Kena Betancur

Introduction

Good things often don’t come cheap. This goes for houses, cars, electronics, bourbon, and pretty much anything you can think of, including great stocks.

This year, I have increasingly focused on healthcare stocks, including biotech, drug manufacturers, suppliers of research tools, wearable devices, and so much more.

One of the companies I have not covered – ever – is Stryker Corporation (NYSE:SYK). Shame on me, as this has been one of the best compounders in its sector, generating wealth for investors with a highly favorable volatility profile.

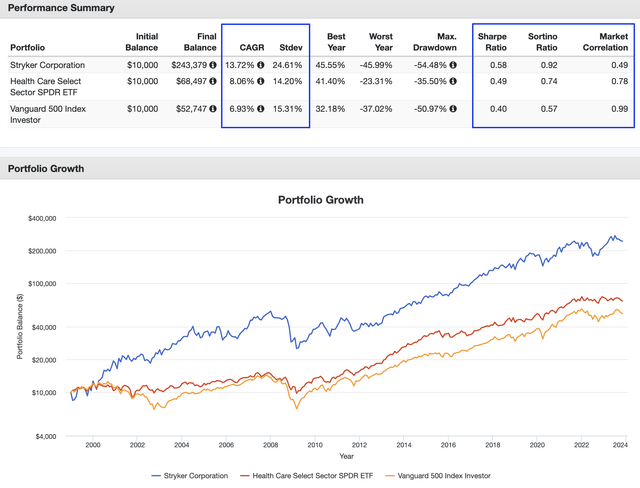

Going back to 1999, SYK has returned 13.7% per year, beating both the healthcare sector (XLV) and the S&P 500 by a considerable margin.

Even better, it has done this with a subdued standard deviation of 24.6%, resulting in highly favorable risk-adjusted returns (Sharpe & Sortino Ratios) and a market correlation of roughly 50%.

Portfolio Visualizer

Furthermore, this outperformance has been very consistent, as we can see in the table below.

Portfolio Visualizer

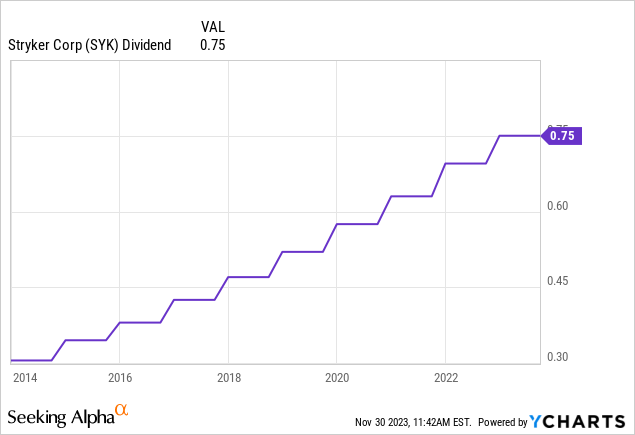

The company is also a dividend champion with consistent dividend growth, which adds to its allure.

Going forward, I expect Stryker to continue this outperformance.

In this article, I’ll tell you why.

What Makes Stryker So Special

Stryker is a global leader in medical technology and is dedicated to enhancing healthcare outcomes.

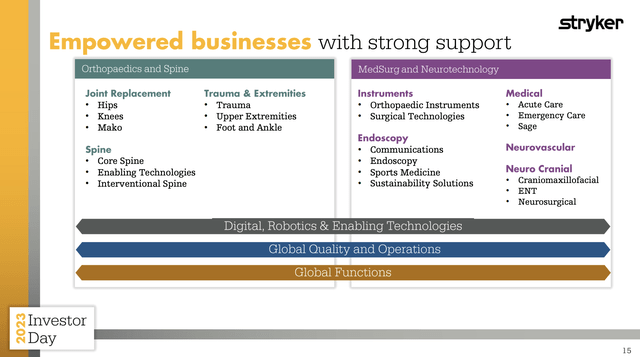

It offers a range of innovative products and services, including Medical and Surgical, Neurotechnology, Orthopaedics, and Spine, impacting over 130 million patients every single year.

