare for, adjust to and withstand climate hazards, and to rebuild after climate damage. Think early monitoring systems to forecast floods, air conditioning to cope with heatwaves, or retrofitting buildings to better withstand extreme weather. With climate damages set to keep mounting in coming years, it will take extensive investment to build society’s resilience to them.

Just how big will those damages be? It’s hard to put a number on the impact on human health and well- being. The quantifiable economic damage is growing fast, as the chart shows. We already see demand growing for products and services that build climate resilience. Markets may be underappreciating how this can become a mainstream investment theme over time.

In our recent paper, we divide this theme into three sub-themes: assessing and quantifying risks, managing risk and rebuilding physical infrastructure. That helps us build a framework to recognize opportunities that cut across sectors, such as industrials and technology, and asset classes.

We see opportunities in climate resilience solutions offering flood, fire and drought resistance. – Olivia Markham, Portfolio Manager, Thematic and Sectors, BlackRock Fundamental Equity

Mega Forces: Deepening fragmentation

Paying more attention

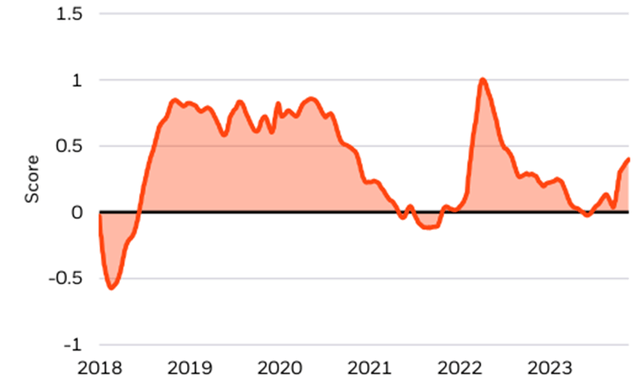

BlackRock Geopolitical Risk Dashboard, 2018-2023

|

Chart takeaway: Market attention to geopolitics has hit its highest this year, according to our BlackRock Geopolitical Risk Indicator. Source: BlackRock Investment set up. December 2023. The BlackRock Geopolitical Risk Indicator (BGRI) tracks the relative frequency of brokerage reports (via LSEG) and financial news stories (Dow Jones News) associated with specific geopolitical risks. We adjust for whether the sentiment in the text of articles is positive or negative, and then assign a score. This score reflects the level of market attention to each risk versus a 5- year history. We assign a heavier weight to brokerage reports than other media sources since we want to measure the market’s attention to any particular risk, not the public’s. |

The rewiring of economic ties along geopolitical lines is set to accelerate. We are focused on the investment opportunities this creates.

Cascading crises have accelerated global fragmentation and the rise of competing geopolitical and economic blocs, in our view. Our BlackRock Geopolitical Risk Indicator is elevated – see chart – suggesting markets are paying more attention than before.

Should investors hunker down as a result – and keep their investments close to home? We don’t think so. The new mantra of resilience over economic efficiency may raise costs – but also presents opportunities. Countries appreciate Vietnam and Mexico could benefit from the diversification of supply chains, in our view. And we see opportunities in the Gulf states, India and Brazil. They are pursuing ties with multiple blocs and have valuable resources and supply chain inputs.

In this more competitive world, we expect a surge of investment in strategic sectors appreciate tech, energy, defense and infrastructure. We also see opportunities in firms with expertise in managing and reducing cybersecurity risks.

War in the Middle East, ongoing conflict between Russia and Ukraine, and structural competition between the U.S. and China mean increased geopolitical risks. The number of volatile situations worldwide is the highest in decades, according to the UN. And 2024 is set be the biggest election year in history, with more than half the world population voting. We see the U.S. and Taiwan elections as particularly significant.

Navigating this new world order isn’t necessarily about avoiding risks or positioning for specific events, in our view, but about whole portfolio strategies that aim to both seize its opportunities and mitigate risks.

