gorodenkoff

Alvotech (NASDAQ:ALVO) specializes in biosimilars, as lower-cost alternatives to branded biologic medicines. Simply put, the company works around the patents from existing approved blockbuster drugs to produce molecules that are technically different but with the same therapeutic efficacy and safety.

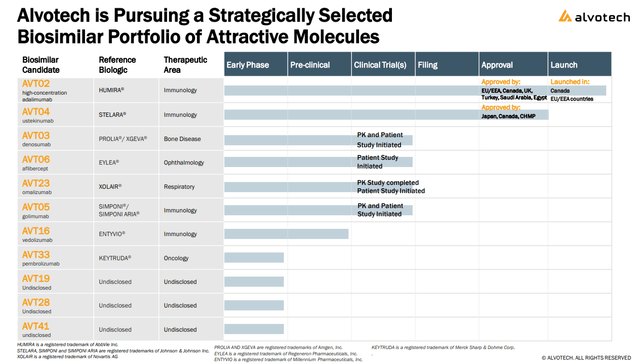

The good news is that Alvotech has already proven its process works with a biosimilar of “Humira” from AbbVie Inc. (ABBV) on sale in the European Union and Canada while seeking FDA approval in the U.S. The company is also moving forward with a broader portfolio of drug candidates including a competitor to the branded “Stelara” from Johnson & Johnson (JNJ).

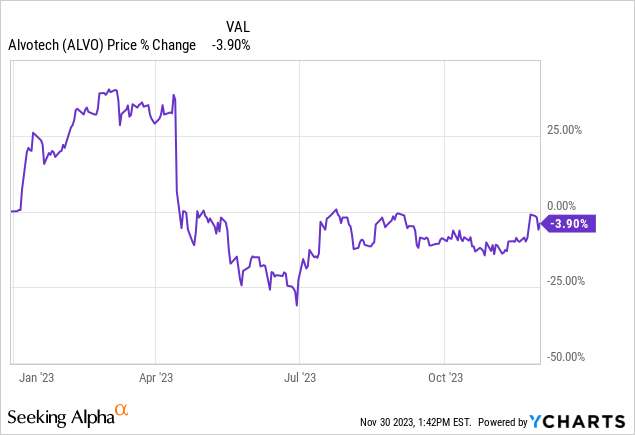

On the other hand, profitability remains elusive with the latest quarterly report showing a widening loss and ongoing cash bleed. Even as revenues are on track to nearly double this year, milestones in 2024 will be critical to maintaining that operating momentum. Ultimately, Alvotech has an interesting outlook but we expect shares to remain volatile and high-risk.

ALVO Financials Recap

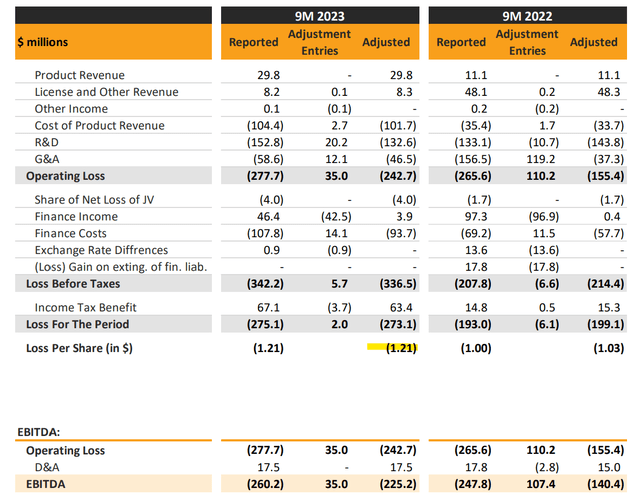

ALVO reported its Q3 update with a net loss of $275 million over the first nine months of the year, representing EPS of -$1.21, compared to a net loss of -$193 million over the period in 2022.

Even as product revenues have reached $29.8 million, up 169% y/y, costs are even higher following the launch of “AVT02” as the biosimilar to Humira “adalimumab” in late 2022. R&D has increased to uphold ongoing clinical trials for its various candidates. The adjusted EBITDA loss of -$225 million, has widened from -$140 million in the period last year.