Established in Michigan in 1946 by Dr. Homer H. Stryker, a renowned orthopedic surgeon and inventor, the company manages two major business segments: MedSurg and Neurotechnology, and Orthopaedics and Spine.

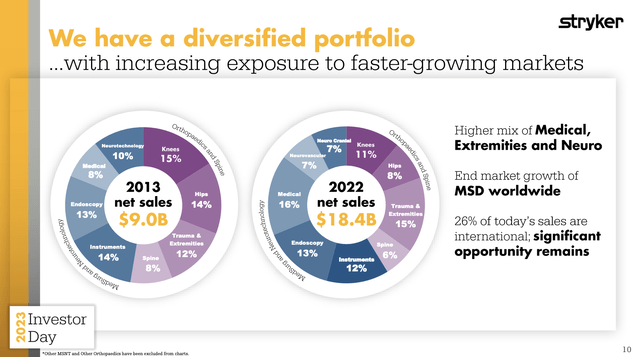

In 2022, MedSurg and Neurotechnology contributed $10.6 billion (58%), while Orthopaedics and Spine contributed $7.8 billion (42%) to the total net sales of $18.4 billion.

| USD in Million | 2021 | Weight | 2022 | Weight |

|---|---|---|---|---|

|

MedSurg and Neurotechnology |

9,538 | 55.8 % | 10,611 | 57.5 % |

|

Orthopaedics and Spine |

7,570 | 44.2 % | 7,838 | 42.5 % |

- MedSurg and Neurotechnology: This segment covers surgical equipment, patient safety technologies, neurosurgical devices, and more.

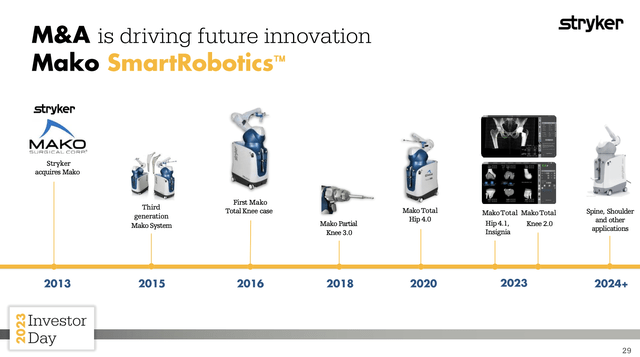

- Orthopaedics and Spine: Focused on implants for joint replacements and trauma surgeries, this segment provides advanced designs and specialized instrumentation. For example, the Mako Robotic-Arm Assisted Surgical System, supporting Partial Knee, Total Hip, and Total Knee procedures, offers a personalized surgical encounter. In 2022, the Insignia hip stem saw a full commercial launch in the U.S.

Stryker Corporation

When it comes to dealing with competitors, Stryker differentiates itself through a commitment to innovation, quality, and service, which sounds a bit generic.

According to Stryker, the company’s substantial patent portfolio, focus on research, and reputation, position it favorably in a highly competitive market, while continued investment in new product development ensures Stryker stays ahead of industry trends and maintains a competitive edge.

During the November Annual Evercore ISI HealthCONx Conference, the company commented on market opportunities.

For example, Stryker is well-positioned to capitalize on the market growth and procedural tailwind in Orthopaedics. With positive year-to-date trends, the company anticipates continued momentum in hip and knee procedures.

The procedural tailwind, driven by factors such as demographic shifts and advancements in medical technology, presents a significant opportunity for Stryker to enlarge its market share and drive revenue growth.

The company’s optimism is underscored by the successful introduction of innovative products admire Mako and Insignia, contributing to its robust performance.

Stryker Corporation

These innovations not only address current market demands but also position the company as an industry leader in medical technology.

Furthermore, the anticipation of the Spine offering introduces a new dimension to Stryker’s product portfolio.

According to the company, the differentiation offered by the end effector for Spine, along with the development of a comprehensive ecosystem, creates an exciting opportunity for Stryker to establish a strong presence in the Spine market.

Stryker Corporation

Furthermore, one of the biggest issues at the moment is a less favorable funding environment.