Repeated shocks are driving long-term, structural changes in the world order. – Tom Donilon, Chairman, BlackRock Investment set up

Focus- Regions: Moving away from home

Reforms take root

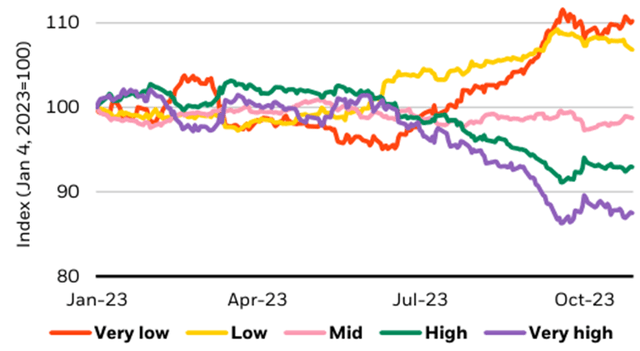

Japan: equity relative performance by price-to-book ratio, 2023

|

Chart takeaway: Shares of Japanese firms with low price-to- book ratios have outperformed as investors expect such companies will double down on steps to boost shareholder value. Past performance is no assure of future results. Source: BlackRock Investment set up, with data from QUICK and Daiwa. December 2023. Notes: The chart illustrates the year-to-date rebased performance of the TOPIX index constituents, grouped into five buckets based on their price-to-book (P/B) ratios. The process of grouping involves arranging the constituents in ascending order by their P/B ratios and then dividing them into five market-cap-weighted buckets, ensuring each bucket represents an equal segment of the market’s total capitalization. For example, the “Very low” bucket comprises constituents with lowest P/B ratio. The buckets are rebalanced monthly. |

Selectivity across geographies is an important layer of our playbook that aims to achieve above-benchmark returns in the new regime.

We see greater dispersion of returns unfolding across global markets, creating opportunities for investors who look beyond their home markets. We get selective across regions and countries, assessing valuations, earnings prospects and what’s in the price.

Take Japan. We think 2023 was a pivotal year for the country. We upgraded Japan twice this year on appealing valuations, earnings growth, and as corporate reforms aimed at boosting shareholder take root. It remains our strongest DM equity view. Investors are latching on, partly explaining the broad market’s surge this year.

Under the hood, a more nuanced proceed is unfolding. The chart shows the outperformance this year of companies that sit at the low end of price-to-book ratios – a reflection of investors getting in front of more value-enhancing measures coming at such firms. We still see overall valuations as attractive. One risk is potentially tighter monetary policy

– and why we prefer to take equity risk without hedging for currency.

We have maintained a broad preference for emerging market (‘EM’) assets over DMs. EMs are not disconnected from global growth, so selectivity is important, in our view.

Mega forces may offer abundant EM equity opportunities. India’s system of digital payments bodes well for the future of finance there. We believe it could pave the way for a credit boom as banks adjust lending. We think the low-carbon transition presents an important opportunity for Latin America, especially for countries that hold large reserves of key resources appreciate copper and lithium. And U.S. companies bringing operations and production closer to home could benefit countries appreciate Mexico.

Japan and India are among the beneficiaries from global fragmentation. – Belinda Boa, CIO of Emerging Markets, BlackRock Fundamental Equity

Focus – Real assets: Real estate opportunities

Private lags public

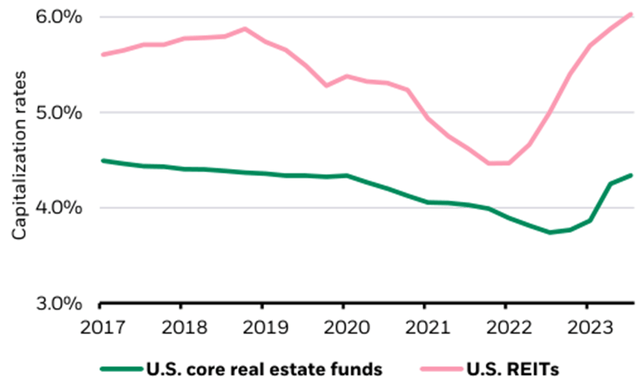

Real estate capitalization rates, 2017-2023

|

Chart takeaway: Real estate investment trusts (REITs) valuations have reacted to rising interest rates faster and advocate than private real estate. We think that makes publicly listed REITs more attractive relative to private real estate. Sources: BlackRock Investment set up, NCREIF and Greenstreet, December 2023. Notes: The chart shows historical capitalization rates (green line) and REITs (pink line). Past performance is no assure of future results. |

Real estate valuations have adjusted differently to the new regime. We think structurally higher inflation should benefit real assets in strategic portfolios longer term.