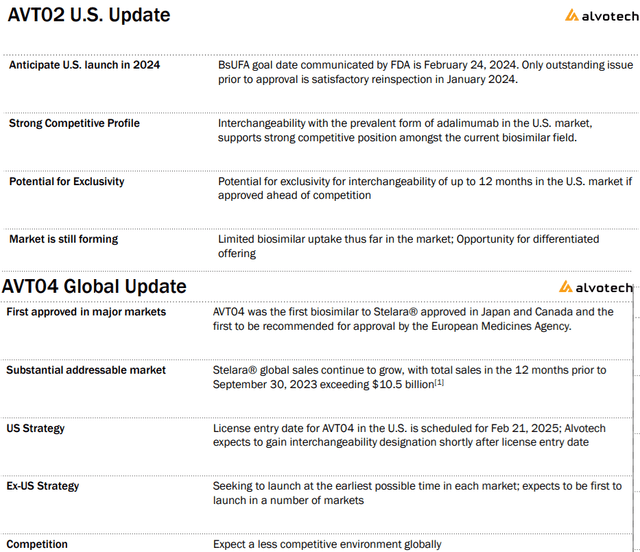

Currently, AVTO2 is sold in several European countries and Canada. In the U.S., the company expects to launch in 2024 pending a satisfactory FDA manufacturing facility reinspection set for January.

This is another attempt following a failed inspection earlier this year. Management believes the specific issues have been addressed ahead of the Biosimilar User Fee Act goal date of February 24, 2024, when it will be possible to commercialize this Humira alternative.

The separate growth driver into next year is the AVT04 molecule as a ” ustekinumab” biosimilar for Stelara has been approved in Japan and Canada as the next growth driver.

Alvotech has made progress in its AVT23 an omalizumab biosimilar candidate for “Xolair”, initiating a patient trial while entering into an exclusive licensing agreement with “Kashiv Biosciences” for a potential future commercialization. Finally, the company is also pursuing licensing deals for its early phase programs that can supply cash upfront and by reaching development milestones over time.

What’s Next for ALVO?

Overall, there are many moving parts with 2024 poised to mark a make-or-break year for the company operationally and financially assuming the U.S. launch of AVT02 and AVT04 internationally.

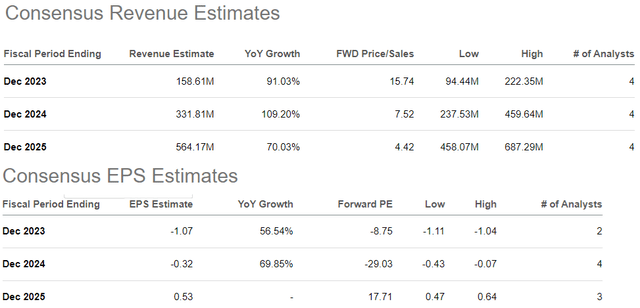

According to consensus estimates, from a full-year 2023 revenue forecast of $159 million, ALVO is expected to more than double that amount to $332 million in 2024. From an expected EPS loss of -$1.07 this year, the top-line momentum is forecast to at least narrow to -$0.32 in 2024, with a ramp to profitability on the horizon in 2025 to positive EPS of $0.53.

We’re a bit skeptical on that last point with a sense that either growth will underperform or earnings disappoint amid rising costs. There is a lot of uncertainty here between the timetable for a full commercialization rollout with an understanding that the logistics involved and manufacturing ramp-up can face some bottlenecks in both AVT02 and AVT04.

In terms of valuation, ALVO trading at 16x sales or even 8x into next year is already a lofty premium for a company that still has a lot to verify.

What’s more pressing is that balance sheet position which ended the quarter with $68.3 million in cash and cash equivalents in addition to $25 million in restricted cash against $1 billion in total debt.

While these levels could be seen as reasonable given the growth momentum, the argument we make is that even the path to approach $564 million in sales by 2025 may not be enough.

For context, finance costs including interest on debt and convertible equity have totaled $108 million for the first nine months of 2023. Net cash used in operating activity is negative -$245 million year to date. The cash bleed setup here points to advance funding requirements which would likely translate into a capital raise or share insurance sooner rather than later.

From a high-level perspective, the market for biosimilars is evolving quickly and Alvotech is hardly the only game in town. Even with Humira, the understanding is that there are more than 10 biosimilars from various developers targeting different indications in the works. It’s a competitive market which adds to the long-term uncertainty regarding any earnings potential.

Beyond the balance sheet position, the other big risk to consider when looking at ALVO is the potential for a setback in the clinical trial phase for any of its existing candidates. As was the case in 2023, the company is exposed to unfavorable regulatory decisions that push back on any commercialization timetable.

Final Thoughts

We rate ALVO as a hold, balancing what we view as some fundamental weakness against a long string of looming catalysts. The stock’s current $2.5 billion market capitalization is pricing in a trajectory that faces several roadblocks going forward.

It’s possible the market can overlook some of the financial challenges and bid up shares ahead of the U.S. AVT02 launch, although we believe risks are tilted to the downside. Into 2023, monitoring points include cash flow trends and indications of early sales momentum.