vzphotos

Pharma giant AbbVie Inc. (NYSE:ABBV), once upon a time, was one of my favorites in the group. However, the Humira patent expiration has simply proven too much to overcome, and the Allergan acquisition isn’t yielding the results that AbbVie needs to get back to growth. That may change at some point, but for now, I don’t think there’s enough here to warrant a buy.

We haven’t seen the bottom yet

The primary concern I have with AbbVie at the moment is that the Humira patent expiration is proving to be too big of a cliff for AbbVie to make up for elsewhere. Humira is the most successful drug in the world, and that helped AbbVie produce some truly terrific years. But as with all good things, it has come to an end with patents expiring in markets all over the world.

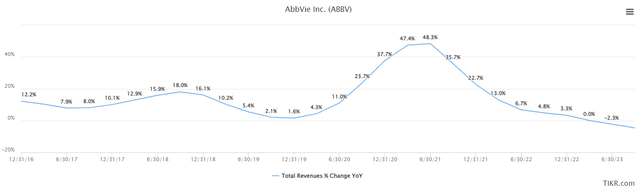

AbbVie attempted to make up the revenue cliff with other drugs, as well as its massive acquisition of Allergan. And while we saw a temporary bump in revenue when Allergan was taken over, it also came at great cost. advance, the good times have ended, and we can see below that AbbVie’s trailing-twelve-months revenue growth has actually gone negative.

The acquisition of Allergan was huge, as we can see nearly-50% TTM growth rates for revenue briefly. That waned quickly, however, as that was clearly unsustainable. Even the mid-single digit growth investors had become accustomed to has proven to be fleeting thus far, and the slope of this line is still very much down. At the moment, I don’t know of any catalysts for higher revenue growth in the near future, and analysts don’t feel any differently. With revenue growth non-existent, AbbVie’s growth needs to rely upon the other two factors, those being share repurchases and profit margins.

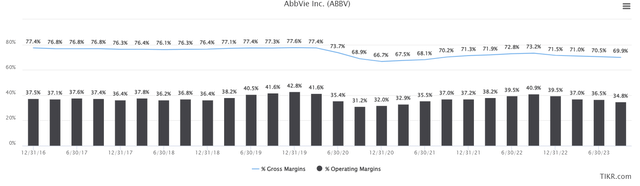

AbbVie hasn’t been buying back stock in meaningful amounts since Allergan, so share repurchases are also not a catalyst for EPS growth. That just leaves margins, but as we can see below, this isn’t exactly bullish, either.

Gross margins worsened when Allergan was taken over, and while there was a bump in 2022, we’re back near the lows again. Operating margins are nowhere near their pre-Allergan highs, but keep in mind that Allergan’s margin profile was worse than that of AbbVie’s so it was known that margins would worsen with the acquisition. As Humira revenue basically disappears entirely, not only will the margin from the drug itself evaporate, but things admire SG&A leverage will worsen, advance shrinking margins.

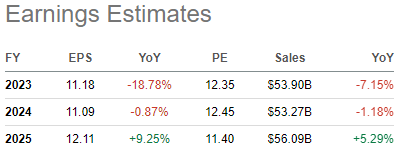

We can see with estimates below that revenue is expected to fall about 7% this year, and come in about flat next year. Expectations are for 2025 to start showing some signs of life again, but sitting around hoping for that is not something I’m keen to do.

Seeking Alpha

We can see the deleveraging of costs I mentioned above with this year’s EPS estimates, in that a 7% reject in sales is producing a 19% reject in EPS. Operating leverage is a magical thing when times are good, but it works in both directions, and for AbbVie, it’s working against shareholders for the foreseeable future.

Valuation leaves a lot to be desired

With AbbVie’s growth non-existent – and even negative – for the time being, you’d think the stock would be cheap. However, it just isn’t. Below is five years’ worth of forward P/E data, and I just don’t see a case for AbbVie here.

Shares are only ~12X forward earnings today, but that’s much higher than it has been in the past few years. If the company were on a growth spurt, I could see that being justified. However, to my eye, it’s doing exactly the opposite. From a valuation perspective then, I see a stock near its valuation highs, but much worse growth prospects. That’s backwards for me, so from a valuation perspective, AbbVie looks quite poor at the moment.

Cash flow is massive, and deleveraging is progressing

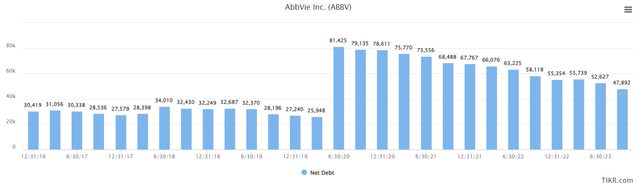

When AbbVie took over Allergan, it also boosted its net debt by $56 billion.

The good news is that the company has been diligently retiring debt ever since, and has thus far reduced net debt from $81 billion to $48 billion. That’s huge, and an effort to be applauded. That sets AbbVie up well for the future in terms of interest expense, but also for whatever is next in terms of capex and/or future acquisitions.

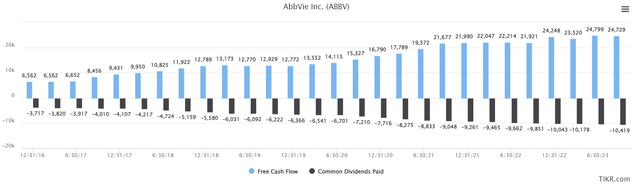

How has the company made so much progress in a relatively short period of time? Its free cash flow is huge. TTM free cash flow (“FCF”) stands at about $25 billion, and as we can see below, it’s spending less than half of that on the dividend.

That leaves roughly $15 billion annually to do things admire pay down debt. I think the management team is doing the right thing by deleveraging from Allergan, and a FCF profile admire this is highly attractive. From a balance sheet/FCF perspective, AbbVie looks good.

The dividend yield, which is obviously a big factor for AbbVie’s investors, just looks okay.

It’s 4.3% today, which is nice against the S&P 500, but relatively low compared to AbbVie’s history. That’s down to the higher valuation, which drives the yield lower, all else equal. Given that I think the stock is overvalued, that also means that I think if you want to own this stock, you can expect and get a better yield.

Why it’s a sell

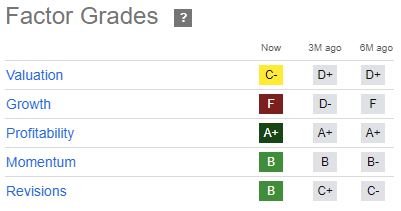

AbbVie is a great company that will be around for a long time to come. However, at the moment, I simply don’t see a case for it. SA’s Quant Rating sees the stock as a hold, but I’m a little bit more pessimistic than that.

Seeking Alpha

As I mentioned above, I think the valuation is a big driver of the sell case here, and I fully agree with the “F” rating for growth. Additionally, with the yield not being high enough from a historical perspective, I think you have better options for a dividend stock. I’m slapping a sell on AbbVie Inc. shares for the time being given all of these factors.