We think inflation will be structurally higher and see real estate and infrastructure playing a key role in strategic portfolios as a result. Why? Some real asset values or cash flows are linked to measures that correlate with inflation – think property prices or rental income.

But the macro matters here too. Low interest rates – previously a benefit to returns – have given way to structurally higher financing costs. The question now: how much is in the price today? We had expected valuations for core real estate to adjust to rising interest rates and financing costs – leading us to turn cautious on the asset class in June 2022.

Valuations have adjusted – but we

think there’s more to go. Capitalization (cap) rates – the ratio of a property’s income to its price – are the commonly referenced valuation metric for real estate. As rates and yields surged, we expected cap rates for both private and public real estate to rise, too.

The reality? Cap rates for U.S. core real estate funds have moved less than publicly traded real estate investment trusts (REITs). See the chart. We think this shows public markets better ponder the new backdrop.

Cap rates at the aggregate level aren’t the full story given large dispersion across geographies, sectors and strategy types. Plus, the nature of the underlying assets is why they differ in their relative attraction. U.S. REITs invest in a wider array of properties than core real estate funds, such as data centers and healthcare. That means some REITs could be more resilient to a weaker economy – and is why it’s key to go beyond a simple mantra of buying real estate in inflationary times.

Our bottom line: Some public real asset prices have adjusted more than some private counterparts. Capturing the opportunities requires selectivity, understanding what’s in the price and having the agility to shift between real assets at a granular level, in our view.

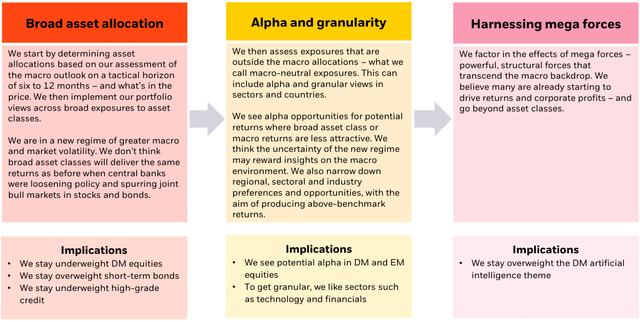

Views: Behind the views

Explaining our approach to tactical asset allocation

Broad and static investment solutions won’t take you as far in this new regime as in the past, in our view. We think it calls for selectivity and granularity instead. We advocate extend our investment playbook to include alpha.

|

This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a assure of future results. This information should not be relied upon by the reader as research or investment advice regarding any funds, strategy or security in particular. The statements on alpha do not consider fees. Source: BlackRock Investment set up, December 2023. |

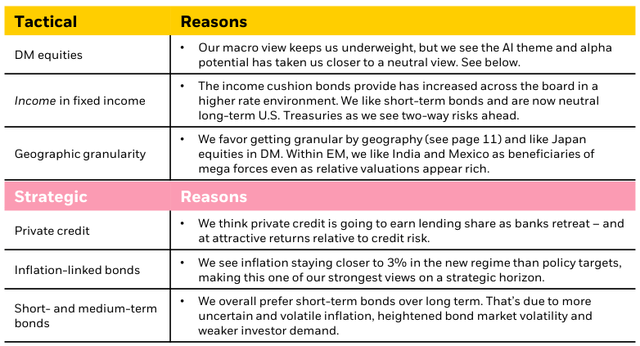

Views: Dynamic and nimble

Big calls

Our highest conviction views on tactical (6-12 month) and strategic (long-term) horizons, December 2023

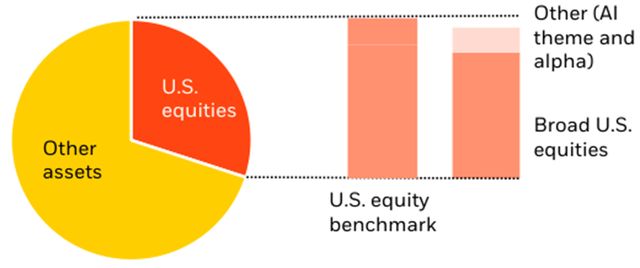

Deep dive of including the mega force overweight on overall U.S. equity view

|

We are underweight broad U.S. equities. But our AI theme has taken us closer to neutral. Note: Views are from a U.S. dollar perspective, December 2023. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a assure of future results. This information should not be relied upon by the reader as research or investment advice regarding any particular funds, strategy or security. |

Our core conviction is that investors need to be more dynamic with portfolios in the new regime. The one- and-done approach to asset allocation simply won’t work as it did before.

