saoirse_2010

CVR Partners (NYSE:UAN) has underperformed since I upgraded the stock in September, that stock looks attractive based on normalized earnings and that fertilizer pricing seemed to have bottomed. With the stock down, generating a -14% return since then, let’s catch up on the name.

Company Profile

As a refresher, CVR Partners produces nitrogen fertilizer from its two fertilizer plants. Its Coffeyville facility uses pet coke as a feedstock, and it upgrades most of its ammonia production to UAN. The East Dubuque facility, located in the Corn Belt, uses natural gas as its feedstock and is more flexible with production, making a mix of ammonia, UAN, liquid and granulated urea, and nitric acid.

Q3 Earnings

CVR Partners reported its Q3 earnings at the end of October, recording revenue of $130.6 million, down nearly -17% year over year.

Product pricing at the gate for ammonia fell -56% year over year to $365 per ton, while UAN pricing dropped -48% to $223 per ton.

Ammonia production jumped 90% to 217,000 tons, while UAN production rose 95% to 358,000 tons. Plant capacity utilization was 99% for the quarter compared to 52% a year ago. A year ago, the company had turnarounds in Q3 at both of its plants.

Adjusted EBITDA increased from $10.2 million to $32.4 million. Cash available for distribution fell -12% from $18.7 million to $16.4 million. The company reserved $2.3 million for future turnarounds in the quarter, as well as $3.3 million for maintenance capex, while releasing $7.5 million for future operating needs. A year ago, the company released $15 million for future operating needs and $28.1 million for maintenance capex.

The company declared a variable distribution of $1.55 per common unit. This was well below the $4 distribution I thought was possible in my last write-up.

Operationally, CVR Partners performed pretty well outside a mechanical issue towards the end of Q3 at its Dubuque plant. Fertilizer prices were down considerably from last year, as expected, but the company sold at prices well below the $325 UAN and $530 ammonia prices I had modeled out in my last write-up. But as I said, NOLA prices and the pricing it gets can be quite different, and prices were very volatile in the quarter.

Outlook

Looking forward, CVR Partners is looking for utilization of between 90-95% from both its facilities in Q4. It is expecting Coffeyville utilization of 95-100% and East Dubuque utilization of between 85-90%. A workers’ strike started at the East Dubuque facility in mid-October, but the company said its utilization guidance was unrelated to that and instead was due to a mechanical issue that occurred at the end of Q3 that has since been repaired.

The company is expecting between $55-60 million in direct operating expenses and between $10-15 million in CapEx.

At the end of the quarter, the company noted that ammonia prices for the Southern Plains were $429 a ton, down -54% compared to where it was a year ago at $1,241 a ton and slightly lower than where it was at the end of June when it was $435 a ton.

Ammonia in the Corn Belt was $501 per ton, down -52% from $1,048 a ton a year ago, but up from $472 per ton at the end of Q2. UAN prices at the end of September were $272 per ton, -45% below the $496 a ton it traded at a year earlier and below the $298 per ton it was at the end of June. Natural gas prices, meanwhile, were -67% lower at $2.66, but higher than the $2.33 it was at the end of June.

Discussing the current state of the nitrogen fertilizer market on its Q3 earnings call, CEO Mark Pytosh said:

“Following the reset of nitrogen fertilizer prices in July, prices steadily rose throughout the summer, driven by a combination of strong demand and reduced supply as a result of planned and unplanned outages across the industry. Looking ahead, we believe market conditions have firmed for the fourth quarter, and we’re optimistic about nitrogen fertilizer demand for 2024 … Weather permitting over the next month, we expect a strong fall ammonia application season this year and have a good book of orders. Overall, grain market conditions remained steady and bode well for nitrogen fertilizer demand for 2024. We believe that the length of this upward cycle — demand cycle will, in large part, be driven by grain prices staying at elevated levels, and we see fundamentals for grains remaining steady. Since July, production in nitrogen fertilizer has experienced a combination of unplanned production outages, a heavy plant turnaround arrange and natural gas availability issues in several geographies. These supply issues, coupled with steady demand from customers to replenish inventories depleted in the spring, have tightened supply-demand balances and have led to significant firming of prices in the market. As I mentioned on the last earnings call, customer purchasing patterns have evolved to more ratable purchasing due to higher carrying costs over the past year from higher interest rates. We think this buying pattern matches well with our production arrange.”

Pricing has improved nicely from what CVR Partners realized in Q3. The biggest impact has been with ammonia pricing, which as the company noted had risen to $502 per ton at the end of September. However, earlier this month, Corn Belt ammonia prices were up to between $700-725 per short ton. UAN32 prices were up to $280-290 a ton mid-month, while NOLA prices were between $240-260 per ton. However, much of the fall season’s UAN demand would inevitably have been filled through pre-sales.

Modeling Q4

As I’ve noted in the past, modeling CVR Partners isn’t easy, as little changes to the model in prices can direct to some pretty big differences versus actual results, while the pricing it gets doesn’t always match tracked pricing.

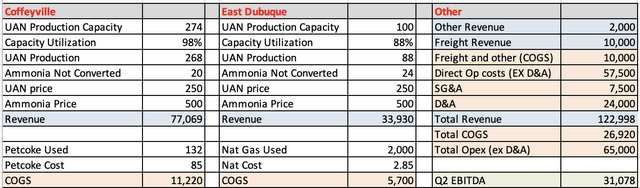

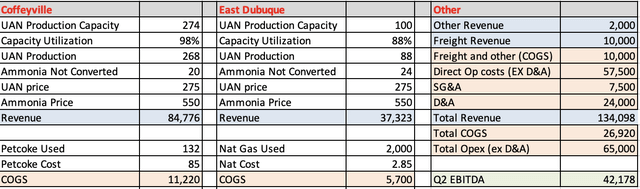

That said, using $250 UAN prices and $500 ammonia, I can get to around $31 million in Q4 EBITDA. Take out $7.5 million in interest expense and $5 million on maintenance capex, as well as $5 million in turnaround and other future costs, and you get an over $1.25 distribution. Using $275 UAN and $550 ammonia would get you $42 million in EBITDA and around a $2.30 distribution.

UAN EBITDA Model (Filings and Self) UAN EBITDA Model (Filings and Self)

I could see pricing in 2024 settling in around $300 per ton for UAN and getting $600 per ton for ammonia, which could get you between $210-220 million in yearly EBITDA with no turnarounds. The company previously said it didn’t expect any turnarounds until the fall of 2024 at the earliest, so there could be one next year. Place a 6.5x multiple on that to get you a $95 stock and over $13 in distributions, which would be close to a 19% yield. With a turnaround, the distribution could be closer to $10.

Conclusion

How CVR Partners performs will depend a lot on nitrogen fertilizer prices in 2024. Right now, prices appear to have bottomed and have been increasing. Ammonia has led the way, but UAN prices should follow. The market is just very thin this time of year for the product.

A lot of international factors can impact nitrogen fertilizer prices, including Chinese exports, Indian and Brazilian imports, and international gas prices, so there is always risk associated with fertilizer names. However, in September China asked fertilizer producers to suspend urea exports, which has bode well for pricing and should continue to do so. The East Dubuque strike, meanwhile, is still ongoing, so we’ll have to see if that impacts the plant’s utilization at some point.

Taken all together, though, I think CVR Partners looks admire a “Buy” at these levels.