Korisbo/iStock via Getty Images

Summary

Seeking Alpha Quant ranks Direxion Daily Homebuilders & Supplies Bull 3X Shares (NYSEARCA:NAIL) as the top ETF is in the class of equity leveraged funds. The recent refuse in mortgage rates has led to improved earnings expectations for homebuilding stocks. We believe that the current economic and market conditions are favorable for investing in homebuilding stocks.

NAIL – Direxion Daily Homebuilders & Supplies Bull 3X Shares ETF

Fund Details

Fund Type Miscellaneous

Issuer Direxion Funds

Inception 09/15/2015

Expense Ratio 0.98%

AUM $248.67M

# of Holdings 57

*Holdings as of 2023-11-30

The fund seeks to track 3x the daily performance of the Dow Jones U.S. Select Home Construction Index $DJUSHB.

As of December 1, 2023, the Direxion Daily Homebuilders & Supplies Bull 3X Shares ETF has net assets of 248M. It paid 0.26% dividend yield and had an expense ratio of 0.98%.

The holdings are concentrated in the following sectors: Industrials 17.93%, Consumer Discretionary 74.29% and Basic Materials 7.78%. The top 10 holdings contribute 94.43% of the total assets.

Investment Thesis

I rate NAIL as a BUY, with expectation of healthy gains over the next twelve months.

There are a number of factors that preserve the thesis.

On the fundamental side, the recent decrease in long-term mortgage rates creates a favorable business environment for homebuilding companies.

On the technical side, NAIL made a strong trend reversal at the end of October. Since then, the fund has been in a sustained uptrend.

The intermarket analysis is supporting a broad stock market rally for the remainder of this year. All four risk indicators used in my AMI service are risk-ON.

Price Action

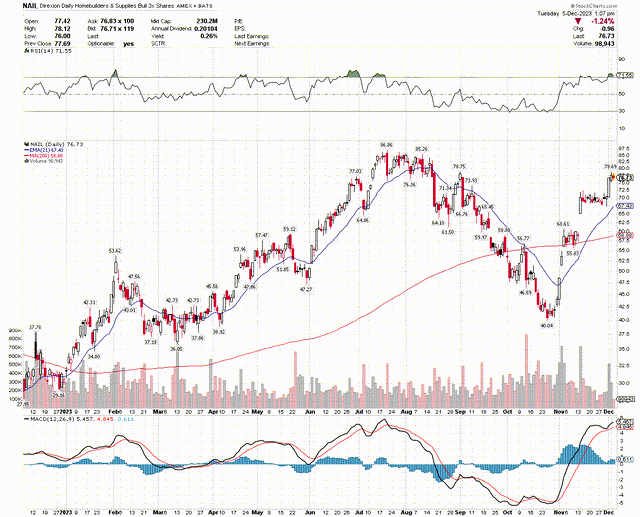

The chart below shows the price action of NAIL over the last twelve months. It made huge gains during the first half of the year followed by a deep correction from August to the end of October. Since the end of October, NAIL has been in a strong uptrend.

StockCharts.com

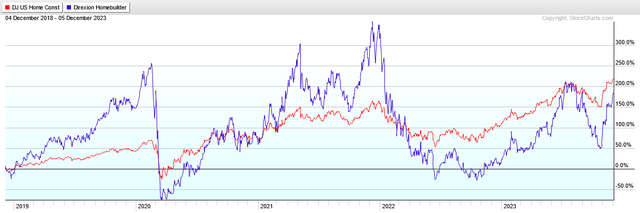

Because NAIL is a leveraged instrument, it is appropriate to scrutinize its performance relative to the stock index on which it is based. The next chart shows its price evolution over the last five years versus that of the Home Construction Index $DJUSHB.

StockCharts.com

The chart shows clearly that, over the long term, the ratio of the returns between the leveraged fund and its underlying index is much lower than the leverage factor. In fact, the 5-year total return of NAIL is lower than that of the index.

We see that the homebuilding stocks display long periods of advance in one direction. The 5-year chart may be broken down into 7 periods, as shown in the table below. For each period, we show the returns of the index DJUSHB and those of the leveraged fund, NAIL.

|

Period |

DJUSHB |

NAIL |

|

12/24/18 – 2/20/20 |

81.61% |

373.01% |

|

2/20/20 – 3/23/20 |

-56.05% |

-93.11% |

|

3/23/20 – 12/10/21 |

257.33% |

1762.41% |

|

12/10/21 – 10/20/22 |

-38.44% |

-84.40% |

|

10/20/22 – 8/1/23 |

86.50% |

335.04% |

|

8/1/23 – 10/25/23 |

-18.49% |

-52.45% |

|

10/25/23 – 12/5/23 |

27.83% |

91.05% |

The Home Construction Index had long periods with extremely large returns. It also had similarly large declines. The leveraged fund amplified those moves. Over the one-month COVID crash in February-March 2020, NAIL declined over 93%. This shows the extreme risk of holding a leveraged fund in a market crash.

Market State

To ascertain the state of the market we compute the difference in total returns of the following four ETF pairs: (DBB, UUP), (XLI, XLU), (SLV, GLD) and (XLC, XLV) over an evaluation period. The evaluation period is variable. It is a function of market volatility.

Currently, the evaluation period is 78 trading days and all the pairs suggest risk-on.

Additionally, I watched the behavior of the market implied volatility. Lately, VIX declined to levels not seen since before the COVID crash.

The market state is supportive of a continuation of the rally.

Conclusion

I rate NAIL as a BUY for the following reasons:

Most stocks in its composition are in an uptrend Mortgage rates started to refuse bringing more home buyers on the market. The prevailing market expectations are for the FED to stop raising interest rates and start cutting rates by the summer of 2024. Seeking Alpha Quant has a STRONG BUY rating of NAIL (4.96/5).

Risk Warning

NAIL, as a leveraged fund, may suffer value erosion and should only be used as a tactical, short-term investment vehicle.

Here is a detailed message from the SEC on the risks inherent in leveraged ETFs.