We have updated how we present both our tactical and strategic views to focus on where we have the strongest conviction on both time horizons – but with an emphasis on staying nimble and getting granular. We also break down how we now build on our macro view at the asset class level to blend a view of where we see potential return opportunities outside of such broad exposures.

On a tactical horizon, our overall macro view would keep us underweight DM equities as a standalone because we expect growth to stay stagnant with persistent inflation, prompting central banks to keep policy rates higher for longer. But we find greater alpha opportunities in DM stocks. When incorporating the AI theme and alpha, our overall view is more neutral on U.S. equities. See the example on the right. We stay positive on Japan as laid out on page 11. And we keep favoring the AI theme in DM stocks.

Strategically, it is more of an income story. Our inflation view keeps us maximum overweight inflation-linked bonds. We still appreciate income within private markets. And within DM government bonds, we still prefer short- and medium-term maturities.

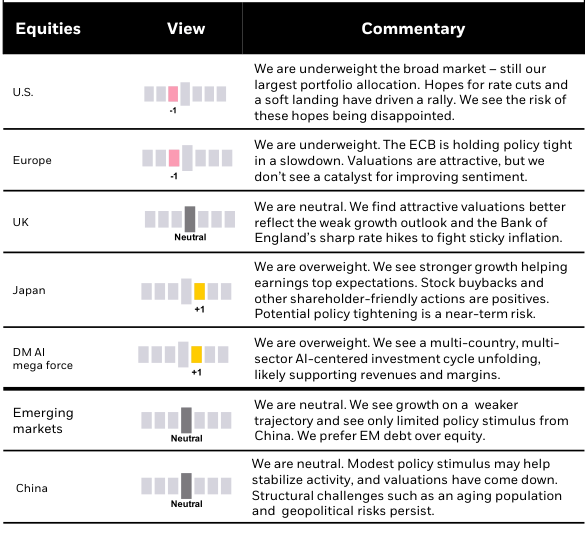

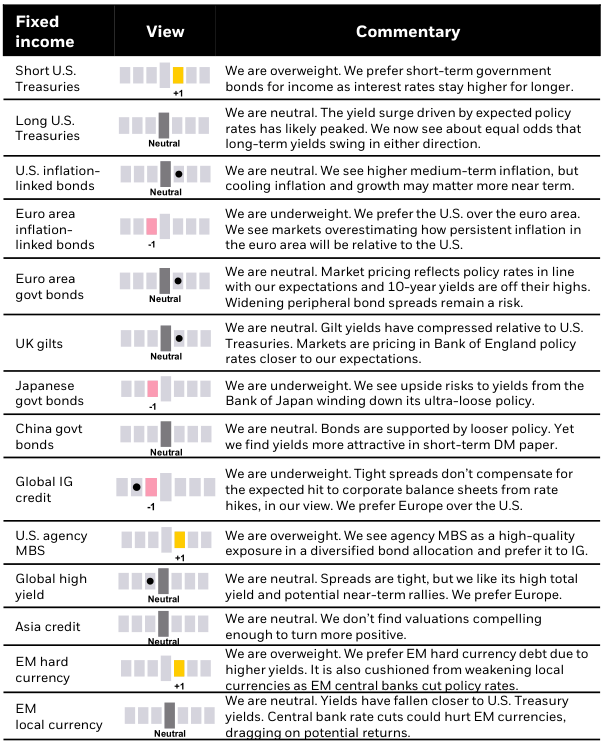

Tactical granular views

Six- to 12-month tactical views on selected assets vs. broad global asset classes by level of conviction, December 2023

|

Our approach is to first set up asset allocations based on our macro outlook – and what’s in the price. The table below reflects this. It leaves aside the opportunity for alpha, or the potential to create above-benchmark returns. The new regime is not conducive to static exposures to broad asset classes, in our view, but it is creating more space for alpha. For example, the alpha opportunity in highly efficient DM equities markets historically has been low. That’s no longer the case, we think, thanks to greater volatility, macro uncertainty and dispersion of returns. The new regime puts a premium on insights and skill, in our view. |

Past performance is not a reliable indicator of current or future results. It is not possible to invest directly in an index. The statements on alpha do not consider fees. Note: Views are from a U.S. dollar perspective. This material represents an

assessment of the market environment at a specific time and is not intended to be a forecast or assure of future results. This information should not be relied upon as investment advice regarding any particular fund, strategy or security.

