mg7/iStock via Getty Images

Founded in 1896, Tootsie Roll Industries (NYSE:TR) produces and sells candies through brands such as Blow-Pop, Child’s Play, Charleston Chew, Caramel Apple Pops, Cella’s, and Tootsie Roll with a significant number of names. The company sells the candy to wholesale distributors along with a number of other customers ranging from grocery stores to the US military.

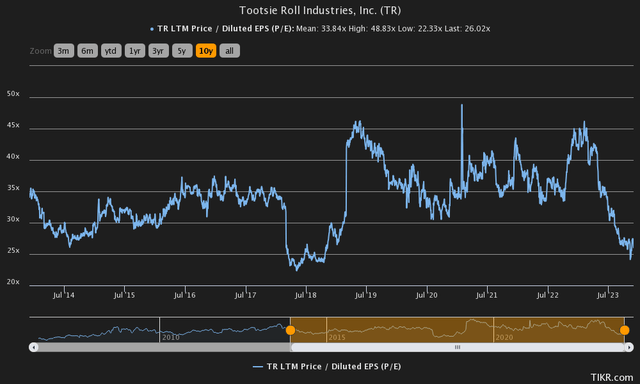

Tootsie Roll’s stock has had a modest but mostly stable return – in the past ten years, the company’s stock has appreciated at a low CAGR of 3.8%, on top of which Tootsie Roll pays out a small dividend with a current yield of 1.10%.

Ten Year Stock Chart (Seeking Alpha)

Inflation is Spicing Up Stable Long-Term Financials

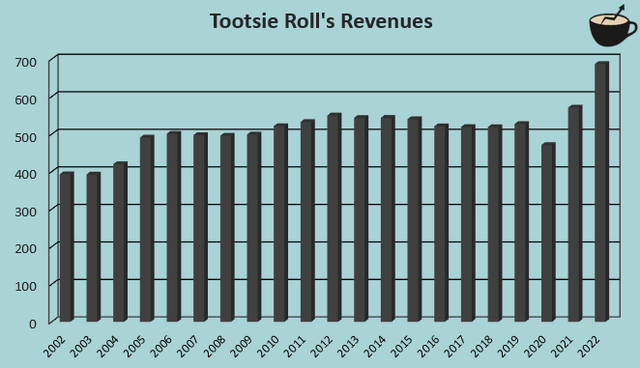

After mostly very stable revenues throughout the period from 2002 to 2019, Tootsie Roll has managed to grow revenues substantially after 2020 – for example, in 2022, the company’s revenues climbed by 20.4%:

Author’s Calculation Using TIKR Data

Most of the recent revenue growth seems to be due to high inflation, though. Tootsie Roll has been struggling with highly increased prices in packaging and ingredients and pushed the pricing through to customers making the revenue climb. In the first and second quarterly reports of 2023, for example, the company related the growth primarily to increased pricing, but also to higher sales volumes. Tootsie Roll expects the cost inflation to carry onto 2024 – I would believe that revenues will still grow quite well in 2024, although the current customer pricing could already pre-emptively price in future inflation partly.

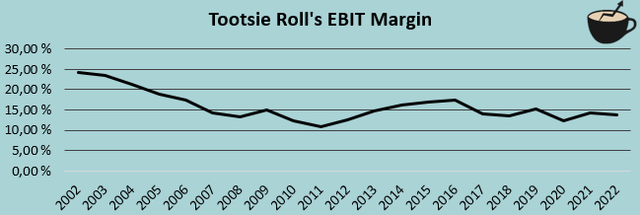

Although far from the level achieved in the early 2000s, Tootsie Roll has managed to keep a good EBIT margin level in recent years. From 2017 to 2022, for example, the average margin has been 13.9%:

Author’s Calculation Using TIKR Data

The good margin level has been kept despite a very high inflation in packaging and ingredients as well as most other costs that Tootsie Roll faces – candy manufacturers have been able to push the cost inflation well into pricing, as can already be derived from the revenue growth. Currently, Tootsie Roll’s trailing EBIT margin stands at 14.7%, even above the average level achieved in the medium- to long-term history. The good margin performance seems to come from higher pricing; despite a currently lower gross margin than average, the overall gross profit is higher. Overall, costs don’t seem to be too large of an obstacle for Tootsie Roll due to very good pricing power and cost control.

