ValentynVolkov/iStock via Getty Images

Introduction

Good Times Restaurants Inc (NASDAQ:GTIM) operates two distinct business models: Good Times Burgers & Frozen Custard (GT) and Bad Daddy’s Burger Bar (BD). GT reflects a quick-service restaurant model similar to McDonald’s (MCD), while BDBB embodies a full-service casual dining experience akin to The Cheesecake Factory (CAKE). For a comprehensive understanding of the company’s origins and narrative, refer to the article linked here. Since covering the company in Feb 2023 and assigning Buy rating, the company stock price has fluctuated significantly from $2.88 when the article was first published, rose a high of $3.49 in July, and dropping to a low of $2.35 in the month after.

Given the developments within the year and management’s continued execution and a lower stock price, I am assigning this a Strong Buy rating. Traditionally, the company discloses its FY23 results between mid-December (14th to 20th). This article aims to encapsulate the company’s advancements in 2023, providing investors with insights on what to appraise to gauge the company’s success in FY23.

Increased operating store count:

-

Bad Daddy’s: Acquisition of 5 stores, Development of 1 store

Bad Daddy’s brand witnessed substantial growth from the opening of its inaugural store in 2014 to a total of 37 stores by 2019, expanding at a rate of approximately 6 stores annually. However, after this extensive expansion phase, the company has adopted a more selective approach to growing its presence encourage. From 2019 through 2022, the company has opened just another 3 stores: a stark contrast to its expansion years. That all changed this year.

In late January this year, the company revealed the acquisition of 5 Bad Daddy’s locations from its Joint Venture, contributing an estimated 850k in EBITDA. The purchase, priced at around $4.4 million, translates to roughly 5.2 times the EBITDA. Worth noting, this acquisition doesn’t augment the company’s store count as it’s historically reported within the “Company-Owned/Co-Developed” segment.

Furthermore, the company disclosed the construction of a new Bad Daddy’s restaurant in Madison, Alabama, during its Q2 conference call, subsequently opening in late August. Management highlighted that the new store in Madison exhibited an exceptional performance with average weekly sales trending 50% higher than the system-wide average. While this surge in demand is likely due to its newness, it reflects positively on the meticulous location selection and execution of opening procedures.

-

Good Times: Acquisition of 1 Store

On the Good Times front, amidst the Bad Daddy’s expansion, the company rationalized its GT brand until the recent Q3 conference call. There, they announced the acquisition of 1 GT store from franchisees, marking the brand’s first expansion since 2017 when they operated 28 stores. With this addition, the company now oversees 24 GT stores.

Throughout 2023, the company strategically pursued acquisitions and developmental ventures, positioning itself for amplified revenue streams and streamlined cost efficiency. What truly captivates my attention, however, is the manner in which these initiatives were financed. In a climate marked by high interest rates, the company astutely utilized its strong cash balance instead of resorting to debt for its acquisitions. Notably, had debt been used, the high hurdle rate of approximately 9.1% today, (a 2.5% base, ~5.6% LIBOR, and a 1% Cadence bank premium), would have loomed large.

As it stands, the company has and continues to produce a substantial amount of free cash flow, and this year should not be any different. Management’s consistent choice to reinvest the available cash encourage underscores the company’s capacity to thrive and extend, sans reliance on debt. It’s a testament to the company’s ability to create substantial cash flow, fueling organic growth and fortifying its financial foundation.

| 2023 Q3 | 2022 | 2021 | 2020 | 2019 | 2018 | |

| EBIT | 1,368 | -878 | 6,897 | -12,041 | -3,495 | 372 |

| Less: Capex | 3,178 | 2,678 | 3,198 | 2,596 | 8,079 | 10,444 |

| Add: D&A | 2,740 | 3,895 | 3,842 | 4,129 | 4,345 | 3,705 |

| Add: Litigation Contingencies | 0 | 332 | 0 | 0 | 0 | 0 |

| Add: Asset Impairments | 1,041 | 3,437 | 0 | 15,606 | 2,771 | 72 |

| Add: Preopening Cost | 110 | 51 | 766 | 1,031 | 1,774 | 2,784 |

| Add: Development Cost | 1,000* | 1,000* | 1,862 | 2,034 | 6,620 | 9,692 |

| Run Rate FCF | 3,081 | 5,159 | 10,169 | 8,163 | 3,936 | 6,181 |

Source: Company 10-K filings.

*Development cost of $1 million per new store is inferred from company’s historical expenditures.