BlackRock Investment set up

The BlackRock Investment set up (‘BII’) leverages the firm’s expertise and generates proprietary research to furnish insights on macroeconomics, sustainable investing, geopolitics and portfolio construction to help Blackrock’s portfolio managers and clients pilot financial markets. BII offers strategic and tactical market views, publications and digital tools that are underpinned by proprietary research.

General disclosure: This material is intended for information purposes only, and does not constitute investment advice, a recommendation or an offer or solicitation to purchase or sell any securities to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. This material may contain estimates and forward-looking statements, which may include forecasts and do not represent a assure of future performance. This information is not intended to be complete or exhaustive and no representations or warranties, either articulate or implied, are made regarding the accuracy or completeness of the information contained herein. The opinions expressed are as of December 2023 and are subject to change without notice. Reliance upon information in this material is at the sole discretion of the reader. Investing involves risks.

In the U.S. and Canada, this material is intended for public distribution. In EMEA, in the UK and Non-European Economic Area (‘EEA’) countries: this is Issued by BlackRock Investment Management (‘UK’) Limited, authorised and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL. Tel: + 44 (0)20 7743 3000. Registered in England and Wales No. 02020394. For your protection telephone calls are usually recorded. Please refer to the Financial Conduct Authority website for a list of authorised activities conducted by BlackRock. In the European Economic Area (‘EEA’): this is Issued by BlackRock (Netherlands) B.V. is authorised and regulated by the Netherlands Authority for the Financial Markets. Registered office Amstelplein 1, 1096 HA, Amsterdam, Tel: 020 – 549 5200, Tel: 31-20-549-5200. Trade Register No. 17068311 For your protection telephone calls are usually recorded. In Italy, for information on investor rights and how to raise complaints please go to https://www.blackrock.com/corporate/compliance/investor-right available in Italian. In Switzerland, for qualified investors in Switzerland: This document is marketing material. Until 31 December 2021, this document shall be exclusively made available to, and directed at, qualified investors as defined in the Swiss Collective Investment Schemes Act of 23 June 2006 (“CISA”), as amended. From 1 January 2022, this document shall be exclusively made available to, and directed at, qualified investors as defined in Article 10 (3) of the CISA of 23 June 2006, as amended, at the exclusion of qualified investors with an opting-out pursuant to Art. 5 (1) of the Swiss Federal Act on Financial Services (“FinSA”). For information on art. 8 / 9 Financial Services Act (FinSA) and on your client segmentation under art. 4 FinSA, please see the following website: www.blackrock.com/finsa For investors in Israel: BlackRock Investment Management (‘UK’) Limited is not licensed under Israel’s Regulation of Investment Advice, Investment Marketing and Portfolio Management Law, 5755-1995 (the “Advice Law”), nor does it carry insurance thereunder. In South Africa, please be advised that BlackRock Investment Management (‘UK’) Limited is an authorized financial services provider with the South African Financial Services Board, FSP No. 43288. In the DIFC this material can be distributed in and from the Dubai International Financial Centre (‘DIFC’) by BlackRock Advisors (‘UK’) Limited — Dubai Branch which is regulated by the Dubai Financial Services Authority (‘DFSA’). This material is only directed at ‘Professional Clients’ and no other person should rely upon the information contained within it. Blackrock Advisors (‘UK’) Limited – Dubai Branch is a DIFC Foreign Recognised Company registered with the DIFC Registrar of Companies (DIFC Registered Number 546), with its office at Unit 06/07, Level 1, Al Fattan Currency House, DIFC, PO Box 506661, Dubai, UAE, and is regulated by the DFSA to engage in the regulated activities of ‘Advising on Financial Products’ and ‘Arranging Deals in Investments’ in or from the DIFC, both of which are limited to units in a collective investment fund (DFSA Reference Number F000738). In the Kingdom of Saudi Arabia, issued in the Kingdom of Saudi Arabia (‘KSA’) by BlackRock Saudi Arabia (‘BSA’), authorised and regulated by the Capital Market Authority (‘CMA’), License No. 18-192-30. Registered under the laws of KSA. Registered office: 29th floor, Olaya