Healthcare equipment is expensive. Elevated rates make it even more expensive.

The company believes it is protected against these issues.

Stryker’s two-tiered capital approach, which caters to both large and small capital needs, reflects a strategic response to the competitive capital environment.

This diversified product portfolio allows the company to confront the varied requirements of its customers, contributing to sustained financial health.

Moreover, demographic trends, including an aging population and the entrance of younger patients into procedures, present a long-term opportunity.

Another thing worth mentioning is inorganic growth.

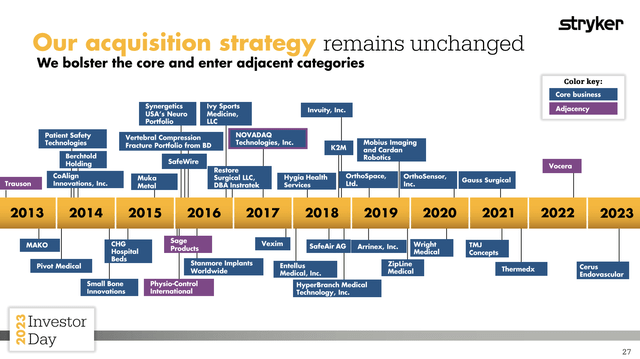

With over 50 acquisitions in the last ten years, Stryker has actively sought opportunities to improve its portfolio, enlarge its market presence, and diversify its business.

Stryker Corporation

While the company has recently been in a mode of debt reduction, the company used this year’s investor day to note that it intends to resume aggressive acquisitions.

Fast Business Growth & More Opportunities

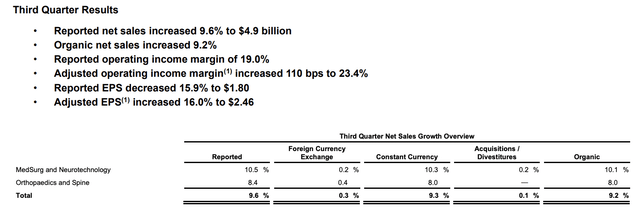

In early November, Stryker reported its third-quarter earnings. While some healthcare companies are struggling with the aforementioned funding issues, weakness in China, or general post-pandemic weakness, Stryker is doing very well.

As we can see below, the organic sales growth was impressive at 9.2%, driven by positive trends in the U.S. and international markets.

- The impact of pricing initiatives, particularly in MedSurg and Neurotech businesses, contributed to a favorable pricing impact of 0.3%.

- Foreign currency exchange also played a role, with a 0.3% favorable impact on sales.

- The adjusted EPS for the quarter stood at $2.46, reflecting a substantial 16% boost from the same period in 2022.

This growth was attributed to higher sales, expansion of the operating margin, and a lower adjusted income tax rate.

Stryker Corporation

Despite ongoing challenges such as hospital staffing pressures and supply constraints in some regions, Stryker sees opportunities for growth.

Procedural volumes remain strong, and the expectation is that the patient backlog will uphold elevated orthopedic procedural demand through 2024.

The demand for capital products, especially Mako, is healthy, with double-digit organic growth in key divisions.

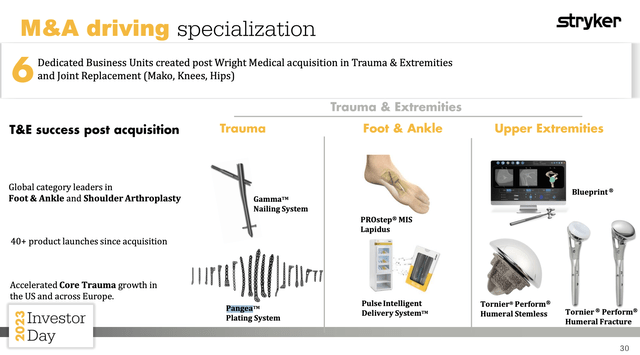

Meanwhile, The product super cycle, marked by the full launch of the 1788 camera platform and the approval of the Pangea plating system, presents significant growth prospects.