Same-Store Sales

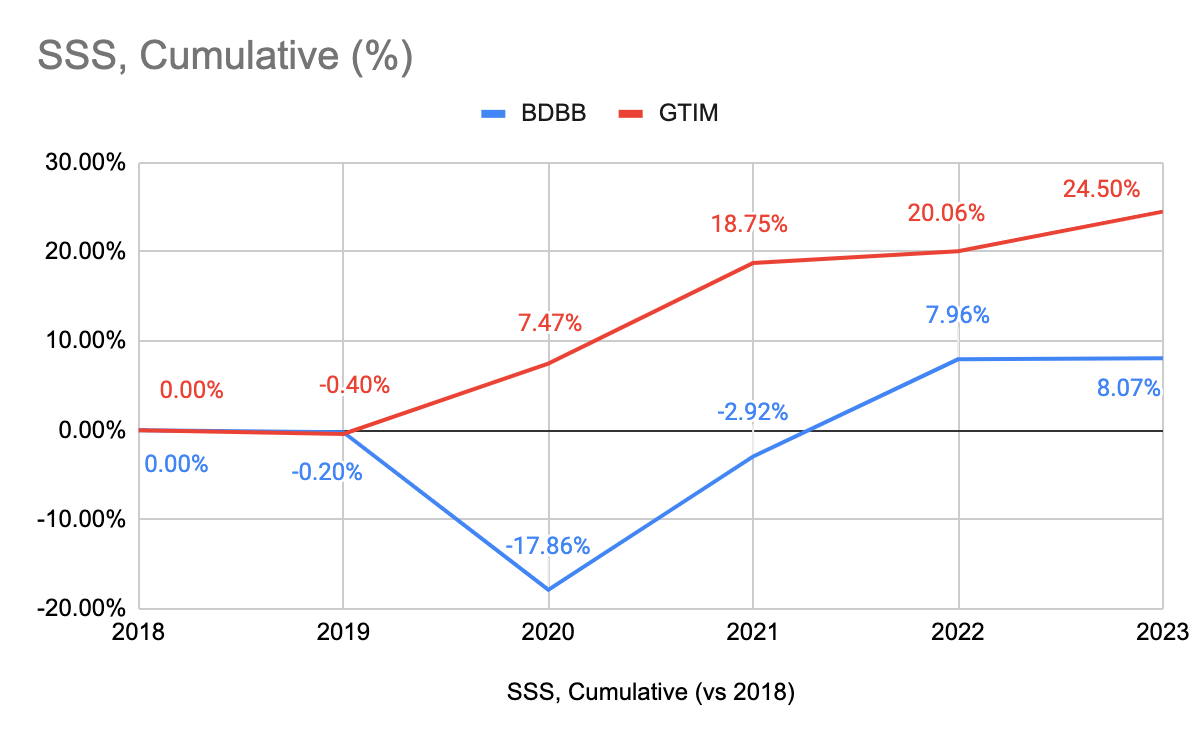

From 2018 to 2023, same-store sales (SSS) witnessed growth for both brands. Compared to the base year of 2018, SSS increased by more than 24% and 8% for GT and BD respectively (with CAGR of approximately 4.5% and 1.6%). However, this growth appears relatively modest in light of the 22.5% inflation rate, especially concerning for the Bad Daddy’s brand. This might be disheartening for investors as it indicates either minimal revenue progress for GT or potential losses for Bad Daddy’s brand when adjusted for inflation.

Company 10-K, Q4 press release

Taking a deeper look, it’s clear that there has been a considerable rise in average check sizes for both of these brands. Particularly for the BD brand, there has been a dramatic boost in check sizes over the last 5 years. This, paired with decreased foot traffic, has been the focal point impacting its same-store sales outcomes. It’s important to highlight that this intentional shift was explicitly outlined as a strategic proceed by management in their latest press release:

Bad Daddy’s saw worsening declines throughout the quarter as we experienced broad-based reductions in traffic and increased check management activity by our guests. Our management team is fiercely focused on delivering value, consistent with our brand position, in a market that has seen increasing discounting activity to drive a turnaround in sales and traffic – Q4 Press Release

Credit is due to the company for recognizing the underwhelming sales performance in Bad Daddy and taking action by engaging a marketing agency to address the issue. However, the impact of this proceed remains uncertain as there hasn’t been a clear improvement in sales trends yet. Additionally, management shed light on external factors admire weather disruptions and road closures that have hampered sales, but they foresee these issues will ease, offering a positive boost moving forward.

On the whole, the company’s same-store sales (SSS) haven’t shown improvement, particularly for the Bad Daddy’s brand. Fortunately, management seems proactive in addressing this concern. It’s my hope that they’ll elaborate more on their strategies in this regard.

Net Income… Positive?

In my prior article, I highlighted the consistent trend of the company reporting negative net income in their financial statements. However, a shift seems imminent this year. Despite ongoing impairment charges, the value of impairments has notably decreased. Coupled with the release of deferred tax assets, valued at $11.4 million, the company is poised to declare a positive net income this year unless unforeseen circumstances arise. Moreover, the revaluation of tax assets suggests an anticipation of sustained positive net income in the future.

This development presents both advantages and drawbacks for investors. Reporting a positive net income enhances the company’s appeal to investors and analysts who seek profitable ventures. Increased visibility could potentially drive more interest in the company, potentially boosting its stock price. Yet, this could pose challenges for investors seeking to build significant positions, particularly considering the company’s historically low trading volume and substantial spread. Additionally, the surge in stock price might prompt the company to conduct stock buybacks at higher prices, resulting in fewer shares repurchased than otherwise possible. This leads us to the subsequent subject: stock repurchases.