Towers – Tower B, 3074 Prince Mohammed bin Abdulaziz St., Olaya District, Riyadh 12213 – 8022, KSA, Tel: +966 11 838 3600. The information contained within is intended strictly for Sophisticated Investors as defined in the CMA Implementing Regulations. Neither the CMA or any other authority or regulator located in KSA has approved this information. In the United Arab Emirates this material is only intended for -natural Qualified Investor as defined by the Securities and Commodities Authority (‘SCA’) Chairman Decision No. 3/R.M. of 2017 concerning Promoting and Introducing Regulations. Neither the DFSA or any other authority or regulator located in the GCC or MENA region has approved this information. In the State of Kuwait, those who confront the description of a Professional Client as defined under the Kuwait Capital Markets Law and its Executive Bylaws. In the Sultanate of Oman, to sophisticated institutions who have go through in investing in local and international securities, are financially solvent and have knowledge of the risks associated with investing in securities. In Qatar, for distribution with pre-selected institutional investors or high net worth investors. In the Kingdom of Bahrain, to Central Bank of Bahrain (‘CBB’) Category 1 or Category 2 licensed investment firms, CBB licensed banks or those who would confront the description of an Expert Investor or Accredited Investors as defined in the CBB Rulebook. The information contained in this document, does not constitute and should not be construed as an offer of, invitation, inducement or proposal to make an offer for, recommendation to apply for or an opinion or guidance on a financial product, service and/or strategy. In Singapore, this is issued by BlackRock (Singapore) Limited (Co. registration no. 200010143N). This advertisement or publication has not been reviewed by the Monetary Authority of Singapore. In Hong Kong, this material is issued by BlackRock Asset Management North Asia Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong. In South Korea, this material is for distribution to the Qualified Professional Investors (as defined in the Financial Investment Services and Capital Market Act and its sub-regulations). In Taiwan, independently operated by BlackRock Investment Management (Taiwan) Limited. Address: 28F., No. 100, Songren Rd., Xinyi Dist., Taipei City 110, Taiwan. Tel: (02)23261600. In Japan, this is issued by BlackRock Japan. Co., Ltd. (Financial Instruments Business Operator: The Kanto Regional Financial Bureau. License No375, Association Memberships: Japan Investment Advisers Association, the Investment Trusts Association, Japan, Japan Securities Dealers Association, Type II Financial Instruments Firms Association.) For Professional Investors only (Professional Investor is defined in Financial Instruments and Exchange Act). In Australia, issued by BlackRock Investment Management (Australia) Limited ABN 13 006 165 975 AFSL 230 523 (‘BIMAL’). The material provides general information only and does not take into account your individual objectives, financial situation, needs or circumstances. In New Zealand, issued by BlackRock Investment Management (Australia) Limited ABN 13 006 165 975, AFSL 230 523 (‘BIMAL’) for the exclusive use of the recipient, who warrants by receipt of this material that they are a wholesale client as defined under the New Zealand Financial Advisers Act 2008. In China, this material may not be distributed to individuals resident in the People’s Republic of China (“PRC”, for such purposes, excluding Hong Kong, Macau and Taiwan) or entities registered in the PRC unless such parties have received all the required PRC government approvals to take part in any investment or acquire any investment advisory or investment management services. For Other APAC Countries, this material is issued for Institutional Investors only (or professional/sophisticated /qualified investors, as such term may apply in local jurisdictions). In Latin America, no securities regulator within Latin America has confirmed the accuracy of any information contained herein. The provision of investment management and investment advisory services is a regulated activity in Mexico thus is subject to strict rules. For more information on the Investment Advisory Services offered by BlackRock Mexico please refer to the Investment Services Guide available at www.blackrock.com/mx

©2023 BlackRock, Inc. All Rights Reserved. BLACKROCK is a trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other trademarks are those of their respective owners.

This post originally appeared on the iShares Market Insights.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.