Looking ahead, Stryker is gearing up for a full launch of the Pangea plating system in the second quarter of 2024, while the extension of the Vocera platform’s capabilities to be compatible with Prime Connect stretchers addresses patient safety in emergency room settings, providing another avenue for growth.

The Pangea system was a big M&A-driven success, making Stryker a bigger player in Trauma & Extremities.

Stryker Corporation

This finally brings me to the next part of this article.

The Stryker Dividend

As we work our way to its dividend, it also needs to be said that its balance sheet remains in great shape!

The company ended the third quarter with $1.9 billion in cash and marketable securities and total debt amounting to $12.7 billion. This would imply that it has a 2024E net debt leverage ratio of roughly 1.9x EBITDA, which excludes advance debt repayments. That’s a healthy leverage number.

It enjoys an investment-grade BBB+ credit rating, which is one step below the A-range.

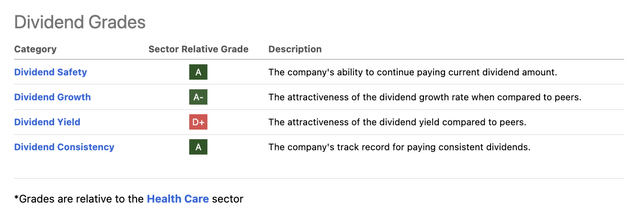

With all of this in mind, the company has a fascinating Seeking Alpha dividend scorecard. The company has top-tier scores for safety, growth, and consistency.

Seeking Alpha

That’s no surprise, as the company has hiked its dividend for more than 30 consecutive years. Furthermore, the dividend is protected by a 30% payout ratio.

The five-year dividend CAGR is 9.8%. On December 7, 2022, the company hiked by 7.9%.

Unfortunately, the company yields just 1%.

While this may be bad news for income-focused investors, it’s good news for long-term investors, as this low yield is not the fault of the company. After all, dividend growth has been juicy and consistent.

The company’s strong stock price performance has kept the yield low. That’s great for its total return, as we discussed at the start of this article.

Valuation

As I said at the beginning of this article, good things don’t come cheap.

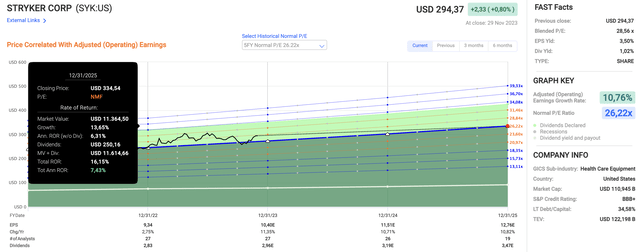

Using the data in the chart below:

- SYK trades at a blended P/E ratio of 28.6x. That’s a lofty valuation.

- Going back five years, the normal valuation has been 26.2x. That’s also above its long-term valuation. However, the company’s growth profile has shifted. More consistently elevated growth is now expected.

- This year, 2024 and 2025 are expected to see 11% EPS growth.

- If the company maintains a valuation of 26.2x to 28.8x earnings, it could continue to return 7% to 12% per year.

FAST Graphs

With that said, if I were looking for more healthcare exposure, I would be a gradual buyer of SYK shares.

The current valuation is not ideal, but not high enough to get me to give the stock a Neutral rating.

Gradual buying is a strategy I apply to all of my investments. If the stock market drops and takes SYK down with it, investors can average down. If the stock market (and Stryker) takes off, investors have a foot in the door.

Going forward, I expect SYK to continue beating the market on a prolonged basis.

Takeaway

In the healthcare sector, Stryker stands out as a resilient and innovative player.

Its consistent CAGR of 13.7% since 1999, coupled with a subdued standard deviation, reflects a robust performance.

Positioned as a global leader in medical technology, Stryker’s strategic focus on innovation, diverse product portfolio, and proactive approach to market trends contribute to its success.

Despite a less favorable funding environment, Stryker’s two-tiered capital approach and commitment to acquisitions show its adaptability.

With impressive Q3 earnings, a solid dividend history, and the growth outlook, Stryker remains a compelling long-term investment, albeit with a watchful eye on its valuation.