Stock Buybacks

In February 2022, the company disclosed a stock buyback strategize worth $5 million. For deeper insights into the origin of this program, refer to the “Shareholder Value Creation” section in an earlier article. Since the program’s initiation, the company has consistently repurchased its shares at maximum capacity (20% of trading volume on non-blackout days). As a result, there has been a significant reduction in outstanding shares, amounting to over 7%, approximately 1.2% per quarter, as illustrated below.

| Period | Count | Price | Total Cost | Fiscal Quarter-Year |

| 5/24/2023 – 6/27/2023 | 69,037 | 3.17 | 218,847 | 3Q23 |

| 4/26/2023 – 5/23/2023 | 32,707 | 2.82 | 92,234 | 3Q23 |

| 3/29/2023 – 4/25/2023 | 21,879 | 2.76 | 60,386 | 3Q23 |

| 2/22/2023 – 3/28/2023 | 42,171 | 2.87 | 121,031 | 2Q23 |

| 1/25/2023 – 2/21/2023 | 66,188 | 2.94 | 194,593 | 2Q23 |

| 12/28/2023 – 1/24/2023 | 58,531 | 2.59 | 151,595 | 2Q23 |

| 11/23/2022 – 12/27/2022 | 60,421 | 2.57 | 155,282 | 1Q23 |

| 10/26/2022 – 11/22/2022 | 126,171 | 2.40 | 302,810 | 1Q23 |

| 9/28/2022 – 10/25/2022 | 184,803 | 2.25 | 415,807 | 1Q23 |

| 8/24/2022 – 9/27/2022 | 60,735 | 3.03 | 184,027 | 4Q22 |

| 7/27/2022 – 8/23/2022 | 37,909 | 3.38 | 128,132 | 4Q22 |

| 6/29/2022 – 7/26/2022 | 21 | 3.11 | 65 | 4Q22 |

| 5/27/2022 – 6/28/2022 | 49,173 | 2.97 | 146,044 | 3Q22 |

| 4/29/2022 – 5/26/2022 | 44,575 | 2.80 | 124,810 | 3Q22 |

| 3/30/2022 – 4/28/2022 | 0 | 0 | 0 | 3Q22 |

| 2/23/2022 – 3/29/2022 | 43,748 | 4.23 | 185,054 | 2Q22 |

| 1/26/2022 – 2/22/2022 | 32,152 | 4.52 | 145,327 | 2Q22 |

| 12/29/2021 – 1/25/2022 | 0 | 0 | 0 | 2Q22 |

| Total Shares Purchased | 930,221 |

| Total $ spent: | 2,626,044 |

| Average buyback price ($): | 2.82 |

| Shares outstanding | |

| Dec 28, 2021 | 12,539,694 |

| Jun 27, 2023 | 11,622,727 |

| Change | – 916,967 |

| Total % of shares outstanding repurchased | – 7.31% |

| % of shares repurchased per quarter | – 1.22% |

Source: Company SEC filings, 2022 to 2023.

This is what gets me most excited about GTIM. With 7.31% of shares repurchased since 2022, investors’ share of the business has gained ~7.89%, without spending an extra dollar. On a quarterly basis, our share of the business increases at a rate of 1.12% per quarter. A lower share count acts as a springboard for the company’s performance, especially as it begins to consistently report positive net income. Furthermore, it proves to be more tax-efficient for most investors compared to dividends and demonstrates management’s consistent commitment to creating shareholder value.

Headwinds/Risks

There are several headwinds and risks to this company. I will explain some of them here.

1. Colorado Minimum Wage boost:

The company operates a majority of its stores in Colorado, including all of its GT brands. The company faces a 7.2% rise in the minimum wage for tipped workers in 2024, climbing from $10.63 to $11.40 per hour. This hike will escalate payroll expenses, potentially reducing operating profits by necessitating higher spending on skilled employees.

2. Elevated Commodity Prices:

GTIM grapples with persistently high commodity prices for key inputs admire chicken breast, bacon, and ground beef. Additionally, livestock futures show no signs of relief, indicating sustained elevated costs. While the company has hitherto offset these pressures by raising menu prices, this tactic may no longer be viable without risking decreased sales volume and overall revenue.

3. GTIM’s Micro Cap Status:

As a micro-cap stock traded on NASDAQ with around 11.6 million shares, GTIM poses inherent investment risks and rewards. Despite its exchange listing, its trading liquidity remains exceedingly low, potentially resulting in substantial price fluctuations driven by individual investors seeking to accumulate or divest their holdings. Investors should carefully weigh the benefits and pitfalls of investing in such micro-cap stocks.

Conclusion

In summary, the company’s consistent approach this year echoes its previous strategies: cash generation used for share buybacks or expanding store count, while increasing cost efficiencies to the best they can. Though the company lacks extraordinary moves, this isn’t viewed negatively; maintaining a cash-positive trajectory is paramount, making predictability a positive ascribe. Boring is good.

Anticipating the Q4 call, my expectation is that the company continues its ongoing ‘boring’ operations, which signifies stability. Insight into same-store sales and the impact of their marketing partnership is anticipated, along with potential details on next year’s store openings. Minor shifts in operating costs won’t be a significant concern. The hope remains for the company to maintain its consistent and ‘boring’ yet robust performance.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.