There’s a toxic mix of data that may be getting ready to “steamroll” the used car retail stocks.

Names admire Carvana (CVNA) and Carmax (KMX) perked to life in the last week as speculative buying found its way to these names. But does it make sense to buy these stocks now?

The short answer is “NO.” Here’s why…

Two weeks ago, the Manheim Used Car Index showed that used car prices continued their reject as consumer demand for autos continues to soften.

To make matters worse, reports are now suggesting that the end of the United Autoworker’s strike may put even more pressure on used car sales as the “Big Three” – GM, Ford, and Stellantis (formerly Fiat Chrysler) – try to ramp-up production and sales to start 2024 on a strong foot.

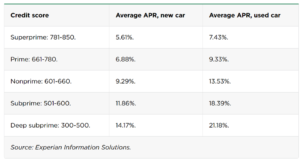

To make things even worse… interest rates on used car loans remain elevated. Rates for loans start above 7% for credit scores of 750 and higher and can go above 20% for the lowest credit scores.

The combination of lower inventory prices, lower demand, and higher rates are three strikes against auto resellers.

Let’s turn the headlines into trades.

As mentioned, Carvana and Carmax shares have ridden a short-term wave of speculative buying. That’s likely to change as investors see any sign of potential weakness on the short-term horizon.

Knowing that the market loves to trade round numbers, I’m watching the following levels.

CVNA – Any break below $33.50 is likely to see the stock proceed to $30 in a matter of less than a week.

KMX – A break below $66 will draw sellers into the market causing shares to drop back to short-term uphold at $60.

About the Author

Chris Johnson is a highly regarded equity and options analyst who has spent much of his nearly 30-year market career designing and interpreting complex models to help investment firms change millions of data points into impressive gains for clients.

At heart Chris is a quant – admire the “rocket scientists” of investing – with a specialty in applying advanced mathematics admire stochastic calculus, linear algebra, differential equations, and statistics to Wall Street’s data-rich environment.

He began building his proprietary models in 1998, analyzing about 2,000 records per day. Today, that database, which Chris designed and coded from scratch, analyzes a staggering 700,000 records per day. It’s the secret behind his track record.

Chris holds degrees in finance, statistics, and accounting. He worked as a licensed broker for 11 years before taking on the role of Director of Quantitative Analysis at a big-name equity and options research firm for eight years. He recently served as Director of Research of a Cleveland-based investment firm responsible for hundreds of millions in AUM. He is also the Founder/CIO of ETF Advisory Research Partners since 2007, noted for its groundbreaking work in Behavioral Valuation systems. Their research is widely read by leaders in the RIA business.

Chris is ranked in the top 99.3% of financial bloggers and top 98.6% of overall experts by TipRanks, the track record registry of financial analysts dating back to January 2009.

He is a frequent commentator on financial markets for CNBC, Fox, Bloomberg TV, and CBS Radio and has been featured in Barron’s, USA Today, Newsweek, and The Wall Street Journal, and numerous books.

Today, Chris is the editor of Night Trader and Penny Hawk. He also contributes to Money Morning as the Quant Analysis Specialist.