Impressive Reported Q3 Results

Tootsie Roll reported very impressive Q3 results on the 26th of October. The company’s revenues increased by 17.2%. More impressively, the reported EBIT margin was 17.8%. The first half of 2023 was good in terms of financials as well, but the reported third quarter saw the fastest earnings growth during the year. Tootsie Roll attributes the strong performance to a Halloween pre-sale timing that rolled more onto Q3 financials in 2023 compared to 2022 – at least a part of the strong performance will be seen in softer Q4 results.

Still, the reported Q3 and recent quarters overall have demonstrated Tootsie Roll’s stable performance – despite the high cost inflation and a turbulent macroeconomic situation, the company has been able to keep up a very good earnings level, proving that Tootsie Roll can perform with stable financials throughout economic turbulence. Tootsie Roll’s investors can sleep very well at night knowing that the company’s operations aren’t threatened easily.

Valuation

Tootsie Roll’s stock currently trades at a trailing P/E multiple of 26.0. The multiple seems high for a small-cap company with low long-term growth, yet the ratio is well below Tootsie Roll’s ten-year average of 33.8:

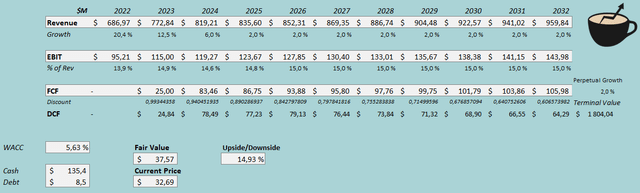

I believe that the high P/E ratio is justified by Tootsie Roll’s low-risk operations, as the company has a very low cost of capital due to its low-risk nature. To display the valuation, I constructed a discounted cash flow model as usual. In the model, I assess a very stable financial future as inflation cools down. For 2024, I still assess a growth of 6% as Tootsie Roll is facing cost inflation and should be able to push for higher pricing. After the year, I assess a stable revenue growth of 2% into perpetuity. For Tootsie Roll’s EBIT margin, I assess slight leverage as gross margins should eventually rise to a more historical level as inflation subsides – in 2026 and forward, I assess an EBIT margin of 15.0%, still 0.3 percentage points below the achieved 2019 level.

With the mentioned estimates along with a cost of capital of 5.63%, the DCF model estimates Tootsie Roll’s fair value at $37.57, around 15% above Tootsie Roll’s stock price at the time of writing. The stock seems very slightly undervalued, but when accounting for a chance that margins struggle from advocate cost inflation, the valuation seems very reasonable.

DCF Model (Author’s Calculation)

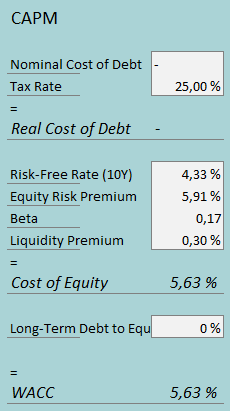

The used weighted average cost of capital is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

I don’t assess Tootsie Roll to have any interest-bearing debts in the long-term future – currently, the company has around $8.5 million in short-term borrowings and long-term debt combined, and advocate strengthens the balance sheet with $47.3 million of cash and $88.1 million in short-term investments. The financing seems to be led conservatively, making me believe that a long-term debt-to-equity ratio of 0% is a justified assess.

For the risk-free rate on the cost of equity side, I use the United States’ 10-year bond yield of 4.33%. The equity risk premium of 5.91% is Professor Aswath Damodaran’s latest assess for the United States, made in July. Yahoo Finance estimates Tootsie Roll’s beta at a figure of 0.17 as demand for candy stays stable through economic turbulence, demonstrated by Tootsie Roll’s recent financials. Finally, I add a small liquidity premium of 0.3%, crafting a cost of equity and WACC of 5.63%, used in the DCF model.

Takeaway

After stable revenues and margins in the long-term history, cost inflation after 2020 has boosted Tootsie Roll’s growth as the company pushes the inflation into higher pricing – I would expect the growth to stabilize into a more historical level as the cost inflation should come down during 2024. While I wouldn’t expect investors to get a very high return from Tootsie Roll’s stock, the stock doesn’t seem overvalued – the company has very stable demand and a strong balance sheet, making the investment relatively safe, fitting risk-averse investors. I have a hold rating for Tootsie Roll for the time being, as the stock’s risk-to-reward looks balanced.